简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IC Markets Global 、FXCM 交易商比较(前端未翻译)

Do you want to know which is the better broker between IC Markets Global and FXCM ?

在下表中,您可以并排比较 IC Markets Global 、 FXCM 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

EURUSD: 0.2

XAUUSD: -3.4

Long: -8.39

Short: 2.61

Long: -59.57

Short: 51.3

EURUSD: -0.1

XAUUSD: 7.7

Long: -9.55

Short: 3.12

Long: -55.87

Short: 21.54

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ic-markets, fxcm lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

ic-markets

| Quick IC Markets Global Review | |

| Founded in | 2007 |

| Registered in | Australia |

| Regulated by | ASIC, CYSEC |

| Trading Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Account Type | Standard, Raw Spread, Raw Spread (cTrader) |

| Min Deposit | $200 |

| Max Leverage | 1:500 |

| Spread | From 0.8 pips (Standard account) |

| Trading Platform | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) |

| Social Trading | ✅ |

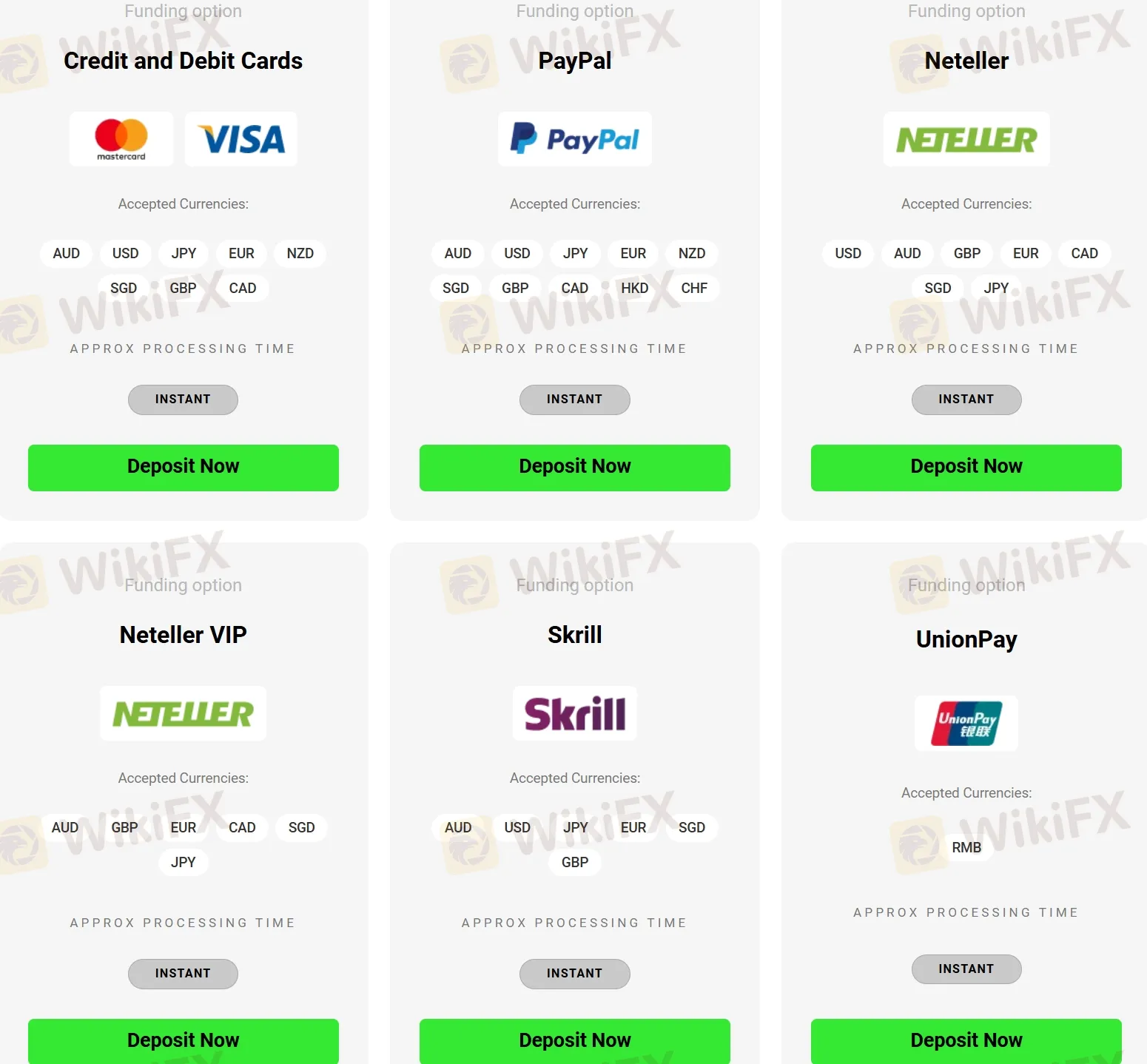

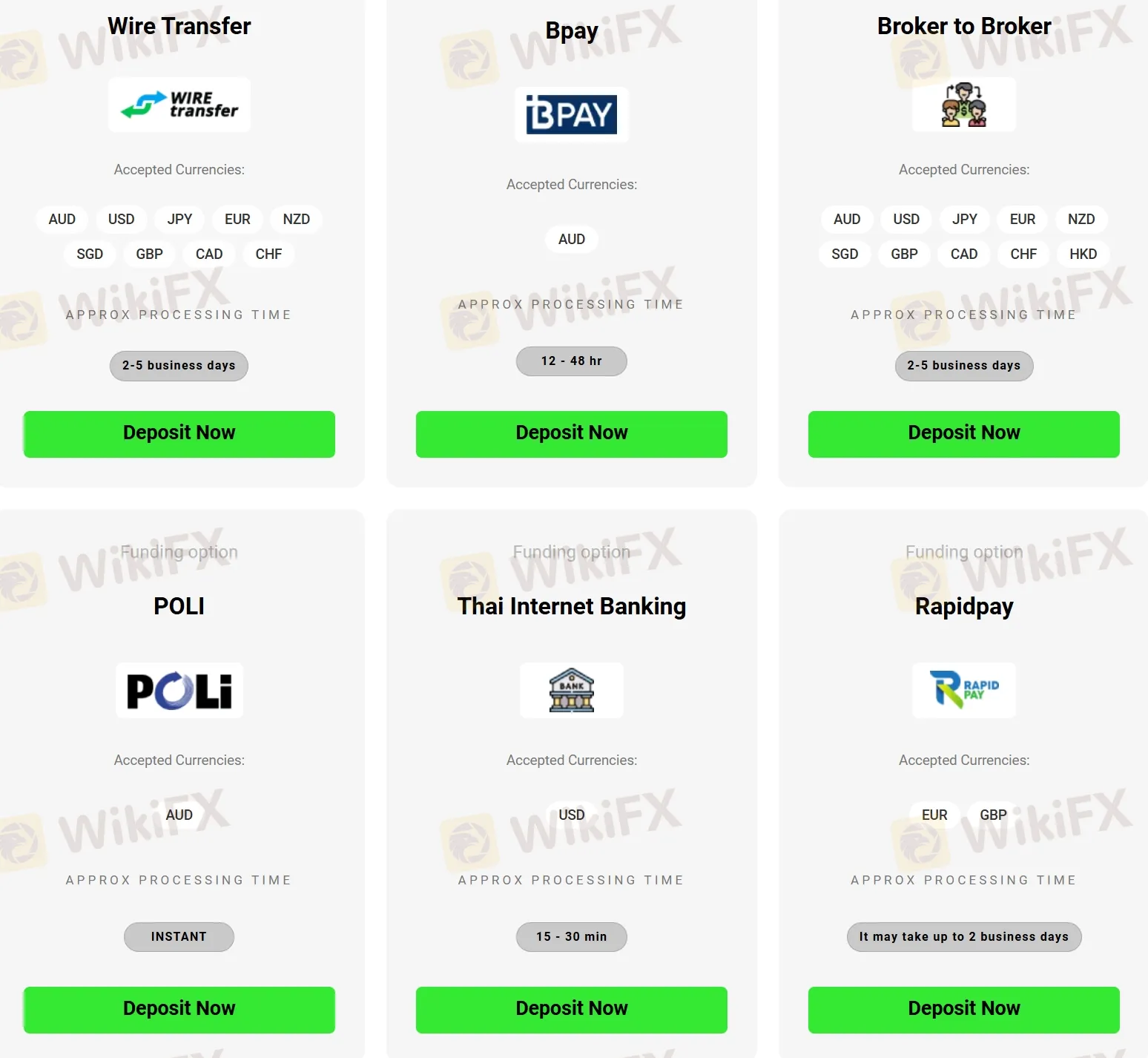

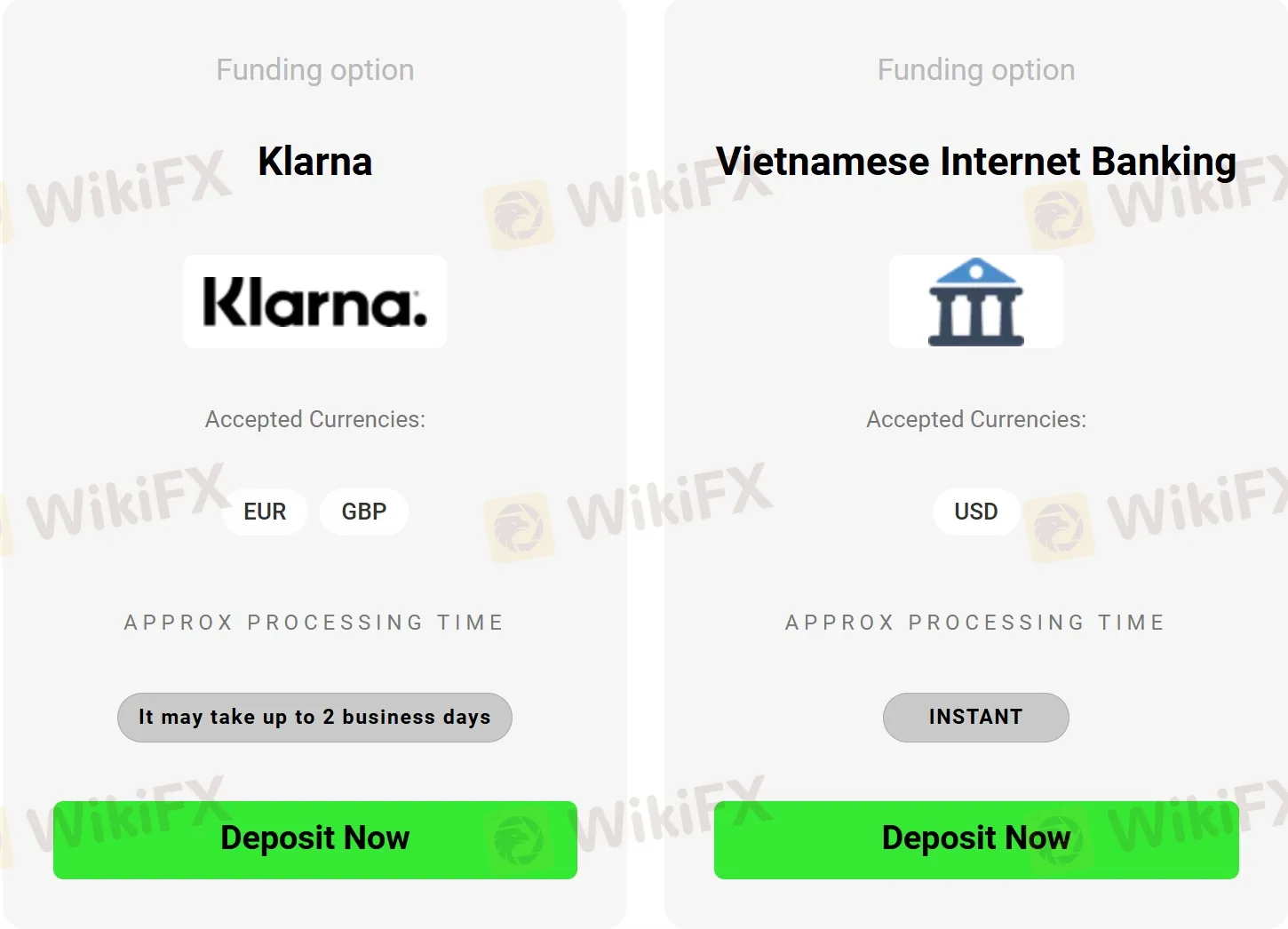

| Payment Methods | MasterCard, Visa, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna, Vietnamese Internet Banking |

| Deposit & Withdrawal Fee | ❌ |

| Customer Support | 24/7 live chat, contact form |

| Tel: +248 467 19 76 (Monday - Saturday (AEDT)07:00 - 07:00) | |

| Email: support@icmarkets.com (Sunday - Friday (GMT)22:00 - 22:00) | |

IC Markets Information

IC Markets Global is an Australian online forex and CFD broker that provides traders access to the global financial markets. The company was founded in 2007 and is regulated by ASIC in Australia and CySEC in Cryprus. IC Markets offers 2,250+ CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, and 4 futures via the advanced trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView. The company also offers 24/7 customer support and a variety of educational resources for traders of all levels.

