Score

EXCO

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://excotrader.com/

Website

Rating Index

MT4/5 Identification

MT4/5

White Label

RSGFinance-Demo

United Kingdom

United KingdomInfluence

C

Influence index NO.1

Nigeria 4.89

Nigeria 4.89MT4/5 Identification

MT4/5 Identification

White Label

United Kingdom

United KingdomInfluence

Influence

C

Influence index NO.1

Nigeria 4.89

Nigeria 4.89Surpassed 19.80% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+234 912 698 8988

Other ways of contact

Broker Information

More

RSG Finance Ltd

EXCO

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | From 10 USD |

| Minimum Spread | 1 |

| Products | Forex, Cryptocurrency, Commodities, Indices |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | From 10 USD |

| Minimum Spread | 0.5 |

| Products | Forex, Cryptocurrency, Commodities, Indices |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | 2 USD |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed EXCO also viewed..

XM

VT Markets

AUS GLOBAL

ATFX

EXCO · Company Summary

| Aspect | Details |

| Company Name | EXCO |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2019 |

| Regulation | Not regulated |

| Market Instruments | Indices, Commodities, Cryptocurrencies |

| Account Types | EXCO ECN, EXCO STP |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:1000 |

| Spreads | Starting from 0.5 pips (both account types) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Demo Account | Available for both account types |

| Customer Support | Email: support@excotrader.com , Phone: +234 912 698 8988 Social Media: Facebook, Instagram, LinkedIn |

| Deposit & Withdrawal | online banking, bank transfers, cryptocurrencies, and payment wallets |

| Educational Resources | Live Trading, Webinars, Mentoring, Articles, Trading Courses |

Overview of EXCO

EXCO is a trading platform established in 2019 and registered in Saint Vincent and the Grenadines. It's important to note that EXCO is not regulated by any financial authority. The platform offers trading in indices, commodities, and cryptocurrencies through two account types: EXCO ECN and EXCO STP. The minimum deposit to open an account is $50, and the maximum leverage offered is 1:1000. Spreads start from 0.5 pips for both account types.

EXCO utilizes the MetaTrader 4 (MT4) platform for trading, and demo accounts are available for users to explore the platform before committing real funds. Customer support is accessible through email, phone, and social media channels. Deposit and withdrawal options include online banking, bank transfers, cryptocurrencies, and payment wallets. EXCO also provides a range of educational resources, such as live trading sessions, webinars, mentoring, articles, and trading courses.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulatory Oversight |

| Two Account Types Catering to Different Trader Profiles | Withdrawal Processing Limited to Business Hours |

| Competitive Spreads Starting from 0.5 pips | Potential Fees for Withdrawals |

| Availability of Demo Account | Variable Maximum Leverage Noted for Currency Pairs |

| Comprehensive Customer Support via Email, Phone, and Social Media | |

| Educational Resources (Live Trading, Webinars, Mentoring, Articles, Trading Courses) |

Pros:

Diverse Market Instruments: EXCO offers a wide range of trading options, including popular indices, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and explore different market opportunities.

Two Account Types for Different Needs: EXCO provides both ECN and STP accounts, catering to both experienced and beginner traders. The ECN account offers tighter spreads and direct market access, while the STP account features wider spreads but no commissions.

Competitive Spreads: Starting from 0.5 pips, EXCO's spreads are competitive and can potentially increase profitability for traders.

Availability of Demo Account: A demo account allows traders to explore the platform and test their strategies with virtual funds before committing real money. This is a valuable tool for beginners and experienced traders alike.

Comprehensive Customer Support: EXCO offers multiple customer support channels, including email, phone, and social media. This ensures that traders can easily reach out for assistance if needed.

Educational Resources: EXCO provides a variety of educational resources, including live trading sessions, webinars, mentoring programs, articles, and trading courses. This can help traders of all levels improve their skills and knowledge.

Cons:

Lack of Regulatory Oversight: A significant concern is the lack of regulation for EXCO. This means that traders may not have the same level of protection as they would with a regulated broker. For example, if EXCO were to become insolvent, there would be no guarantee that traders would be able to recover their funds.

Withdrawal Processing Limited to Business Hours: While convenient options like cryptocurrencies exist for deposits, withdrawals at EXCO are only processed during business hours, Monday through Friday. This can be inconvenient for traders who need to access their funds outside of normal business hours.

