Score

RONG HUI

United Kingdom|2-5 years|

United Kingdom|2-5 years| http://www.ronghui.club/en

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 18065751413

Other ways of contact

Broker Information

More

Ronghui Group Co., Ltd

RONG HUI

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed RONG HUI also viewed..

XM

ATFX

HFM

FBS

RONG HUI · Company Summary

| RONG HUI | Basic Information |

| Registered Country/Area | United Kingdom |

| Founded year | 1-2 years ago |

| Company Name | Ronghui Group Co., Ltd |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $1,000 |

| Maximum Leverage | 1:400 |

| Spreads | 0.0 pips ( Raw Spreads account) |

| Trading Platforms | MT5 trading platform |

| Tradable Assets | Forex exchange, Metal, Index |

| Account Types | Original Spreads account and Commission-free Standard account |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | Phone: +44 18065751413, Email: ceo@Ronghui.club |

| Payment Methods | Not specified |

| Educational Tools | No |

General Information

Ronghui Group Co.,Ltd is a newly established forex broker. Although it is still considered to be relatively young compared with other forex brokers, however, its performance in the financial sector remains commendable. Ronghui Group Co.,Ltd allows its clients to trade with a massive market including stocks trading, foreign exchange, gold and silver, oil trading. Ronghui Group Co.,Ltd offers its clients access to the leading MT5 trading platform, with leverage reaching up to 1:400, minimum lot 0.01 lot.

Established approximately 1-2 years ago, the company operates under the registered name Ronghui Group Co., Ltd. However, it is important to note that the regulatory license held by RONG HUI raises suspicions.

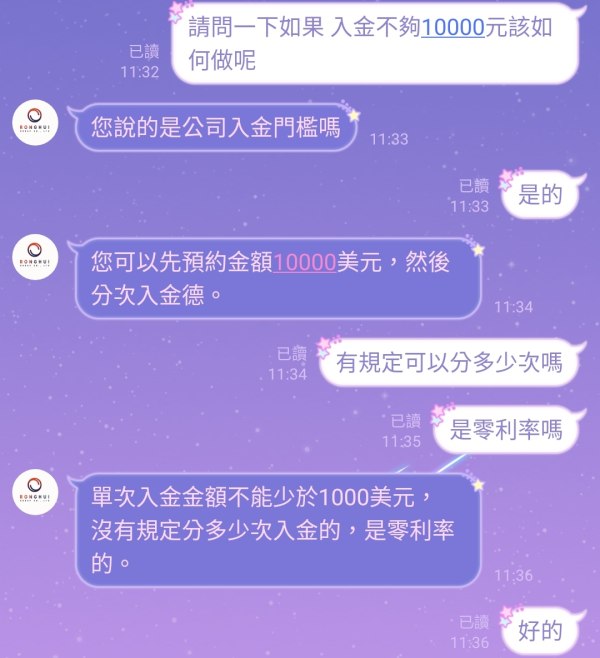

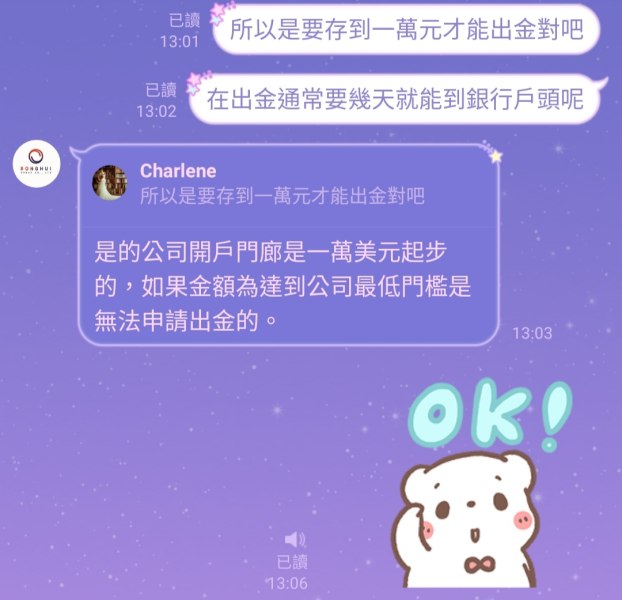

To start trading with RONG HUI, a high minimum deposit of $1,000 is required. The broker offers a maximum leverage of 1:400, allowing clients to amplify their trading positions. For those looking for tight spreads, RONG HUI provides a Raw Spreads account option with spreads starting from 0.0 pips.

The trading platform supported by RONG HUI is the MT5 trading platform. This provides traders with a robust and versatile platform to execute their trades. However, the broker offers a limited range of tradable assets, including forex exchange, metals, and indices.

RONG HUI offers two main types of accounts: the Original Spreads account and the Commission-free Standard account. While the website does not explicitly mention the availability of a demo account or an Islamic account, it is best to contact RONG HUI's customer support for further information on account types and suitability for individual trading preferences.

Is RONG HUI legit or a scam?

The regulatory status of RONG HUI, a financial services provider, has raised suspicions as the broker claims to be registered with the NFA (National Futures Association) and holds a license from the Common Financial Service Association. However, upon closer examination, it has been discovered that the license number provided, 0549987, does not correspond to any valid regulatory license listed on the NFA website.

This discrepancy and lack of verifiable information regarding the claimed regulatory license of RONG HUI are concerning. Regulatory oversight is of utmost importance in the financial industry, as it ensures that brokers adhere to stringent standards and safeguards the interests of clients. Without proper regulation, clients may be exposed to potential risks, such as inadequate client protection measures, insufficient financial transparency, and a lack of recourse in the event of disputes.

Pros and Cons

| Pros | Cons |

| Offers MT5 trading platform | Suspicious Regulatory License |

| High leverage up to 1:400 | Relatively high minimum deposit of $1,000 |

| Limited spreads information (0.0 pips for Raw Spreads account) | |

| No demo account for beginners to practice trading | |

| No information about accepted payment methods | |

| Limited range of trading instruments | |

| Lack of educational tools and resources |

Market Instruments

Ronghui Group Co.,Ltd gives its clients the access to a massive market, and four classes of trading assets including Forex exchange, Metal, Index are available through the brokerage platform.

Forex exchange serves as a cornerstone of the financial markets, enabling participants to trade currencies from various countries around the world. This provides traders with access to a highly liquid market where they can speculate on the fluctuations in exchange rates and potentially profit from these movements.

Metal trading is another market instrument offered by RONG HUI. Metals, such as gold, silver, platinum, and others, have long been recognized as valuable assets and can serve as safe-haven investments in times of economic uncertainty.

Additionally, RONG HUI provides access to trading indices. Indices comprise a selection of stocks representing a specific market or industry sector.

Account Types

With Ronghui Group Co.,Ltd, two forex trading accounts are on offer: Original Spreads account and Commission-free Standard account. Typically, investors are given the ability to trade on the interbank markets at the most competitive rates by setting up an ECN trading account.

Please note that one clients can only set up one transaction account.

Leverage

Ronghui Group Co.,Ltd offers the maximum leverage up to 1:400, which is a generous offering. Leverage can improve potential returns by allowing you to double or even quadruple your account amount. However, it can also cause to serious fund losses, especially to inexperienced traders. Therefore, it is essential for traders to choose the proper amount based on their risk tolerance.

Spreads

Ronghui Group Co.,Ltd offers its traders an ultra-low spread trading environment, as it partners with liquidity providers. The Standard commission free account spreads as low as 0.9 pips, and the Raw spreads accounts offers spreads as low as 0.0 pips. The first account is designed for beginners, only charging them spreads, while the certain commission is levied on the second account since its offers raw spread as low as 0.0 pips.

Non-Trading Fees

Certain non-trading fees that may be applicable at RONG HUI include but are not limited to withdrawal fees, inactivity fees, and account maintenance fees. Withdrawal fees are typically charged when a trader requests the withdrawal of funds from their trading account. Inactivity fees, on the other hand, may be levied if a trading account remains inactive for an extended period of time. Account maintenance fees could be imposed on a periodic basis to cover the operational costs related to maintaining and servicing an active trading account.

The precise amount or rate applicable for non-trading fees may vary, and it is advisable for traders to consult the relevant terms and conditions or reach out to RONG HUI directly for a comprehensive understanding of the fee structure.

Trading Platform Available

When it comes to trading platforms available, Ronghui Group Co.,Ltd offers its clients access to the leading MT5 Trading platform. With this advanced trading software, traders can get access online transaction of foreign exchange, cryptocurrencies, precious metals and indices. Besides, MT5 also enables them to operate trading bots such as EA, study financial markets, and engage in advanced trading operations, even duplicating the strategies of other investors without difficulty.

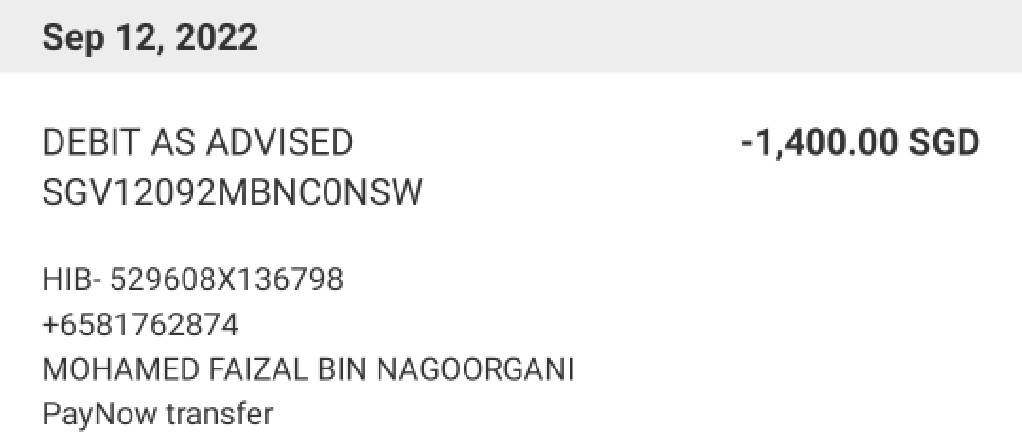

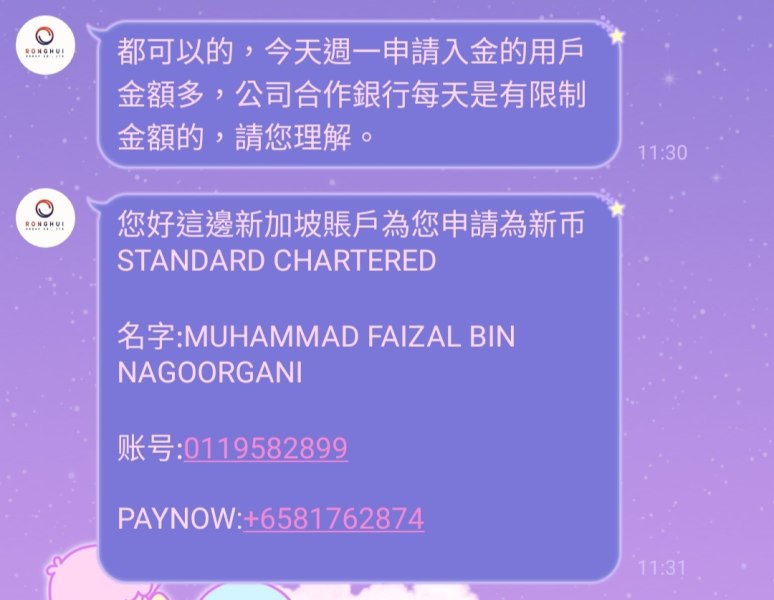

Deposit & Withdrawal

Clients must satisfy a minimum deposit requirement of $1000 to commence the deposit process, setting a standard that ensures traders possess an adequate capital base to engage in their desired trading activities. The available payment methods for deposit and withdrawal transactions are not explicitly specified.

Customer Support

RONG HUI's provision of customer support can be described as somewhat lacking. The company offers limited means of communication, with only a phone line (+44 18065751413) and an email address (ceo@Ronghui.club) available for clients to reach out with their concerns. This limited availability may prove frustrating for clients who require immediate assistance or prefer alternative modes of communication.

The companys opening and closing times are listed below:

Winter time: Monday 7 a.m. - Saturday 5 a.m. summer time: Monday 6 a.m. - Saturday 4 a.m.

Educational Resources

Unfortunately, RONG HUI fails to offer any substantial educational materials or resources to assist clients in expanding their knowledge and understanding of the financial markets.