Is IC Market Legit?

IC Markets Global maintains regulatory compliance in both Australia and Cyprus, adhering to the respective financial regulatory standards in these jurisdictions. Regulatory oversight by Australia Securities & Investment Commission (ASIC) and Cyprus Securities and Exchange Commission (CYSEC) contribute to a safer trading environment for clients.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | INTERNATIONAL CAPITAL MARKETS PTY. LTD. | Market Making (MM) | 335692 |

| CySEC | IC Markets (EU) Ltd | Market Making (MM) | 362/18 |

IC Markets' Australian entity, INTERNATIONAL CAPITAL MARKETS PTY. LTD., regulated by ASIC under license number 335692, holding a license for Market Making (MM).

IC Markets' enropean entity, IC Markets (EU) Ltd, regulated by CYSEC under regulatory number 362/18, holding a license for Maket Making ( MM) as well.

WikiFX's investigation team personally visited the registered address located at Omonoias, 141, The Maritime Centre, Block B, 1st floor, 3045, Limassol, Cyprus. Notably, the IC Markets Global logo was prominently displayed on billboards in the vicinity of the building. Hence, their visit to the location confirmed that IC Markets was indeed operating from the officially designated regulatory address.

Market Instruments

IC Markets Global offers a wide range of over 2250 tradable instruments to trade, including CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, and 4 futures. This provides traders with the opportunity to diversify their investment portfolio and access multiple markets and assets.

| Asset Class | Supported |

| CFDs | ✔ |

| Currency pairs | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indexes | ✔ |

| Bonds | ✔ |

| Cryptocurrencies | ✔ |

| Futures | ✔ |

| Options | ❌ |

| ETFs | ❌ |

Minimum Deposit

IC Markets Global requires a minimum deposit of $200 for traders to open an account. In the industry, many established brokers frequently impose minimum deposit requirements that surpass $500 or even reach $1,000. In contrast, certain major players such as Avatrade and Aixonly mandate minimum deposits of $100 and $0, respectively. So, IC Markets's minimum deposit requirement seems to be in the “middle”.

Here is the comparison of IC Markets Global minimum deposit with Avatrade, Exness, and Axi:

| Broker | Minimum Deposit |

| $200 |

| $100 |

| $10 |

| $0 |

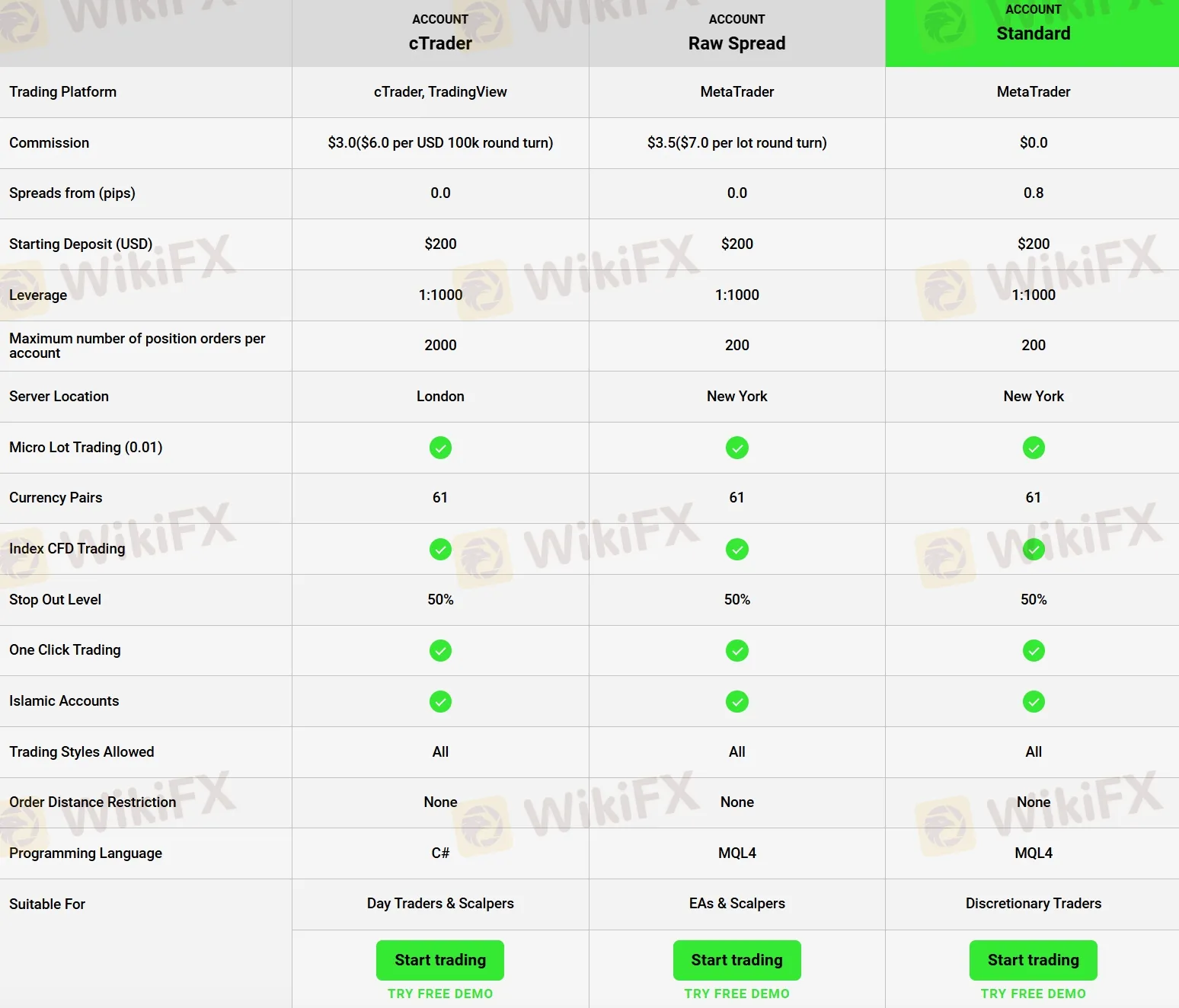

Account Type/Fees

IC Markets offers traders a range of account types with different trading platforms, commissions, and spreads. The Raw Spread and Raw Spread (cTrader) accounts charge a commission of $3 and $3.5 respectively but offer spreads from 0.0 pips, while the Standard account has no commission but wider spreads from 0.8 pips.

