User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

2

CommentsWrite a review

2024-03-25 01:09

2024-03-25 01:09 2024-02-28 17:08

2024-02-28 17:08

United States|2-5 years|

United States|2-5 years| https://www.topstep.com/

Website

Influence

AA

Influence index NO.1

United States 8.77

United States 8.77No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

More

Topstep LLC

Topstep

United States

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 2-5 years ago |

| Company Name | Topstep |

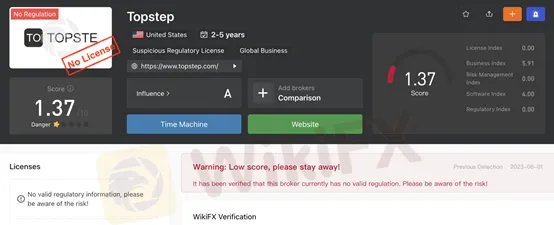

| Regulation | No Regulation |

| Minimum Deposit | $1 |

| Maximum Leverage | Up to 1:100 |

| Spreads | Not specified |

| Trading Platforms | MetaTrader 4, MetaTrader 5, TSTrader, NinjaTrader, TradeStation, TradingView, Bookmap X-ray, CTS, DayTradr, InvestorRT, MotiveWave, MultiCharts, Order Flow Trading, R |

| Tradable Assets | Forex currency pairs, Futures contracts (including E-mini S&P 500, NASDAQ 100, Crude Oil, Gold, Interest Rates, Micro Indices), Stocks, Commodities, Bonds, Metals |

| Account Types | Trading Combine, Express Funded Account, Live Funded Account |

| Demo Account | Yes (Trading Combine account) |

| Islamic Account | Not specified |

| Customer Support | Email (support@topstep.com), Phone (+1 (888) 407-1611), Chat (available on certain pages during business hours) |

| Payment Methods | Visa, Mastercard, American Express, Discover, PayPal |

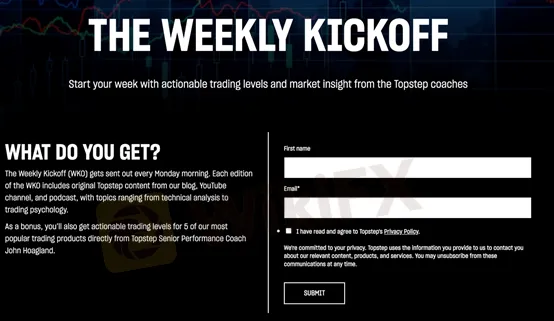

| Educational Resources | Blog, Videos, Podcasts, Trader Success Stories, Weekly Kickoff newsletter |

Topstep is an online trading platform operating in the United States. It's important to note that Topstep is currently not regulated by any valid regulatory body, which raises concerns about investor protection and the potential risks associated with trading through an unregulated broker. Traders should exercise caution and consider alternative regulated options for their trading needs.

Topstep offers a diverse range of market instruments for traders, including forex currency pairs, futures contracts on indices, commodities, precious metals, and interest rates. These instruments provide opportunities for traders to participate in various markets and diversify their portfolios.

The platform offers different account types to cater to the needs and preferences of traders. These include the Trading Combine, Express Funded Account, and Live Funded Account. Each account type has its own features, rules, and costs, allowing traders to choose the one that aligns with their trading goals and preferences.

Traders at Topstep can access leverage of up to 1:100, enabling them to trade larger positions relative to their account balance. However, it's crucial to understand that leverage amplifies both potential profits and losses, and traders should manage their risk responsibly.

Topstep charges commissions and fees for its services. The fees can vary depending on the trading program and market conditions. Traders should be aware of the specific fees applicable to their chosen account type and trading activities.

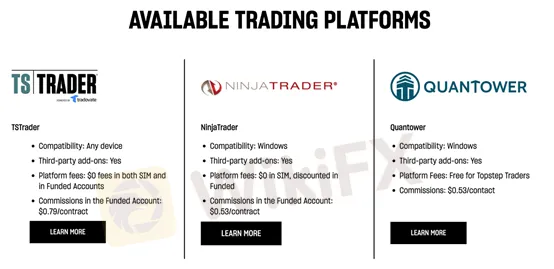

The platform provides a range of trading platforms to choose from, including TSTrader and NinjaTrader, offering different features and capabilities. However, it's worth noting that mobile trading is not available on these platforms.

Topstep offers educational resources, such as blogs, videos, podcasts, and success stories, to support traders in their trading journey. These resources cover a variety of topics, including market news, trading strategies, trading psychology, and insights from industry experts.

Customer support is available to assist traders with their inquiries and concerns. Traders can reach out to the support team through email or phone during weekdays. Live chat support is not currently available directly through the Help Center, but traders can utilize the chat button on the website during business hours.

In summary, Topstep is an online trading platform operating in the United States, but it's important to be aware of its lack of regulation. The platform offers a variety of market instruments, account types, leverage options, and trading platforms. Traders should carefully consider the associated risks and fees, as well as utilize the educational resources and customer support provided by Topstep.

Topstep offers a diverse range of market instruments, multiple account types, and account plans to cater to traders' needs. With leverage of up to 1:100 and educational resources to support learning, traders have opportunities to explore different markets and improve their skills. However, it's important to note that Topstep lacks regulation, charges fees and commissions, and has limited withdrawal options. Traders should carefully evaluate the risks and costs associated with trading on the platform and consider alternative regulated options.

| Pros | Cons |

| Offers a diverse range of market instruments to trade | Not regulated by any valid regulatory body |

| Provides different account types to suit traders' needs | Limited protection for investments due to lack of regulation |

| Leverage of up to 1:100 available | Potential for encountering fraudulent activities |

| Educational resources available for traders | Fees and commissions may apply for certain programs |

| Multiple trading platforms to choose from | Withdrawals not available in the Trading Combine program |

| Customer support available via email and phone | Mobile trading not available on trading platforms |

Topstep is currently not regulated by any valid regulatory body. It is important to be cautious and aware of the potential risks associated with trading through an unregulated broker. The lack of regulatory oversight means that there may be limited protection for your investments and a higher likelihood of encountering fraudulent activities. It is advisable to exercise caution and consider alternative regulated options for your trading needs.

Topstep provides investors with a diverse range of market instruments to trade.

FOREX CURRENCY PAIRS

They offer forex currency pairs, allowing traders to participate in the foreign exchange market and trade different combinations of global currencies.

FUTURES CONTRACTS

Additionally, Topstep offers futures contracts of the CME group. These futures contracts cover various financial instruments, including:

- E-mini S&P 500 and NASDAQ 100: These futures contracts allow traders to speculate on the performance of the S&P 500 and NASDAQ 100 stock market indices, representing a basket of top US-listed companies.

- Crude Oil: Traders can participate in the energy market by trading futures contracts based on the price of crude oil, a vital commodity in the global economy.

- Gold: Futures contracts on gold enable investors to engage in the precious metals market and take positions based on the price movements of gold.

- Interest Rates: Topstep offers futures contracts tied to interest rates, allowing traders to speculate on the future direction of interest rates and their impact on various financial instruments.

- Micro Indices: These futures contracts provide smaller-sized versions of popular stock market indices, allowing traders to trade the price movements of these indices with reduced contract sizes and capital requirements.

STOCKS, COMMODITIES, BONDS, AND METALS

Topstep's market instruments also cover a wide range of other financial products, including stocks, commodities, bonds, and metals. This enables traders to diversify their portfolios and take advantage of opportunities across different asset classes.

By offering a comprehensive selection of market instruments, Topstep aims to provide investors with the tools and opportunities to trade a wide range of financial assets in various markets.

| Pros | Cons |

| Diverse range of market instruments | Limited asset classes compared to other platforms |

| Access to global opportunities | Lack of regulatory oversight |

| Multiple options for speculative trading |

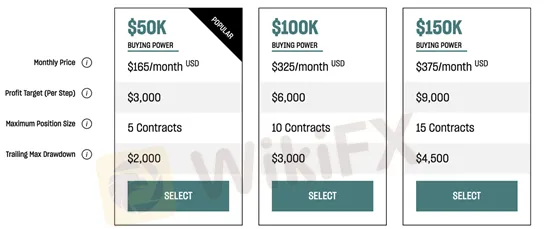

Topstep's scaling plan offers three different Trading Combine® account sizes for traders to choose from based on their goals. The three account sizes are $50K, $100K, and $150K in buying power.

For the $50K account size, the monthly price ranges from $165/month USD to $606,204/month COP, depending on the currency. The profit target per step is $3,000, and the maximum position size is 5 contracts. The trailing maximum drawdown is $2,000.

The $100K account size has a monthly price ranging from $325/month USD to $1,194,037/month COP. The profit target per step is $6,000, and the maximum position size is 10 contracts. The trailing maximum drawdown is $3,000.

For the $150K account size, the monthly price ranges from $375/month USD to $1,377,735/month COP. The profit target per step is $9,000, and the maximum position size is 15 contracts. The trailing maximum drawdown is $4,500.

Traders can select the account size that aligns with their trading objectives and preferences. It's worth noting that the prices and parameters mentioned here are subject to change, and it's advisable to refer to the official Topstep website or contact their support for the most up-to-date information.

Topstep offers leverage for traders in both the Trading Combine and Funded Account types. The leverage available at Topstep is subject to certain conditions and may vary depending on the account type and trading platform.

The maximum leverage offered by Topstep is up to 1:100. This means that traders can trade with up to 100 times the amount of their account balance. For example, if a trader has a $1,000 account balance, they can trade positions worth up to $100,000.

TopStep has a floating spread and its size depends on the volatility of a particular asset. The commission for 1 standard lot is $8.

Topstep provides traders with a range of trading platforms to choose from. These platforms include MetaTrader 4, MetaTrader 5, TSTrader, NinjaTrader, TradeStation, TradingView, Bookmap X-ray, CTS, DayTradr, InvestorRT, MotiveWave, MultiCharts, Order Flow Trading, R|Trader Pro, Trade Navigator, and Volfix.net. However, it's important to note that mobile trading is not available on these platforms.

TSTRADER

TSTrader, powered by Tradovate, is the most popular platform among traders. It offers compatibility with any device and provides a user-friendly interface. Traders can benefit from features such as setting hotkeys, plotting trendlines and retracements, and executing trades directly from the charts. TSTrader also includes a basic stock news ticker page and allows traders to track their profits and losses during the simulation period.

NINJATRADER

NinjaTrader is another platform offered by Topstep, mainly compatible with Windows. It supports third-party add-ons and offers discounted platform fees for funded accounts.

QUANTOWER

Similarly, Quantower is a platform available for Windows users, with free platform fees for Topstep traders.

Each trading platform offered by Topstep has its own features, capabilities, and costs. Traders can choose the platform that suits their needs and preferences. However, it's worth noting that TSTrader is often considered the best beginner platform among the options provided by Topstep.

| Pros | Cons |

| Offers a wide range of trading platforms to choose from, including MetaTrader 4, MetaTrader 5, TSTrader, NinjaTrader, TradeStation, and more. | Mobile trading is not available. |

| TSTrader, powered by Tradovate, is a popular and user-friendly platform that offers compatibility with any device, features like hotkeys, trendline plotting, and direct trade execution from charts, and includes a stock news ticker page and the ability to track profit/loss during simulations. | NinjaTrader, another platform offered by Topstep, is mainly compatible with Windows. |

| Quantower, a platform available for Windows users, is also provided by Topstep and offers free platform fees for traders. |

For the Trading Combine® program, Topstep accepts the following methods of payment:

- Visa

- Mastercard

- American Express

- Discover

- PayPal

It's worth noting that pre-paid credit cards and gift cards may not be valid payment methods. Topstep recommends using a standard credit card, debit card, or PayPal for payment.

Regarding withdrawals, it's important to clarify that withdrawals are not available for the Trading Combine® program. However, in the Funded Account phase, the withdrawal process works as follows:

- If the trader's commission balance is up to $500, they are responsible for paying a withdrawal fee of $50.

- If the commission balance is $500 or more, Topstep pays the withdrawal fee of $50.

| Pros | Cons |

| Accepts major credit cards (Visa, Mastercard, American Express, Discover) and PayPal for payment | Pre-paid credit cards and gift cards may not be valid payment methods |

| Withdrawal fee of $50 is covered by Topstep if the commission balance is $500 or more | Traders are responsible for paying a withdrawal fee of $50 if the commission balance is up to $500 |

| Withdrawals are available in the Funded Account phase | Withdrawals are not available for the Trading Combine® program |

Topstep provides a range of educational resources to support traders in their journey. These resources include:

1. Blog: The Topstep blog offers a variety of articles covering market news, trading strategies, trading psychology, and more. Traders can stay updated on the latest market trends and gain insights from industry experts.

2. Videos: Topstep produces videos that delve into various trading topics, such as technical analysis, trading psychology, and market insights. These videos provide visual explanations and examples to enhance traders' understanding.

3. Podcasts: The Limit Up! podcast by Topstep features interviews with successful traders, discussions on trading-related topics, and insights from industry professionals. Traders can listen to episodes that cover a wide range of subjects, including setting expectations, managing emotions, and improving trading performance.

4. Trader Success Stories: Topstep shares success stories of funded traders who have achieved consistent profitability. These stories provide inspiration and insights into the strategies and approaches employed by successful traders.

5. Weekly Kickoff: The Weekly Kickoff (WKO) is a weekly newsletter sent out every Monday morning. It includes original Topstep content from the blog, YouTube channel, and podcast. Traders also receive actionable trading levels for popular trading products from Topstep Senior Performance Coach John Hoagland.

In conclusion, Topstep is an online trading platform that offers a variety of market instruments and account types to traders. However, it's important to note that Topstep is currently not regulated by any valid regulatory body, which raises concerns about the protection of investments and potential exposure to fraudulent activities. Traders should exercise caution and consider alternative regulated options. Topstep provides a range of educational resources, diverse trading platforms, and customer support to assist traders in their journey. It's crucial for traders to carefully review the fees, commissions, and account plans offered by Topstep and stay updated on the most current information provided by the platform.

Topstep provides customer support to assist clients with any questions or concerns they may have. Clients can contact the support team through multiple channels.

To access the support team, clients can reach out through email at support@topstep.com or call the dedicated phone line at +1 (888) 407-1611. The support team is available on weekdays between 7:00 AM and 6:00 PM CST.

Unfortunately, live chat support is not currently available directly through the Help Center. However, during normal business hours, clients can utilize the chat button located on the bottom-right of certain pages on the Topstep website to connect with chat representatives.

Clients are encouraged to reach out to the support team for assistance with any inquiries related to the program, processes, or any other questions they may have. Additionally, clients can explore the Topstep Help Center or join the Facebook Community to access further information and resources.

Q: Is Topstep regulated by any valid regulatory body?

A: Topstep is currently not regulated by any valid regulatory body. Traders should exercise caution and be aware of the potential risks associated with trading through an unregulated broker.

Q: What market instruments does Topstep offer?

A: Topstep provides a range of market instruments, including forex currency pairs, futures contracts (such as E-mini S&P 500, NASDAQ 100, crude oil, gold, interest rates, and micro indices), as well as stocks, commodities, bonds, and metals.

Q: What are the different account types offered by Topstep?

A: Topstep offers the Trading Combine account, Express Funded Account, and Live Funded Account. Each account type has its own features, rules, and costs, allowing traders to choose based on their preferences and trading goals.

Q: What are the account plans available at Topstep?

A: Topstep's scaling plan offers three different Trading Combine account sizes: $50K, $100K, and $150K in buying power. Each account size has its own monthly price, profit target, maximum position size, and trailing maximum drawdown.

Q: What leverage does Topstep offer?

A: Topstep offers leverage of up to 1:100 for both the Trading Combine and Funded Account types. Traders can trade with up to 100 times the amount of their account balance.

Q: What are the fees and commissions charged by Topstep?

A: Topstep charges commissions and fees for its Live Funded Account and Trading Combine programs. The fees vary depending on the account type and trading platform used. Traders should refer to the official Topstep website or contact their support for the most up-to-date fee information.

Q: What payment methods are accepted for deposits at Topstep?

A: For the Trading Combine program, Topstep accepts Visa, Mastercard, American Express, Discover, and PayPal. However, it's important to note that pre-paid credit cards and gift cards may not be valid payment methods.

Q: What trading platforms are available at Topstep?

A: Topstep offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, TSTrader, NinjaTrader, TradeStation, TradingView, Bookmap X-ray, CTS, DayTradr, InvestorRT, MotiveWave, MultiCharts, Order Flow Trading, R|Trader Pro, Trade Navigator, and Volfix.net. Mobile trading is not available on these platforms.

Q: What educational resources does Topstep provide?

A: Topstep offers educational resources such as a blog, videos, podcasts, trader success stories, and a weekly newsletter. These resources cover topics ranging from market news and trading strategies to trading psychology and insights from industry professionals.

Q: How can I contact Topstep's customer support?

A: Clients can reach Topstep's customer support team through email or phone. The dedicated phone line is available on weekdays between 7:00 AM and 6:00 PM CST. Live chat support is not currently available directly through the Help Center, but clients can use the chat button on certain pages of the Topstep website during business hours.

Sort by content

User comment

2

CommentsWrite a review

2024-03-25 01:09

2024-03-25 01:09 2024-02-28 17:08

2024-02-28 17:08