No data

Do you want to know which is the better broker between eToro and Hantec Markets ?

In the table below, you can compare the features of eToro , Hantec Markets side by side to determine the best fit for your needs.

EURUSD: -0.1

XAUUSD: -0.1

Long: -3.33

Short: 1.53

Long: -15.82

Short: 10.26

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of etoro, hantec-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| eToro | Basic Information |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | CySEC, FCA, ASIC |

| Tradable Assets | Stocks, Cryptocurrencies, Currencies, Commodities, ETFs |

| Minimum Deposit | $10 |

| Trading Fees | Commission-free trading, Spreads from 0.75 pips on EUR/USD |

| Non-Trading Fees | Withdrawal fee of $5, Inactivity fee of $10/month after 12 months of inactivity |

| Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Mobile Trading | Yes, available on iOS and Android |

| Customer Support | 24/5 live chat, email support |

| Educational Resources | Social trading, educational videos, blog articles, eToro Academy |

| Demo Account | Yes, unlimited time |

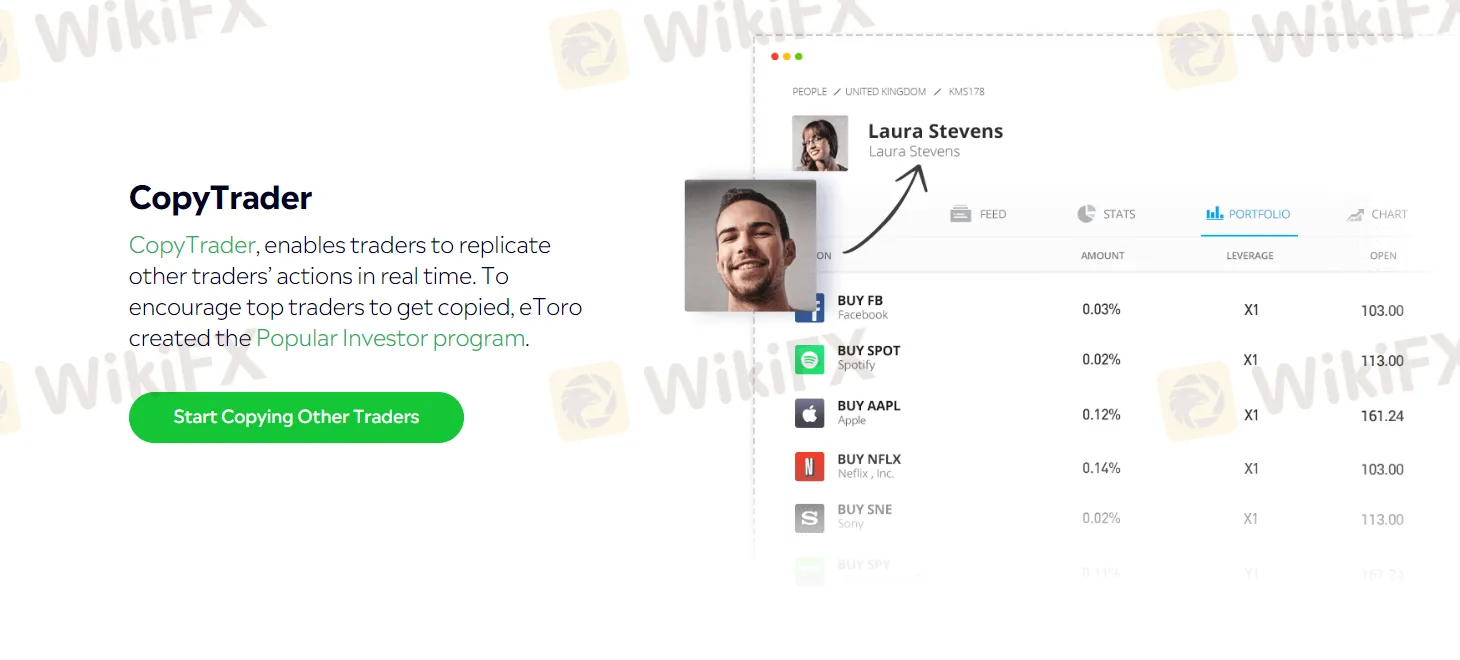

| Other Features | CopyTrader, Popular Investor Program, eToro Wallet |

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

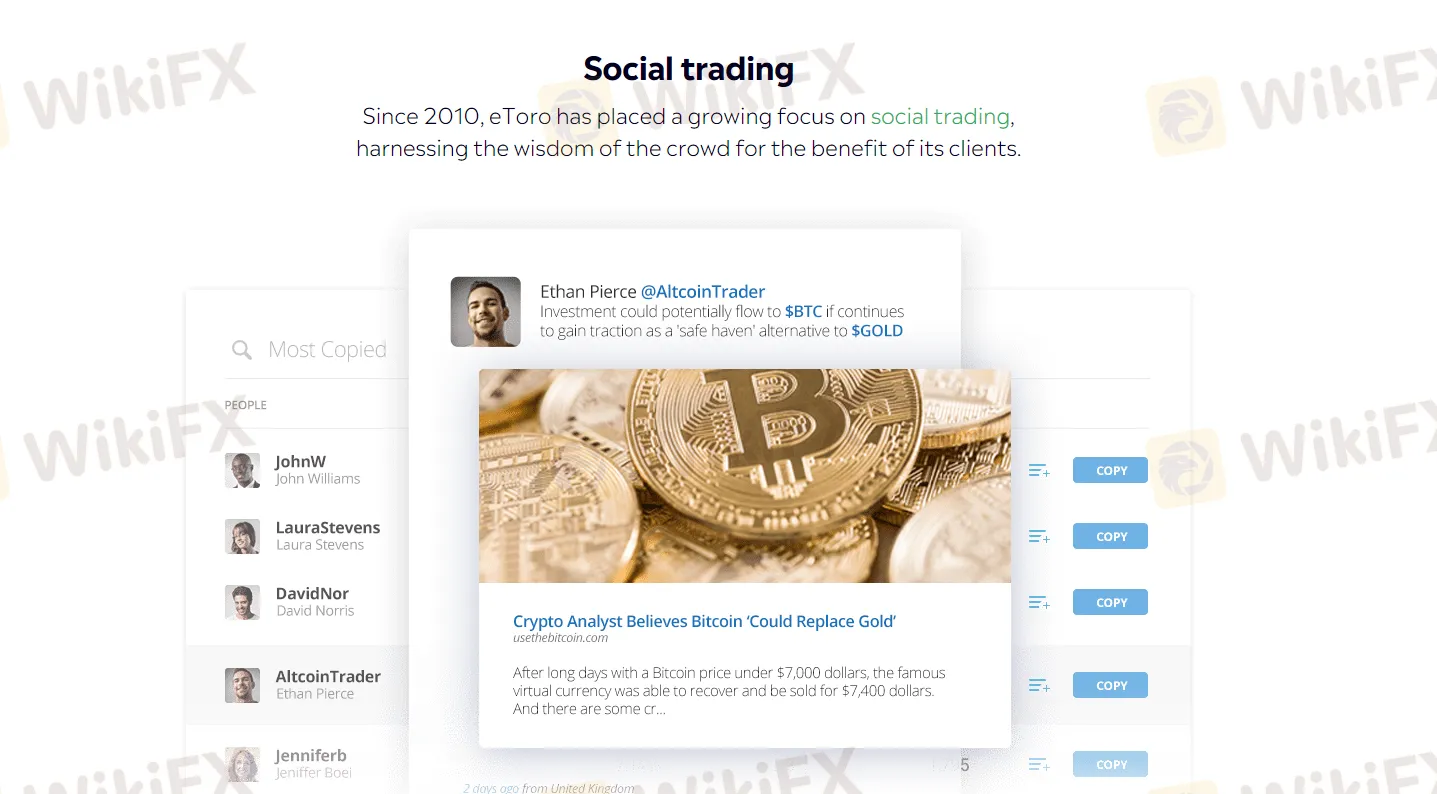

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007. It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds. However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders. However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up. In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Higher spreads compared to some other brokers |

| Regulated by reputable financial authorities | Limited range of tradable assets |

| Copy trading and social trading features | Limited research and analysis tools |

| Wide range of payment methods | Inactivity fee charged after 12 months of inactivity |

| Commission-free trading on stocks and ETFs | Withdrawal fee of $5 |

| Demo account available for practice | Limited customer support options |

Market Instruments

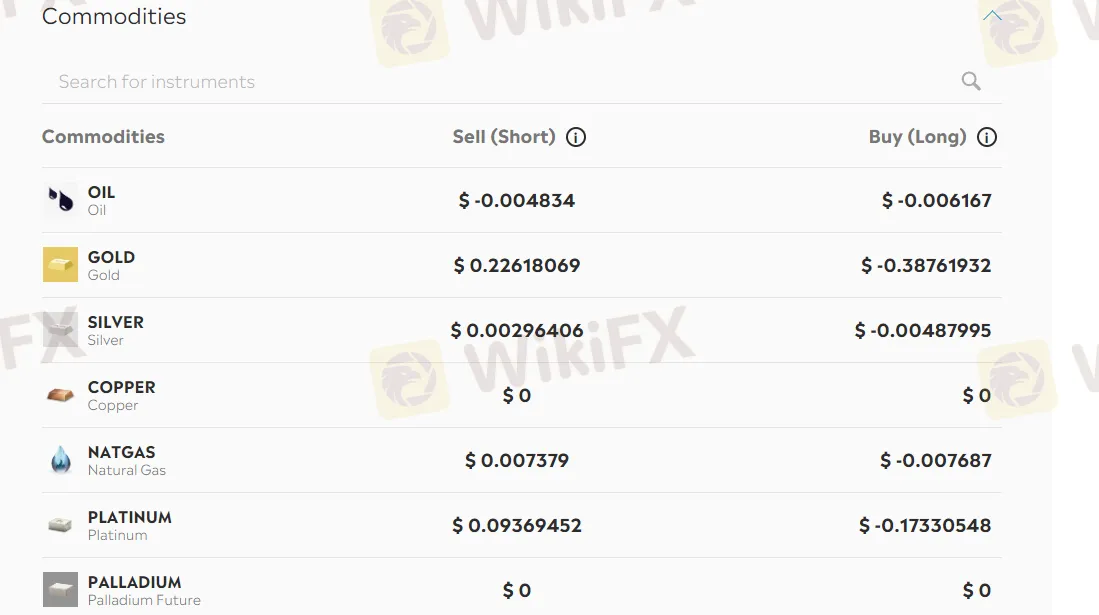

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally. Traders can access more than 2,400 assets, including popular currencies, commodities, indices, and stocks from exchanges around the world. Furthermore, eToro enables traders to trade cryptocurrency, such as Bitcoin and Ethereum, which has become a popular asset class in recent years due to its high volatility and potential for substantial profits. With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Pros | Cons |

| Wide variety of assets including stocks, cryptocurrencies, commodities, forex, and more | Limited selection of options and futures contracts |

| Commission-free trading on most instruments | Limited research tools for fundamental analysis |

| Availability of social trading, allowing for copy trading and following other traders' strategies | Limited access to less popular or niche assets |

| Option to trade fractional shares for stocks, making it accessible to investors with small capital | Limited trading hours on certain assets, such as cryptocurrencies |

| Lack of transparency in pricing structure for some assets |

eToro provides traders with two primary types of accounts to choose from, namely the Retail and Professional accounts. These account types differ in various aspects, such as trading features, account requirements, leverage limits, and the level of regulatory protection they offer.

eToro's Retail account is suitable for most traders and investors. This account type requires a minimum deposit of $500 and provides access to all eToro's trading instruments, including cryptocurrencies, stocks, ETFs, commodities, and more. Retail account holders can also benefit from eToro's social trading features, which allow users to follow and copy other successful traders on the platform. However, retail account holders are limited to a maximum leverage of 1:30, as per regulatory requirements.

eToro's Professional account is designed for experienced traders who meet certain criteria, such as having a minimum of two years of trading experience and meeting certain financial thresholds. This account type provides access to higher leverage of up to 1:400, and allows users to benefit from reduced margin requirements and negative balance protection. However, professional account holders are not eligible for certain investor protection rights, such as compensation schemes, as they are deemed to have a higher level of trading knowledge and experience.

| Aspects | Pros | Cons |

| Account Types | Offers both retail and professional accounts | Professional accounts require certain qualifications |

| Minimum Deposit | Low minimum deposit requirement for retail account | High minimum deposit requirement for professional account |

| Commission | No commission on trades for most assets | Higher spreads compared to other brokers |

| Leverage | Up to 1:30 for major currency pairs | Limited leverage options for professional accounts |

| Platform | User-friendly platform with social trading features | Limited customization options |

| Customer Support | 24/7 customer support in multiple languages | Phone support only available during market hours |

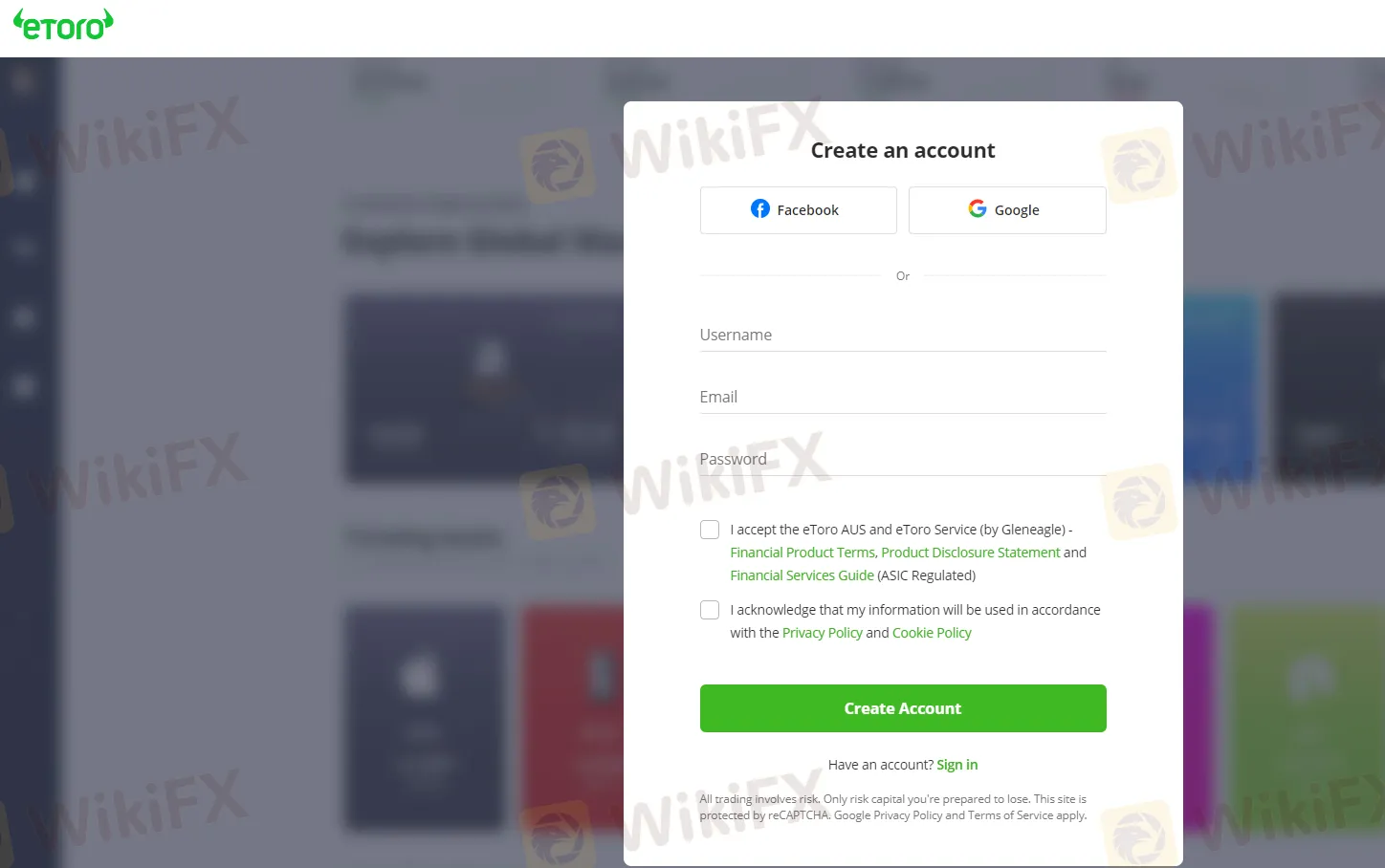

To open an account with eToro, you need to follow these steps:

Go to the eToro website and click on the “Join Now” button.

Enter your personal information, including your name, email address, and phone number.

Verify your email address by clicking on the verification link sent to your email. Provide additional information, including your date of birth, address, and tax ID number. Agree to the terms and conditions and submit your application.

Wait for eToro to review and approve your account, which usually takes a few minutes to a few business days.

After approval, you can fund your account with preferable payment methods and then start your real trading with this broker.

eToro offers a demo account for traders who want to practice trading strategies without risking real money. The eToro demo account provides $100,000 in virtual money and is valid for an unlimited amount of time, allowing traders to familiarize themselves with the platform and practice their trading skills.

To open a demo account, traders can simply sign up for an eToro account and select the option to use the demo account. It's important to note that the eToro demo account does not require any deposit or funding, making it a risk-free way to test out the platform.

When using the demo account, traders should keep in mind that the virtual money provided is not real, and any profits or losses made are also not real. It's also important to note that while the demo account provides a good introduction to the platform, it may not accurately reflect the actual market conditions and trading experience.

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client. For example, for major forex pairs, eToro offers leverage up to 1:30 for retail clients and up to 1:400 for professional clients. For commodities such as gold and silver, leverage can be up to 1:20 for retail clients and up to 1:100 for professional clients. For stocks, eToro offers leverage up to 1:5 for both retail and professional clients. It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

eToro's spreads vary depending on the asset being traded. The platform charges variable spreads, which means that the spread can widen or narrow depending on market conditions. The typical spread for major currency pairs such as EUR/USD and GBP/USD is around 3 pips during normal market conditions. However, this can vary depending on market volatility and liquidity.

For other assets, such as cryptocurrencies and commodities, eToro's spreads are generally higher. For example, the spread for Bitcoin can range from 0.75% to 5% depending on market conditions.

| Pros | Cons |

| Zero commission on stock and ETF trading | Wider spreads compared to other brokers |

| Competitive spreads on major forex pairs | Overnight fees charged on leveraged positions |

| No hidden fees or surprises | Limited selection of exotic currency pairs |

| Transparent pricing | Higher spreads on cryptocurrencies |

| Tight spreads on commodities and indices | Spreads can widen during volatile market conditions |

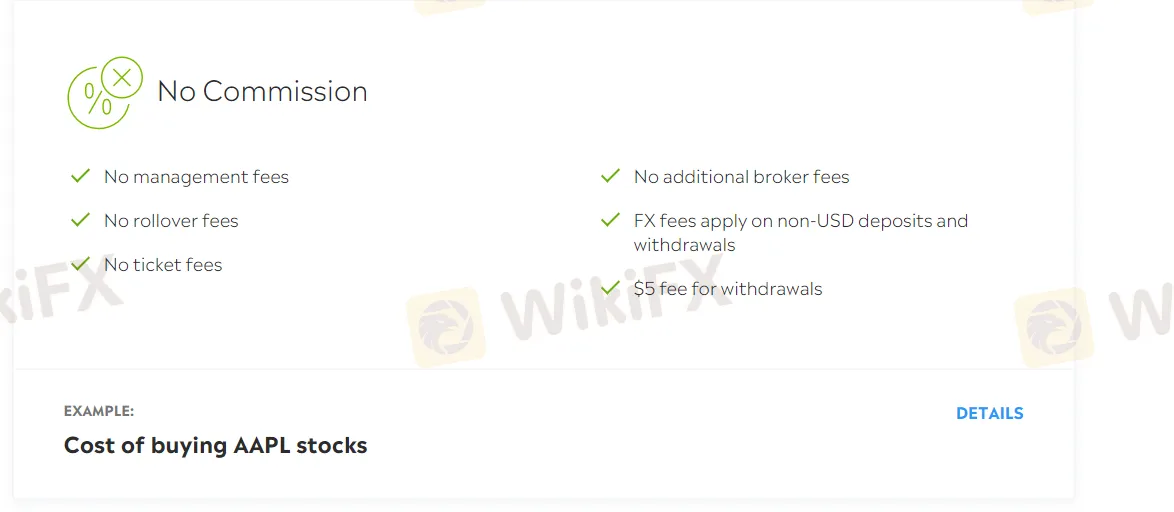

In addition to spreads and commissions, eToro also imposes a few non-trading fees that traders should take into consideration before trading on this platform. These fees include:

Withdrawal fee: eToro charges a withdrawal fee of $5 per withdrawal. This fee is relatively low compared to other brokers.

Inactivity fee: If you don't log in to your eToro account for 12 months, an inactivity fee of $10 per month will be charged to your account. This fee is charged until you log in again or until your account balance reaches zero.

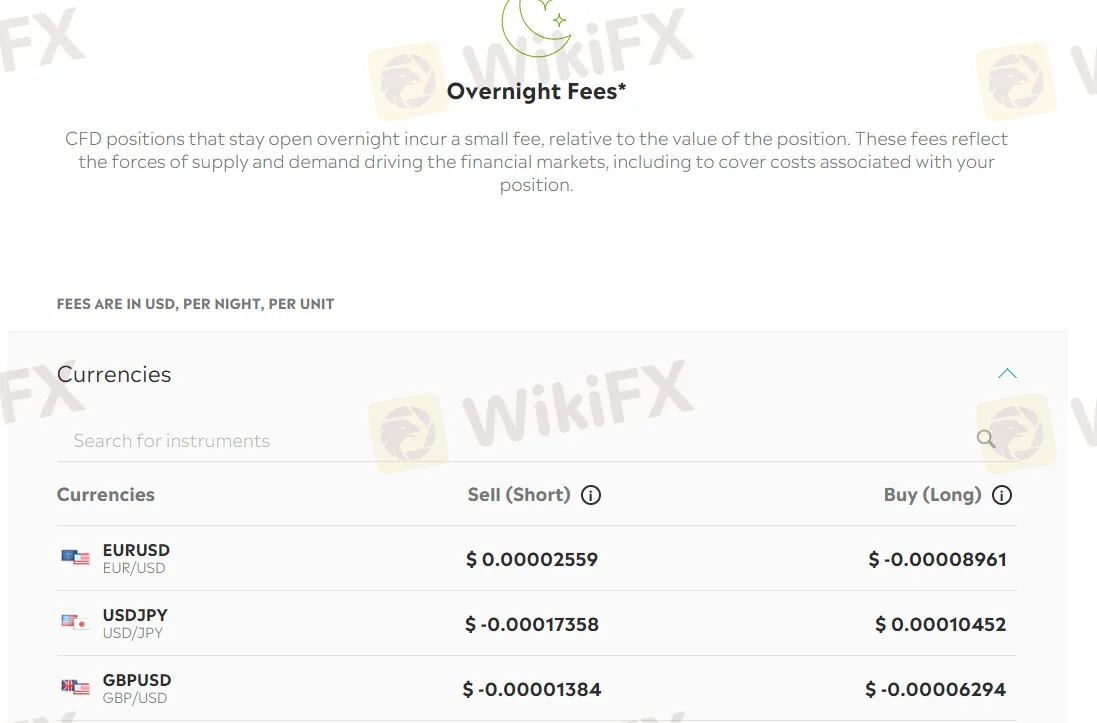

Overnight fees: eToro charges overnight fees or rollover fees for positions held open overnight. The amount of the fee depends on the instrument traded, the direction of the position, and the size of the position.

Currency conversion fee: If you deposit funds in a currency different from the base currency of your account, eToro charges a currency conversion fee. The fee is 0.5% of the deposited amount, and it's calculated based on the exchange rate at the time of the conversion.

| Pros | Cons |

| No commissions on stock and ETF trading | Higher spreads compared to other brokers |

| No deposit fees | High withdrawal fees |

| No account maintenance fees | Inactivity fee after 12 months of inactivity |

| No fees for using the CopyTrader feature | Limited payment methods |

| No fees for currency conversion | Overnight fees for positions held overnight |

| High fees for using PayPal as a payment method |

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Here is a comparison table of the trading platform offered by eToro, FP Markets and Exness:

| Broker | Trading Platform | Desktop | Web-based | Mobile |

| eToro | eToro Platform | ✔️ | ✔️ | ✔️ |

| FP Markets | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

| Exness | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

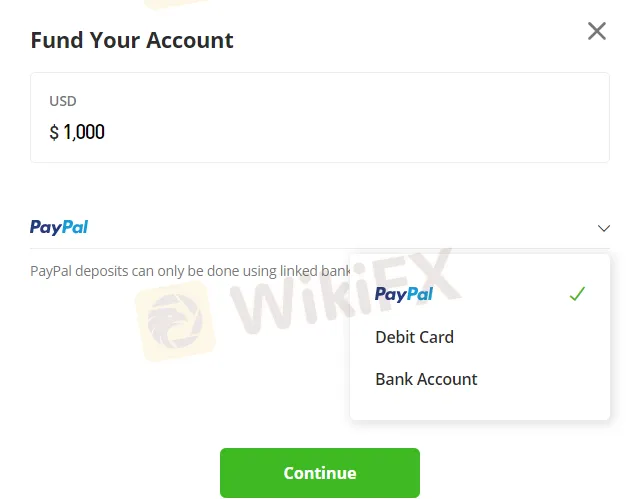

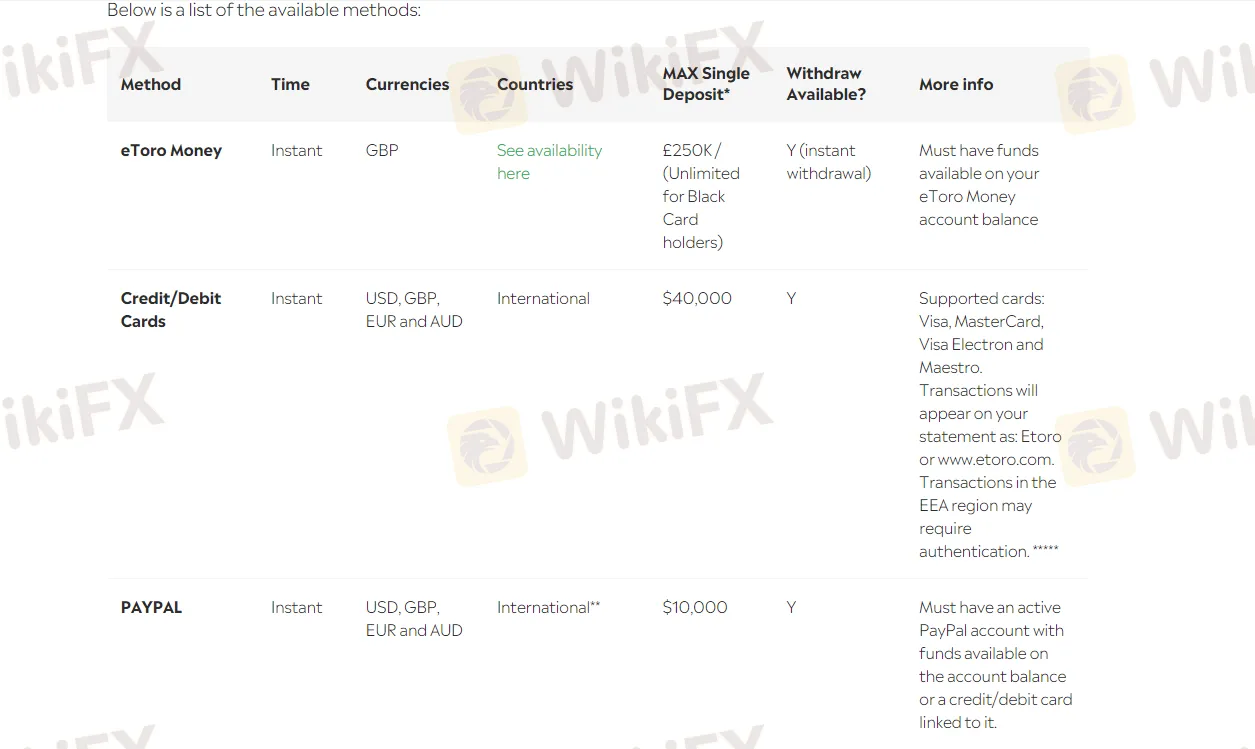

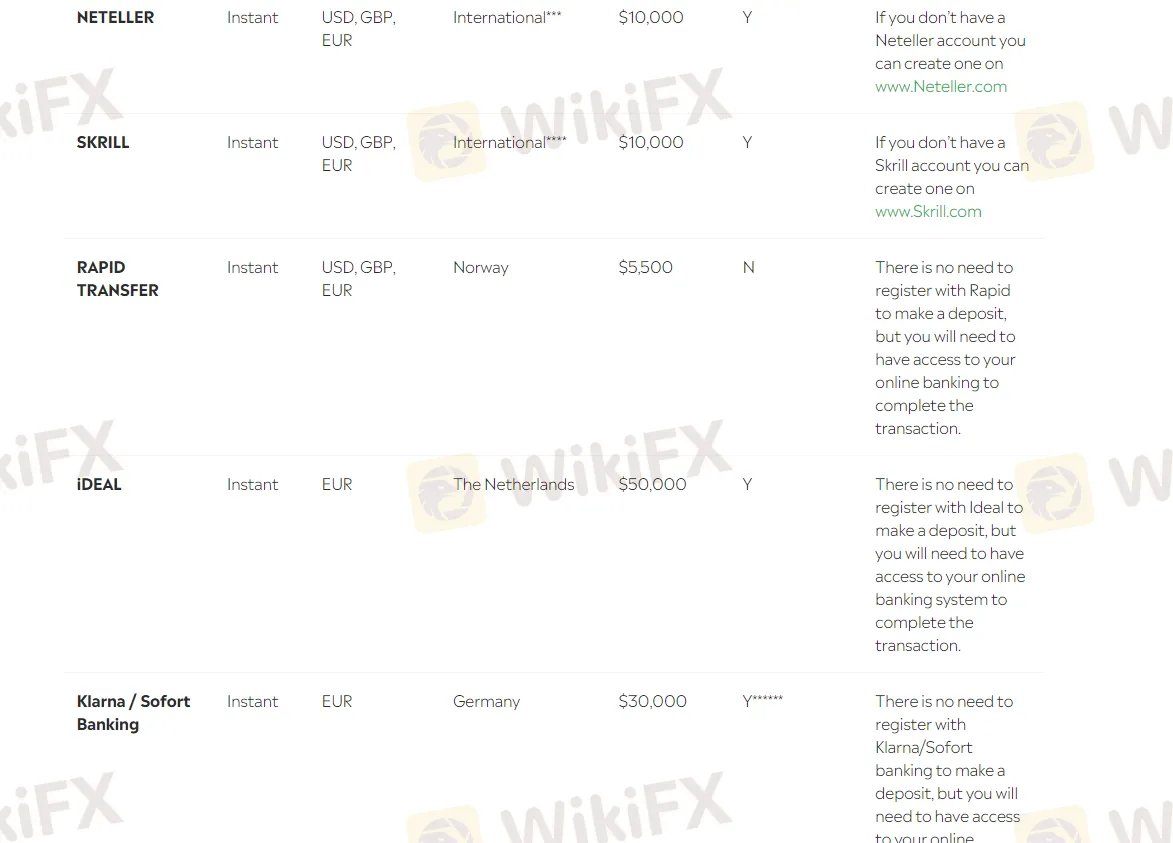

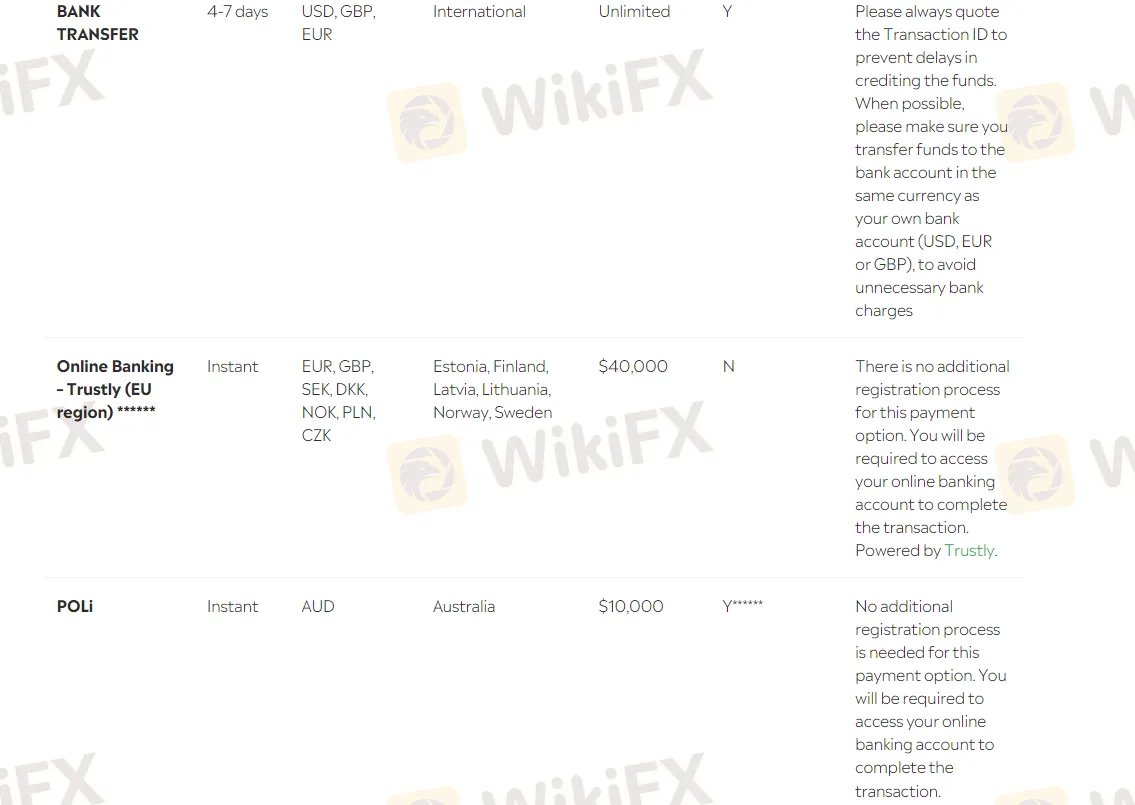

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill. The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry. Deposits are usually processed instantly or within one business day, depending on the payment method. eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.The minimum withdrawal amount is $30, and there is a withdrawal fee of $5.Withdrawals are usually processed within one business day, but it may take longer for bank transfers.Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures. eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

| Pros | Cons |

| Wide range of payment methods available including credit/debit cards, PayPal, and bank transfer | Withdrawal fee of $5 per transaction |

| Quick and easy deposit process with most methods being processed instantly | Minimum withdrawal amount of $30 |

| No deposit fees charged by eToro | Limited number of currencies available for deposits and withdrawals |

| Supports deposits and withdrawals in multiple currencies | Withdrawal processing time can take up to 7 business days |

| Allows users to set up multiple payment methods for convenience | Third-party fees may be charged by payment processors |

| Negative balance protection ensures that users cannot lose more than they have deposited | Users may need to provide additional verification documents for withdrawals |

Customer support is an important aspect of any online brokerage firm, and eToro is no exception. eToro offers various channels for customers to get in touch with its support team. These channels include:

Live chat: This is available 24/5, Monday to Friday. It is the fastest and most efficient way to get support.

Email: Customers can send an email to the eToro support team. The response time is usually within 24 hours.

Phone: Customers can also call the support team during office hours. eToro provides local phone numbers for various countries.

Social media: eToro has a presence on various social media platforms, including Twitter and Facebook. Customers can use these platforms to get in touch with the support team.

FAQ section: eToro offers a comprehensive FAQ section on their website that covers a wide range of topics related to their services, trading, account management, and more. The FAQ section is organized into categories, making it easy for users to find answers to their questions quickly.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include:

eToro Academy: This is an online education portal that provides traders with a wide range of educational materials, including articles, videos, webinars, and courses on various topics such as trading strategies, market analysis, risk management, and more.

Trading Guides: eToro also offers a series of trading guides that provide in-depth information on various trading topics, including stocks, commodities, currencies, and indices.

Market News and Analysis: eToro provides traders with up-to-date news and analysis on the financial markets. This includes daily market updates, weekly market analysis, and other educational content.

Blog: eToro has a blog that provides traders with the latest news, market analysis, and trading tips.

Virtual Portfolio: eToro offers a virtual portfolio feature that allows traders to practice trading without risking real money. This is a great way for beginners to gain experience and test out their trading strategies before trading with real money. Here is an instructional video for users to know clearly what Virtual Portfolio is:https://www.youtube.com/watch?v=GWK7uQ98KpM.

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as relatively high fees, limited research tools, and a lack of advanced charting capabilities.

FAQs

Q: Is eToro a regulated broker?

A: Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Q: What trading instruments are available on eToro?

A: eToro offers a wide range of trading instruments, including stocks, ETFs, cryptocurrencies, forex, commodities, and indices.

Q: What is the minimum deposit required to open an account on eToro?

A: The minimum deposit required to open an account on eToro varies depending on your location and the type of account you choose. For most countries, the minimum deposit is $500.

Q: Does eToro offer a demo account?

A: Yes, eToro offers a demo account that allows you to practice trading with virtual funds. The demo account is free and can be used for an unlimited period of time.

Q: What is eToro's customer support like?

A: eToro's customer support is available 24/5 and can be reached through email, live chat, and phone. They also have a comprehensive help center and a community forum where you can get answers to common questions and connect with other traders.

| Registered in | United Kingdom |

| Regulated by | FCA |

| Year(s) of establishment | 10-15 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energies, cryptocurrencies, stocks |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:500 |

| Minimum spread | 0.1 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | debit card, credit card, China UnionPay, Skrill, Neteller |

| Customer Service | |

| Fraud Complaints Exposure | Yes |

Hantec Markets is a reputable forex broker that was established in 1990 and is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. They offer a variety of trading platforms, including MT4 and MT5, along with TradingCentral for market analysis. Traders have access to a wide range of tradable assets, including forex, CFDs, indices, commodities, stocks, and bullion. Hantec Markets provides different account types, including demo account, cent account, and standard account, catering to traders of various levels. They offer customer support through live chat and telephone, and provide educational resources such as market reports, analysis videos, and podcasts. The minimum deposit required is $10, and the maximum leverage offered is 1:1000. Hantec Markets supports multiple payment methods for deposits and withdrawals

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Yes, Hantec Markets is a legitimate and regulated forex broker that operates under the oversight of reputable financial regulatory bodies. Hantec Markets adheres to strict regulatory standards to ensure financial stability, security, transparency, and fair trading practices.

Hantec Markets is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The company is authorized and supervised by the FCA, with registration number 502635. The FCA is a renowned financial regulatory body known for its stringent regulations and supervision of financial firms.

| Pros | Cons |

| Regulated by the FCA | Limited information was provided regarding commissions for stock CFDs and indices trading. |

| Wide range of tradable assets, including forex, CFDs, indices, commodities, stocks, and cryptocurrencies. | Currency conversion fee is applied for trades involving different base currencies. |

| Various account types offered, including demo accounts, cent accounts, and standard accounts. | Withdrawal processing time can take two to seven business days. |

| Access to popular trading platforms like MT4 and MT5. | Toll fees may apply for international customer support calls. |

| Dedicated customer support and educational resources for traders. | Hantec Social platform is currently only available as a mobile app. |

Currency pairs, indices, commodities, metals, energies, cryptocurrencies, stocks... Hantec Markets gives its clients access to a massive trading market. So, both beginners and sophisticated traders could find what they want to trade on Hantec Markets.

It is worth noting that, in the trading instruments screen, Hantec Markets provides a detailed table showing spreads, SWAPs, trading hours and other conditions of various instruments in detail, which greatly facilitates clients' consultation and comparison.

Below is a comparison table of trading instruments offered by different brokers:

| Forex | Metals | Crypto | CFD | Indexes | Stock | ETF | |

| Hantec Markets | Yes | Yes | Yes | Yes | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

As mentioned before, in Hantec Markets spreads are clearly displayed in tables. For example, the AUDCAD spread is 1.8 pips. However, we have not been able to find detailed information on commissions.

Visit the Hantec Markets website. Look for the “Open account” button on the homepage and click on it.

2. Select an account type and submit your details via our registration form.

3. Upload your documents and await approval.

4. Fund your wallet and transfer to your trading account.

5. Start trading

Hantec Markets offers Forex trading with spreads starting from specified values for various currency pairs. There are no commissions charged for Forex trades. The spread type is floating, and the minimum order size is 0.01 lot. The trading conditions also include a stop-out level set at 40% of the used margin. Overall, Hantec Markets provides competitive spreads and transparent commission-free trading for Forex.

Trade major pairs like EUR/USD, GBP/USD, and USD/JPY:

EUR/USD spread: 0.00014898 pips.

GBP/USD spread: 0.000213589 pips.

USD/JPY spread: 0.022286942 pips.

Hantec Markets offers precious metals trading with competitive spreads and floating spread types. Traders can trade gold (XAU) with a minimum margin requirement of 5% and silver (XAG) with a minimum margin requirement of 10%. The minimum order size for gold is 0.1 lot (10 ounces) and for silver is 0.1 lot (500 ounces). There are no commissions charged for trading these metals, and the trading hours are available according to the server time.

Hantec Markets offers CFD trading on a variety of symbols, including stocks. The spreads for stock CFDs start from specified values for each symbol. Additionally, there are no specific details provided regarding commissions for stock CFD trading.

Hantec Markets offers indices trading on various major indices in Europe, Asia, Australia, and the US. The spreads for indices trading start from specified values for each symbol. Additionally, there are no specific details provided regarding commissions for indices trading.

In terms of Commodity Trading conditions at Hantec Markets, both US Oil and UK Oil have a spread of 0.05. There are no specific details provided regarding commissions for commodity trading.

Hantec Markets offers cryptocurrency trading with competitive spreads on a range of popular cryptocurrencies.

Currency Conversion Fee:

A conversion fee may be applicable to trades based on the currency settings of your trading account, funding currency, and the settlement currency of the market being traded.

The conversion fee is set at 0.6% and is added to the settlement exchange rate, which is determined by the market rate at the time of settlement. To account for the conversion fee, the underlying exchange rate is multiplied by 1.006 during the conversion process.

For instance, if the GBP/USD exchange rate is 1.1, the applicable FX conversion rate would be 1.1 x 1.006 = 1.1066.

By default, CFD accounts are set to 'instant' conversion. This means that any realized profit, loss, funding, dividend adjustments, or commission will be automatically converted to your account's base currency.

Let's consider an example:

Suppose you have purchased £20 per point worth of FTSE (UK100), and the base currency of your trading account is USD. Since you are trading in GBP, which is different from your account's base currency, the related transactions need to be converted to USD.

Assuming the exchange rate is 0.7576 ($1 equals £0.7576), after incorporating the conversion fee of 0.6%, the conversion rate becomes 0.7576 x 1.006 = 0.7621.

If FTSE increases by 30 points, your profit would amount to £600. This profit will be reflected as £600/0.7621 = $787.30 in your account. To calculate the admin fee charged, multiply your profit by 0.6%:

$787.30 profit x 0.6% = £4.72 currency conversion fee (already included – not charged separately)

Also known as the 'Swap' charge, this is the cost of holding a position overnight. The amount will be dependent on the size of your trade, whether you have a long or short position and the instrument you are trading. Swap rates are determined by the underlying interest rates of the products or currency pairs you have open positions in.

Demo account: Hantec Markets offers a demo account for you to test a little on the financial market without the risk of losing money.

Real account: there are 2 types of real accounts in total: cent account and standard account. The initial deposit to open an account is respectively $10 and $100, which is quite friendly for beginners. Other differences are market access, spreads, demo account and copy trading.

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade.

Hantec Markets offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

The broker provides a variety of payment options for transactions in USD, EUR, GBP, or NGN. Clients can choose from the following payment methods: Bank Wire (Bank Transfer/SWIFT), VISA, MasterCard, Neteller, Skrill, and UnionPay.

Hantec Markets offers a competitive minimum deposit requirement of just $10, which makes it an appealing choice for beginners looking to start trading with a smaller initial investment.

When it comes to withdrawals, there is a minimum payment threshold of $100. Hantec Markets aims to process withdrawal requests made before 15:00 GMT on the same day. However, please note that it may take between two to seven business days for the funds to be credited to your account, depending on various factors such as the payment method and bank processing times.

For European clients, deposits and withdrawals are free of charge. However, international clients may incur charges for large withdrawals made through e-wallets. It's also important to be aware that some banks may have their own processing fees for handling withdrawals.

Overall, Hantec Markets strives to provide convenient and transparent deposit and withdrawal processes for its clients, ensuring that funds can be efficiently managed according to individual needs and preferences.

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Hantec Markets prides itself on providing excellent customer service to its clients. Each client is assigned a dedicated relationship manager who serves as their primary point of contact for any queries or issues. The relationship manager can be reached conveniently through the live chat tool available on the website.

The customer support team is also available 24/5 and can be contacted by leaving a message in the “contact us” section of the website.

Alternatively, you can reach out to them through the live chat feature, which is located at the lower right corner of the broker's website. Additionally, you have the option to contact customer support via telephone using the following numbers:

China – 4000280332

Nigeria – 7080601265

Jordan – 18442000155

Thailand – 1800019263

Taiwan – 886801491458

Pakistan – 080090044349

Main Office (UK) – +41225510215

Please note that international numbers may incur toll fees.

Office Locations:

Hantec Markets' main headquarters is situated at 5-6 Newbury St, Barbican, London EC1A 7HU in the United Kingdom. For the addresses of their Dubai, India, or other offices, please refer to the Hantec Markets website.

Hantec Markets offers a wide range of educational resources on its website to support traders in their learning journey. These resources include market reports, analysis videos, YouTube webinars featuring Nigerian and African traders, as well as podcasts. Moreover, there is a dedicated learning hub that provides valuable content across four experience tiers, along with lessons on strategy creation and risk management.

Hantec Markets strives to empower its clients with the knowledge and tools they need to make informed trading decisions, fostering a supportive community of traders along the way.

Another interesting aspect to point out from this broker is the client portal, in which customers can manage accounts and payments with ease. The portal houses various functions to help customers get the account overview, manage multiple accounts, view trades (ongoing and closed) with ease, receive market insights from Richard Perry's Daily Market Report, deposits, and withdrawals, as well as easy access from mobile platforms.

A number of educational resources are available at Hantec Markets. We have market analysis, economic calendar, glossary and many important knowledge. We cannot deny their importance, but the best teacher for you to learn Forex trading is always real trading. It is impossible to make progress relying only on tools.

Hantec Markets is a well-established forex broker founded in 1990, regulated by the FCA in the UK. They offer a wide range of tradable assets, including forex, CFDs, indices, commodities, stocks, and cryptocurrencies. With competitive spreads, transparent commission-free trading, and access to popular trading platforms like MT4 and MT5. Traders can benefit from various trading platforms and a diverse selection of tradable assets. However, some aspects, such as limited information about certain commissions and the availability of Hantec Social platform, could be improved. Traders should carefully assess their trading requirements and preferences, as well as consider the associated risks and costs, before choosing Garnet Trade as their trading platform.

Q: Is Hantec Markets a legitimate broker?

A: Yes, Hantec Markets is a legitimate and regulated forex broker. They are authorized and supervised by the Financial Conduct Authority (FCA) in the United Kingdom.

Q: What account types do Hantec Markets offer?

A: Hantec Markets offers three types of accounts: demo account, cent account, and standard account. The minimum deposit to open an account is $10.

Q: What trading platforms are available on Hantec Markets?

A: Hantec Markets offers the popular trading platforms MT4 and MT5, as well as TradingCentral for market analysis and insights.

Q: What is the maximum leverage offered by Hantec Markets?

A: Hantec Markets offers maximum leverage of 1:1000 for international clients using the Cent Account and 1:500 for international clients using the Standard Account. However, for European clients, leverage is limited by ESMA regulations to 1:30 for major FX pairs, 1:20 for minors and exotics, gold, and stock indices, and 1:10 for oil and silver.

Q: What deposit and withdrawal methods are supported by Hantec Markets?

A: Hantec Markets supports various deposit and withdrawal methods, including Bank Wire, VISA, MasterCard, Neteller, Skrill, and UnionPay.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive etoro and hantec-markets are, we first considered common fees for standard accounts. On etoro, the average spread for the EUR/USD currency pair is -- pips, while on hantec-markets the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

etoro is regulated by ASIC,CYSEC,FCA,FSC. hantec-markets is regulated by ASIC,FCA,FSA,CGSE,VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

etoro provides trading platform including -- and trading variety including --. hantec-markets provides trading platform including -- and trading variety including --.