简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HANTEC FINANCIAL 、USGFX 交易商比较(前端未翻译)

Do you want to know which is the better broker between HANTEC FINANCIAL and USGFX ?

在下表中,您可以并排比较 HANTEC FINANCIAL 、 USGFX 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of hantec, usgfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

hantec

| Hantec Review Summary in 10 Points | |

| Founded | 1990 |

| Registered Country/Region | Vanuatu |

| Regulation | ASIC, VFSC (offshore) |

| Market Instruments | Forex, Bullion, Commodities CFDs, Stock CFDs, Indices CFDs |

| Demo Account | Available |

| Max. Leverage | 1:400 |

| EUR/USD Spread | Raw spreads from 0.1 pips (Standard account) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | $100 |

| Customer Support | working hours: 24 hours service, 8:00 a.m. Monday - 7:00 a.m. Saturday (GMT+8) |

| Live chat, email, social media: Facebook and LinkedIn | |

| Registered Address: 1276, 1st Floor, Govant Building, Kumul Highway, Port Vila, Republic of Vanuatu | |

| Regional Restrictions | Residents of USA, Canada, Iran, North Korea, Hong Kong, and Macau are not allowed |

What is Hantec?

Hantec is a brokerage firm that provides online trading services for various financial instruments, including Forex, Bullion, Commodities CFDs, Stock CFDs, and Indices CFDs. Hantec is regulated by the Australian Securities & Investments Commission (ASIC) and is also offshore regulated by the Vanuatu Financial Services Commission (VFSC). The company offers various account types and MT4/5 trading platform, as well as educational resources and 24-hour customer support services.

Pros & Cons

When it comes to brokers, Hantec Markets stands out as a well-established, reliable option. It is regulated by Australia Securities & Investment Commission (ASIC). The site facilitates trade in a wide variety of instruments. Customized offering that includes the industry-standard MT4/5 trading platform and in-depth market analysis suitable for both novices and seasoned traders.

| Pros | Cons |

| • ASIC Regulation | • Offshore regulated by VFSC |

| Wide range of trading assets | • Clients from USA, Canada, Hong Kong, Macau, Iran and North Korea are not accepted |

| • Free demo accounts | • Reports of difficulty with withdrawals |

| • Low spreads | • Limited information on trading conditions and deposit/withdrawal |

| • MT4/5 supported | |

| • In-depth market analysis |

However, the lack of transparency on trading conditions and deposit/withdrawal, as well as reports of withdrawal issues in the past, are potential drawbacks to consider. Ultimately, it is important for traders to thoroughly research and evaluate any potential broker before investing their funds.

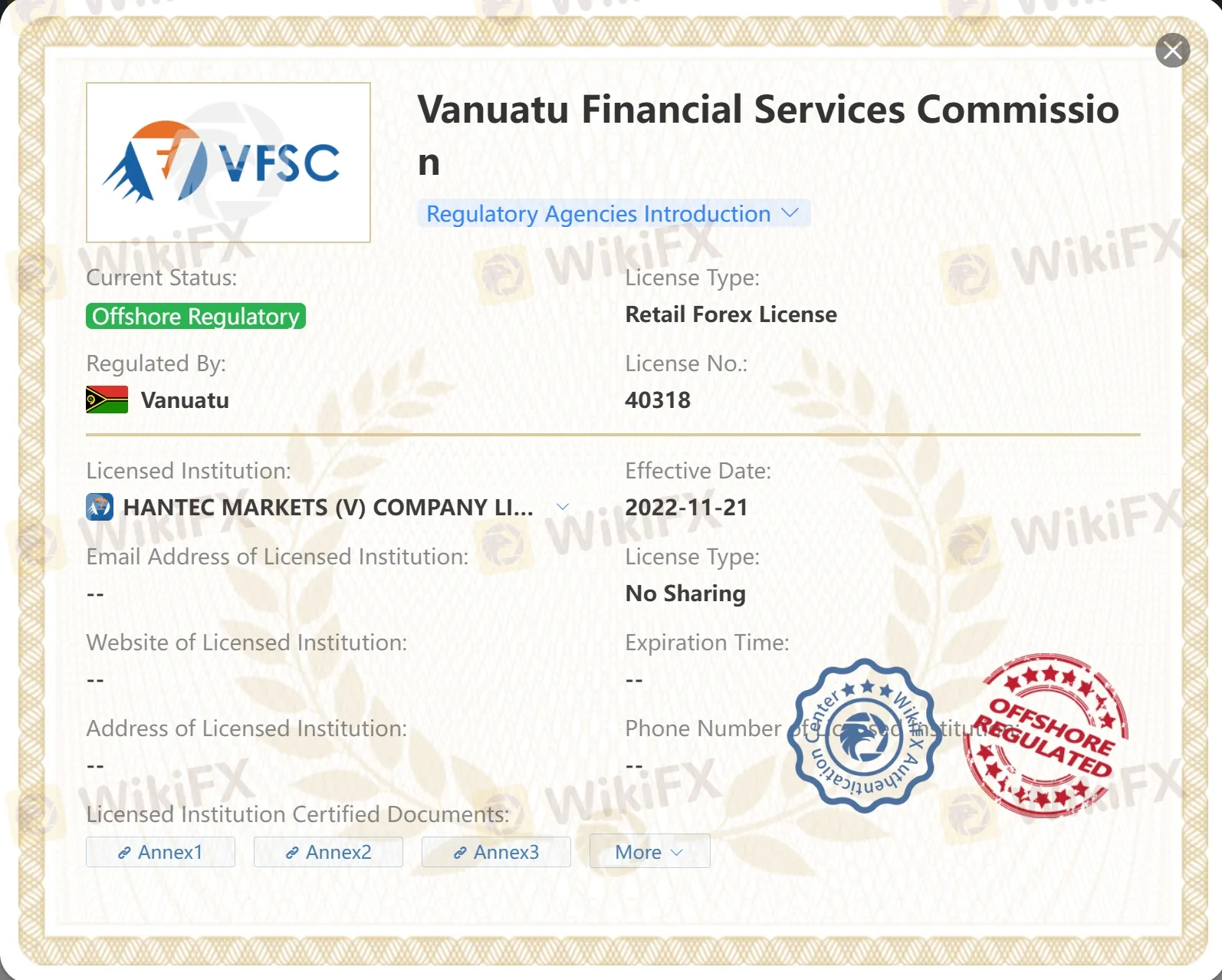

Is Hantec Legit?

Being regulated by Australia Securities & Investment Commission (ASIC, License No. 326907) and offshore regulated by Vanuatu Financial Services Commission (VFSC, License No. 40318), Hantec appears to be a legitimate broker which has been in operation for several years.

However, it's important to note that offshore regulation may not provide the same level of protection as other major regulatory bodies.

Market Instruments

Hantec provides a diverse range of market instruments that cater to various trading preferences and strategies, making it a versatile choice for traders. The offerings include Forex, which allows traders to engage in the dynamic and potentially lucrative currency exchange markets. For those interested in precious metals, Hantec offers Bullion trading, including gold and silver, which are often considered safe-haven assets.

Additionally, the platform provides opportunities to trade Commodities CFDs and Stock CFDs, enabling traders to speculate on the price movements of essential goods and prominent company stocks without the need to own the underlying assets. Indices CFDs are also available, offering a way to trade on the performance of specific sections of the stock market.

Accounts

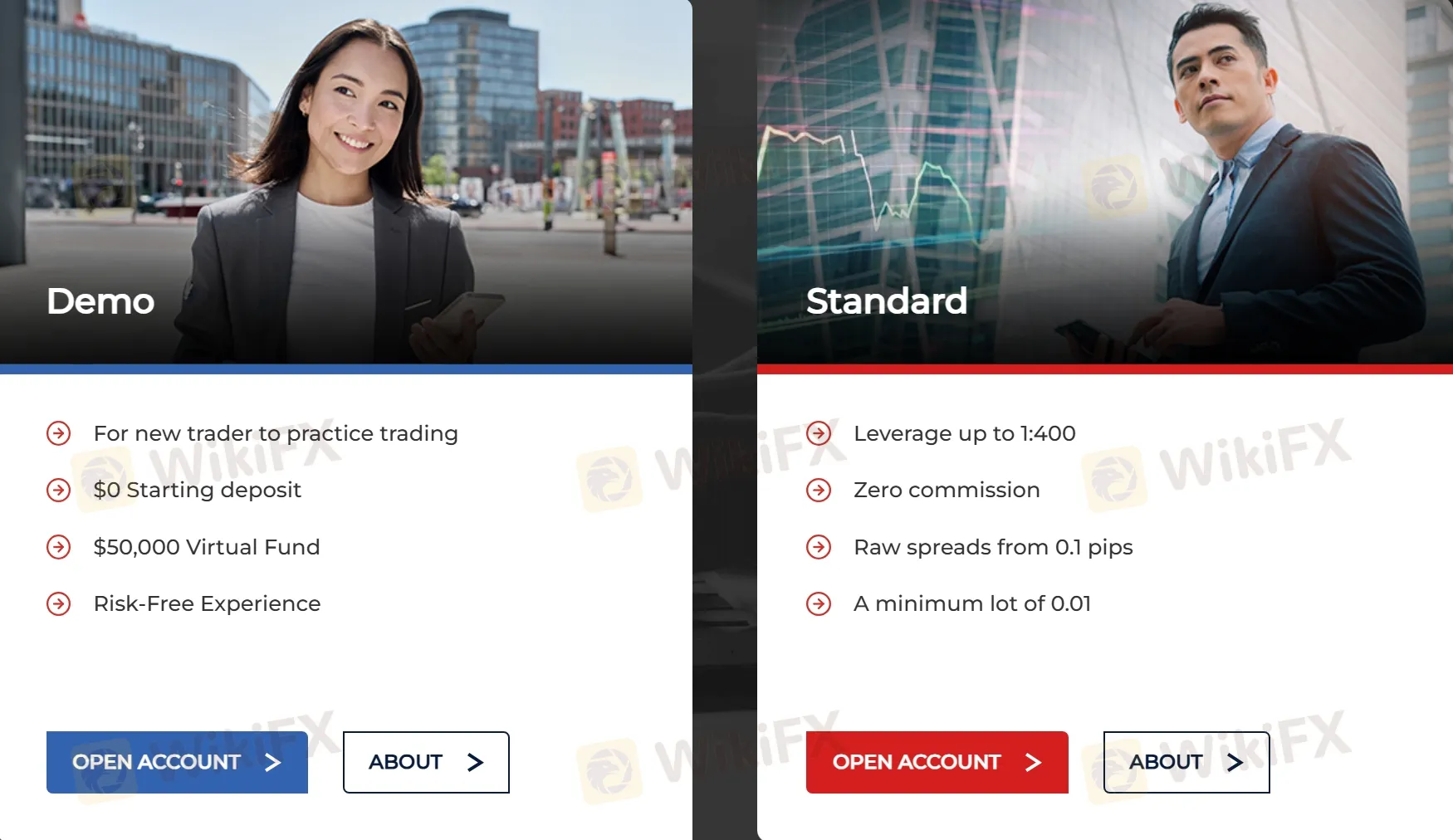

Hantec provides two primary types of trading accounts that cater to both novice and experienced traders.

The demo account is an excellent option for beginners or those looking to refine their trading strategies without financial risk, offering $50,000 in virtual funds. This setup allows users to practice trading under real market conditions, helping them gain confidence and experience before committing real capital.

For more seasoned traders or those ready to engage with real funds, Hantec offers the Standard account, which can be opened with a minimum deposit of $100. This account type provides access to all the trading instruments available on Hantec, including Forex, commodities, indices, and more, making it a versatile choice for serious traders looking to capitalize on a broad range of opportunities in the financial markets.

Both account types are designed to provide users with flexibility and practical options tailored to their experience level and trading goals.

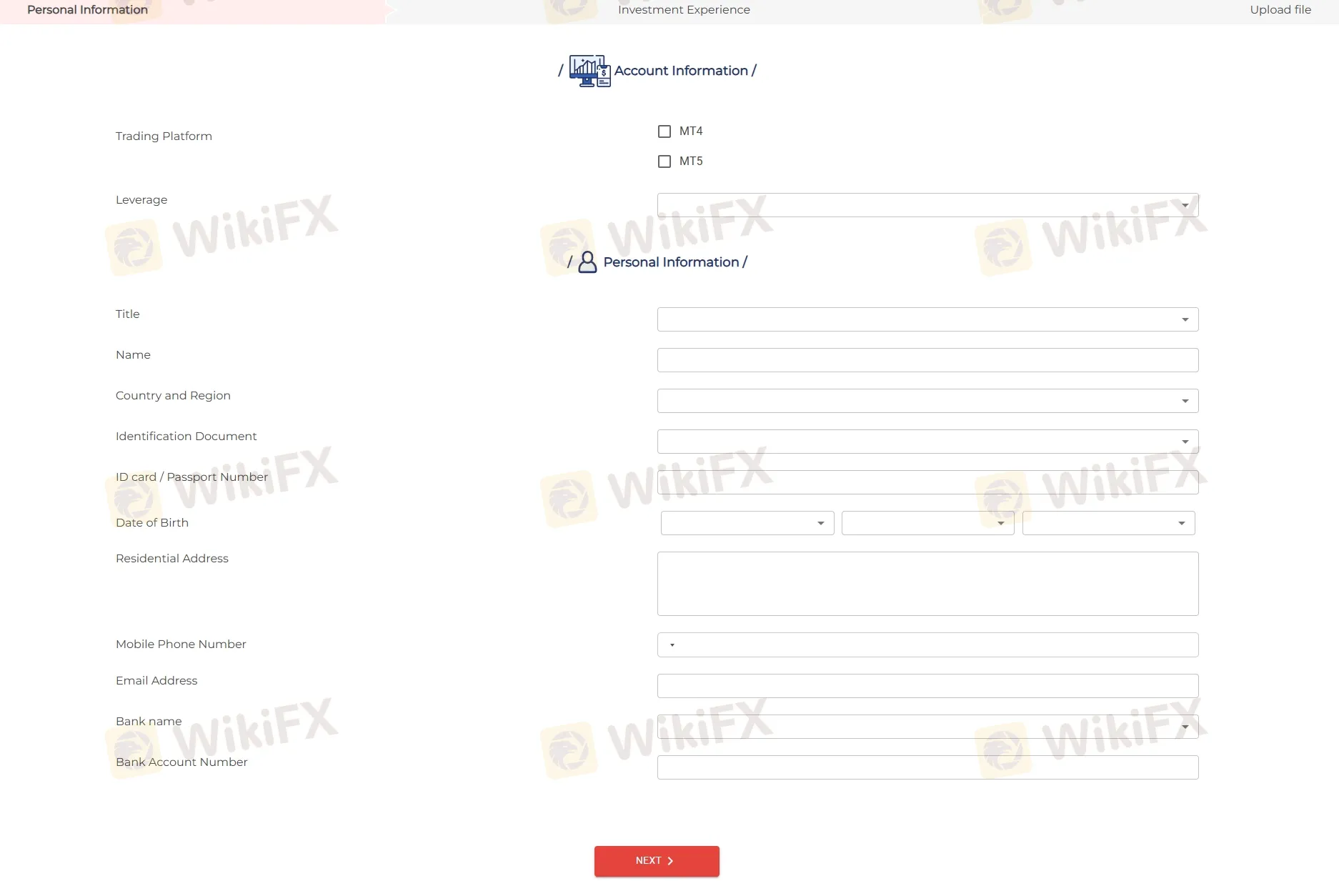

How to Open an Account?

Opening an account with Hantec is a straightforward and structured process designed to get traders set up and ready to trade as efficiently as possible.

To begin, prospective clients need to click the 'Open Account' button on the Hantec website. The initial step involves filling out account information, such as selecting a trading platform and setting the desired leverage.

Following this, personal details are required, including gender, full name, country and region, type of identification document (ID card or passport), ID number, date of birth, residential address, mobile phone number, email address, bank name, and bank account number.

After entering these details, users will click the 'NEXT' button to proceed to the next stage where they will provide information about their investment experience to ensure suitability for trading.

The final step involves uploading necessary documents for verification purposes. Once all steps are completed and the information is verified by Hantec, the account will be activated and ready for trading.

Leverage

Hantec offers leverage up to 1:400, which is a high level of leverage compared to some other brokers. This means that traders can open larger positions with a smaller amount of capital, which can potentially lead to higher profits.

Spreads & Commissions

Hantec's Standard account offers exceptionally competitive trading conditions, particularly appealing for traders looking for cost-effective access to the markets. One of the standout features of this account is the offering of raw spreads starting from as low as 0.1 pips, which allows traders to execute their trades at very close to the underlying market prices without significant spread costs adding to their trading expenses.

Additionally, the Standard account benefits from zero commission on trades, further enhancing its appeal by reducing the overall cost of trading.

