16萬捷克克朗被盜! 所有利潤被扣除,賬戶被關閉!

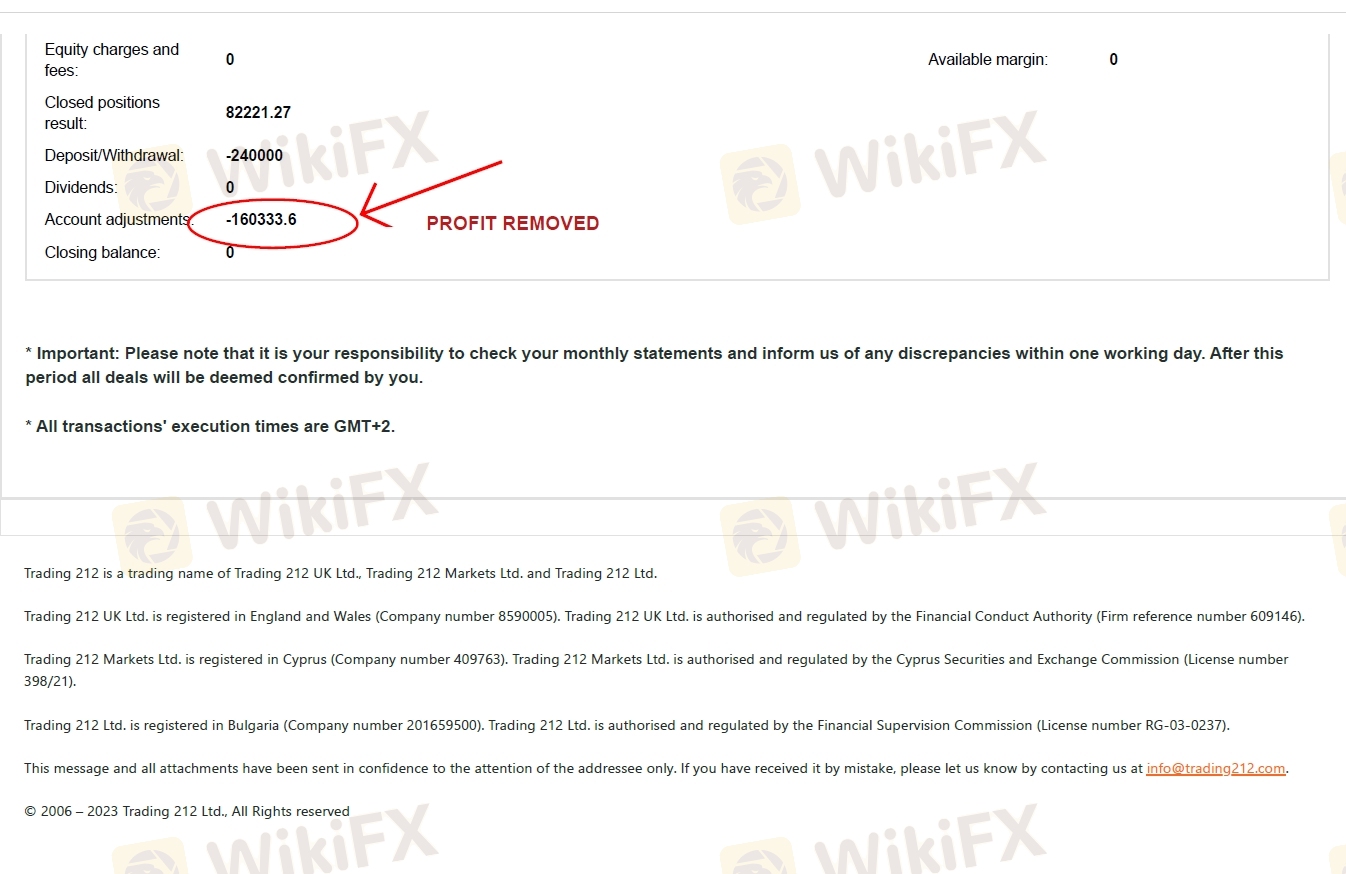

作為零售客戶,我于 2023 年 8 月 4 日在交易商 Trading212 開設了實盤賬戶。Trading 212 UK Ltd. 在英格蘭和威爾士注冊(公司編號 8590005)。 Trading 212 UK Ltd. 經金融行為監管局授權并受其監管(公司參考號 609146)。 注冊地址:107 Cheapside, London, EC2V 6DN, United Kingdom。 經過 4 個月的實時交易后,2023 年 11 月 27 日,在沒有任何事先通知的情況下,經紀人通知我,我“違反”了他們的條款和條件,因為與“平均”客戶相比,我在短的時間內達成如此高的交易量,這很不正常。在交易價格和基礎市場價格之間有利地下單,而不是“公平”使用交易平臺時預期的“隨機分布”......并且就這個“理由”,他們單方面決定關閉我的賬戶。我在4個月內所做的所有17筆交易全部作廢,我賺取的所有利潤(約5000英鎊)也被取消。我覺得Trading212對我不公平。 1. 很明顯,(根據我的交易歷史)我沒有使用任何短線、倒賣策略。我幾乎所有的交易都持續了 3 分鐘以上,有些交易甚至超過 20 分鐘,這很難被視為“不尋常”的訂單,也不能被定義為幾秒鐘的倒賣……2。 他們指責我“交易量很大”...檢查我的交易歷史,很明顯我在 4 個月內只進行了 17 筆交易,而且我最多交易 1 個未平倉頭寸。 3.他們指責我“延遲”或“價格”操縱。 我的交易純粹基于主要基本面新聞或事件的價格走勢(和波動性),這是標準交易策略。 據我所知,沒有哪個歐盟/英國交易商不允許這種交易策略。我以同樣的方式與許多其他受 FCA/CySec/ASIC 監管且信譽良好的交易商進行交易,沒有任何問題。 Trading212 是第一個質疑我交易策略的交易商。至于“平臺濫用”,我只能使用交易商交易平臺提供的報價進行工作/交易。 我認為同一個經紀人指責我“濫用”他自己的平臺和報價是不公平的。 作為零售客戶,我沒有機會“操縱”在交易商平臺上收到的報價,我也不能對 Trading212 應該提供的價格與正在傳輸的價格之間的差價負責。 提供準確的報價是交易商的風險,而不是客戶的風險,如果交易商發生錯誤定價錯誤,客戶不應受到懲罰。 如果交易商無法提供準確且穩定的市場工具定價,他們根本不應該提供這些產品。 不過,如果我們將價格(我的交易執行價格)與第三方報價進行比較,會發現這些價格是真實的,并且與其他交易商類似。4. 我仔細檢查了 Trading212 條款和條件,還沒有找到任何有關被禁止的特定交易策略的信息。另外,我也沒有找到任何需要遵守的具體信息,例如 最短交易持有時間、最大開倉訂單、最大交易量等。如果這很重要并且可能導致關閉客戶賬戶(甚至使所有利潤作廢),為什么他們不在條款和條件中明確這些規則?這樣我和其他交易者就可以遵守規則。在他們的條款和條件中,我發現只有不確定和模糊的條款,這些條款完全由交易商自行決定。5. 最后,我想強調的是,我在 Trading212 的交易始于 2023 年 8 月,持續了 4 個多月,沒有出現任何問題。 自八月份以來,交易商沒有任何關于我的交易有任何問題或我的訂單有問題的通知。 然后突然間,經過4個月的交易,他們在沒有任何事先警告的情況下單方面關閉了我的賬戶,并取消了我所有的交易和利潤。 也許不是交易本身,我的賬戶不斷增長的利潤對于 Trading212 來說才是一個“真正的”問題。假設我在 Trading212 上賠了錢,賬戶就不會被關閉。 一些外匯交易商(甚至是受監管的交易商)的運營方式非常可疑。 虧損的零售客戶受到歡迎,而盈利的賬戶則被簡單地關閉并取消利潤。 這對他們來說是完美的策略。從我的角度來看,這種做法是不公平的。 如果交易商不再需要我這個客戶,我也可以接受。 但我不同意將我 4 個月的交易利潤全部扣除,受監管的金融機構不應該這樣運作。我還是希望Trading212能給我一個合理的解決方案。

以下為原文推薦

160.000 CZK stolen! All profits removed, account closed!

As a retail client, I opened a live account with broker Trading212 on August 4th, 2023.Trading 212 UK Ltd. is registered in England and Wales (Company number 8590005). Trading 212 UK Ltd. is authorised and regulated by the Financial Conduct Authority (Firm reference number 609146). Registered address: 107 Cheapside, London, EC2V 6DN, United Kingdom.After 4 months of live trading, on 27th November 2023, without any previous notice, I was informed by the broker that I "breached" their T&C with "a high volume of transactions that are opened and closed within an unusually short period of time as compared to the ‘average’ client, with a disproportionate number placed advantageously between the price of trade and the price of the underlying market instead of the 'random distribution' that would be expected when the Trading Platform is used "fairly"...And for this "reason", they unilaterally decided to close my live account. All 17 trades I made in 4 months were voided and all the profit I made (approx. 5000 GBP) was canceled.I feel I wasn't treated fairly by Trading212. 1. It's obvious and very easy to prove, that (according to my trading history) I didn't use any short, tick-scalping strategies. Almost all my trades lasted more than 3+ minutes and some trades even 20+ minutes, which can hardly be seen as something "unusual" and also can not be defined as a few seconds scalping...2. They accused me of "high volume of transactions"... checking my trading history, it's obvious I made only 17 trades in 4 months and I always traded max. 1 open position/trade at the time. 3. They accused me of "latency" or "price" manipulation. My trading is based purely on price action (and volatility) following major fundamental news or events, which is generally seen as a standard trading strategy. I don't know a single EU/UK broker that wouldn't allow this kind of trading. I trade exactly the same way with many other FCA/CySec/ASIC regulated and reputable brokers without any issues. Trading212 is the first broker having a "problem" with my trading style. As for "platform misuse", I can only work/trade with price quotes provided via broker's trading platform. I see unfair that the same broker accused me of "misusing" his own platform and price quotes. I, as a retail client, have no chance to "manipulate" what price quotes I receive on the broker's platform - nor I can be responsible for any discrepancy between prices Trading212 should've been providing, and the ones that were in fact being streamed. Providing accurate quotes is the broker's risk, not clients' risk and the client should not be penalized for broker's mispricing errors if they occur. If the broker isn't able to provide accurate and stable pricing of market instruments, they shouldn't offer them at all.Still, it's worth noting here that if we compare prices (my trades were executed at) with 3rd party quotes, we will see these prices were absolutely realistic and similar to my other brokers at the time of trades.4. I double-checked Trading212 T&C and I haven't found any information about specific trading strategies that would be prohibited. Also, I haven't found any specific information to comply with, e.g. minimum trading holding time, max orders open, max volume, etc. If this is so important for them and can lead to closing clients' accounts (or even voiding ALL the profits), why didn't they specify these parameters in T&C clearly? so I or anyone else could comply with them? In their T&C, I found only uncertain and vague clauses that leave the decision entirely up to broker's discretion.5. Finally, I wish to emphasize, that my trading history with Trading212 started in August 2023 and lasted more than 4 months, with no issues. Since August, there has been zero notice from broker's side that there is anything wrong with my trades or that they have problems with my orders. Then suddenly, after 4 months of trading, they unilaterally closed my account without any previous warning and voided all my trades and profits.Probably not trading itself, but my constantly growing profit was a "real" problem here for Trading212. I assume if I lost money with Trading212, no account closure would ever happen.It seems that some forex brokers (even regulated ones) operate in a very questionable way. Retail clients losing money are welcomed, while profitable accounts are simply closed and profits canceled. Flawless business for them. From my point of view, this practice is unfair.If the broker doesn't want me as a client anymore, I'm fine with that. But I strongly don't agree with removing all my profits for 4 months of trading. Regulated financial institutions should not work like that. I still hope I can find a reasonable solution with Trading212.

印尼

印尼