| Account Type | Raw Spread (cTrader) | Raw Spread | Standard |

| Min Deposit | $200 | ||

| Max Leverage | 1:1000 | ||

| Spread | From 0.0 pips | From 0.8 pips | |

| Commission | $3 ($6 per USD 100k round turn) | $3 ($6 per USD 100k round turn) | ❌ |

| Trading Platform | cTrader, TradingView | MT4/5 | |

| Suitable for | Day traders & scalpers | EAs & scalpers | Discretionary traders |

A demo account and Islamic account are also available. Although the minimum deposit of $200 may be high for some traders, the variety of account types and competitive spreads on some accounts may make up for it. However, traders should note that commissions are charged on all other accounts apart from the Standard account, and there is limited information on account features.

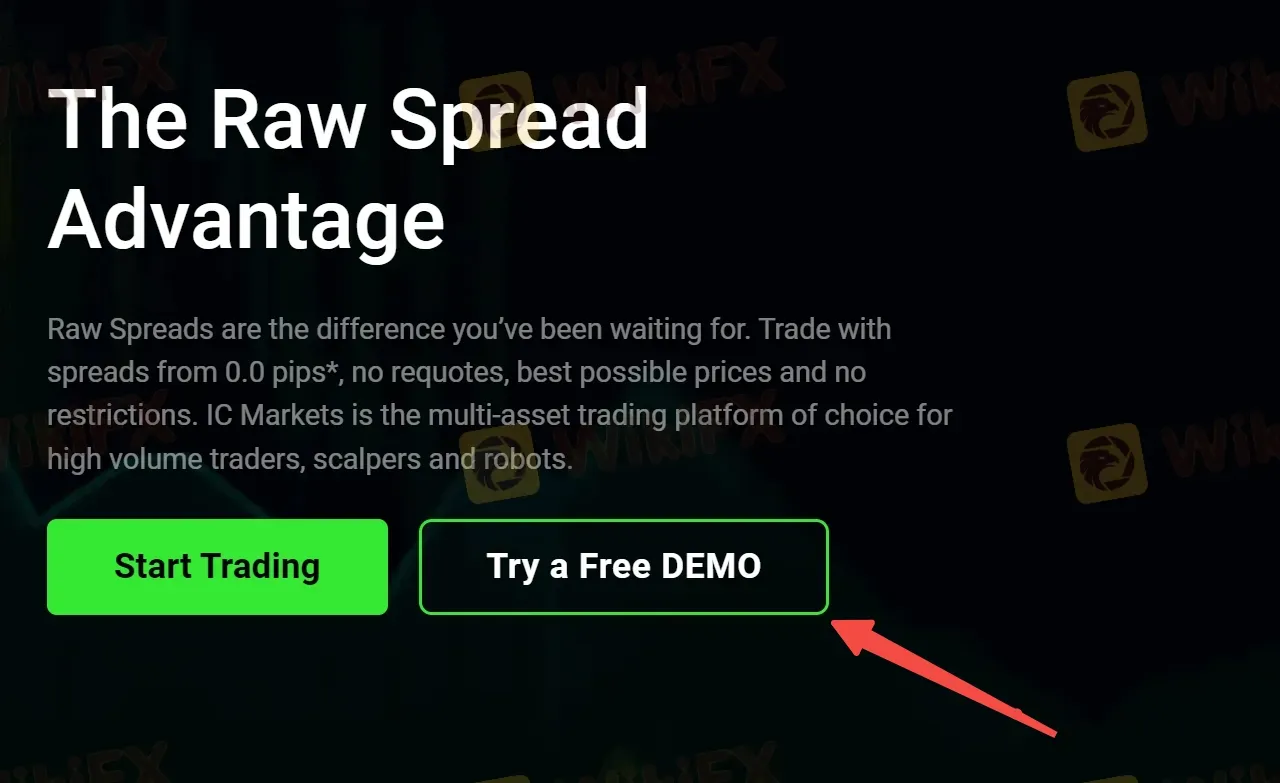

Demo Account

IC Markets Global offers a free advanced demo account for beginner traders to practice on, which lasts for 30 days.

Users who open a demo account can enjoy the following features:

- Access to Raw Pricing

- Spreads Starting at 0.0 pips

- Fast Order Execution

- Available on MT4, MT5 and cTrader platforms

However, demo accounts aim to mimic real markets but function in a simulated environment. This means there are significant differences compared to real accounts, including not relying on real-time market liquidity, encountering price delays, and having access to certain products that may not be tradable on live accounts.

Opening a demo account is simple:

Step 1: Click the “Try a Free DEMO” button on the homepage of IC Markets.

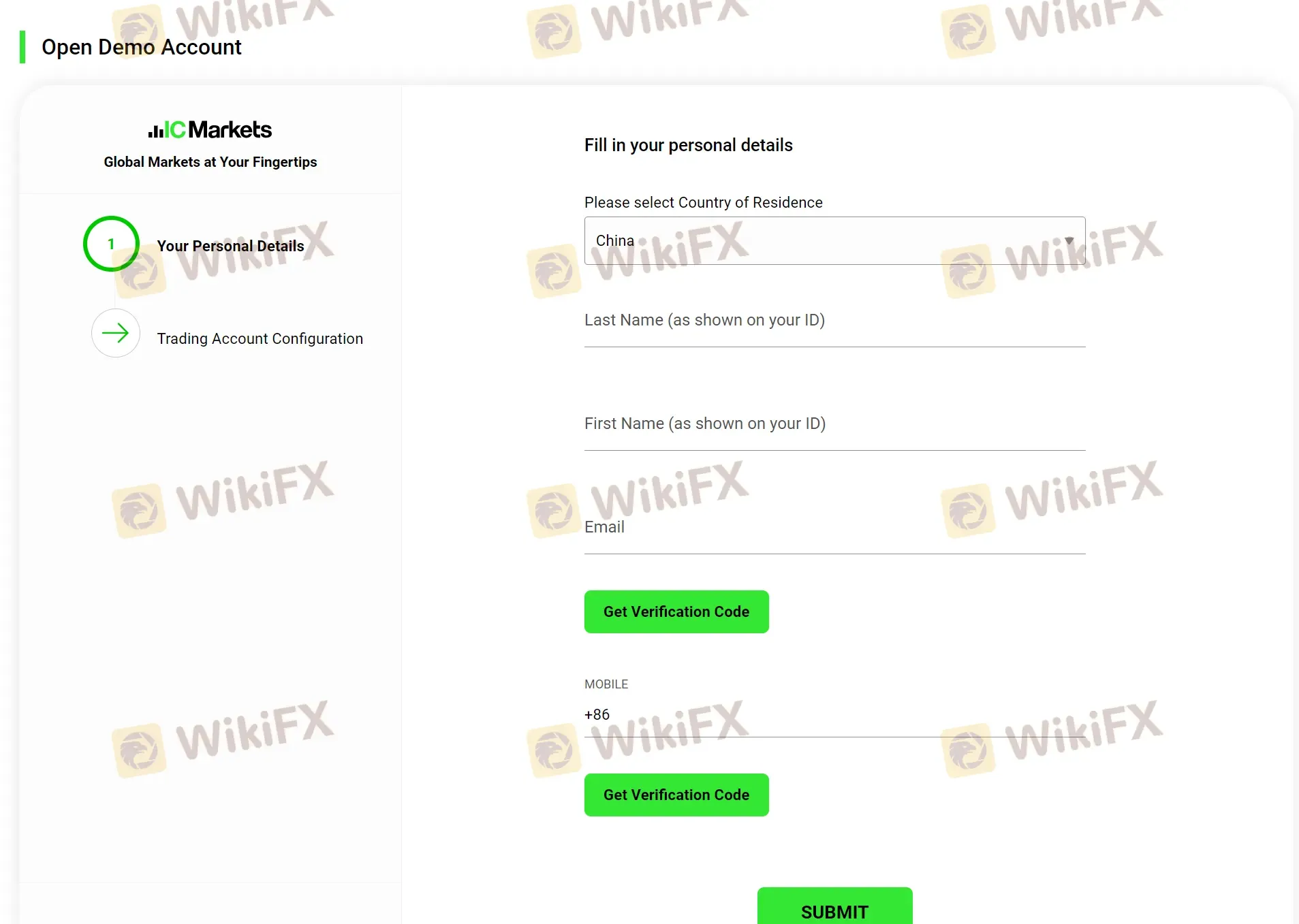

Step 2: Fill in your personal info, including your country of residence, name, email, phone number to get a verification code.

Step 3: Choose to demo accounts on your preferrable trading platform, MT4, MT5, cTrader, or TradingView. Then choose your account currency, virtual funds, starting from $200 to $5,000,000, your desired leverage level.

Step 4: Log into your demo account and start trading.

Leverage

IC Markets' maximum leverage offering of up to 1:1000 can be beneficial for experienced traders who know how to manage their risks well. The high leverage can potentially magnify the profits of a successful trade, enabling traders to take advantage of larger positions in the market.

Trading Platform

IC Markets Global offers its clients a variety of trading platforms, including the popular MetaTrader4 and MetaTrader5 platforms as well as the cTrader and TradingView platforms.

The MetaTrader4 and MetaTrader5 platforms are similar and offer a range of trading tools and indicators, as well as the ability to use Expert Advisors (EAs) and automate trading strategies.

The cTrader platform, on the other hand, offers advanced charting capabilities and a variety of order types. However, it has a steeper learning curve and limited customization options compared to the MetaTrader4 and MetaTrader5 platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, web, iPhone/iPad, Android, Mac | Beginners |

| MT5 | ✔ | Experienced investors | |

| cTrader | ✔ | ||

| TradingView | ✔ | / | Beginners |

Deposit & Withdrawal

IC Markets Global offers a variety of deposit and withdrawal options, including MasterCard, Visa, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna, and Vietnamese Internet Banking.

IC Markets Global does not charge any fees for deposits and withdrawals. However, additional fees may occur at some banking institutions.

Withdrawal requests have a cut off time at 12:00 AEST/AEDT, and take up to 10 business days to process depending on the bank.

International bank wire transfers take up to 14 days and incur additional intermediary and/or beneficiary fees.

Credit/debit card withdrawals are processed free of charge and take 3-5 business days to reach your credit card.

Paypal/Neteller/Skrill withdrawals are processed instantly and free of charge, but must be made from the same account as the initial funds were sent from.

fxcm

| Quick FXCM Review Summary | |

| Founded | 1999 |

| Headquarters | London, UK |

| Regulation | ASIC, FCA, CySEC, ISA |

| Market Instruments | Forex, shares, commodities, indices, cryptocurrencies |

| Demo Account | ✅($20,000 virtual money) |

| Min Deposit | $50 |

| Leverage | 1000:1 |

| EUR/USD Spread | Floating around 1.1 pips |

| Trading Platforms | Trading Station, TradingView Pro, MT4, Capitalise AI |

| Payment Methods | Bank Transfer, Visa, MasterCard, Google Pay, Neteller, Skrill |

| Customer Support | 24/5 live chat, request a callback |

| WhatsApp: +44 7537 432259 | |

| Regional Restrictions | The United States, Canada, United Kingdom, European Union, Hong Kong, Australia, Israel and Japan |

FXCM Information

FXCM is a retail forex broker that was founded in 1999. The company is headquartered in London, UK, but has offices and affiliates in a number of other countries, including Australia, Germany, France, Italy, Greece, Hong Kong, Japan, South Africa, and the United States.

The company provides online trading services in forex, contracts for difference (CFDs), and other financial instruments. FXCM offers various trading platforms including Trading Station, TradingView Pro, MT4, and Capitalise AI.

Pros & Cons

| Pros | Cons |

| • Globally and heavily regulated | • Regional restrictions |

| • Multiple trading platforms to choose from | • Limited customer support availability on weekends |

| • Competitive spreads on forex pairs | |

| • Low minimum deposit requirement |

Is FXCM Legit?

FXCM is a legitimate broker with a long-standing reputation in the industry. The company is regulated by top-tier financial authorities, such as the FCA in the UK, the ASIC in Australia, CYSEC in Cyprus, and ISA in Israel, which ensures that it operates under strict financial and ethical guidelines. FXCM also has a solid track record of handling client funds in a secure and responsible manner.

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | STRATOS TRADING PTY. LIMITED | Market Making (MM) | 000309763 |

| Financial Conduct Authority (FCA) | Stratos Markets Limited | Market Making (MM) | 217689 |

| Cyprus Securities and Exchange Commission (CySEC) | Stratos Europe Ltd | Market Making (MM) | 392/20 |

| The Israel Securities Authority (ISA) | STRATOS LIGHT LTD | Retail Forex License | 515234623 |

How are you protected?

FXCM provides negative balance protection and offers its clients access to segregated accounts, providing additional security measures. More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | ASIC, FCA, CySEC, ISA |

| Segregated Funds | ✔ |

| Investor Protection | Up to £85,000 |

| Negative Balance | ✔ |

| Financial Audit | ✔ |

| Insurance | ❌ |

Our Conclusion on FXCM Reliability:

FXCM is a well-regulated and reputable broker with a long-standing history in the industry. The company is regulated by top-tier financial authorities and has multiple licenses, demonstrating a commitment to client protection.

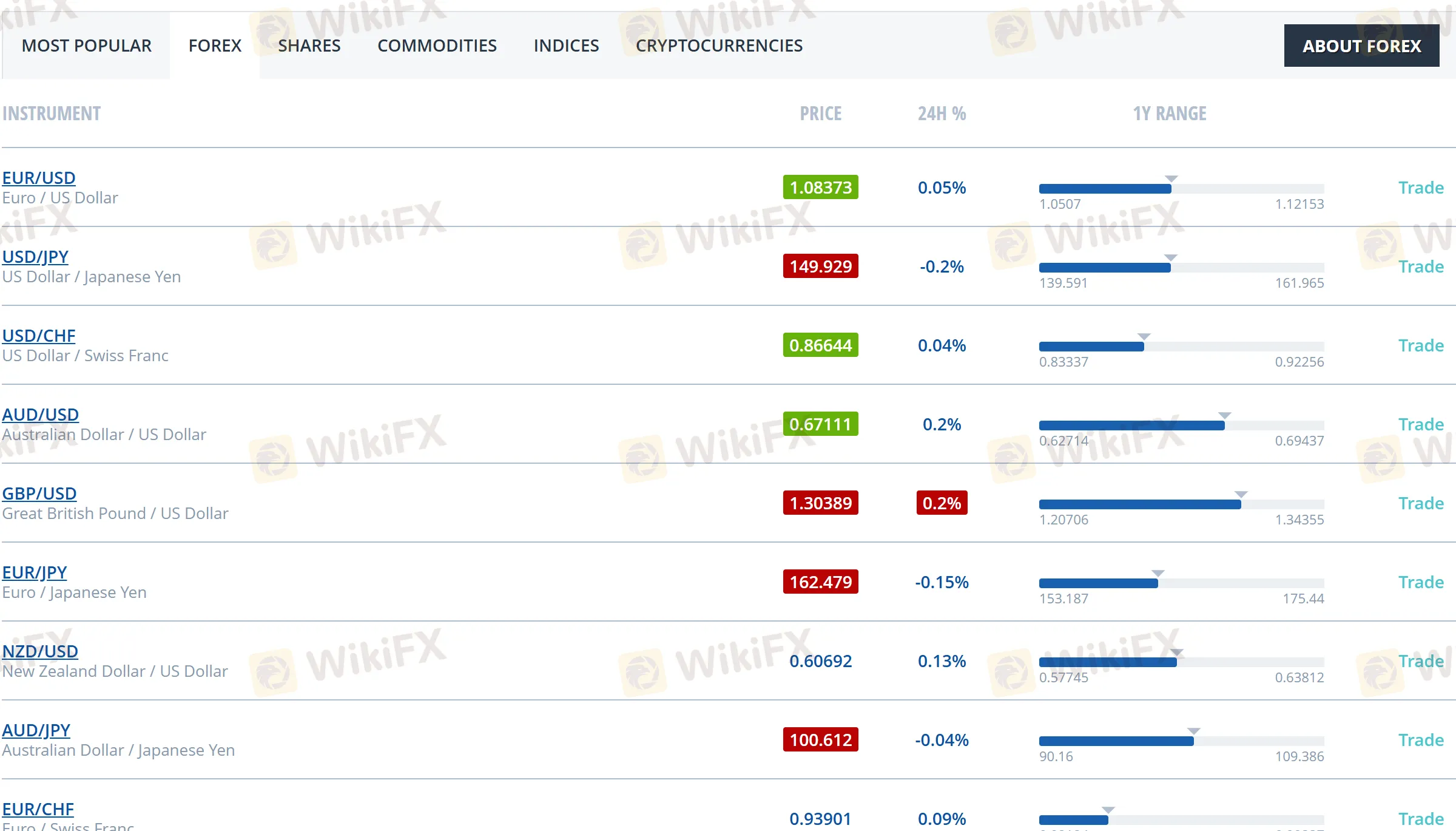

Market Instruments

FXCM offers trading in five major classes of tradable assest, including forex, shares, commodities, indices, and cryptocurrencies, which provides traders with varying interests and strategies a broader portfolio.

| Trading Assets | Available |

| Forex | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

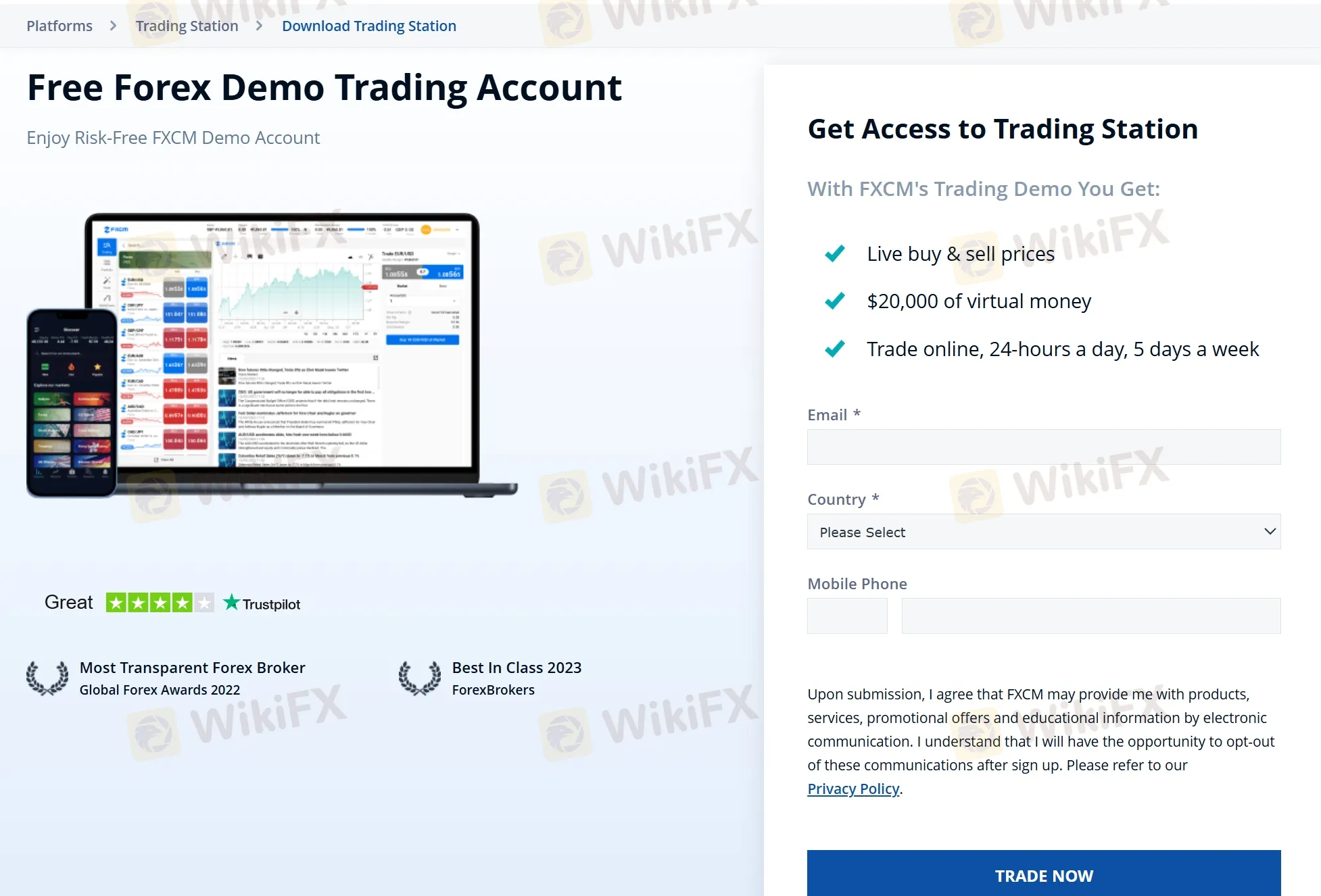

Accounts

FXCM seems to only offer a single live account type. Their website does not reveal specific info on account types.

However, it offers demo account options. FXCM's demo account, elaborately, provides a realistic trading experience with access to live market prices across multiple asset classes. Traders can receive $20,000 in virtual funds to practice executing buy and sell orders on FXCM's user-friendly trading platform, available 24/5. This risk-free environment enables traders to hone their strategies and gain confidence before transitioning to a live funded account.

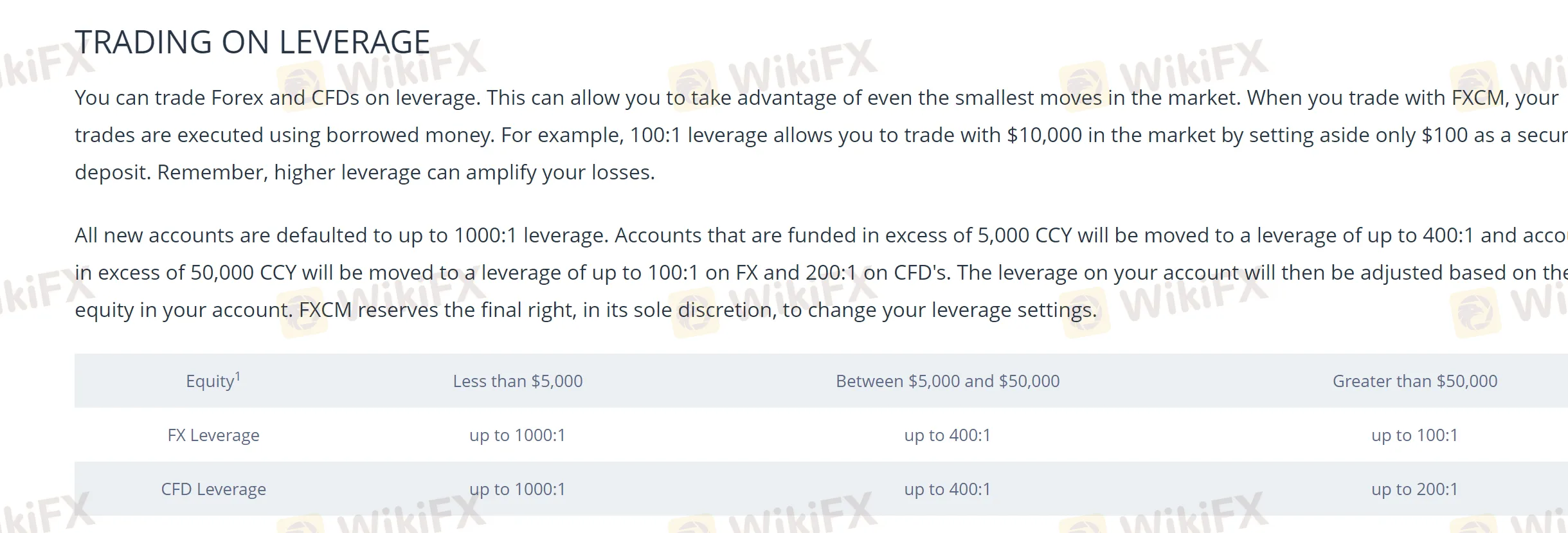

Leverage

FXCM offers several leverage options for trading Forex (FX) and Contracts for Difference (CFDs), depending on the account equity.