User Exposure

RONG HUI's user exposure can be characterized as deeply concerning and fraught with numerous negative reviews. Clients overwhelmingly express dissatisfaction with the broker, particularly regarding serious issues related to withdrawals of funds. A substantial number of clients report facing difficulties and delays when attempting to withdraw their own money, which raises serious concerns about the broker's integrity and reliability.

Is RONG HUI suitable for beginners?

RONG HUI's suitability for beginners can be evaluated based on three critical aspects - the minimum deposit requirement, availability of a demo account, and educational resources. Unfortunately, this broker falls short in all three categories, making it less than ideal for novice traders.

Firstly, RONG HUI's minimum deposit requirement is notably high, a major disadvantage for beginners who may have limited capital to invest. This high barrier to entry may deter newcomers from choosing RONG HUI as their preferred brokerage, as it restricts their ability to start with a smaller investment and gradually build their trading skills and experience.

Secondly, the absence of a demo account, a fundamental tool for newcomers to practice and gain familiarity with trading concepts, further undermines RONG HUI's suitability for beginners. A demo account allows novices to learn the ropes of trading without risking real funds, providing a safe and supportive environment to develop their skills. Unfortunately, without this essential learning resource, beginners may find themselves at a significant disadvantage and without the opportunity to gain practical experience before engaging in real trades.

Lastly, RONG HUI's educational resources, or rather the lack thereof, pose a considerable challenge for beginners in their journey to acquire knowledge and understanding of the financial markets. The absence of informative tutorials, webinars, and educational articles means that beginners are denied vital resources to expand their trading knowledge and make well-informed investment decisions. The lack of educational support hinders beginners' ability to develop the necessary skills and strategies required to succeed in the highly competitive trading arena.

Is RONG HUI suitable for experienced traders?

When it comes to experienced traders, RONG HUI's suitability can be examined through three critical aspects - advanced trading tools, multiple trading accounts, and customer support. Unfortunately, RONG HUI's performance in these areas raises concerns and may not meet the expectations of experienced traders.

Firstly, the availability of advanced trading tools is crucial for experienced traders who rely on sophisticated strategies and data analysis to execute their trades. However, RONG HUI's offering in this regard is limited, potentially hindering experienced traders from fully capitalizing on their skills. The absence of comprehensive charting tools, technical indicators, and advanced order types may restrict the range of trading possibilities and limit the ability to implement complex trading strategies effectively.

Secondly, the provision of multiple trading accounts is an essential aspect for experienced traders as it offers flexibility and cater to their diverse trading needs. However, RONG HUI's options in this area may be lacking. The absence of various account types tailored for different trading styles and requirements could limit experienced traders' ability to optimize their trading approach.

Lastly, effective and responsive customer support is paramount for experienced traders who may require timely assistance or have specific inquiries related to their advanced trading strategies. Unfortunately, RONG HUI's customer support may fall short in providing the level of service expected by experienced traders. Reports of slow response times, limited availability, and inadequate resolution of issues raise concerns about the broker's ability to address the complex needs and demands of more experienced traders.

Conclusion

In summation, the suitability of RONG HUI as a brokerage is questionable at best, compounded by a multitude of deficiencies that make it an unideal choice for both beginners and experienced traders alike. From high minimum deposit requirements to the absence of a demo account and limited educational resources, RONG HUI fails to cater to the needs and aspirations of novice traders seeking a supportive and educational environment to cultivate their trading skills. Similarly, experienced traders seeking advanced trading tools, diverse account options, and reliable customer support are met with disappointment and inconvenience due to RONG HUI's inadequate offerings in these crucial areas.

FAQs

Q: Does RONG HUI offer a demo account for beginners to practice trading?

A: Unfortunately, RONG HUI does not provide a demo account.

Q: What are the minimum deposit requirements for opening an account with RONG HUI?

A: RONG HUI has relatively high minimum deposit requirements, starting from $1000.

Q: Are there educational resources available for traders on RONG HUI's platform?

A: RONG HUI's offering of educational resources falls short of expectations.

Q: Can traders choose from a variety of trading accounts on RONG HUI?

A: RONG HUI's options for trading accounts are limited, which may be a disadvantage for those who prefer diverse account types tailored to their trading style and requirements.

Q: What is the maximum trading leverage offered by RONG HUI?

A: The maximum trading leverage offered by RONG HUI is up to 1:400.

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now