eToro-Overview Guide of This Broker

Abstract:eToro was founded in 2007 as an online multi-asset investment platform that was easy for traders, with graphical representations of different financial instruments. In 2009, eToro launched an intuitive trading platform for novice and experienced traders. eToro added a variety of stocks to its commodities, forex, and other asset trading services in 2013 and continued to expand its portfolio of cryptocurrencies in addition to bitcoin in 2017. In 2008, eToro officially entered the U.S. market, offering cryptocurrency trading services to U.S. investors.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Registered Country/Region | United Kingdom |

| Found | 2007 |

| Regulation | Regulated by ASIC, CYSEC & FCA |

| Market Instrument | CFDs, cryptocurrencies, stocks, commodities, currencies and ETFs |

| Account Type | Retail & Professional |

| Demo Account | Yes ($100K virtual capital) |

| Maximum Leverage | 1:30 for Retail/1: unlimited for Professional |

| Spread (EUR/USD) | From 0.9 pips |

| Commission | N/A |

| Trading Platform | Mobile/Web |

| Minimum Deposit | $10 |

| Deposit & Withdrawal Method | credit/debit cards, PayPal, Neteller, Skrill, Rapid Transfers, iDEAL, Klarna / Sofort Banking, Bank Transfers, Online Banking, POLi, Przelewy 24, and Payoneer |

eToro was founded in 2007 as an online multi-asset investment platform that was easy for traders, with graphical representations of different financial instruments. In 2009, eToro launched an intuitive trading platform for novice and experienced traders. eToro added a variety of stocks to its commodities, forex, and other asset trading services in 2013 and continued to expand its portfolio of cryptocurrencies in addition to bitcoin in 2017. In 2008, eToro officially entered the U.S. market, offering cryptocurrency trading services to U.S. investors.

Here is the home page of this brokers official site:

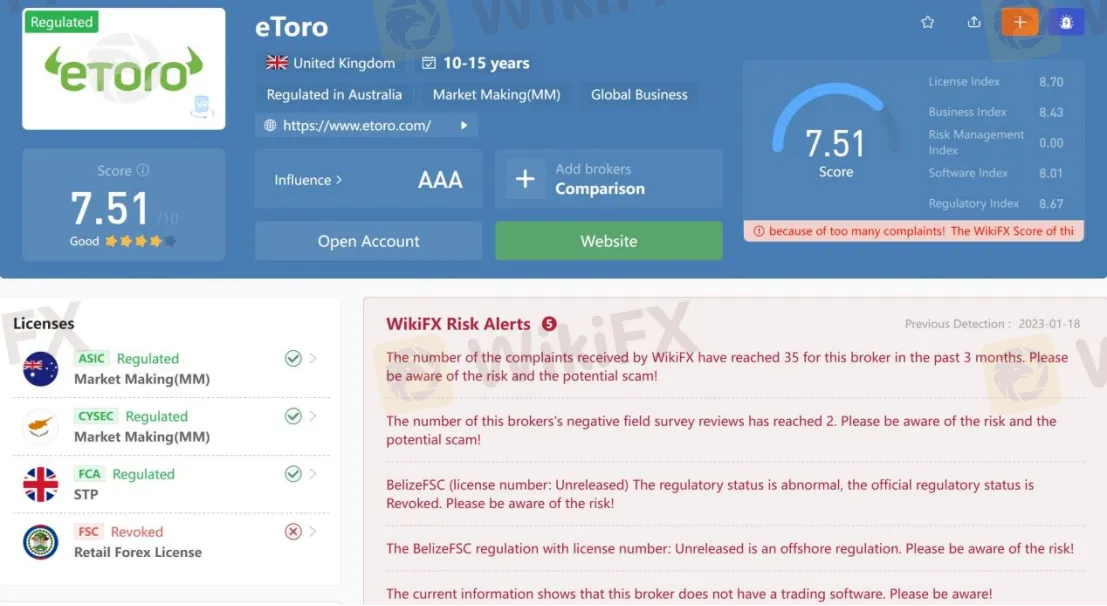

Currently, eToro subsidiaries are regulated by the following authorities:

eToro (Europe) Ltd., authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under license # 109/10;

eToro (UK) Ltd, authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263;

eToro AUS Capital Limited authorised by the Australian Securities and Investments Commission (ASIC) under Australian Financial Services License 491139.

eToro (Seychelles) Ltd. licenced by the Financial Services Authority Seychelles (“FSAS”) under the Securities Act 2007 License SD076.