For equity less than $5,000, traders can access up to 1000:1 leverage for both FX and CFDs.

Accounts with equity between $5,000 and $50,000 are eligible for up to 400:1 leverage on both FX and CFDs.

Accounts with equity greater than $50,000 can leverage up to 100:1 for FX and up to 200:1 for CFDs.

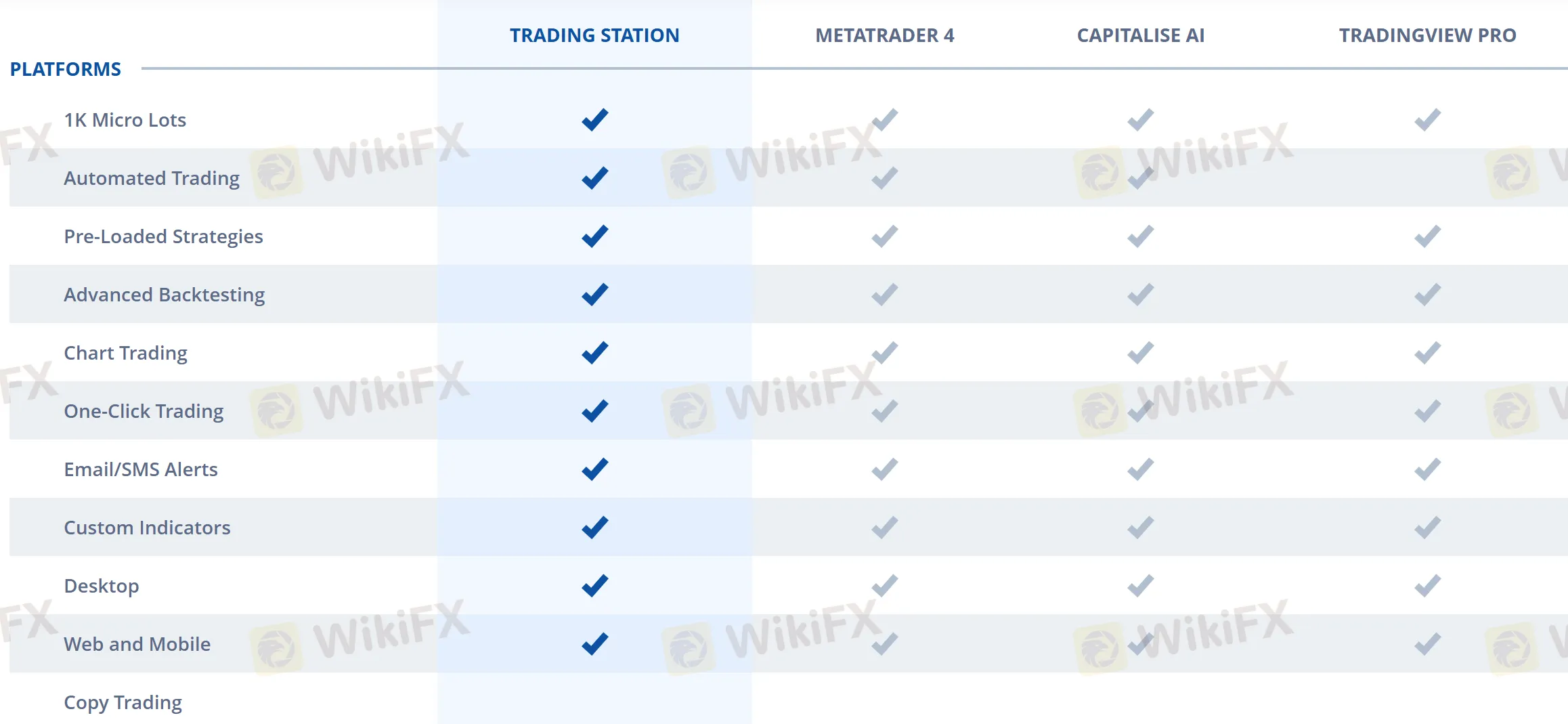

Trading Platforms

FXCM offers four different trading platforms for traders to choose from, Trading Station, MT4, Capitalise AI, and TradingView Pro. All are available on desktop, web and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Trading Station | ✔ | Desktop, Web, Mobile | / |

| MT4 | ✔ | Desktop, Web, Mobile | Beginners |

| Capitalise AI | ✔ | Desktop, Web, Mobile | / |

| TradingView Pro | ✔ | Desktop, Web, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

Deposits & Withdrawals

FXCM welcomes several payment methods, including Bank Transfer, Visa, MasterCard, Google Pay, Neteller, and Skrill.

FXCM minimum deposit vs other brokers

| FXCM | Most Other | |

| Minimum Deposit | $50 | $100 |

Conclusion

In conclusion, FXCM is a well-established and reputable broker that offers a range of trading instruments and account types with competitive spreads and commissions. The broker's trading platforms are user-friendly and offer advanced features for traders of all levels. Additionally, FXCM provides educational resources and excellent customer support, including 24/5 live chat support.

However, FXCM is not available in all countries, clients from the USA, Canada, UK, European Union, Hong Kong, Australia, Israel and Japan are not accepted.

Frequently Asked Questions (FAQs)

| Is FXCM regulated? |

| Yes. It is regulated by ASIC, FCA, CySEC, and ISA. |

| Does FXCM offer demo accounts? |

| Yes. |

| Does FXCM offer industry-standard MT4 & MT5? |

| Yes. Not only MT4, but also Trading Station, TradingView Pro, and Capitalise AI. |

| What is the minimum deposit for FXCM? |

| The minimum initial deposit to open an account is $50. |

| Is FXCM a good broker for beginners? |

| Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions via multiple trading platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating.

Are the transaction costs and expenses of ic-markets, fxcm lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ic-markets and fxcm are, we first considered common fees for standard accounts. On ic-markets, the average spread for the EUR/USD currency pair is -- pips, while on fxcm the spread is --.

Which broker between ic-markets, fxcm is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ic-markets is regulated by ASIC,CYSEC. fxcm is regulated by ASIC,FCA,CYSEC,ISA.

Which broker between ic-markets, fxcm provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ic-markets provides trading platform including cTrader,Raw Spread,Standard,Islamic and trading variety including --. fxcm provides trading platform including -- and trading variety including --.