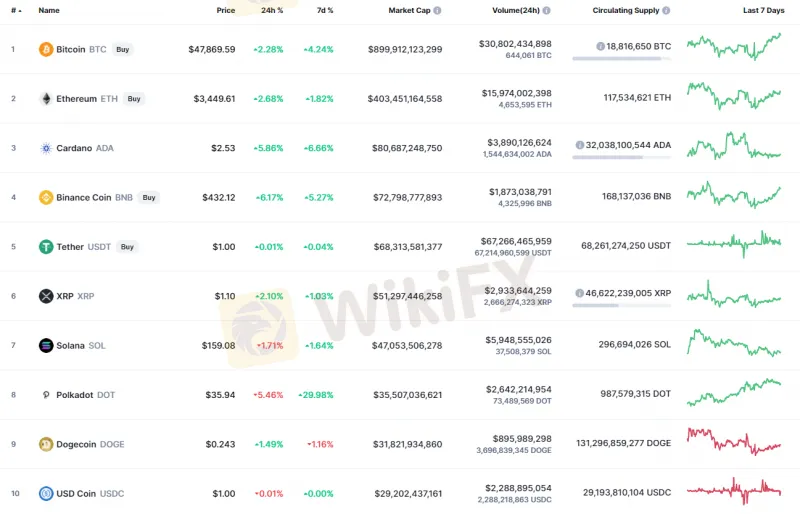

Can Bitcoin (BTC) rise faster than Binance Coin (BNB) and Cardano (ADA)?

Abstract:The market has slightly increased after a fall, and only some coins are in the red zone.

The market has slightly increased after a fall, and only some coins are in the red zone. Mainly, Solana (SOL) and Polkadot (DOT) remain under a bearish mood.

BTC/USD

Yesterday, buyers were able to break through the two-hour EMA55 resistance and restore the Bitcoin price above the POC line. The volumes decreased tonight, but the price continued to rise and came close to the 61.8% fibo level ($47,745).

It should be noted that the daily trading volumes were at an average level, and if bulls manage to increase the volumes, they may be able to break the $43,800 resistance.

ADA/USD

The rate of Cardano (ADA) has risen by 6.55% over the last 24 hours.

Cardano (ADA) has fixed above the $2.40 level, which means that bulls are trying to seize the initiative in the mid-term scenario. However, one may think about the trend reversal when ADA fixes above the vital $3 mark.

BNB/USD

Binance Coin (BNB) has gained less than Cardano (ADA), with growth accounting for 5.77%.

Despite the ongoing rise, Binance Coin (BNB) has not entered the long zone yet.

At the moment, one needs to pay close attention to the $456 level, where buyers have the chance to seize the initiative. If they manage to do that, the rise may continue to $500.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bitcoin hovers below $50K after weekend wipeout – Crypto Roundup, Dec 6, 2021

Global market jitters spread to crypto at the weekend, with Bitcoin falling to $42K before bouncing to almost $50K.

Bitcoin (BTC/USD) Surges Back to Multi-Month Highs on Renewed ETF Chatter

Bitcoin futures ETF – when not if? Bitcoin all-time high likely to be tested soon.

Bitcoin Cash Price Prediction

Pair Holds Steady After BCH SV 51% Attack

What’s Next for BTC Price

Bitcoin traders are at odds about where BTC price may head after it failed to flip the $40,000 level to support.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator