Gold Prices Hint at Topping Before Jackson Hole Symposium

Ikhtisar:Gold prices may form a top if bearish technical cues find follow-through as all eyes turn to a speech by Fed Chair Powell at the Jackson Hole symposium.

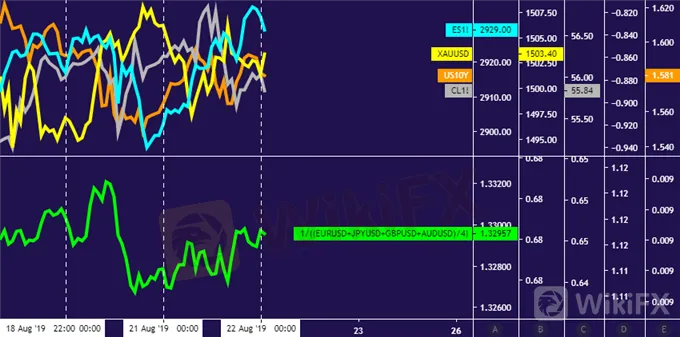

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

Gold prices mark time as all eyes turn to Jackson Hole symposium

Downturn may be in the cards as Powell cools rate cut speculation

ECB minutes, Eurozone PMI data may struggle for follow-through

The release of minutes from July‘s FOMC meeting did not inspire a strong response from financial markets. While the document reiterated that the central bank sees last month’s rate cut as a “mid-cycle adjustment” – downplaying scope for follow-on easing – stimulus-hungry financial markets refused to relent.

Indeed, Fed Funds futures still imply 50-75bps in further easing before year-end. Investors‘ defiant stance probably reflects lingering hope that the dated Minutes document will be superseded by promises of lavish accommodation to be unveiled at the US central bank’s symposium in Jackson Hole, Wyoming.

The gathering gets underway today, but the main event comes on Friday when Fed Chair Powell steps up to the microphone. The bar to exceed the markets ultra-dovish baseline outlook seems exceedingly high while the risk of disappointment appears outsized against the backdrop of still-solid economic data.

That probably bodes ill for gold. The appeal of the non-yielding metal is likely to be diminished if Mr Powell and company appear unwilling to commit to big-splash rate reduction. Cycle-geared crude oil prices look likewise vulnerable as fading faith in policy support sours market-wide risk appetite.

Directional conviction may be absent in the meanwhile. July ECB meeting minutes could cheer investors a bit if the central bank telegraphs fireworks with its own stimulus boost – a move whose likelihood might be reinforced by soft Eurozone PMI data – but Jackson Hole anticipation may contain follow-through.

GOLD TECHNICAL ANALYSIS

Gold prices are still treading water below Augusts high at 1535.03 but negative RSI divergence warns a turn lower may be ahead. A daily close below initial support at 1480.00 opens the door for a test of the 1437.70-52.95 area. Alternatively, a break of resistance targets a weekly chart inflection level at 1563.00.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are still grinding against resistance set from late April, now at 58.18. A daily close above that targets the 60.04-84 zone next. Alternatively, a reversal back below the 53.95-54.84 congestion area sets the stage to challenge the $50/bbl figure once more.

Crude oil price chart created using TradingView

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

GO MARKETS

FXTM

SMART BALANCE

GRIC FX

Octa

FXOpulence

GO MARKETS

FXTM

SMART BALANCE

GRIC FX

Octa

FXOpulence

WikiFX Broker

GO MARKETS

FXTM

SMART BALANCE

GRIC FX

Octa

FXOpulence

GO MARKETS

FXTM

SMART BALANCE

GRIC FX

Octa

FXOpulence

Berita Terhangat

Hilang Uang Saya ! Trader Indo Marah Ke Broker Loyal Trust Market

Hari Ketiga! Kontes Tebak Broker WikiFX 2024 Berhadiah USDT

Slogan Broker Forex Baru Broker Ini Sukses Mencuri Perhatian Para Trader!

Klarifikasi Tuduhan Fixed Income: Oknum Di Broker PT Menara Mas Futures

Broker Penipu! Regulator Bongkar Si Broker Bermasalahnya

Gathering Pengawas Global WikiFX! Berpartisipasilah untuk memenangkan hadiah uang tunai!

Hari Keempat! Kontes Tebak Broker WikiFX 2024 Berhadiah USDT

Hari Terakhir! Kontes Tebak Broker WikiFX 2024 Berhadiah USDT

Peringatan SFC: Kasus Internal Broker Futu & Interactive Brokers

Nilai Tukar