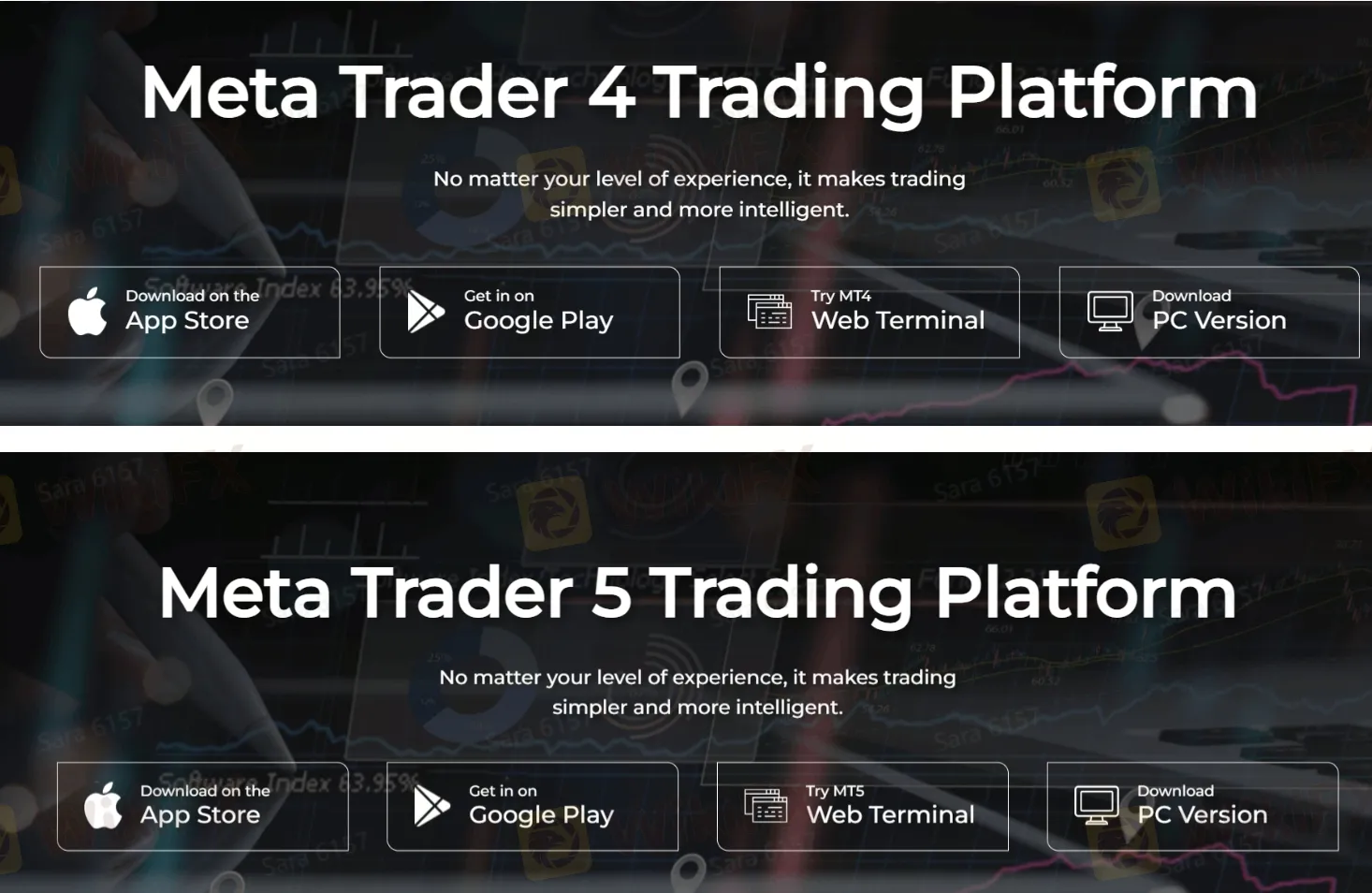

Trading Platforms

Hantec provides its clients with the highly acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, ensuring a versatile and powerful trading experience across multiple devices.

MT4 is particularly favored for its user-friendly interface and strong analytical capabilities, making it ideal for both novice and experienced traders. MT5 offers all the advantages of MT4 but with additional features such as more time frames, advanced financial trading functions, and better tools for price analysis. Hantec makes these platforms accessible on various devices including iPhone, Android, Web, and PC.

Tools & Analysis

Hantec equips its traders with a comprehensive suite of tools and analytical resources designed to enhance trading effectiveness and market understanding.

For planning and strategy, Hantec provides an Economic Calendar and access to Trading Central, which offers insightful technical analysis and trading recommendations. These tools are invaluable for staying updated on important economic events and market movements that can impact trading decisions.

Additionally, Hantec's robust analysis features include Daily Reviews and Market Analysis, offering detailed evaluations of market conditions to help traders identify potential opportunities. The Trader Life section adds a unique perspective by exploring lifestyle aspects of trading, while the Academy offers educational resources that cater to both new and experienced traders, aiming to broaden their knowledge and improve their trading skills. Together, these tools and resources form a dynamic support system that empowers Hantec's clients to navigate the financial markets more effectively.

Deposits & Withdrawals

Hantec maintains a somewhat opaque approach regarding the specifics of its deposit and withdrawal processes, providing limited information publicly. However, it is known that Hantec offers a 24/5 withdrawal service, suggesting that clients can initiate withdrawals during the business week with the expectation of timely processing.

Additionally, the minimum deposit requirement for opening a Standard account is set at $100, which is relatively accessible for most traders and provides an entry point for those looking to start trading without a significant initial investment.

