Australian Dollar Pops as the RBA Leaves Taper Plan in Place. Now What?

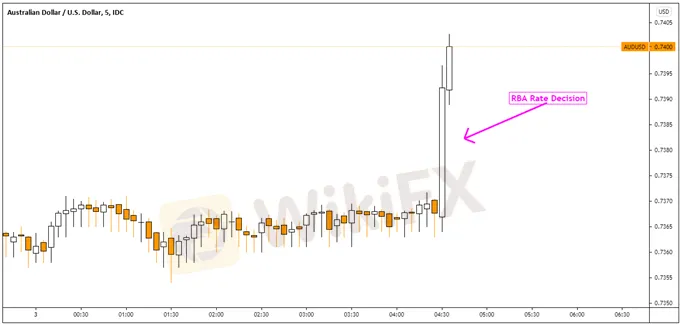

Abstract:AUSTRALIAN DOLLAR, AUD/USD, RBA, NFPS, TECHNICAL ANALYSIS – MARKET ALERT Australian Dollar gains on RBA as central bank leaves taper plan alone Fairly confident outlook in the medium-term overshadows near-term risks AUD/USD testing 20-day Simple Moving Average, watch for a breakout

The Australian Dollar rallied after the Reserve Bank of Australia updated its latest monetary policy announcement in August. As anticipated, the central bank left the benchmark cash rate target at 0.10 percent. What likely drove investors to buy Aussie Dollars was that the RBA left alone its plan to reduce the amount of weekly asset purchases to A$4 billion in September from the current pace of 5b.

Since July‘s interest rate decision, lockdowns across parts of Australia amid the emerging Delta Covid variant have been denting local growth prospects. This was pushing Australian government bond yields lower as traders priced in a more dovish central bank. There were also rising expectations that the central bank could reverse July’s decision to reduce weekly asset purchases later this year given these developments.

ADDITIONAL RBA HIGHLIGHTS (COMMENTARY REPORTED BY BLOOMBERG):Sees Australian economic outlook in the coming months as uncertain

Sees growth at a ‘little over’ 4% in 2022, then around 2.5% over 2023

Will consider economic, health situation towards the policy outlook

The economy is still expected to grow strongly again next year

All things considered, the central bank seemed fairly confident about the economic outlook in the long run. Even though there have been lockdowns, the RBA noted that past experience has shown that the ‘economy bounces back quickly’. GDP is expected to decline in the third quarter. Despite some downward revisions to the outlook, the RBA seems confident in proceeding as normal, offering the Aussie Dollar some relief.

The road ahead arguably remains uncertain. China, Australia‘s largest trading partner, placed millions under a strict lockdown amid rising Covid cases. If growth falters in the world’s second-largest economy, then that pain could be felt in Australia. AUD/USD might find some relief if a softer-than-expected US non-farm payrolls report further tempers Fed tapering bets. But, an outsized miss could induce risk aversion.

AUD/USD RBA REACTION 5-MINUTE CHART

From a technical standpoint, the broader focus for AUD/USD still seems to be pointed to the downside. A bearish crossover between the 50- and 200-day Simple Moving Averages (SMAs) is hinting towards a downward bias. Keep a close eye on the near-term 20-day SMA. A breakout above this line, with confirmation, may open the door to a push higher in the short run. Otherwise, extending under key support at 0.7290 exposes the 78.6% Fibonacci retracement at 0.7209.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

Easy Trading Online in Trader Fair Thailand Expo 2024

The Traders Fair Thailand 2024 was successfully held at Bangkok Shangri-La Hotel on February 3rd. As an exhibitor and sponsor, Easy Trading online attended the Expo with professional service team and extraodinary online trading experience on FX & CFDs.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator