User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

2

CommentsWrite a review

2024-01-16 12:32

2024-01-16 12:32

2023-12-27 17:29

2023-12-27 17:29 China|5-10 years|

China|5-10 years| https://www.ccbfutures.com/en/about_us/company_profile/index.shtml

Website

Influence

C

Influence index NO.1

China 3.78

China 3.78Single Core

1G

40G

| Aspect | Information |

| Company Name | CCB Futures |

| Registered Country/Area | China |

| Founded Year | 1995 |

| Regulation | CFFEX |

| Products & Services | Finance & Derivatives, Precious and non-ferrous metals, Agricultural products, Energy and chemical industry |

| Demo Account | Available |

| Trading Platform | Wenhua Win Shun Cloud Market Trading Software HD Edition (wh6),Fast trading terminal,Infinity Easy (Pro Edition).etc |

| Customer Support | Phone: 400-90-95533 |

| Educational Resources | Investor Education(Futures Knowledege,Anti-money laundering.etc), CCB Research |

CCB Futures, founded in 1995 and based in China, is a regulated financial services provider overseen by CFFEX.

The company specializes in a wide range of products including finance and derivatives, precious and non-ferrous metals, agricultural products, as well as the energy and chemical industries.

CCB Futures offers several advanced trading platforms like Wenhua Win Shun Cloud Market Trading Software HD Edition (wh6), Fast trading terminal, and Infinity Easy (Pro Edition), meeting diverse trading needs. A demo account is available for newcomers to practice trading.

Customer support is accessible via phone at 400-90-95533. Additionally, the company provides educational resources covering futures knowledge and anti-money laundering practices, alongside research published by CCB Research, enhancing the trading experience with valuable insights and learning opportunities.

CCB Futures is regulated by the China Financial Futures Exchange(CFFEX) under the oversight of Chinese regulatory authorities.

The company holds a Futures License, with the license number 0103, ensuring that its operations comply with the strict standards and regulations set forth by the Chinese government.

This regulatory framework aims to provide a secure and transparent trading environment, safeguarding the interests of traders and maintaining the integrity of the financial markets.

| Pros | Cons |

| Regulated by CFFEX | Limited Customer Support |

| Long History | Complexity for Beginners |

| Comprehensive Educational Resources | Uncertain Fee Structure |

| Wide Range of Products | Complicated Trading Platform |

| Robust Research and Market Analysis Tools |

Pros

Regulated by CFFEX: CCB Futures is regulated by the China Financial Futures Exchange (CFFEX), ensuring that it adheres to specific standards and regulations which enhance its credibility and reliability.

Long History: Founded in 1995, CCB Futures has a long-standing presence in the market, indicating experience and a sustained track record in the futures trading industry.

Comprehensive Educational Resources: The company offers a variety of educational resources, including investor education on futures knowledge and anti-money laundering, along with research publications from CCB Research, providing valuable insights and learning for traders.

Wide Range of Products: CCB Futures deals in a variety of markets including finance and derivatives, precious and non-ferrous metals, agricultural products, energy, and chemical industries, offering ample trading opportunities.

Robust Research and Market Analysis Tools: The availability of extensive research and sophisticated market analysis tools supports informed decision-making and potentially enhances trading strategies.

Cons

Limited Customer Support: Customer support is only available via phone, which might not be adequate for traders needing immediate or diverse types of support, especially in today's digital age where online and real-time assistance is often expected.

Complexity for Beginners: The broad range of products and sophisticated trading platforms will overwhelm beginners who are not yet familiar with complex trading environments.

Uncertain Fee Structure: Without clear details on the fee structure provided, traders will find it difficult to understand the potential costs ,commissions and spreads associated with their trading activities.

Complicated Trading Platform: With platforms like the Wenhua Win Shun Cloud Market Trading Software and others mentioned, the trading interface are too complicated for less experienced traders or those accustomed to more straightforward systems.

CCB Futures offers an extensive portfolio of trading products that meet a variety of market sectors, enabling traders to diversify their investment strategies. Here are detailed descriptions of each product category:

Energy and Chemicals: This category includes vital commodities like coking coal, which is essential for steel production, and rubber, crucial for various industries from automotive to manufacturing. These commodities are integral to industrial processes and offer traders opportunities to invest in the raw materials that fuel global economic activity.

Agricultural Products: CCB Futures provides a platform for trading a variety of agricultural commodities such as live hogs, which are a significant part of the livestock market, and other unspecified farm products that likely include grains, vegetables, or fruits. These products are fundamental to the food supply chain and present a way for traders to engage with the agricultural sector's seasonal and market-driven fluctuations.

Metals: The metals traded at CCB Futures include both industrial metals like aluminum and lead, used extensively in construction and manufacturing, and precious metals such as gold and silver, which are sought after for investment, currency hedging, and jewelry making. Trading in these metals allows investors to hedge against economic volatility and participate in global trade markets.

Financial Products and Derivatives: This category encompasses a range of sophisticated financial instruments. Options provide traders the right, but not the obligation, to buy or sell an asset at a set price before a certain date, offering strategies for hedging or speculation. Government bonds are considered a safe investment, particularly appealing during times of market uncertainty.

CCB Futures offers a large suite of trading software solutions designed to meet the varied needs of its clientele. Each platform is tailored for specific trading strategies and user preferences, ensuring that all traders, regardless of their experience or focus, can find a tool that suits their needs. Heres an overview of the trading platforms available at CCB Futures:

Wenhua Win Shun Cloud Market Trading Software HD Edition (wh6): This platform integrates market analysis, trading, and order management into a single solution. It is designed for simplicity, speed, and convenience, supporting various market activities including night trading in Dalian and Zhengzhou, bank-futures transfers, and features like market push for faster transaction execution.

Fast Trading Terminal: Updated regularly to ensure reliability and speed. This terminal provides real-time disclosure of trading information such as account funds, equity, and positions. It features unique capabilities like “automatic leveling” for trades and multi-area ordering, supporting both mouse and keyboard operations for quick and efficient trading.

Infinity Easy (Pro Edition): Attracting professional traders, this platform supports multi-account login and multi-window layouts for a smooth trading experience. It offers a lot of trading coverage, including short-term wizard, algorithmic trading, basis rollover, custom portfolio arbitrage, and various options strategies integrated with Python for quantitative analysis.

Straight Flush Futures Connect PC: A super information platform that combines quotations, transactions, and fundamental and technical analysis to keep traders updated with the latest market developments. It features intelligent trading technology, disk analysis, core market indicators, and real-time industry and macro news.

Polaris 9.5 Jianxin Futures Edition and **Polaris 9.3 Jianxin Futures Edition**: These platforms offer high-quality genuine market data and support diverse trading activities including futures, options, and spot trading. They provide rich arbitrage strategies, strategy orders for flexible control, and a variety of options strategies for quick proficiency in options trading.

Quick Trade V3 Terminal: A new generation client that covers both quotations and trading for futures & options. It features exclusive support for full historical market data, extensive technical indicators for futures and options, and innovative multi-screen, multi-chart displays.

Trading Pioneer: Designed for programmatic trading, this platform allows users to quickly translate their trading ideas into computer code to create personalized trading strategies, facilitating hands-off trading operations.

CCB Futures offers convenient customer support to assist clients with their trading needs and inquiries.

Clients can access support through the national customer service hotline at 400-90-95533, which provides immediate assistance with any questions or issues they may encounter.

Additionally, CCB Futures hosts a variety of support services online, including software downloads, account opening guides, billing inquiries, and more, all accessible through their website.

CCB Futures provides a huge range of educational resources tailored to enhance investor knowledge and proficiency in various aspects of futures trading. Here are the key educational offerings provided by CCB Futures:

Futures Knowledge: This includes basic to advanced concepts in futures trading, helping both new and experienced traders understand market mechanisms, trading strategies, and risk management.

Training and Workshops: CCB Futures conducts regular training sessions and workshops, such as the “Financial National Education Journey” series and specialized training on topics like “Futures Hedging for Grain Enterprises”. These sessions are designed to provide hands-on learning and are conducted by experienced professionals like Ho Zhuo Qiao. Recent sessions have covered topics such as “London Gold Breakthroughs” and “Copper Core Cohesion”.

Investor Education Classes: These classes cover a range of topics from fundamentals training to options knowledge. Events are typically held in accessible locations like conference halls or meeting rooms and include detailed discussions on specific financial themes.

Laws and Regulations: Understanding the legal framework surrounding futures trading is crucial. CCB Futures offers education on pertinent laws and regulations, including anti-money laundering practices, ensuring that traders comply with all legal standards.

Investor Protection: Providing information and resources aimed at protecting investors, ensuring they are well-informed about their rights and the safety measures available in the trading environment.

Medium-term Association Futures Investment Education Network and China Investor Network: These platforms offer additional educational content and networking opportunities, further supporting investor education and community engagement.

CCB Futures is a big futures trading firm regulated by the China Financial Futures Exchange, offering a wide range of products across various market sectors including energy, metals, agricultural products, and financial derivatives.

Established in 1995, the firm provides robust trading platforms tailored to both novice and experienced traders, alongside extensive educational resources and investor support services.

Question: What types of products can I trade with CCB Futures?

Answer: CCB Futures offers a variety of trading options including energy and chemical products, metals such as gold and silver, agricultural commodities, and financial derivatives like futures and options.

Question: What educational resources does CCB Futures provide?

Answer: CCB Futures provides various educational resources, including futures knowledge training, laws and regulations training, investor protection information, and regular training sessions on various financial topics.

Question: What trading platforms are available at CCB Futures?

Answer: CCB Futures offers several trading platforms such as Wenhua Win Shun Cloud Market Trading Software HD Edition, Fast Trading Terminal, Infinity Easy (Pro Edition), and others, meeting different trading needs and styles.

Question: How can I contact CCB Futures for support?

Answer: You can reach CCB Futures through their national customer service hotline at 400-90-95533 for any queries or support needed.

Question: Are there any specific tools for risk management offered by CCB Futures?

Answer: Yes, CCB Futures offers various risk management tools and resources as part of their trading platforms and educational initiatives to help traders manage and mitigate risks associated with futures trading.

CCB Futures Co., Ltd.

CCB Futures

Regulated

Platform registered country and region

China

--

--

--

--

--

5F CCB Building,99 Yincheng Road,Pudong District,Shanghai 200120 PRC

--

--

--

--

wangkan@ccbfutures.com

Company Summary

Sort by content

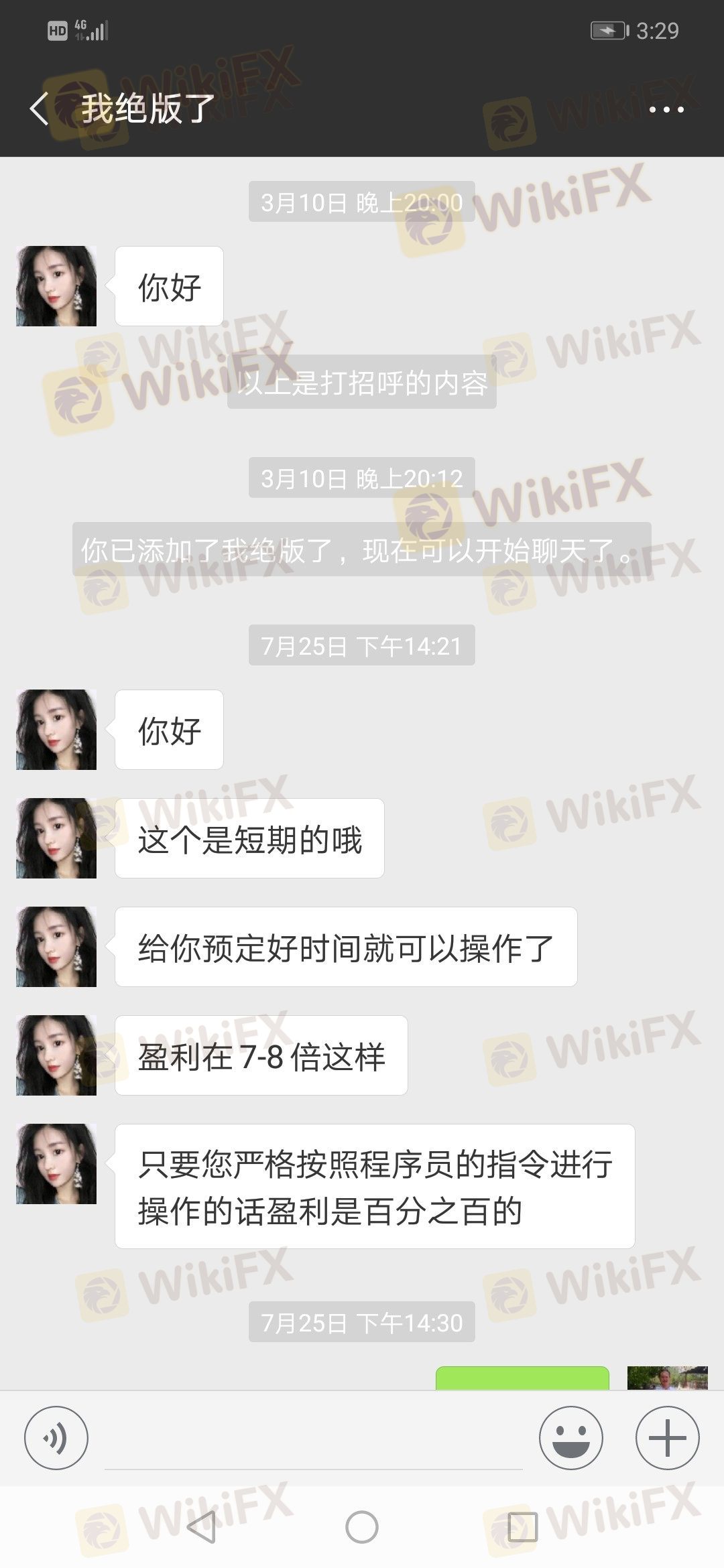

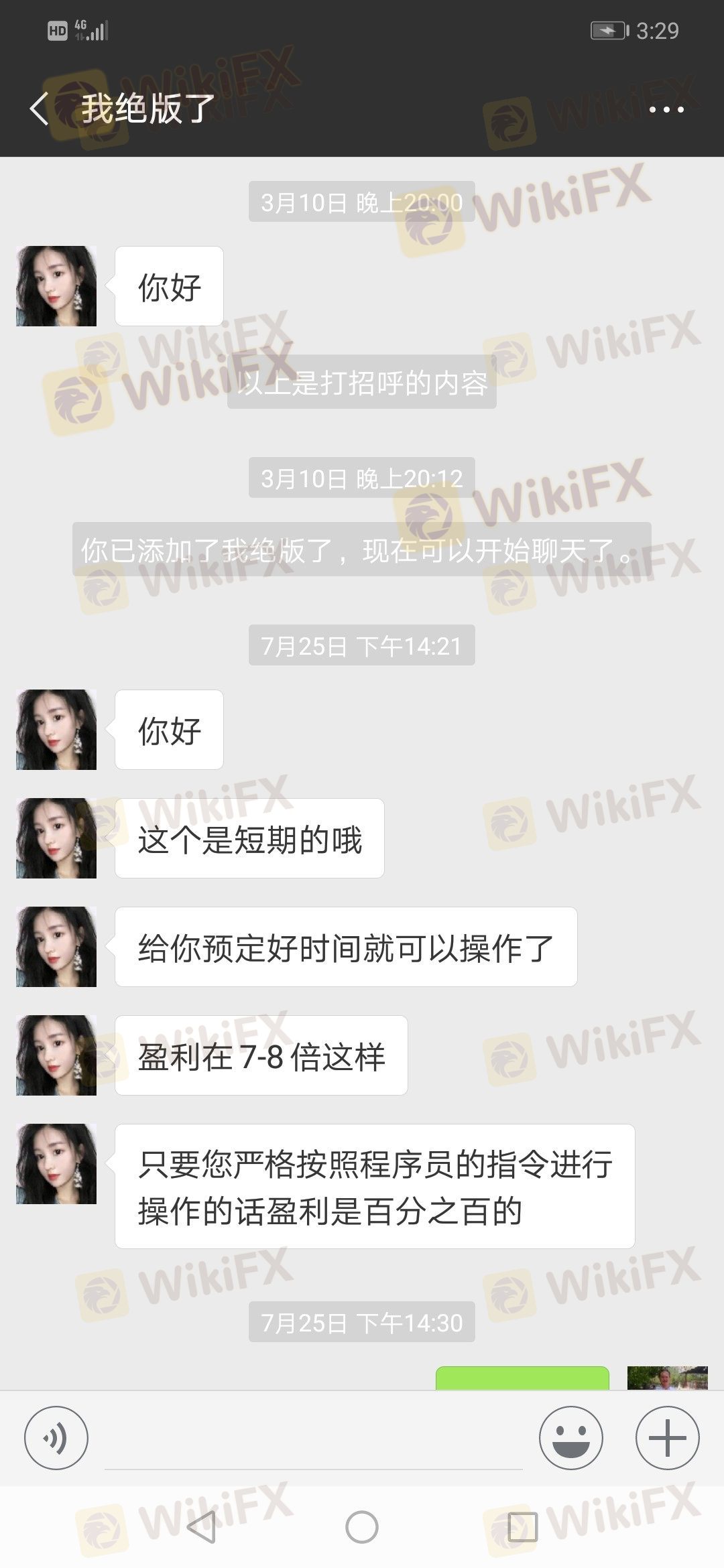

User comment

2

CommentsWrite a review

2024-01-16 12:32

2024-01-16 12:32

2023-12-27 17:29

2023-12-27 17:29