Hantec minimum deposit vs other brokers

| Hantec | Most other | |

| Minimum Deposit | $100 | $100 |

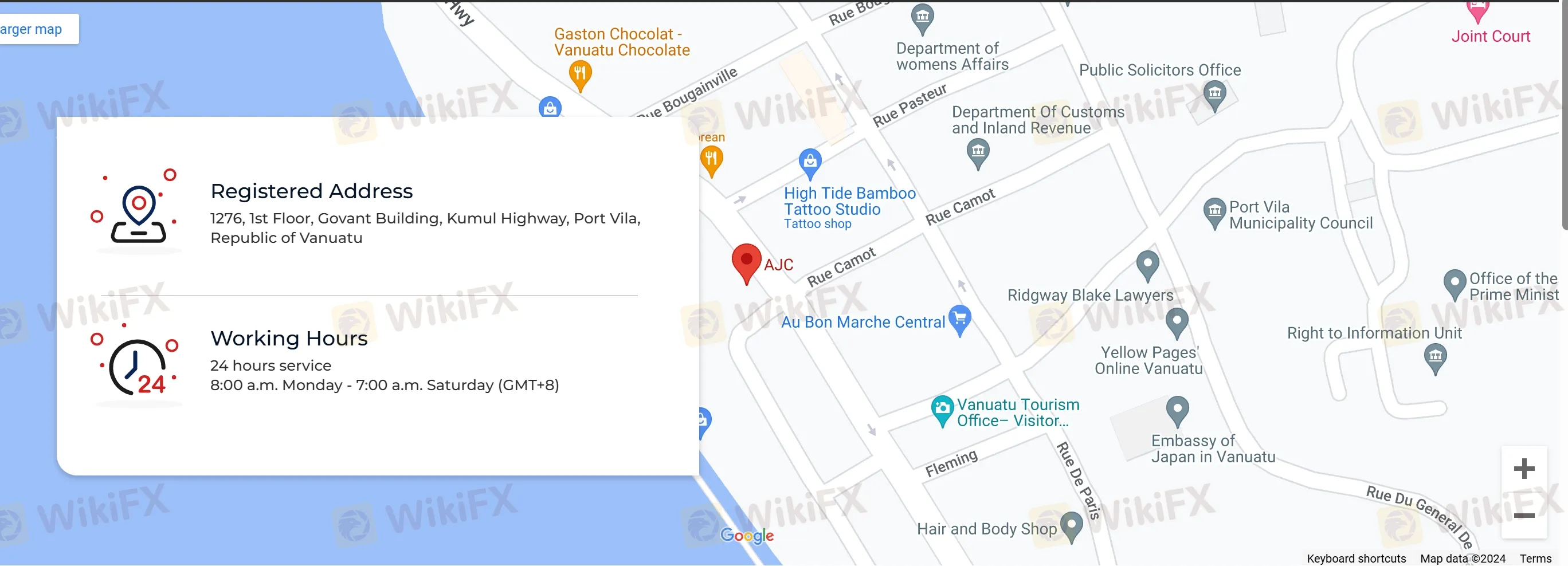

Customer Support

Hantec offers comprehensive customer support designed to cater to traders around the globe with a 24-hour service from 8:00 a.m. Monday to 7:00 a.m. Saturday (GMT+8), ensuring that assistance is readily available almost any time it is needed. Traders can reach out via various channels including live chat, email, and social media platforms such as Facebook and LinkedIn, providing multiple avenues for support according to the user's preference.

Registered Address: 1276, 1st Floor, Govant Building, Kumul Highway, Port Vila, Republic of Vanuatu.

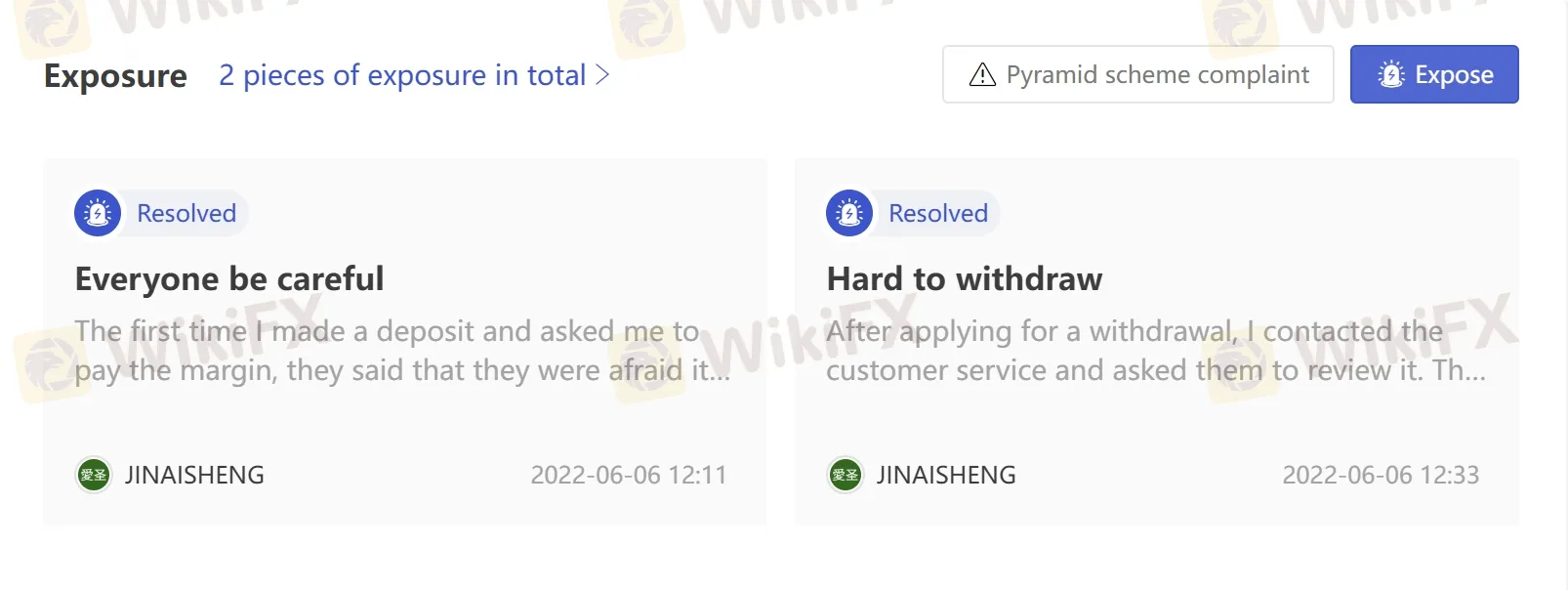

User Exposure on WikiFX

As with any investment, it's important to exercise caution when choosing a broker, including Hantec. While there have been some reports of difficulties with withdrawals, these issues appear to have been resolved. It's important to do your research and take precautions when investing. You can use our platform to access information about brokers before making a decision. If you encounter fraudulent brokers or have been a victim of one, please report it in the Exposure section. Our team of experts will do everything possible to help resolve the problem for you.

Frequently Asked Questions (FAQs)

Is Hantec regulated?

Yes. It is regulated by ASIC in Australia and offshore regulated by VFSC.

At Hantec, are there any regional restrictions for traders?

Yes. Hantec does not offer its services to residents of certain jurisdictions, including USA, Canada, Hong Kong, Macau, Iran and North Korea.

Does Hantec offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for Hantec?

The minimum deposit is $100.

usgfx

| USGFX | Basic Information |

| Registered Countries/Region | Australia |

| Founded in | 2005 |

| Regulation | No Regulation (ASIC, FCA, VFSC, all revoked) |

| Tradable Assets | Forex, CFDs, Indices, Commodities, Cryptocurrencies |

| Trading Platforms | MT4, MT5, WebTrader, mobile app |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | From 1.4 pips |

| Commissions | No commissions on most account types, but swap fees apply |

| Inactivity Fee | $10 per month after 3 months of inactivity |

| Educational Resources | Trading guides, video tutorials, webinars, eBooks, economic calendar, market news |

| Customer Support | 24/5 support via phone, email, live chat, and social media; multiple language support |

Overview of USGFX

Union Standard Group (USG) is an Australian investment firm that provides access to trade forex and CFDs under the brand name ‘USGFX’. The brand began operations in 2005 and is headquartered in Sydney, Australia with subsidiaries in London and Asia. This broker offers a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies, which can be traded on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

USGFX prides itself on its commitment to customer service, with a 24/5 customer support team available to assist traders with their queries. The broker also offers educational resources such as webinars, ebooks, and video tutorials, as well as a free demo account for traders to practice their strategies. In addition, USGFX offers a range of account types to cater to the needs of different traders, including Standard, Pro, and VIP accounts.