Potential Fees for Withdrawals: Although the specific fees are not readily available, some withdrawal methods at EXCO might incur additional charges. This can eat into potential profits, particularly for smaller withdrawal amounts.

Variable Maximum Leverage: The maximum leverage offered by EXCO varies depending on the instrument and account type. For example, leverage can reach 1:1000 for currency pairs but is capped at 1:100 for other instruments. This can be confusing for traders and may not be suitable for everyone.

Regulatory Status

EXCOwithout any regulated licenses. It's important to note that operating without regulatory oversight can pose risks for traders, as regulatory bodies are responsible for ensuring financial entities adhere to established standards and protect the interests of investors.

Before engaging with any trading platform, it is crucial for investors to thoroughly research and verify the regulatory status of the broker. A reputable and regulated broker is typically licensed by recognized financial authorities, providing a level of transparency and accountability.

Market Instruments

EXCO is a platform catering to various investment needs through trading in three main categories: Indices, Commodities, and Cryptocurrencies. Here's a concrete breakdown of what you can expect to trade on EXCO:

Indices:

Investors have the opportunity to engage in the financial markets by trading established indices, such as the S&P 500, Dow Jones, and NASDAQ. These indices allow for the efficient investment in a broad range of stocks with a single trade, providing exposure to the overall performance of the market. This approach simplifies the investment process, making it accessible to a wide range of participants. Moreover, the global reach of indices offers investors the chance to diversify their portfolios by selecting indices from different countries and regions. This diversification strategy helps mitigate risk by tapping into diverse market movements and economic conditions. Whether pursuing long-term growth, hedging existing holdings, or engaging in short-term speculation, indices offer a variety of strategies to align with investors' specific financial goals. The flexibility and accessibility of index trading make it a valuable tool for both seasoned investors and those new to the world of financial markets.

Commodities:

Diversifying investment portfolios beyond traditional stocks, commodities provide an avenue to invest in physical assets such as gold, oil, copper, and coffee. This expansion beyond equities adds resilience to a portfolio, offering exposure to a different class of assets with unique market dynamics. Commodities also serve as a hedge against inflation, safeguarding the purchasing power of a portfolio during economic uncertainties. Investors can tailor their risk profiles by selecting from a spectrum of commodities – opting for potentially high returns through volatile assets like oil or seeking stability through safer options like gold. This versatility allows investors to navigate various market conditions and align their portfolios with specific risk tolerance and financial objectives.

Cryptocurrencies:

Cryptocurrencies offer investors the opportunity to immerse themselves in the digital realm by trading popular digital assets such as Bitcoin, Ethereum, Litecoin, and Tether. This emerging market provides a fast-paced environment with the potential for lucrative returns. One of the key attractions is the decentralized nature of cryptocurrencies, offering exposure to a new asset class that operates independently of traditional financial systems. However, it's essential for investors to approach this realm with caution, as cryptocurrencies are characterized by high volatility and inherent risks. While the potential for substantial gains exists, the market's unpredictability underscores the importance of thorough research, risk management, and a clear understanding of the unique dynamics within the cryptocurrency space.

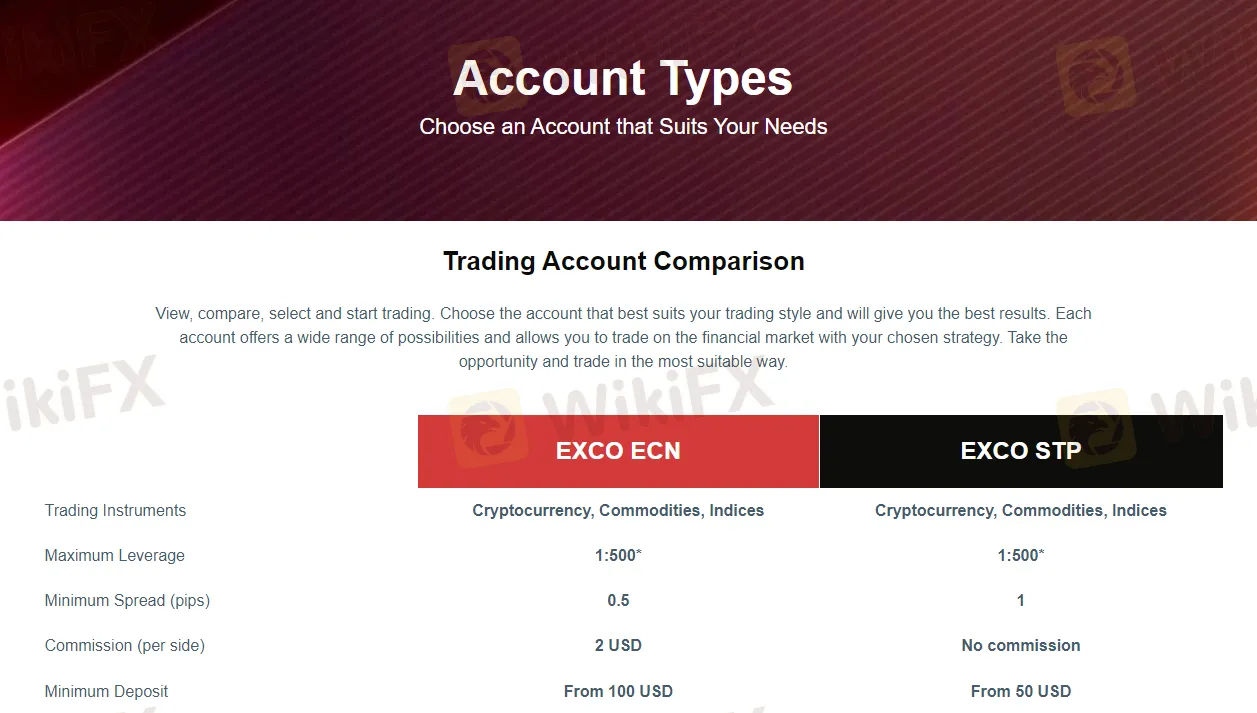

Account Types

EXCO offers two distinct account types to cater to different trading styles and needs: EXCO ECN and EXCO STP.

EXCO ECN Account:

The EXCO ECN account caters specifically to experienced traders comfortable with assuming high levels of risk in their trading activities. Tailored for currency pair trading, it provides a substantial leverage of up to 1:500, enabling traders to control positions that are 500 times larger than their account balance. Notably, the maximum leverage differs for other instruments, with indices and commodities capped at 1:100. This account structure incorporates a commission-based fee model, charging $2 per side, indicating that traders incur a fee for both opening and closing positions. To access this account, a minimum deposit of $100 is required. Overall, the EXCO ECN account is designed for seasoned traders seeking enhanced leverage and are willing to navigate the associated risks and costs.

EXCO STP Account:

The EXCO STP account is designed to be a more suitable option for beginner and risk-averse traders. With a focus on minimizing risk exposure, this account offers lower leverage, reaching a maximum of 1:500 for currency pairs and 1:100 for other instruments. This conservative leverage structure provides a safeguard, reducing the likelihood of traders losing their entire investment if a trade moves unfavorably. Unlike the ECN account, the EXCO STP account operates on a commission-free model, opting for slightly wider spreads instead. The absence of commissions simplifies the fee structure for users. To open an EXCO STP account, traders need a minimum deposit of $50, making it a more accessible choice for those new to trading or with a preference for lower-risk environments.

The best account for you will depend on your individual trading goals and risk tolerance. If you are an experienced trader who is comfortable with taking on high levels of risk, then the EXCO ECN account may be a good option for you. However, if you are a beginner or risk-averse trader, then the EXCO STP account is a better choice.

EXCO Account Type Comparison Table

| Feature | EXCO ECN | EXCO STP |

| Account Type | For experienced traders | For beginners and risk-averse traders |

| Leverage | Up to 1:500 for currency pairs (variable for other instruments) | Up to 1:500 for currency pairs (variable for other instruments) |

| Commissions | $2 per side | None |

| Spreads | Starting from 0.5 pips | Starting from 0.5 pips |

| Minimum Deposit | $100 | $50 |

| 24/7 Live Video Chat Support | Yes | Yes |

| Demo Account | Yes | Yes |

| Other Features | Market execution, limit/stop orders with no minimum distance, trade from 0.01 lot sizes, segregated funds, hedging, automated trading, mobile trading, one-click trading | Market execution, limit/stop orders with no minimum distance, trade from 0.01 lot sizes, segregated funds, hedging, automated trading, mobile trading, one-click trading |

How to Open an Account?

To open an account with EXCO, follow these concise steps:

Register:

Fund:

Trade:

To open an EXCO account, visit their website, find the registration form, accurately input necessary personal and contact details, and create a secure password.

After registering, log in to your EXCO account, navigate to the deposit section, choose your preferred funding method, and follow instructions to complete the deposit process, ensuring compliance with the minimum deposit requirement.

Following successful funding, access the EXCO trading platform, acquaint yourself with its features, and initiate trades by selecting financial instruments, configuring trade parameters, and executing orders.

Spreads & Commissions

EXCO offers competitive spreads and commissions on its trading accounts. Both EXCO ECN and EXCO STP accounts begin with minimum spreads of 0.5 pips for currency pairs, providing a competitive rate that may vary based on specific instruments and market conditions. However, detailed information about spreads for commodities, indices, and cryptocurrencies is not available.

In terms of commissions, EXCO ECN applies a fee of $2 per side, meaning traders pay this commission once when opening a position and again when closing it. On the other hand, EXCO STP does not charge any commissions. Instead, it may feature slightly wider spreads compared to ECN to compensate for the absence of direct market access. Traders can choose between the two account types based on their preference for either a commission-based or commission-free fee structure, taking into account the associated spreads and trading conditions.

Here's a simple table summarizing the Spreads and Commissions for EXCO:

| Account Type | Spreads (Starting from) | Commissions |

| EXCO ECN | 0.5 pips | $2 per side |

| EXCO STP | 0.5 pips (may vary) | No commissions, slightly wider spreads |

Leverage

EXCO offers varying maximum leverage options based on the instrument being traded and the trader's account equity. For currency pairs on both EXCO ECN and STP accounts, users can leverage up to 1:500, allowing control of a position 500 times larger than their account balance. However, for other instruments such as indices, commodities, and bonds, the maximum leverage is more conservative, capped at 1:100. It's important to note that EXCO employs dynamic leverage, reserving the right to adjust the maximum leverage based on the trader's account equity. For instance, if the equity falls below $500, EXCO may reduce the leverage to 1:1000, reflecting a risk management measure in response to changes in account conditions.

Here's a table summarizing the maximum leverage offered by EXCO for different instruments and account types:

| Instrument | EXCO ECN Leverage | EXCO STP Leverage |

| Currency Pairs | Up to 1:500 | Up to 1:500 |

| Other Instruments | Up to 1:100 | Up to 1:100 |

| Dynamic Leverage | Variable ( Up to 1:1000 ) | Variable ( Up to 1: 1000 ) |

Trading Platform

The trading platform of EXCO is built on MetaTrader 4 (MT4), renowned as the world-leading trading platform. This platform provides traders with advanced technology, offering a user-friendly interface that puts powerful tools at their fingertips. With live price streaming and one-click trading, users can execute trades swiftly and efficiently. The platform enables in-depth market analysis with the ability to analyze data at nine different time frames, ensuring a comprehensive view of market trends.

Traders using EXCO's trading platform on MT4 have access to online financial market news, facilitating informed decision-making. The platform supports automated trading, allowing users to implement strategies through expert advisors and other tools. With high-security measures such as 128-bit encoding, EXCO ensures the protection of user data and transactions.

Furthermore, the MetaTrader 4 platform offered by EXCO is equipped with a variety of trading tools, indicators, and advisors to enhance the trading experience. It allows users to monitor, maintain, and manage their trading accounts seamlessly. The platform's versatility extends to the creation of custom instruments, offering traders the option to develop and share their trading tools with others. Overall, EXCO's MetaTrader 4 platform provides a consistent and user-friendly interface for trading CFDs, combining advanced technology with a suite of analytical tools to meet the diverse needs of traders.

Deposit & Withdrawal

EXCO's deposit process offers flexibility and convenience for traders with various methods available. Users can fund their accounts through online banking, bank transfers, cryptocurrencies, and payment wallets like DuusuPay and PaymentAsia. The minimum deposit requirement varies with EXCO ECN requiring $100 and EXCO STP requiring $50. While processing times depend on the chosen method, certain options like cryptocurrencies and payment wallets may provide instant deposits. The platform emphasizes ease of use and highlights security measures to protect financial information.

Regarding withdrawals, EXCO offers a straightforward process with users able to select their preferred method, enter the withdrawal amount, and confirm the transaction. Withdrawals are processed during business hours, Monday through Friday, with specific policies in place, including additional document verification if necessary. The platform reserves the right to reclaim fees for no trading activity and provides transparency regarding potential delays caused by disruptions in payment processor systems. Overall, EXCO's deposit and withdrawal systems aim to provide a seamless and secure financial experience for traders.

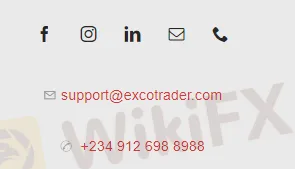

Customer Support

EXCO demonstrates a comprehensive approach to customer support through various channels, ensuring accessibility and responsiveness for their users. For direct communication, users can reach out via email at support@excotrader.com or contact the support team through phone at +234 912 698 8988. This provides users with the option to choose the method that best suits their needs.

Additionally, EXCO maintains an active and engaging presence on social media platforms, including Facebook (https://www.facebook.com/EXCOTRADERCOM), Instagram (https://www.instagram.com/excotrader/), and LinkedIn (https://www.linkedin.com/company/exco-trader/). These social media channels not only serve as communication channels but also provide users with updates, announcements, and a platform to connect with the community.

By offering multiple communication channels, EXCO ensures that users can seek assistance through their preferred means, whether it's traditional email and phone support or engaging with the platform through popular social media channels. This multi-faceted customer support approach enhances accessibility and responsiveness, contributing to a positive overall user experience.

Educational Resources

EXCO provides a comprehensive set of educational resources catering to traders of varying experience levels:

Live Trading: Conducted by market experts on Mondays and Thursdays, these sessions at 3 pm (GMT+1) and 2 pm (GMT+1), respectively, feature real-time orders, individual market approaches, technical and fundamental analysis, live Q&A sessions, and community interaction.

Webinars: Covering diverse topics like live trading, market analysis, price action, and Forex basics, webinars are scheduled on Wednesdays and Thursdays at 11 am (London/Nigeria time). Some sessions require advance registration for participation.

Mentoring: The Strategy and Mentorship Program occurs on Mondays to Thursdays at 2 pm (London/Nigeria time). It covers expert advisors, technical analysis, indicators, and risk management. Registration is necessary to attend these educational sessions.

Articles: EXCO offers a library of free trading articles on its website, covering various aspects of trading to enhance traders' knowledge and skills.

Trading Courses: The online Pro Trading Course, available for purchase on the EXCO website, is designed to help traders master market opportunities. Delivered by a trading expert, the course offers flexible online learning and includes a certificate of completion.

EXCO's educational resources encompass a diverse range of formats, providing traders with live interaction opportunities, webinars for scheduled learning, mentorship programs for in-depth understanding, informative articles for self-paced learning, and a structured Pro Trading Course for a more comprehensive education on trading and investment strategies. This multifaceted approach ensures that traders can access educational content tailored to their preferences and learning styles.

Conclusion

In conclusion, EXCO presents a trading platform with notable advantages and some associated disadvantages. On the positive side, the platform offers a diverse range of market instruments, competitive spreads, and two distinct account types catering to different trader profiles. The availability of a demo account, comprehensive customer support through various channels, and a rich set of educational resources contribute to a user-friendly experience. However, the lack of regulatory oversight raises concerns about transparency and investor protection. Withdrawal processing limited to business hours and the potential for withdrawal fees may inconvenience users.

Additionally, the variable maximum leverage for currency pairs introduces an element of uncertainty. Traders should weigh these pros and cons carefully, considering their individual preferences, risk tolerance, and the importance of regulatory compliance in their trading journey with EXCO.

FAQs

Q: What is EXCO and what does it offer?

A: EXCO is a trading platform for indices, commodities, and cryptocurrencies. It provides two account types with competitive spreads and access to educational resources.

Q: Is EXCO safe to use?

A: Safety is a top concern, and it's important to note that EXCO is not regulated by any financial authority. This means potential users should thoroughly research and consider the risks before engaging with the platform.

Q: What are the advantages of using EXCO?

A: EXCO offers a diverse range of trading instruments, competitive spreads, a user-friendly platform, and educational resources. Additionally, its two account types cater to different trading styles and needs.

Q: What are the disadvantages of using EXCO?

A: The main disadvantage is the lack of regulation, which exposes users to potential risks. Other limitations include withdrawal processing only during business hours and potential fees for certain withdrawals.

Q: Which trading platform does EXCO use?

A: EXCO utilizes the popular MetaTrader 4 (MT4) platform, offering a familiar and user-friendly interface for trading a variety of instruments.

Q: Does EXCO offer a demo account?

A: Yes, EXCO provides demo accounts for both of its account types. This allows you to test the platform and practice your trading strategies before committing real funds.

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now