Score

One Ozo

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://oneozo.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 7492882694

Other ways of contact

Broker Information

More

One Ozo

One Ozo

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed One Ozo also viewed..

XM

ATFX

VT Markets

Exness

One Ozo · Company Summary

| Aspect | Information |

| Registered Country | United Kingdom |

| Company Name | One Ozo |

| Regulation | Unregulated |

| Tradable Assets | Forex, CFDs, Indices, Stocks, Cryptocurrencies |

| Minimum Deposit | $25 |

| Trading Platforms | Desktop, Mobile, Web Browser |

| Account Types | Ozo Start, Ozo Gold, Ozo Prime, Ozo Power |

| Demo Account | No |

| Payment Methods | Credit/debit card, Bank transfer |

| Customer Support | Phone, Email, Live Chat, Social Media |

| Educational Tools | Trading guides, articles, webinars, video tutorials |

Overview of One Ozo

One Ozo is a brokerage based in the United Kingdom and operates without regulation, offering trading services through desktop, mobile, and web platforms. With a minimum deposit requirement of $100, traders can access a variety of assets including forex, CFDs, indices, stocks, and cryptocurrencies across different account types such as Ozo Start, Ozo Gold, Ozo Prime, and Ozo Power. However, the absence of a demo account and limited transparency regarding fees for payment methods may pose challenges for traders. Nonetheless, One Ozo provides multiple customer support channels including phone, email, live chat, and social media, along with educational resources like trading guides, articles, webinars, and video tutorials to assist traders in their journey.

Is One Ozo legit or a scam?

Since Ozo broker is unregulated, there isn't a specific regulatory framework governing its operations. Unregulated brokers typically operate without oversight from financial regulatory authorities, which means they aren't subject to the same rules and standards as regulated brokers. This lack of regulation can pose risks to investors, as there may be less transparency and accountability in the broker's operations. Without regulatory oversight, investors may have limited recourse in case of disputes or malpractice.

Pros and Cons

Ozo Broker offers a variety of features that might be appealing to some traders, including a wide range of tradable instruments, 24/7 customer support, and an easy-to-use platform. However, a major drawback is the lack of regulation by any major financial authority. This means there's higher risk involved when using their platform. Additionally, crucial information on deposit/withdrawal methods and fees, as well as the reliability of customer support, is limited online.

| Pros | Cons |

|

|

|

|

|

|

|

|

Market Intruments

Ozo broker still offer trading instruments such as stocks, forex, commodities, and cryptocurrencies to its clients. These instruments allow investors to speculate on the price movements of various assets.

In terms of stocks, Ozo broker offers trading in a variety of equities from different global markets, allowing investors to buy and sell shares in publicly traded companies.

For forex trading, Ozo broker may provide access to the foreign exchange market, enabling investors to trade currency pairs and speculate on the exchange rate fluctuations between different currencies.

Commodities trading through Ozo broker could involve trading in assets such as gold, silver, oil, agricultural products, and other raw materials. Investors can take positions on the price movements of these commodities in the global markets.

Additionally, Ozo brokers offer trading in cryptocurrencies, allowing investors to buy and sell digital assets like Bitcoin, Ethereum, and others.

Account Types

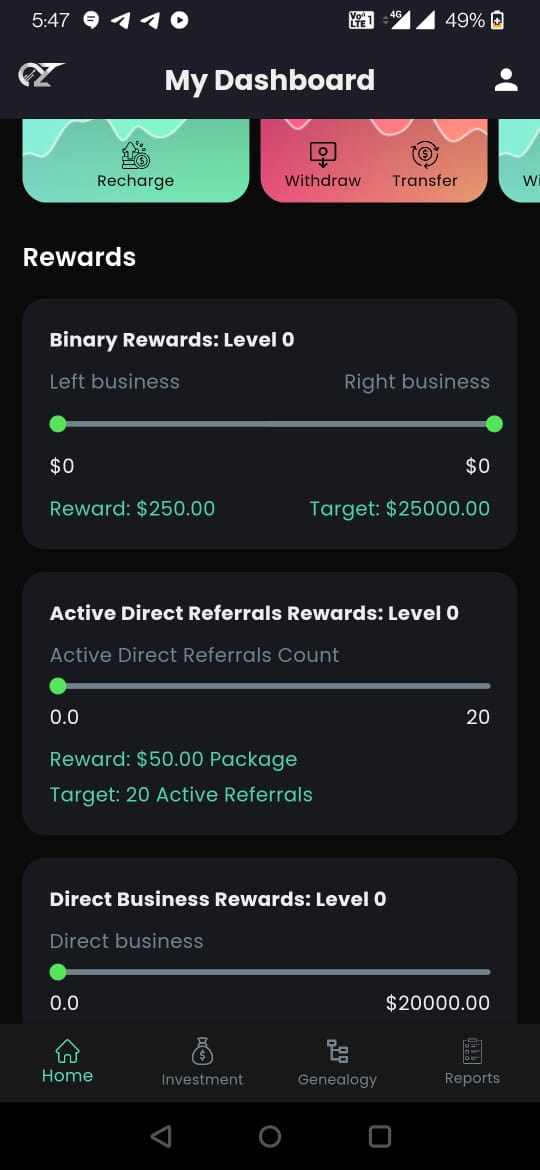

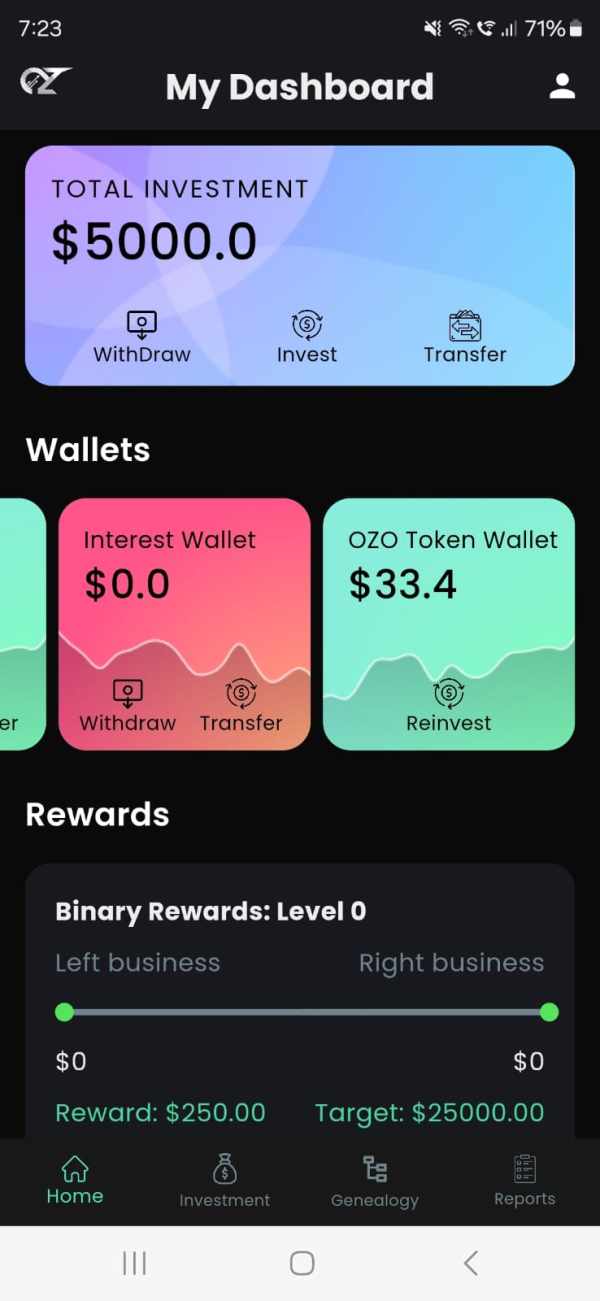

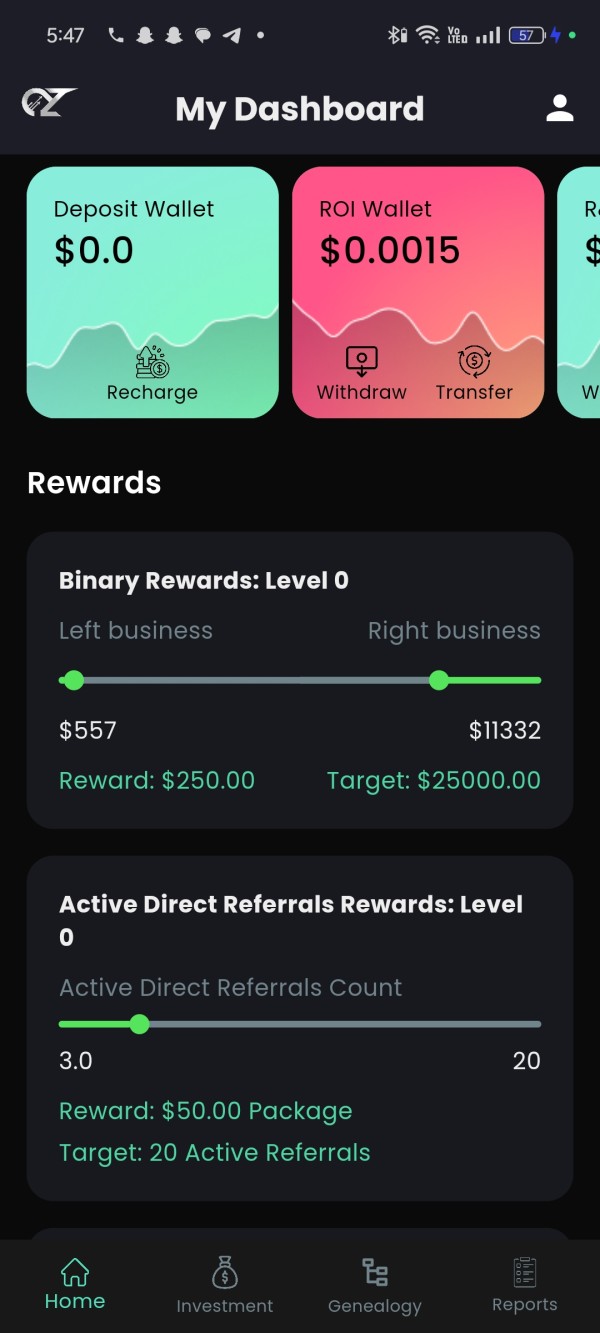

These accounts offer varying levels of returns, durations, and bonuses, allowing investors to choose the option that aligns with their investment preferences and risk tolerance. Additionally, the referral bonus provides an incentive for investors to introduce others to the platform.

| Account Type | Initial Investment | ROI (Daily) | Total Returns | Duration | Binary Bonus | Capping Limit | Principal Returns | Referral |

| OZO START | $25 - $4,999 | 1.30% | 260% | 200 days | 10% | $1,000 | 100% | 5% - 1.5% |

| OZO GOLD | $5,000 | 2% | 200% | 100 days | 10% | $3,000 | 100% | 10% |

| OZO PRIME | $10,000 | 2.25% | 225% | 100 days | 10% | $6,000 | 100% | 10% |

| OZO POWER | $25,000 | 2.50% | 250% | 100 days | 10% | $12,500 | 100% | 10% |

How to open an account?

Based on the available information, the specific steps for opening an One Ozo account are not explicitly provided. However, here's a general outline of the likely process:

Visit the One Ozo Website:Navigate to the One Ozo website (https://www.onezo.us/).

Locate the Registration Page:Look for the “Sign Up” or “Register” button or link. It might be located in the top right corner or on a dedicated registration page.

Complete the Registration Form:Provide accurate and complete personal information, including your name, email address, phone number, and country of residence. Set a strong password and confirm it. Then agree to the Terms of Use and Privacy Policy.

Verify Your Email Address:A verification link will be sent to your registered email address. Click on the link to confirm your email address and complete the registration process.

Fund Your Account:Select the desired investment tier (Ozo Start, Ozo Gold, Ozo Prime, or Ozo Power). Choose a payment method (e.g., credit card, bank transfer, cryptocurrency). Deposit the minimum required amount for your chosen tier.

Complete the Investment Agreement:Review and agree to the investment agreement, which outlines the terms and conditions specific to your chosen tier.

Start Investing:Once your account is funded and the agreement is accepted, you can start investing and earning returns according to your chosen tier.

Trading Fees

One Ozo might offer trading options alongside their fixed-term investment packages. In this respect, spreads and commissions would apply.

Non-Trading Fees

Account Management Fee: Ozo Broker charges a monthly account management fee of $5.

Deposit/Withdrawal Fees: Ozo Broker charges a fee of 2.5% for deposits made via credit card and debit card, and a fee of $10 for deposits made via wire transfer. For withdrawals made via credit card and debit card, a fee of 3% is charged, while a fee of $25 is charged for withdrawals via wire transfer.

Inactive Account Fee: If your account remains inactive for 6 consecutive months, Ozo Broker will charge a monthly inactive account fee of $10.

Conversion Fee: Ozo Broker charges a fee of 0.5% for currency conversion.

Margin Interest: Ozo Broker charges an annual interest of 5% for margin trading.

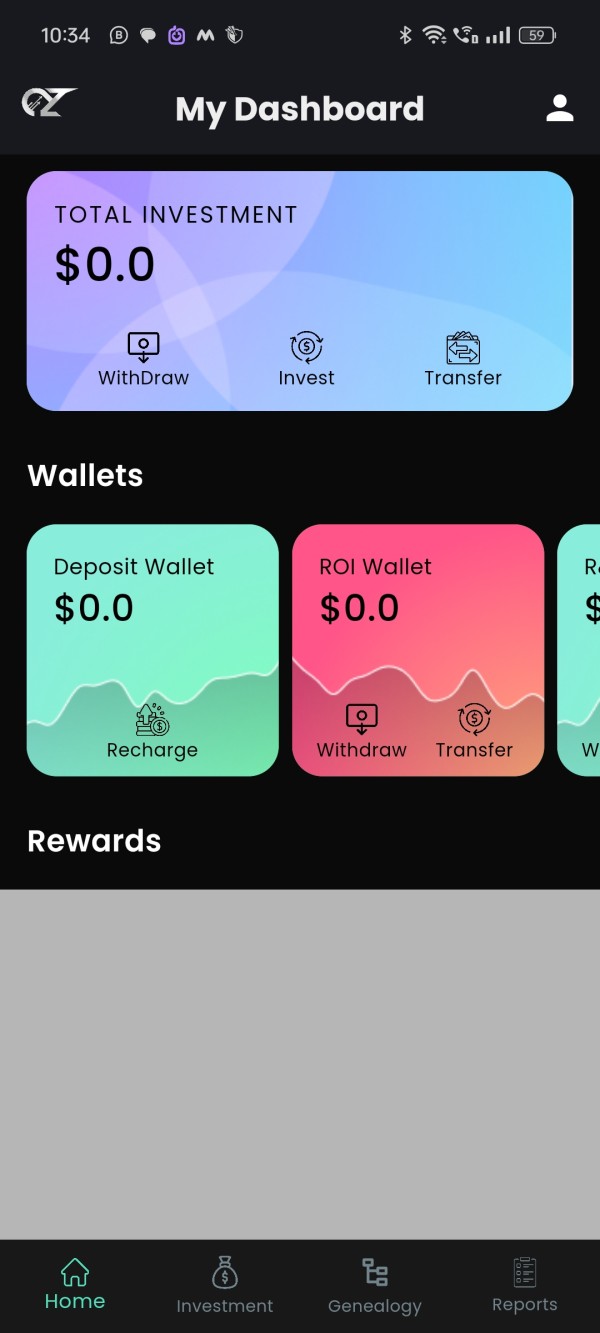

Trading Platform

Ozo Broker is an online trading platform that allows traders to trade forex, CFDs, indices, stocks, and cryptocurrencies. The platform is available for desktop, mobile, and web browsers.

Platform Features:

Supports a wide variety of trading instruments, including forex, CFDs, indices, stocks, and cryptocurrencies.

Offers a variety of charts and indicators for market analysis.

Supports multiple order types, including market orders, limit orders, and stop-loss orders.

Provides real-time market data and news.

Offers 24/7 customer support.

Platform Advantages:

Supports a wide variety of trading instruments.

Offers a variety of charts and indicators.

Supports multiple order types.

Provides real-time market data and news.

Offers 24/7 customer support.

Platform Disadvantages:

Limited to online trading only.

Does not offer a demo account.

Has a minimum deposit of $100.

Charges trading fees and other fees.

Overall, the Ozo Broker trading platform is a functional trading platform that can be used to trade a variety of trading instruments. The platform is easy to use and offers 24/7 customer support. However, the platform is limited to online trading only, does not offer a demo account, and charges trading fees and other fees.

Deposit & Withdrawal

Deposits:

Minimum deposit: $25

Deposit methods: Ozo Broker might offer various deposit methods, but information readily available online is limited. Here are some common methods generally offered by brokers:

Credit/debit card: Deposits are usually instant but might come with fees (be sure to check Ozo's fee schedule).

Bank transfer: This can take 1-3 business days to reflect in your account.

Withdrawals:

Withdrawal processing time: Generally, withdrawals can take 3-7 business days depending on the chosen method.

Withdrawal methods: Similar to deposits, withdrawal methods might vary. Here's a breakdown of common methods and their potential drawbacks:

Credit/debit card: Withdrawals might take longer than deposits due to additional verification steps. Fees might also apply.

Bank transfer: This is a secure method but can be slow.

Customer Support

Ozo Broker offers comprehensive customer support to assist its clients with any inquiries or issues they may encounter. Here are some common channels through which customers can reach Ozo Broker's support team:

Phone Support: Customers can contact Ozo Broker's support team via phone:+44 7452118915 for immediate assistance. The phone number is typically provided on the broker's website or through account documentation.

Email Support: Clients can also reach out to Ozo Broker's support team via email:Info@oneozo.com. This allows for non-urgent inquiries or issues to be addressed in a timely manner. The email address for support is usually listed on the broker's website.

Live Chat: They offer a live chat feature on their website :https://api.whatsapp.com/send?phone=447452118915, allowing customers to chat with a support representative in real-time. This can be convenient for quick questions or technical assistance.

FAQs and Knowledge Base: Ozo Broker may have a comprehensive FAQ section or knowledge base on its website, providing answers to commonly asked questions and troubleshooting guides for common issues.

Social Media: Ozo Broker maintain active social media profiles where customers can reach out for support or updates. This can include platforms like Twitter, Facebook, or LinkedIn.

By offering multiple support channels, Ozo Broker aims to ensure that customers can access assistance in the most convenient way possible, enhancing their overall trading experience.

Educational Resources

Ozo Broker typically provides a variety of educational resources to help clients enhance their trading knowledge and skills. Some common educational resources offered by Ozo Broker may include:

Trading Guides and Articles: Ozo Broker may offer comprehensive guides and articles covering various topics related to trading, including fundamental analysis, technical analysis, risk management, and trading strategies. These resources are typically available on the broker's website or trading platform.

Webinars and Seminars: Ozo Broker may host live webinars or seminars conducted by trading experts. These sessions can cover a wide range of topics, from beginner-level introductions to advanced trading techniques. Webinars and seminars provide an interactive learning experience and may allow participants to ask questions directly to the presenter.

Video Tutorials: Ozo Broker may offer video tutorials covering different aspects of trading, such as how to use their trading platform, how to place trades, and how to analyze market trends. Video tutorials are often helpful for visual learners and can provide step-by-step guidance on various trading processes.

Educational Courses: Some brokers offer structured educational courses designed to take traders from beginner to advanced levels. These courses may cover topics such as forex trading, stock trading, options trading, and more. Courses may be available in various formats, including online modules, e-books, and live sessions.

Market Analysis and Research: Ozo Broker may offer daily or weekly market analysis reports, covering major financial markets and providing insights into current market trends, potential trading opportunities, and economic events that may impact prices. Access to market research can help traders make informed trading decisions.

By providing these educational resources, Ozo Broker aims to empower its clients with the knowledge and skills necessary to become successful traders.

Conclusion

Ozo Broker presents a situation with some potential benefits but overshadowed by significant drawbacks. On the positive side, Ozo offers a vast selection of instruments for trading, from forex to cryptocurrencies. They also boast 24/7 customer support and a user-friendly platform accessible on various devices.

However, these advantages become less appealing when considering the critical issue of regulation. Ozo Broker lacks oversight from major financial authorities, which exposes you to greater risk. This means your funds might not be protected in case of unforeseen circumstances.

Furthermore, readily available information regarding Ozo Broker is limited. Details on deposit/withdrawal methods, fees, and the effectiveness of customer support are unclear. This lack of transparency makes it difficult to assess the true cost and reliability of using their platform.

In conclusion, while Ozo Broker might seem like a convenient option with a wide range of instruments, the lack of regulation and limited information online raise significant red flags. Considering the potential risks involved, it's advisable to explore other brokers that are regulated and offer more transparency regarding fees and customer support.

FAQs

Q: What trading instruments does Ozo Broker offer?

A: Ozo Broker offers a wide range of instruments for trading, including forex, CFDs, indices, stocks, and cryptocurrencies.

Q: What are the advantages of using Ozo Broker?

A: Ozo Broker potentially offers 24/7 customer support, an easy-to-use platform accessible on desktop, mobile, and web browsers, and a variety of educational resources and market analysis tools.

Q: What are the disadvantages of using Ozo Broker?

A: The biggest drawback of Ozo Broker is the lack of regulation by any major financial authorities. This means there's higher risk involved when using their platform, and your funds might not be protected. Additionally, information on deposit/withdrawal methods, fees, and the reliability of customer support is limited online.

Q: Does Ozo Broker offer a demo account?

A: No, information readily available online does not indicate that Ozo Broker offers a demo account.

Q: How do I contact Ozo Broker's customer support?

A: Specific information on contacting Ozo Broker's customer support is limited online.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies. Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

News

Exposure"Broker suddenly stopped withdrawal"- User Said

An Indian user filed a complaint against One Ozo on WikiFX. In his complaint, the complainant wrote, “Out of 5000 dollars, broker used to pay only 850 dollars. Broker ran away. Now neither the website is opening nor is there anything in it.” Further, he added.

WikiFX

WikiFX

ExposureRisk Alert

“The broker suddenly stopped withdrawals without a reason." It’s an excerpt from the complainant’s complaint. The complainant is from India and filed a complaint on May 14, 2024, against One Ozo regarding the fraud which happened to him.

WikiFX

WikiFX

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now