Is USGFX legit or a scam?

USGFX has received mixed reviews and there have been reports of some traders experiencing issues with withdrawals and customer support. USGFX had their ASIC and FSC licenses suspended and VFSC license revoked in 2020 due to concerns over their compliance with regulatory requirements, particularly in regards to client money handling and risk management procedures. The Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) of the British Virgin Islands suspended USGFX's licenses for six months, while the Vanuatu Financial Services Commission (VFSC) permanently revoked their licenses.

Regulated brokers are required to adhere to strict rules and regulations regarding client funds, transparency, and risk management. In the event of any dispute or issue, traders have recourse through the regulatory body. With an unregulated broker, there is no such protection, and traders may be at a higher risk of fraud or other unethical practices

Pros & Cons

Here let's take a closer look at the good and bad things about USGFX. On the plus side, they offer a wide range of financial instruments to trade, including Forex, commodities, and indices. Their trading platforms are also pretty user-friendly and easy to navigate. On the downside, their regulatory status is questionable, which could be a red flag for some traders. Plus, they don't accept clients from certain countries, so you'll want to make sure you're eligible before signing up.

| Pros | Cons |

| Wide range of trading instruments | Revoked licenses by ASIC, FSC, and VFSC |

| Multiple account types with various trading conditions | Negative reviews from customers |

| Various deposit and withdrawal methods | Limited educational and research materials |

| 24/5 customer support | |

| Advanced trading platforms | |

| Bonuses and promotions for clients |

Market Instruments

USGFX offers a range of financial instruments for trading, including forex currency pairs, commodities, indices, and shares of popular companies. Some examples of the instruments offered by USGFX are:

Forex currency pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD

Precious metals like gold, silver, and platinum

Energy commodities such as crude oil and natural gas

Indices such as S&P 500, NASDAQ, FTSE 100, and Nikkei 225

Shares of popular companies like Apple, Amazon, Facebook, and Microsoft

Account Types

USGFX offers four different types of trading accounts to cater to the needs of different traders:

MINI Account: This is the entry-level account with a minimum deposit requirement of $100. Traders with this account type can trade a wide range of instruments with low trading costs, access to educational resources, and 24/5 customer support. However, this account type comes with limited features, such as lower leverage and limited trading tools.

Standard Account: The standard account requires a minimum deposit of $10,000 and comes with additional features such as higher leverage, access to more trading tools, and a dedicated account manager. Traders with this account type can also enjoy free VPS hosting and regular market analysis.

VIP Account: This account type is designed for high-volume traders with a minimum deposit requirement of $50,000. In addition to the features of the standard account, VIP account holders can enjoy custom trading strategies, priority customer support, and exclusive market insights.

Pro-ECN Account: The Pro-ECN account is designed for experienced traders and institutions with a minimum deposit requirement of $50,000. This account type offers ECN trading with no dealing desk, ultra-low spreads, and high execution speeds. Traders with this account type can also access premium research tools and institutional-grade liquidity.

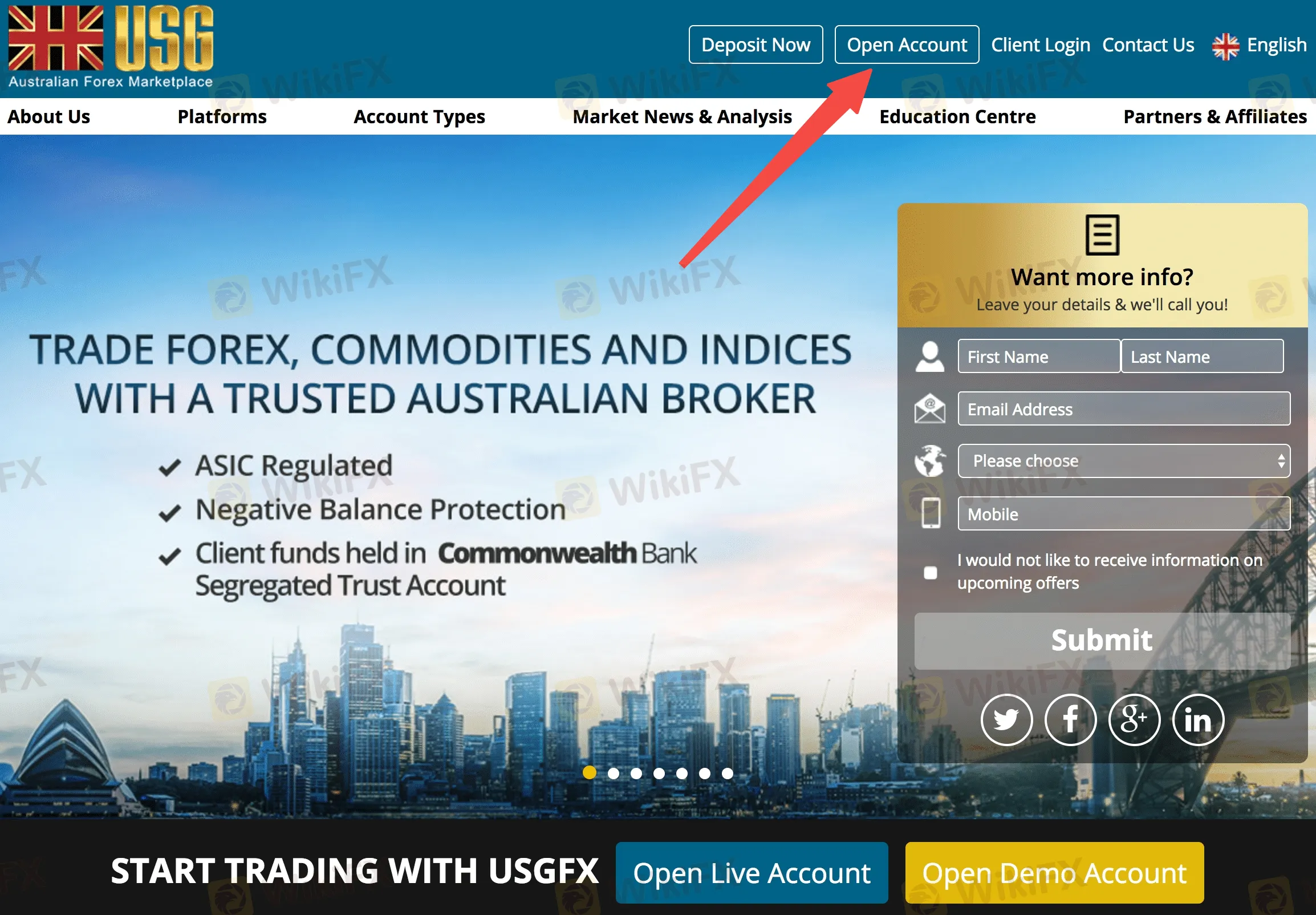

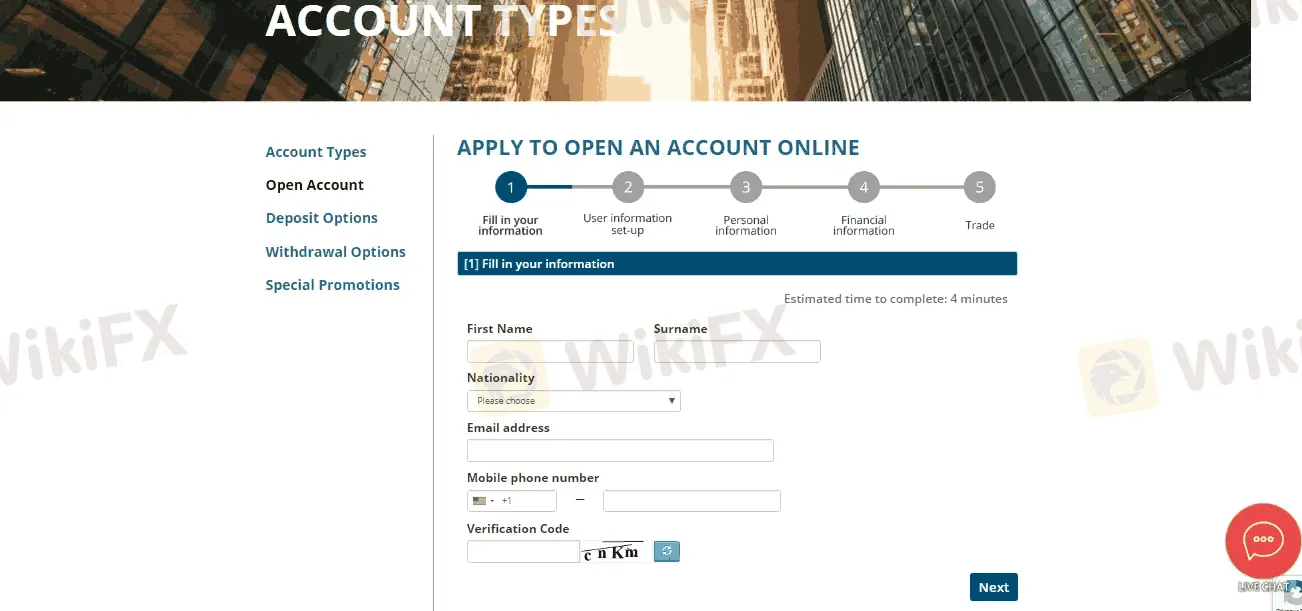

How to open an account with USGFX?

Opening an account with USGFX is pretty straightforward and you need to follow these steps:

First, you need to go to their website and click on the “Open Account” button.

Then, you'll need to fill in some personal details, like your name, email address, and phone number. After that, you'll need to choose the type of account you want to open and provide some additional information, like your date of birth and proof of identity.

Once you've completed the registration process, you'll be able to deposit funds into your account and start trading. Just keep in mind that depending on the type of account you've chosen, there may be different deposit and withdrawal requirements.

Leverage

USGFX offers flexible leverage options ranging from 1:1 to 500:1, depending on the account type and instrument traded. It is important for traders to understand the risks involved with using high leverage and to use it judiciously. Additionally, some instruments may have lower leverage options due to market conditions or regulatory requirements. Traders should check with the broker regarding the available leverage options for specific instruments.

Spreads and Commissions (Trading Fees)

USGFX offers variable spreads, which means that the spread can widen or narrow depending on market conditions. The average spread for major currency pairs such as EUR/USD, USD/JPY, and GBP/USD is around 2-3 pips. Commissions are not charged for forex trading, but there are swap fees for holding positions overnight.

For trading other instruments like commodities, indices, and cryptocurrencies, USGFX charges a fixed spread. The size of the spread varies depending on the instrument traded. For example, the spread for gold is typically around $0.50 per ounce, while the spread for Bitcoin is around $60 per lot.

| Broker | EUR/USD | Gold | BTC/USD |

| USGFX | 1.6 pips | 30 cents | $60 |

| IC Markets | 1.1 pips | 32 cents | $60 |

| Pepperstone | 1.13 pips | 35 cents | $60 |

Non Trading Fees

Apart from spreads and commissions, USGFX also charges several non-trading fees. These fees can add up and affect your overall trading experience, so it's important to be aware of them.

One such fee is the inactivity fee. This fee is charged to your account if you haven't made any trades or withdrawals for a specified period of time. The fee amount varies depending on the type of account you have and how long you've been inactive.

Another fee to be aware of is the withdrawal fee. While USGFX doesn't charge a deposit fee, they do charge a fee for each withdrawal you make from your account. This fee is a fixed amount and varies depending on the payment method you choose for your withdrawal.

USGFX also charges a swap fee, which is a fee charged for holding positions overnight. This fee can be a credit or debit depending on the direction of your position and the interest rates of the currencies you are trading.

Lastly, USGFX may charge a conversion fee if you deposit or withdraw funds in a currency that is different from the base currency of your trading account. The conversion fee is a percentage of the amount being converted and can add up if you frequently deposit or withdraw in different currencies.

Trading Platforms

USGFX offers its clients the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are highly popular among traders worldwide. These platforms are equipped with a range of trading tools, including charting tools, technical analysis indicators, and trading robots, making them suitable for traders of all levels.

MT4 is a well-established platform that has been around for over 15 years. It is known for its user-friendly interface, ease of use, and a wide range of trading tools. MT5, on the other hand, is the latest version of the platform, which was introduced in 2010. It offers several advanced features, such as more technical analysis tools, a multi-threaded strategy tester, and an economic calendar.

One of the significant advantages of MT4 and MT5 is that they are compatible with a range of devices, including desktop computers, laptops, smartphones, and tablets. This allows traders to access their accounts and trade from anywhere at any time.

Here's how USGFX's trading platform stacks up against other brokers' platforms:

| Broker | Trading Platforms |

| USGFX | MetaTrader 4, WebTrader, mobile trading platforms |

| AvaTrade | MetaTrader 4, MetaTrader 5, AvaTradeGO, WebTrader |

| Exness | MetaTrader 4, MetaTrader 5, WebTerminal |

Deposits and Withdrawals

Minimum Deposit

USGFX has a minimum deposit requirement of $100, which is pretty reasonable compared to some other brokers out there. It means that even if you're just starting out with trading and don't have a lot of money to invest, you can still give it a go with USGFX. Of course, you won't be able to make huge trades for just $100, but it's a good starting point to get your feet wet and learn the ropes of trading.

| Broker | Minimum Deposit |

| USGFX | $100 |

| Avatrade | $100 |

| IC Markets | $200 |

USGFX offers a variety of deposit and withdrawal options to its clients. Deposits can be made through bank wire transfer, credit/debit cards, and various e-wallets such as Skrill, Neteller, and FasaPay. The processing time and fees for each method may vary.

Withdrawals can also be made through bank wire transfer, credit/debit cards, and e-wallets. However, it is important to note that there may be fees associated with withdrawals, depending on the method chosen. Withdrawal requests are typically processed within 1-2 business days.

Also, USGFX may apply internal fees to withdrawals that are not actively traded. For example, if you make a deposit and then withdraw it without trading, USGFX may apply a fee of up to 3% of the deposit amount.

| Pros | Cons |

| Multiple payment methods available, including bank transfer, credit/debit card, and e-wallets | High withdrawal fees for some payment methods |

| No deposit fees for most payment methods | Some payment methods have a minimum deposit amount |

| Quick processing times for deposits | Long processing times for withdrawals |

| Multiple currency options available for deposits | Limited currency options available for withdrawals |

| Withdrawals may be subject to additional verification processes |

Customer Support

USGFX offers customer support through various channels, including email, phone, and live chat. The broker has dedicated support teams in different regions to cater to clients' needs. Customer support is available 24/5, and clients can contact the broker through the website's contact form or through the provided phone numbers and email addresses.

USGFX also has an extensive FAQ section on its website that covers different aspects of trading, including account management, deposit and withdrawal, and trading platforms.

| Pros | Cons |

| 24/5 customer support | No 24/7 customer support |

| Live chat support available | No phone support available |

| Fast response time to email inquiries | Limited multilingual support |

| Dedicated account manager for VIP clients | Limited educational resources on customer support issues |

| Comprehensive FAQ section on website | No support via social me |

Educational Resources

USGFX offers a variety of educational resources to help traders improve their knowledge and skills in trading. The broker provides free webinars, video tutorials, e-books, and other resources to help traders learn about various topics such as technical analysis, risk management, trading strategies, and more. Additionally, USGFX offers a demo account, which traders can use to practice trading in a risk-free environment.

The educational resources provided by USGFX can be accessed through the broker's website or the trading platform. The resources are available in multiple languages, making them accessible to traders from different countries. Traders can also interact with the broker's experts and other traders through online forums and social media channels.

| 1. Wide range of educational materials | 1. Some materials may be outdated or not relevant to current market trends |

| 2. Comprehensive courses and tutorials | 2. Limited interactive resources for personalized learning |

| 3. Regular webinars and seminars | 3. Some materials may only be available to premium account holders |

| 4. Market analysis and news updates | |

| 5. Economic calendar with upcoming events and indicators |

Conclusion

USGFX is a forex broker that offers trading services in a variety of markets, including forex, commodities, and cryptocurrencies. The broker offers several account types with varying minimum deposit requirements, allowing traders to choose an account that suits their trading needs. However, the broker's regulation has been a point of concern, with its licenses revoked by various regulatory authorities. This, coupled with negative reviews from clients and the low ranking score, raises questions about the broker's trustworthiness.

FAQs

Q: Is USGFX a regulated broker?

A: USGFX was previously regulated by ASIC, FSC, and VFSC, but their licenses have been revoked due to regulatory violations.

Q: What trading platforms does USGFX offer?

A: USGFX offers the popular MetaTrader 4 (MT4) platform for desktop, web, and mobile devices.

Q: What is the minimum deposit requirement to open an account with USGFX?

A: USGFX offers a MINI account with a minimum deposit requirement of $100.

Q: What is the maximum leverage offered by USGFX?

A: USGFX offers a maximum leverage of up to 500:1 for forex trading.

Q: What are the available payment methods for deposits and withdrawals with USGFX?

A: USGFX offers various payment methods, including bank transfer, credit/debit card, and electronic payment systems such as Neteller and Skrill.

Q: Does USGFX offer educational resources for traders?

A: Yes, USGFX provides a range of educational resources for traders, including webinars, e-books, and trading tutorials.

Are the transaction costs and expenses of hantec, usgfx lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive hantec and usgfx are, we first considered common fees for standard accounts. On hantec, the average spread for the EUR/USD currency pair is -- pips, while on usgfx the spread is EURUSD 0.4.

Which broker between hantec, usgfx is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

hantec is regulated by ASIC,VFSC,FSA. usgfx is regulated by ASIC,FCA,VFSC.

Which broker between hantec, usgfx provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

hantec provides trading platform including PRO,ECN,CENT,STANDARD and trading variety including Forex, Precious Metals, Commodity CFDs, Index CFDs, Stock CFDs. usgfx provides trading platform including ECN/STP account,VIP account,Platinum account,Standard account,Mini account and trading variety including Foreign exchange, precious metals, stock index futures.