Note: The screenshot date is January 18, 2023. WikiFX gives dynamic scores, which will update in real time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

Investors can trade 3,000+ financial assets in multiple categories through the eToro broker, including CFDs, cryptocurrencies, stocks, commodities, currencies and ETFs.

Account Types

Apart from demo accounts with $100K virtual capital, eToro has two types of live trading accounts for different types of investors, Retail and Professional accounts.

The minimum deposit to open a Retail account is $200.

Except for the following:

·

For clients in Israel is $10,000.

·

For clients in the US and Australia is $50.

·

For clients in Russia, China, Hong Kong, and Macau is $500.

·

For bank transfers, it is $500.

Leverage

Traders holding different account types can enjoy different maximum leverage ratios.

Retail Client accounts have maximum trading leverage of 1:30. Still, they can access specific protections such as compensation from the Investor Compensation Fund and assistance from the Financial Grievance Service. Additionally, they have access to negative balance protection and margin force closeout limits.

Professional clients are those investors who have successfully passed the Professional Client Condition Test, which allows them to use unlimited leverage.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

The minimum spreads start from 0.9 pips for EURUSD, 0.8 pips for GBP EUR, 1.2 pips for EUR GBP, 4.5 pips for Gold, 0.05 pips for Silver, 0.05 pips for Crude Oil, 0.01 pips for Natural Gas, 3.6 pips for the Australian 200 and 2 pips for the German 30.

Trading Platform

eToro's online trading platform and application offer a wide range of financial assets for trading and investment. Traders can gain access to more than 3,000 assets to trade through the eToro mobile or web platform.

Deposit & Withdrawal

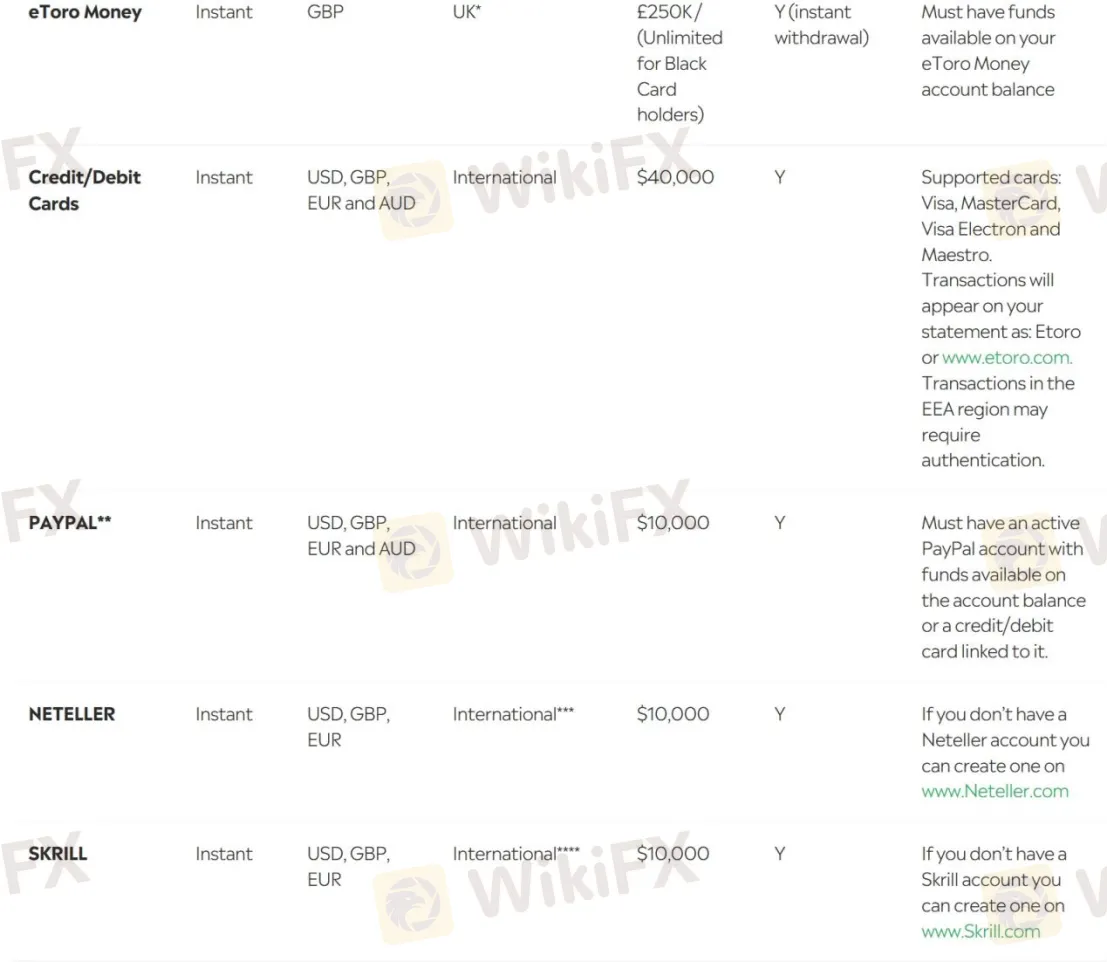

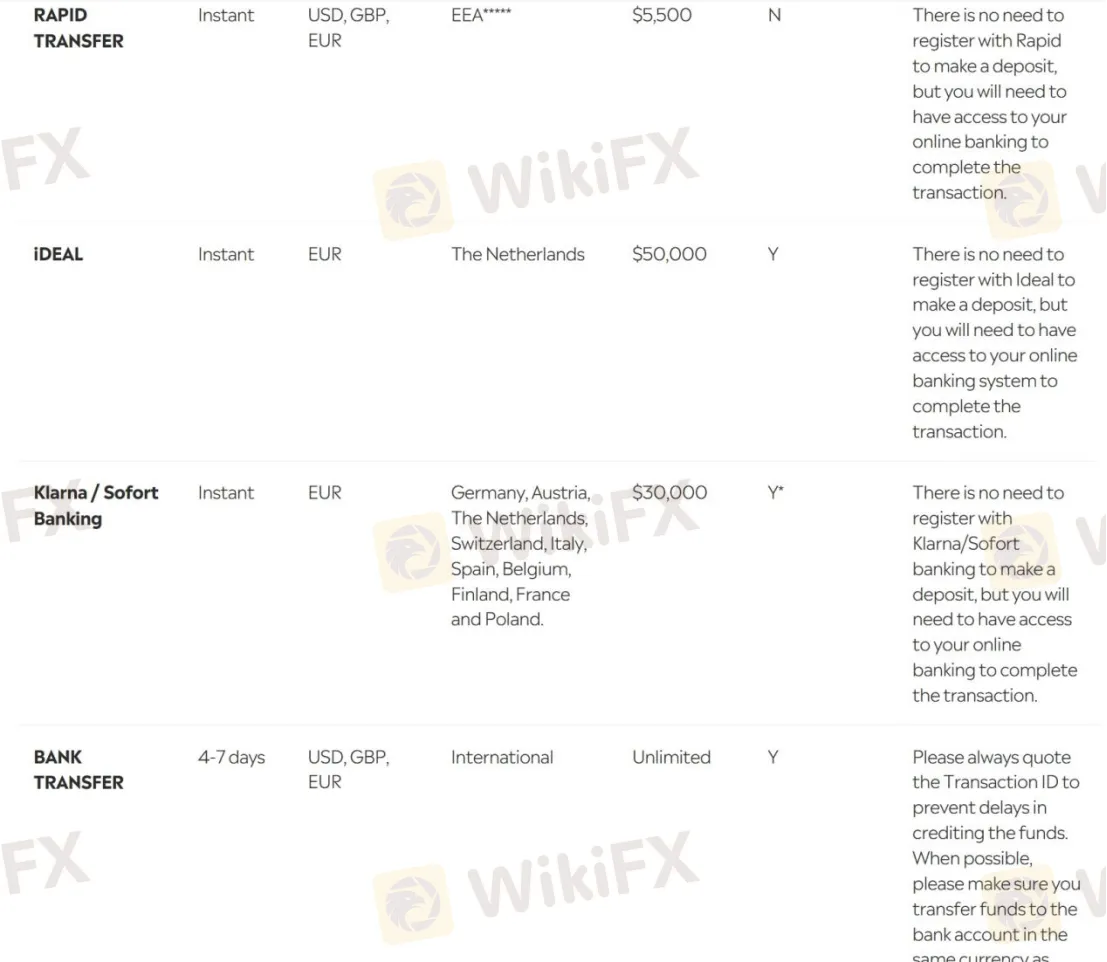

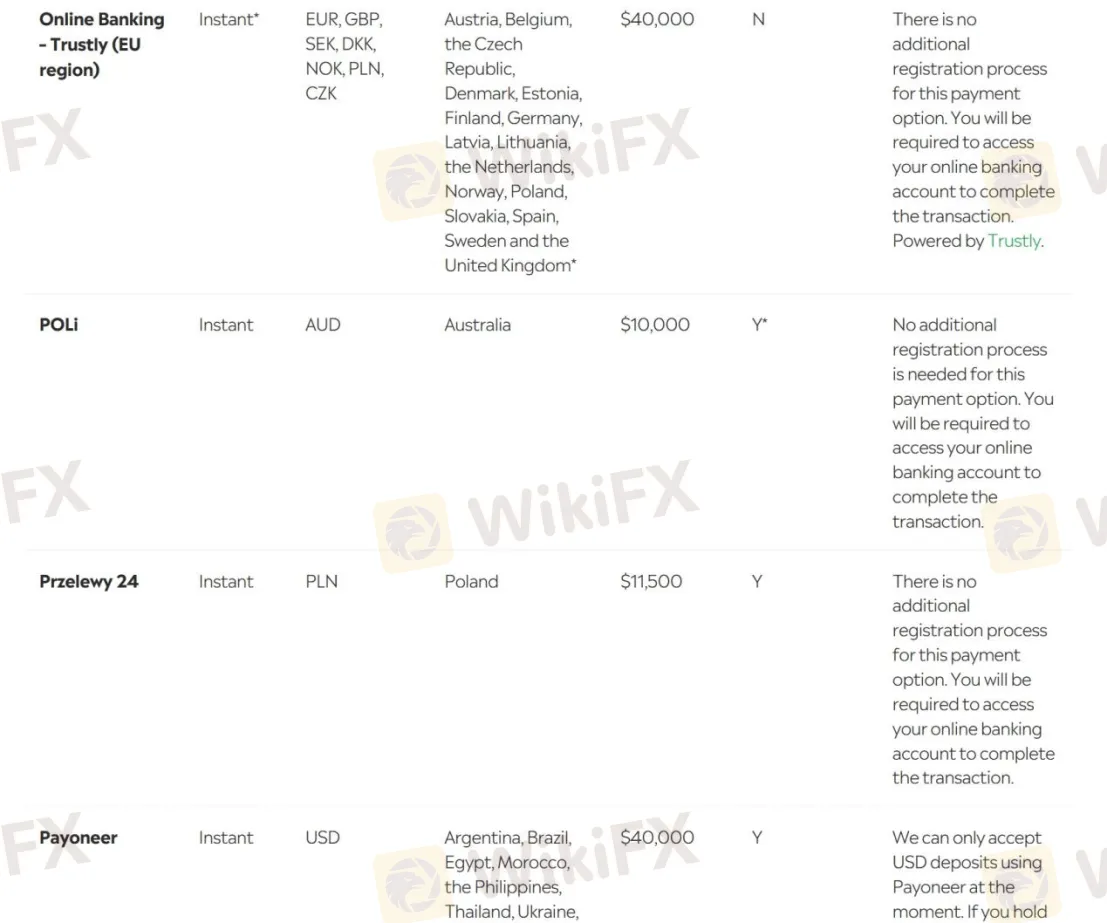

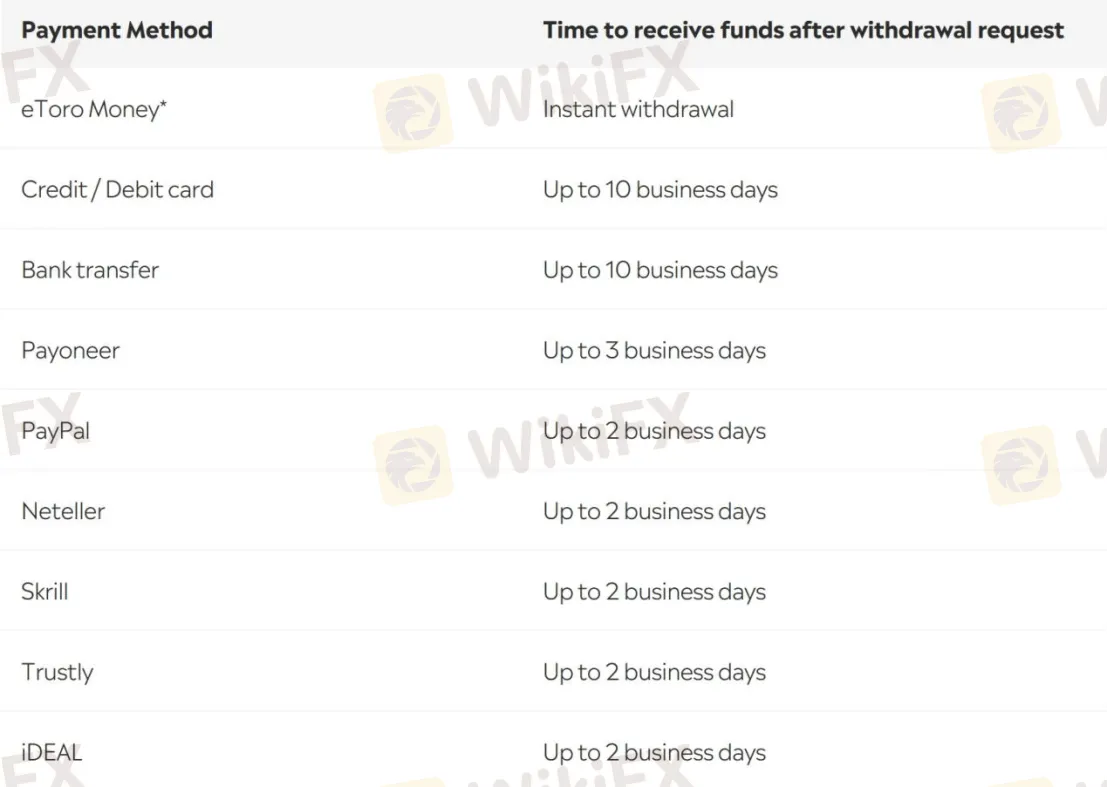

eToro supports deposits and withdrawals through credit/debit cards, PayPal, Neteller, Skrill, Rapid Transfers, iDEAL, Klarna / Sofort Banking, Bank Transfers, Online Banking, POLi, Przelewy 24, and Payoneer.

Depending on your region and countrys regulations, the minimum first-time deposit varies from $10 to $10,000. The minimum amount for withdrawal is $30.

More details can be found in the below screenshots.

There is no deposit fee charged, while withdrawal requests are subject to a withdrawal processing fee. $30+ withdrawal amount will be charged a withdrawal fee of $5.

The broker will send you an email confirming your withdrawal status within 2 business days of your request. However, from the time you request the withdrawal, it may take up to 10 business days, depending on the payment method used.

Funds deposited using Klarna / Sofort or Trustly become withdrawable within 7 business days of deposit. Funds deposited using POLi become withdrawable within 2 business days of deposit.

Customer Support

eToros customer support can be reached by Global: pr@etoro.com; UK – MRM: etoro@mrm-london.com, or +44 20 3326 9900. You can also follow this broker on social networks such as Twitter, Facebook, Instagram, YouTube and LinkedIn.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC, CYSEC & FCA | • FSC license is revoked |

| • Many years experience in the industry | • MT4 & MT5 unsupported |

| • Multiple trading assets and funding options | |

| • Demo accounts available |

Frequently Asked Questions (FAQs)

| Q 1: | Is eToro regulated? |

| A 1: | Yes. eToro is regulated by ASIC, CYSEC & FCA. |

| Q 2: | Does eToro offer demo accounts? |

| A 2: | Yes. eToro offers demo accounts with $100K virtual capital. |

| Q 3: | Does eToro offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, eToro offers mobile apps and web-based trading platforms. |

| Q 4: | What is the minimum deposit for eToro? |

| A 4: | The minimum initial deposit with eToro is $10. |

| Q 5: | Is eToro a good broker for beginners? |

| A 5: | Yes. eToro is a good choice for beginners, because it is regulated well and offers a wide variety of trading assets with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Launches CFD Trading in Japan

Interactive Brokers expands its offerings in Japan, adding leveraged CFDs for US stocks and ETFs, enhancing trading strategies for its clients.

Cyprus Regulator on a License Suspension Marathon

Recently, the Cyprus Securities and Exchange Commission (CySEC) issued statements regarding the suspension and revocation of licenses for three investment firms in accordance with The Investment Services and Activities and Regulated Markets Law.

MetroTrade Now NFA Member & CFTC Introducing Broker

MetroTrade LLC's recent registration with the CFTC as an introducing broker and its NFA membership signify a significant development, as the company prepares for a summer launch to offer traders access to the CME Group's U.S. futures exchanges.

FXM Scam: Trader Lured into Investment Scheme & Left Unable to Withdraw Funds

Amidst a distressing account involving Nguyen Truong and the FXM brokerage platform, his inability to withdraw $12,400 underscores the risks of online trading. Truong's encounter serves as a cautionary tale, emphasizing the need for diligence in broker selection.

WikiFX Broker

FOREX.com

Vantage

Eightcap

SECURETRADE

FXOpulence

SMART BALANCE

FOREX.com

Vantage

Eightcap

SECURETRADE

FXOpulence

SMART BALANCE

WikiFX Broker

FOREX.com

Vantage

Eightcap

SECURETRADE

FXOpulence

SMART BALANCE

FOREX.com

Vantage

Eightcap

SECURETRADE

FXOpulence

SMART BALANCE

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Webull Canada Unveils Desktop Trading Platform

Alert: Beware Unlicensed Trading Broker ProMarkets

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator