No data

Do you want to know which is the better broker between eToro and SBI FXTRADE ?

In the table below, you can compare the features of eToro , SBI FXTRADE side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of etoro, sbi-fxtrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| eToro | Basic Information |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | CySEC, FCA, ASIC |

| Tradable Assets | Stocks, Cryptocurrencies, Currencies, Commodities, ETFs |

| Minimum Deposit | $10 |

| Trading Fees | Commission-free trading, Spreads from 0.75 pips on EUR/USD |

| Non-Trading Fees | Withdrawal fee of $5, Inactivity fee of $10/month after 12 months of inactivity |

| Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Mobile Trading | Yes, available on iOS and Android |

| Customer Support | 24/5 live chat, email support |

| Educational Resources | Social trading, educational videos, blog articles, eToro Academy |

| Demo Account | Yes, unlimited time |

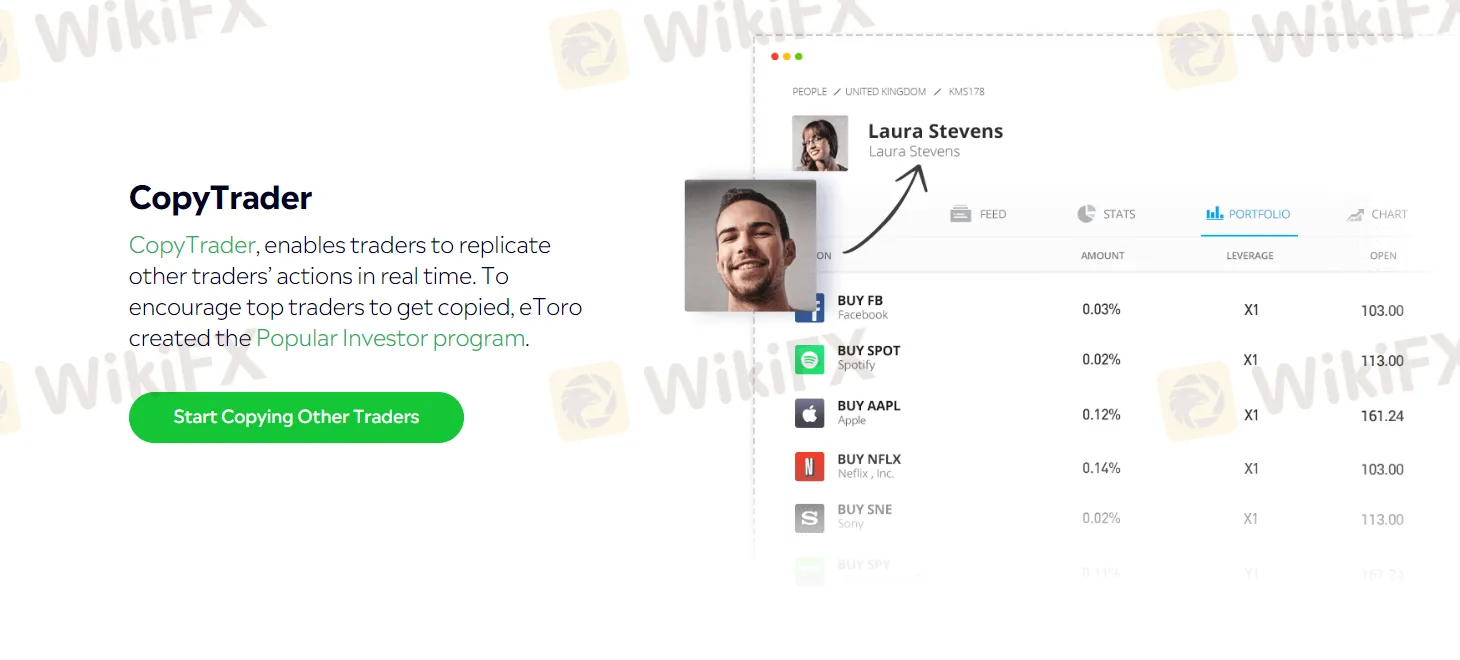

| Other Features | CopyTrader, Popular Investor Program, eToro Wallet |

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

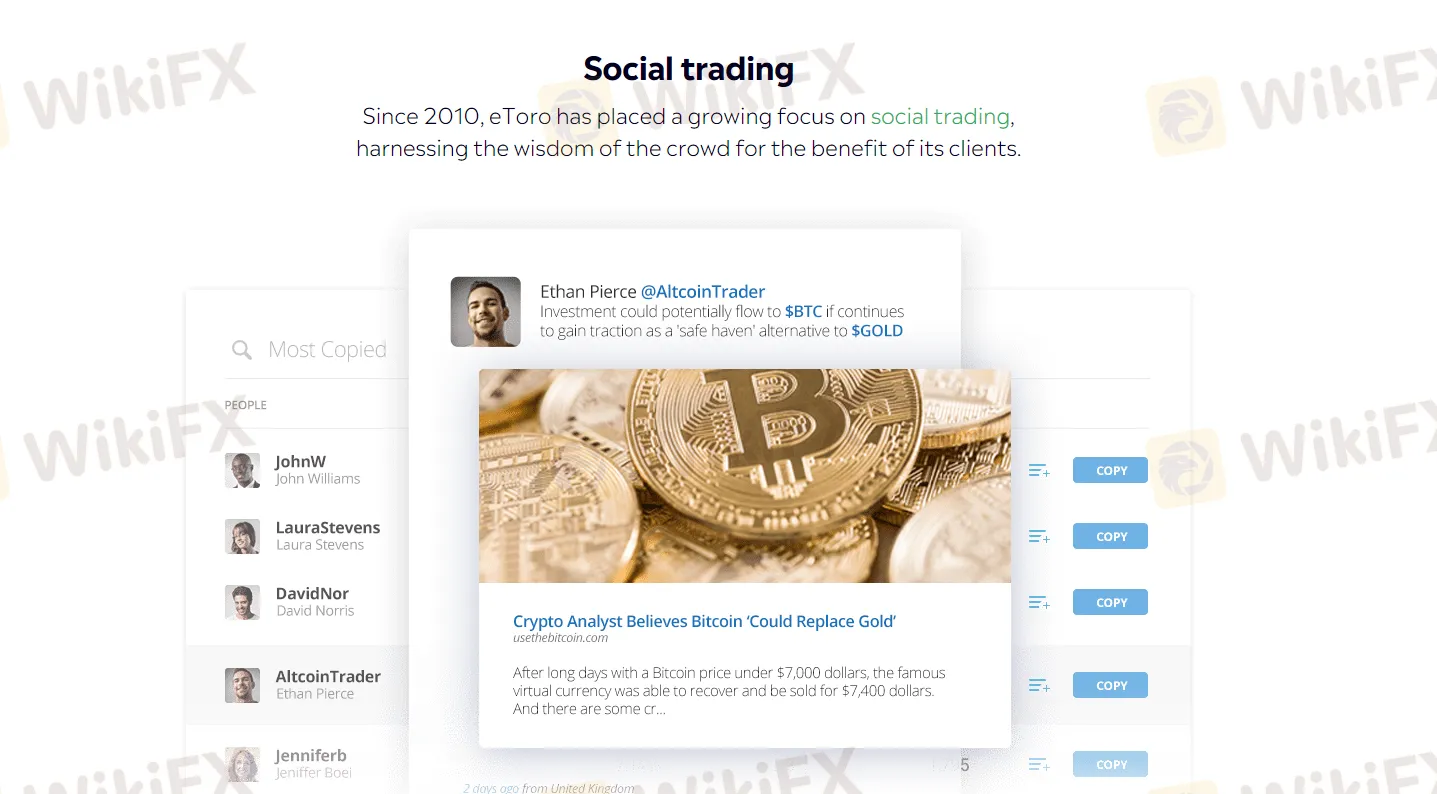

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007. It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds. However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders. However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up. In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Higher spreads compared to some other brokers |

| Regulated by reputable financial authorities | Limited range of tradable assets |

| Copy trading and social trading features | Limited research and analysis tools |

| Wide range of payment methods | Inactivity fee charged after 12 months of inactivity |

| Commission-free trading on stocks and ETFs | Withdrawal fee of $5 |

| Demo account available for practice | Limited customer support options |

Market Instruments

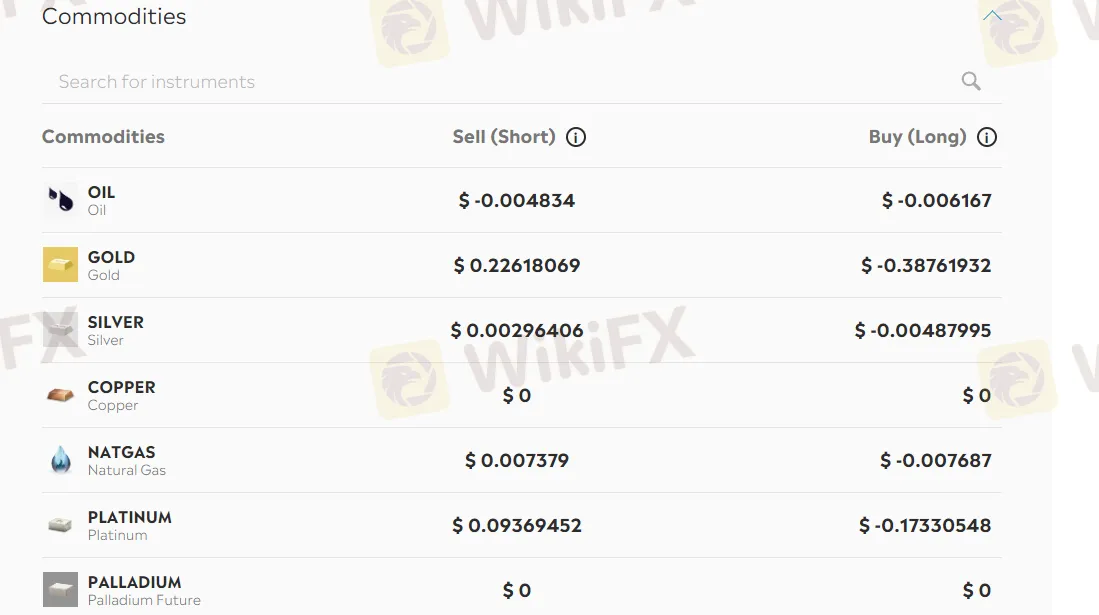

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally. Traders can access more than 2,400 assets, including popular currencies, commodities, indices, and stocks from exchanges around the world. Furthermore, eToro enables traders to trade cryptocurrency, such as Bitcoin and Ethereum, which has become a popular asset class in recent years due to its high volatility and potential for substantial profits. With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Pros | Cons |

| Wide variety of assets including stocks, cryptocurrencies, commodities, forex, and more | Limited selection of options and futures contracts |

| Commission-free trading on most instruments | Limited research tools for fundamental analysis |

| Availability of social trading, allowing for copy trading and following other traders' strategies | Limited access to less popular or niche assets |

| Option to trade fractional shares for stocks, making it accessible to investors with small capital | Limited trading hours on certain assets, such as cryptocurrencies |

| Lack of transparency in pricing structure for some assets |

eToro provides traders with two primary types of accounts to choose from, namely the Retail and Professional accounts. These account types differ in various aspects, such as trading features, account requirements, leverage limits, and the level of regulatory protection they offer.

eToro's Retail account is suitable for most traders and investors. This account type requires a minimum deposit of $500 and provides access to all eToro's trading instruments, including cryptocurrencies, stocks, ETFs, commodities, and more. Retail account holders can also benefit from eToro's social trading features, which allow users to follow and copy other successful traders on the platform. However, retail account holders are limited to a maximum leverage of 1:30, as per regulatory requirements.

eToro's Professional account is designed for experienced traders who meet certain criteria, such as having a minimum of two years of trading experience and meeting certain financial thresholds. This account type provides access to higher leverage of up to 1:400, and allows users to benefit from reduced margin requirements and negative balance protection. However, professional account holders are not eligible for certain investor protection rights, such as compensation schemes, as they are deemed to have a higher level of trading knowledge and experience.

| Aspects | Pros | Cons |

| Account Types | Offers both retail and professional accounts | Professional accounts require certain qualifications |

| Minimum Deposit | Low minimum deposit requirement for retail account | High minimum deposit requirement for professional account |

| Commission | No commission on trades for most assets | Higher spreads compared to other brokers |

| Leverage | Up to 1:30 for major currency pairs | Limited leverage options for professional accounts |

| Platform | User-friendly platform with social trading features | Limited customization options |

| Customer Support | 24/7 customer support in multiple languages | Phone support only available during market hours |

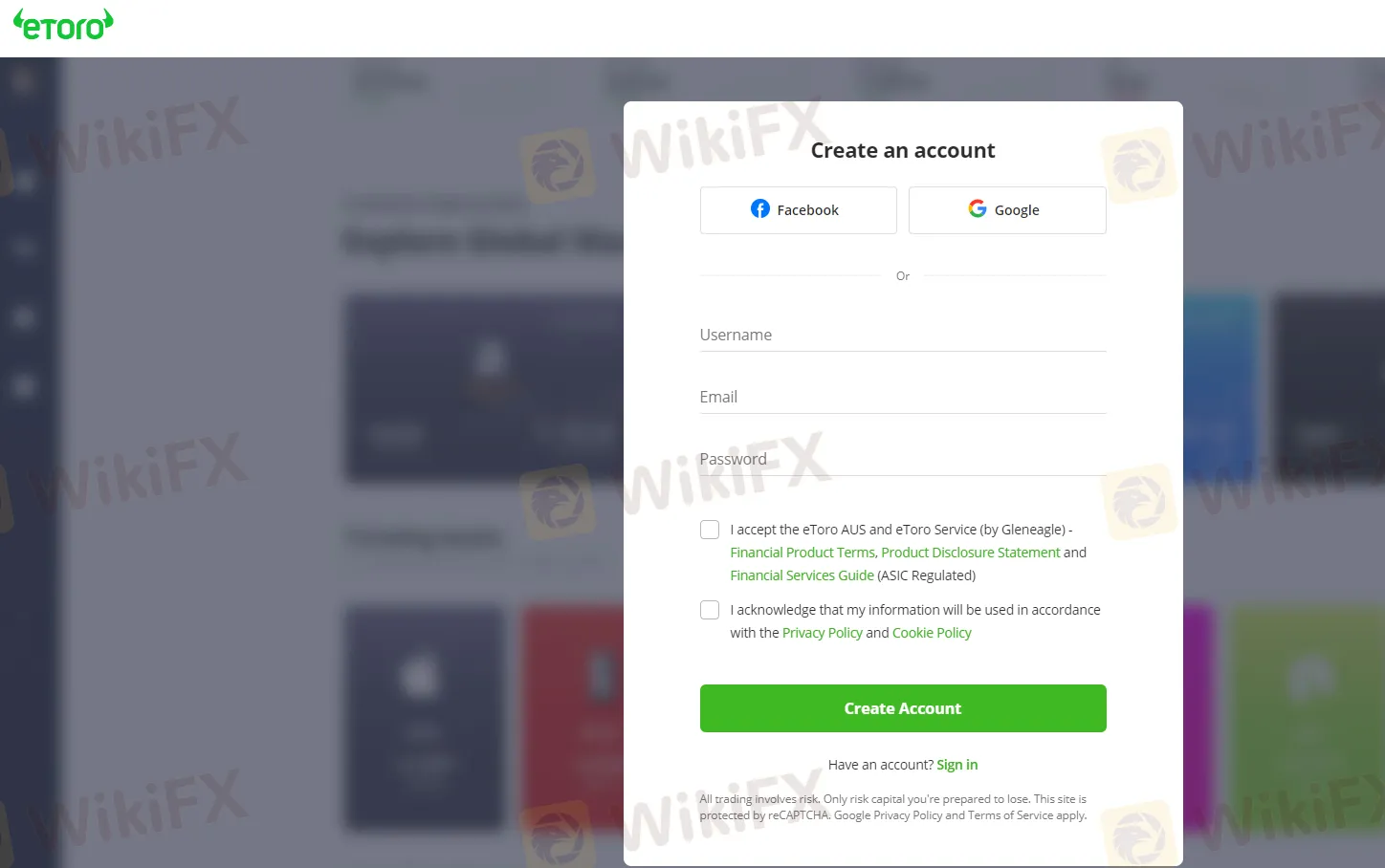

To open an account with eToro, you need to follow these steps:

Go to the eToro website and click on the “Join Now” button.

Enter your personal information, including your name, email address, and phone number.

Verify your email address by clicking on the verification link sent to your email. Provide additional information, including your date of birth, address, and tax ID number. Agree to the terms and conditions and submit your application.

Wait for eToro to review and approve your account, which usually takes a few minutes to a few business days.

After approval, you can fund your account with preferable payment methods and then start your real trading with this broker.

eToro offers a demo account for traders who want to practice trading strategies without risking real money. The eToro demo account provides $100,000 in virtual money and is valid for an unlimited amount of time, allowing traders to familiarize themselves with the platform and practice their trading skills.

To open a demo account, traders can simply sign up for an eToro account and select the option to use the demo account. It's important to note that the eToro demo account does not require any deposit or funding, making it a risk-free way to test out the platform.

When using the demo account, traders should keep in mind that the virtual money provided is not real, and any profits or losses made are also not real. It's also important to note that while the demo account provides a good introduction to the platform, it may not accurately reflect the actual market conditions and trading experience.

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client. For example, for major forex pairs, eToro offers leverage up to 1:30 for retail clients and up to 1:400 for professional clients. For commodities such as gold and silver, leverage can be up to 1:20 for retail clients and up to 1:100 for professional clients. For stocks, eToro offers leverage up to 1:5 for both retail and professional clients. It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

eToro's spreads vary depending on the asset being traded. The platform charges variable spreads, which means that the spread can widen or narrow depending on market conditions. The typical spread for major currency pairs such as EUR/USD and GBP/USD is around 3 pips during normal market conditions. However, this can vary depending on market volatility and liquidity.

For other assets, such as cryptocurrencies and commodities, eToro's spreads are generally higher. For example, the spread for Bitcoin can range from 0.75% to 5% depending on market conditions.

| Pros | Cons |

| Zero commission on stock and ETF trading | Wider spreads compared to other brokers |

| Competitive spreads on major forex pairs | Overnight fees charged on leveraged positions |

| No hidden fees or surprises | Limited selection of exotic currency pairs |

| Transparent pricing | Higher spreads on cryptocurrencies |

| Tight spreads on commodities and indices | Spreads can widen during volatile market conditions |

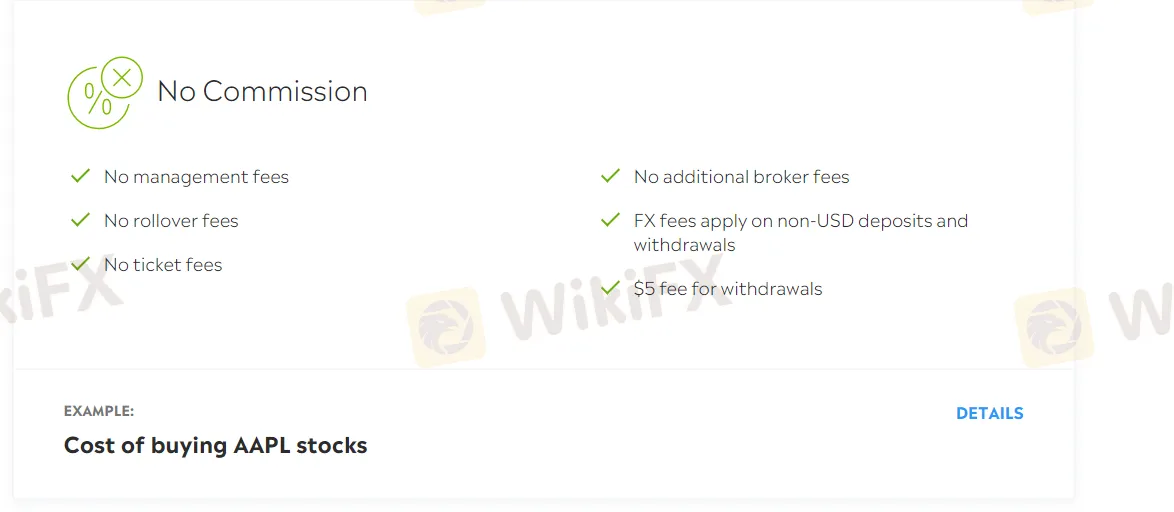

In addition to spreads and commissions, eToro also imposes a few non-trading fees that traders should take into consideration before trading on this platform. These fees include:

Withdrawal fee: eToro charges a withdrawal fee of $5 per withdrawal. This fee is relatively low compared to other brokers.

Inactivity fee: If you don't log in to your eToro account for 12 months, an inactivity fee of $10 per month will be charged to your account. This fee is charged until you log in again or until your account balance reaches zero.

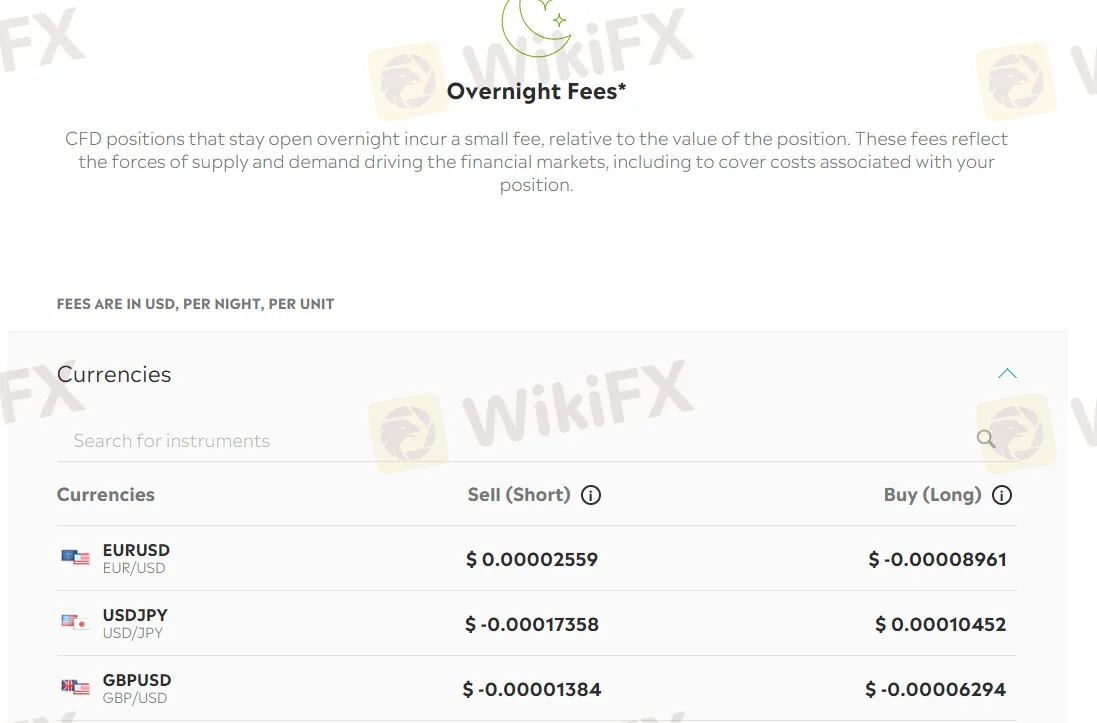

Overnight fees: eToro charges overnight fees or rollover fees for positions held open overnight. The amount of the fee depends on the instrument traded, the direction of the position, and the size of the position.

Currency conversion fee: If you deposit funds in a currency different from the base currency of your account, eToro charges a currency conversion fee. The fee is 0.5% of the deposited amount, and it's calculated based on the exchange rate at the time of the conversion.

| Pros | Cons |

| No commissions on stock and ETF trading | Higher spreads compared to other brokers |

| No deposit fees | High withdrawal fees |

| No account maintenance fees | Inactivity fee after 12 months of inactivity |

| No fees for using the CopyTrader feature | Limited payment methods |

| No fees for currency conversion | Overnight fees for positions held overnight |

| High fees for using PayPal as a payment method |

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Here is a comparison table of the trading platform offered by eToro, FP Markets and Exness:

| Broker | Trading Platform | Desktop | Web-based | Mobile |

| eToro | eToro Platform | ✔️ | ✔️ | ✔️ |

| FP Markets | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

| Exness | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

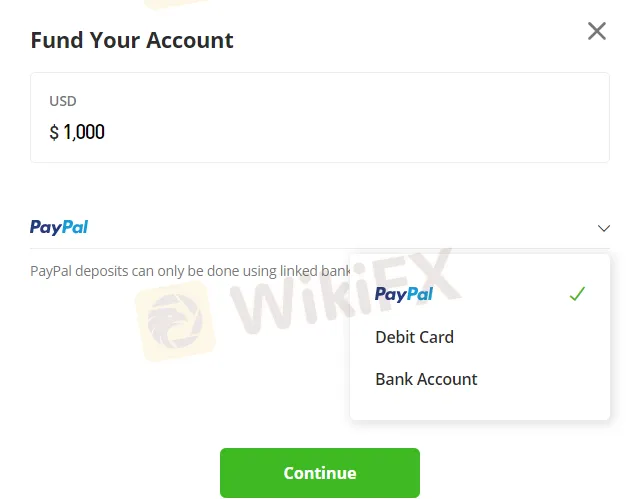

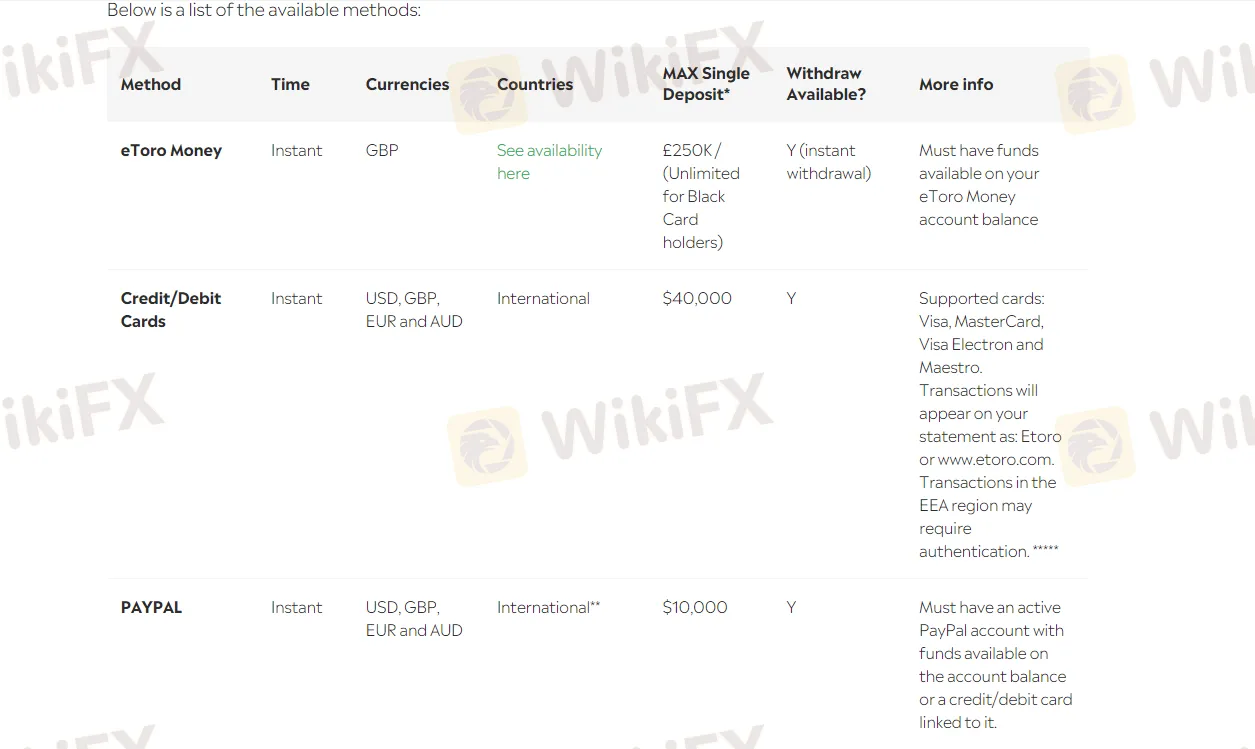

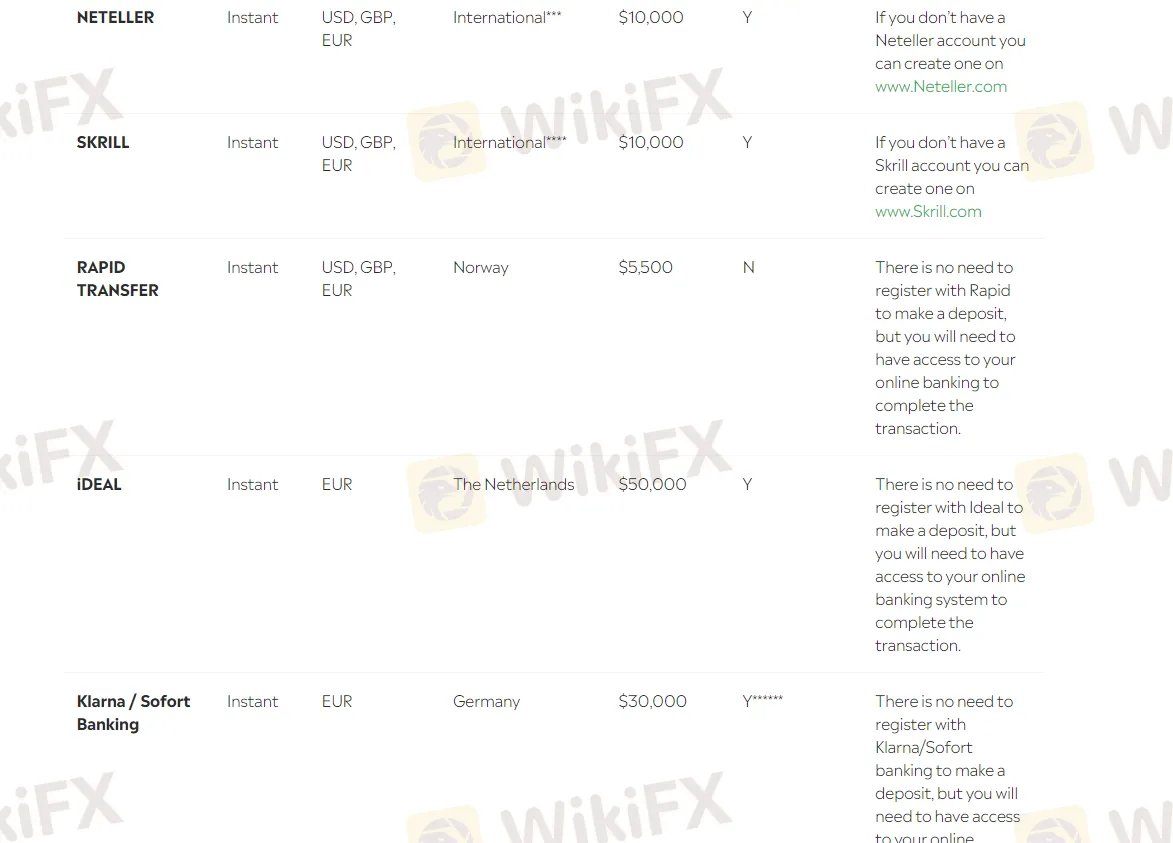

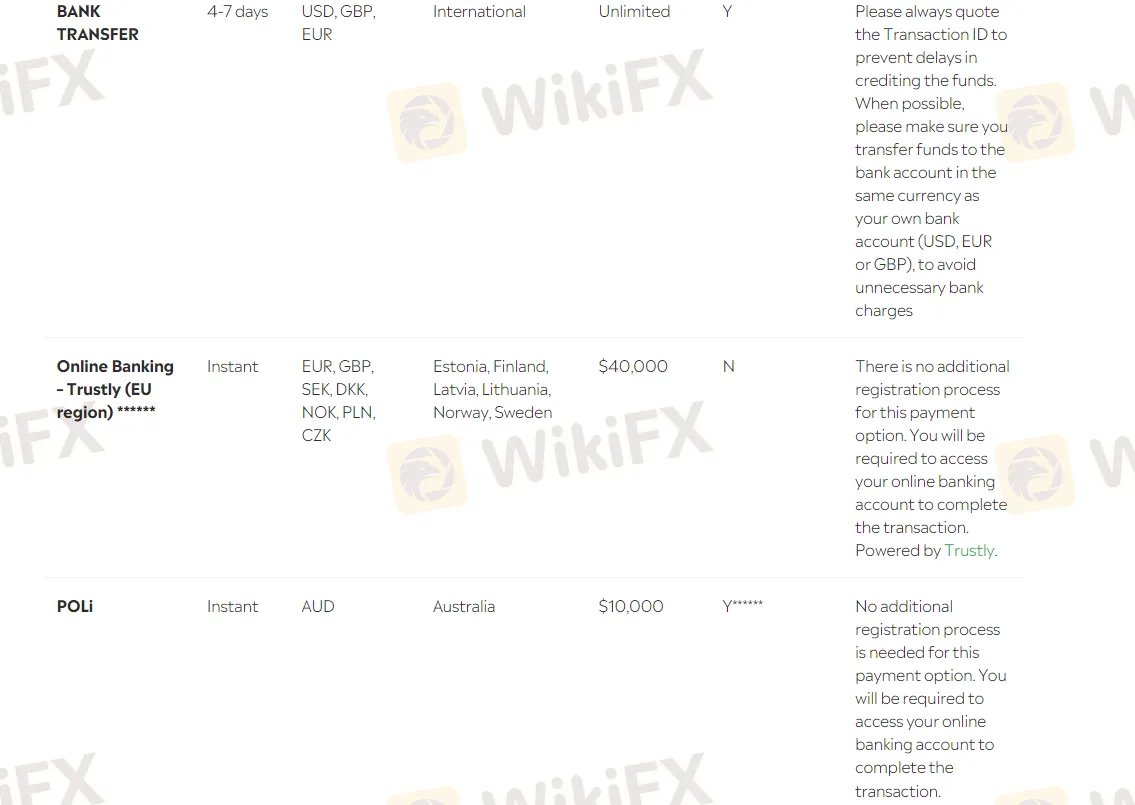

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill. The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry. Deposits are usually processed instantly or within one business day, depending on the payment method. eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.The minimum withdrawal amount is $30, and there is a withdrawal fee of $5.Withdrawals are usually processed within one business day, but it may take longer for bank transfers.Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures. eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

| Pros | Cons |

| Wide range of payment methods available including credit/debit cards, PayPal, and bank transfer | Withdrawal fee of $5 per transaction |

| Quick and easy deposit process with most methods being processed instantly | Minimum withdrawal amount of $30 |

| No deposit fees charged by eToro | Limited number of currencies available for deposits and withdrawals |

| Supports deposits and withdrawals in multiple currencies | Withdrawal processing time can take up to 7 business days |

| Allows users to set up multiple payment methods for convenience | Third-party fees may be charged by payment processors |

| Negative balance protection ensures that users cannot lose more than they have deposited | Users may need to provide additional verification documents for withdrawals |

Customer support is an important aspect of any online brokerage firm, and eToro is no exception. eToro offers various channels for customers to get in touch with its support team. These channels include:

Live chat: This is available 24/5, Monday to Friday. It is the fastest and most efficient way to get support.

Email: Customers can send an email to the eToro support team. The response time is usually within 24 hours.

Phone: Customers can also call the support team during office hours. eToro provides local phone numbers for various countries.

Social media: eToro has a presence on various social media platforms, including Twitter and Facebook. Customers can use these platforms to get in touch with the support team.

FAQ section: eToro offers a comprehensive FAQ section on their website that covers a wide range of topics related to their services, trading, account management, and more. The FAQ section is organized into categories, making it easy for users to find answers to their questions quickly.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include:

eToro Academy: This is an online education portal that provides traders with a wide range of educational materials, including articles, videos, webinars, and courses on various topics such as trading strategies, market analysis, risk management, and more.

Trading Guides: eToro also offers a series of trading guides that provide in-depth information on various trading topics, including stocks, commodities, currencies, and indices.

Market News and Analysis: eToro provides traders with up-to-date news and analysis on the financial markets. This includes daily market updates, weekly market analysis, and other educational content.

Blog: eToro has a blog that provides traders with the latest news, market analysis, and trading tips.

Virtual Portfolio: eToro offers a virtual portfolio feature that allows traders to practice trading without risking real money. This is a great way for beginners to gain experience and test out their trading strategies before trading with real money. Here is an instructional video for users to know clearly what Virtual Portfolio is:https://www.youtube.com/watch?v=GWK7uQ98KpM.

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as relatively high fees, limited research tools, and a lack of advanced charting capabilities.

FAQs

Q: Is eToro a regulated broker?

A: Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Q: What trading instruments are available on eToro?

A: eToro offers a wide range of trading instruments, including stocks, ETFs, cryptocurrencies, forex, commodities, and indices.

Q: What is the minimum deposit required to open an account on eToro?

A: The minimum deposit required to open an account on eToro varies depending on your location and the type of account you choose. For most countries, the minimum deposit is $500.

Q: Does eToro offer a demo account?

A: Yes, eToro offers a demo account that allows you to practice trading with virtual funds. The demo account is free and can be used for an unlimited period of time.

Q: What is eToro's customer support like?

A: eToro's customer support is available 24/5 and can be reached through email, live chat, and phone. They also have a comprehensive help center and a community forum where you can get answers to common questions and connect with other traders.

| Information | Details |

| Company Name | SBI FXTRADE |

| Registered Country/Area | Japan |

| Regulation | Financial Services Agency, Japan |

| Minimum Deposit | 1,000 yen for Quick Deposits |

| Spreads | Narrow Spreads |

| Trading Platforms | Desktop and Mobile |

| Tradable Assets | Forex (34 currency pairs) |

| Demo Account | Available |

| Deposit & Withdrawal | Quick Deposits, Normal Deposits, Deposits to SBI Shinsei Bank |

| Educational Resources | Official YouTube channel |

SBI FXTRADE is a Forex broker and a part of the SBI Group, a leading online financial services company in Japan. Its service allows users to engage in foreign exchange (FX) margin trading. The platform offers real-time market information and various analysis tools, which can assist both novices and experienced traders in their decision-making process.

The SBI FXTRADE platform boasts of features such as narrow spreads and 24-hour trading. It also offers a demo account option for practice. Additionally, there is a user-friendly interface which simplifies the process of FX trading and a mobile application for trading on the go. It is essential to remember that just like any other type of trading and investment, forex trading involves certain risks which should be thoroughly understood before participating.

SBI FXTRADE is a regulated broker under the jurisdiction of Japan. The platform is licensed as a Retail Forex License holder and is overseen by the Financial Services Agency of Japan. The license number is 関東財務局長(金商)第2635号 and the official licensed institution is SBI FX トレード株式会社. The license was effectively granted on 13th April 2012. However, there is no shared email address of the licensed institution. It's crucial to trade with a regulated broker as it provides a certain level of security and oversight.

| Pros | Cons |

| An extensive range of 34 currency pairs for trading | Certain deposit options involve fees |

| Offers Quick deposits starting from 1,000 yen with no fees | Some deposit methods may not reflect immediately |

| Regulated by the Financial Services Agency | Forex and other forms of trading always carry inherent risks |

| Provides a range of educational resources, including a YouTube channel for learning and updates | For Normal deposits and some other services, transfer fees will be borne by the customer |

| Allows 24-hour trading | |

| User-friendly interface | |

| Offers a demo account for practice | |

| Provides both desktop and mobile trading platforms |

Pros:

1. Wide Range of Trading Instruments: SBI FXTRADE offers an extensive range of 34 currency pairs for trading, making it an attractive platform for those who wish to diversify their trading portfolio.

2. Quick Deposits: The platform provides a quick deposit feature that starts from 1,000 yen with no associated fees.

3. Regulation: SBI FXTRADE is regulated by the Financial Services Agency of Japan, adding a higher level of security and trustworthiness.

5. User-Friendly Interface: The platform has a user-friendly interface that simplifies the process of FX trading, making it easier for beginner traders to navigate.

6. Demo Account: SBI FXTRADE provides a demo account which allows users to practice trading strategies before investing real money.

7. 24-Hour Service: The platform facilitates 24-hour trading, enabling traders to take advantage of global forex market hours.

8. Mobile Trading: SBI FXTRADE offers mobile trading platforms for users to trade on the go.

Cons:

1. Deposit Fees: While quick deposits are free, other deposit methods such as the “normal deposit” method have associated transfer fees that will be borne by the customer.

2. Delay in Reflection of Deposits: Certain deposit methods may not immediately reflect the deposited amount in the trading account. If any error occurs, the reflection of deposit will have to wait till the confirmation of payment receipt.

3. Fees on Some Services: For certain services, such as normal deposits, transfer fees will be borne by the customer.

SBI FXTRADE provides its users with the opportunity to trade in a total of 34 currency pairs. This offering is considered to be one of the highest in the industry, giving traders a wide range of options when it comes to choosing their trading instruments.

It signifies that traders have the opportunity to capitalize on the movements of various currencies ranging from major currency pairs to minor and exotic ones. However, it's always important for traders to understand the risks associated with each trading instrument before investing.

The first step would be to navigate to the “Complete application in” button at the top right side of the page.

Please enter your email address using the submit button that is below the “apply for a personal account” sign. An account opening application URL will be sent to the email address you entered.

Enter your name, date of birth, and current address as in the identity verification document. The user is required to have a Japanese “MyNumber” identification in order to continue to after this step.

After the information has been examined, SBI FXTRADE will determine if the account creation process will be completed.

SBI FXTRADE offers two different methods of depositing funds: quick deposits and normal deposits.

Quick deposits start from 1,000 yen, with no associated fees. It's important to note that applications cannot be accepted during maintenance times performed by the broker or financial institutions.

SBI FXTRADE provides several methods for depositing and withdrawing funds.

For making deposits, there are three methods available:

Quick deposits: This method allows clients to deposit funds starting from 1,000 yen with no associated fees. However, deposition isn't guaranteed to reflect immediately - errors might delay the reflection of the deposit.

Normal deposits: This involves a money transfer to a created “Customer Dedicated Deposit Account”. Note that transfer fees are borne by the customer unless they are an SBI Shinsei Bank account holder depositing into the “SBI Shinsei Bank account exclusively for SBI FX Trade”.

Deposit to SBI Shinsei Bank: This method involves a money transfer to the dedicated SBI Shinsei Bank account for SBI FX Trade. There are no transfer fees and the customer has to specify their login ID and first and last name in kana in the remittance name.

The following provides more details on deposit confirmation and conditions:

Payments can be confirmed on the transaction screen.

Payments may not reflect immediately as they need to be received and confirmed by the bank. This process can take some time during busy periods.

Deposit processing is done three times a day at 9:00, 13:00, and 15:30.

Shinsei Bank deposits will be reflected in the FX account and need to be transferred to the savings FX account or the crypto asset CFD account by the user.

SBI FXTRADE offers an array of contact channels enabling seamless and efficient communication:

Direct Phone Line: Enabling immediate assistance, the firm can be directly contacted via their dedicated line at +81 0120-982-417.

Official Web Portal: An exhaustive array of resources could be found on their official website, SBI FXTRADE.

Social Media Presence: Connect with them on Twitter for real-time updates and interactions. They also maintain an active online presence on Facebook and exclusive content on their dedicated YouTube channel.

SBI FXTRADE provides several educational resources for its traders:

Official YouTube Channel: SBI FXTRADE maintains an official YouTube channel where they share informative video content. This includes market news, tutorials, trading strategies, and explanations on various aspects of Forex trading.

Today's Exchange News: This is presumably a feature where recent news and events affecting the exchange market are discussed, providing insights to help traders make informed decisions.

Crypto Asset Market Information: This channel is maintained by SBI VC Trade, which is also a part of the SBI Group. It provides information related to the crypto asset market.

Please note that Forex trading and trading in general can be risky, so it's essential to fully understand these risk factors and strategies before investing. Educational resources are a starting point, but should not be the only source of knowledge or strategy formulation. Real-time experience, trading practice, and individual research are also critical components of trading education.

SBI FXTRADE, a premium trading firm, offers multiple features tailored towards assisting traders succeed. Key offerings include diverse deposit methods (featuring Quick Deposits), a wide array of trading instruments, a user-friendly platform, and well-developed educational resources. However, potential users should be aware of potential deposit fees and delays, and inherent trading risks.

Q: What are some educational resources that SBI FXTRADE provides for traders?

A: SBI FXTRADE offers a variety of educational resources, including a YouTube channel filled with market news, trading strategies, and other trading-related insights, a feature for recent market news, programs providing insights into alternative currencies to USD/JPY.

Q: How can users contact SBI FXTRADE?

A: SBI FXTRADE can be reached through their phone number (+81 0120-982-417), their official website, or their social media accounts on Twitter, Facebook, and YouTube.

Q: What are the unique features of SBI FXTRADE?

A: SBI FXTRADE offers quick deposits without any fees starting from 1,000 yen and is regulated by the Financial Services Agency of Japan for enhanced security.

Q: What cautions should be taken while using SBI FXTRADE or similar trading platform?

A: As with all types of trading and investment, forex trading involves inherent risks. Users should ensure they understand these risks thoroughly before participating.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive etoro and sbi-fxtrade are, we first considered common fees for standard accounts. On etoro, the average spread for the EUR/USD currency pair is -- pips, while on sbi-fxtrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

etoro is regulated by ASIC,CYSEC,FCA,FSC. sbi-fxtrade is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

etoro provides trading platform including -- and trading variety including --. sbi-fxtrade provides trading platform including -- and trading variety including --.