JPMorgan registers decline in Markets & Securities Services revenue in Q3 2021

Abstract:JPMorgan Chase & Co. yesterday posted its financial results for the third quarter of 2021, with Markets & Securities Services revenue marking a slight decrease from the year-ago quarter.

JPMorgan Chase & Co. yesterday posted its financial results for the third quarter of 2021, with Markets & Securities Services revenue marking a slight decrease from the year-ago quarter.

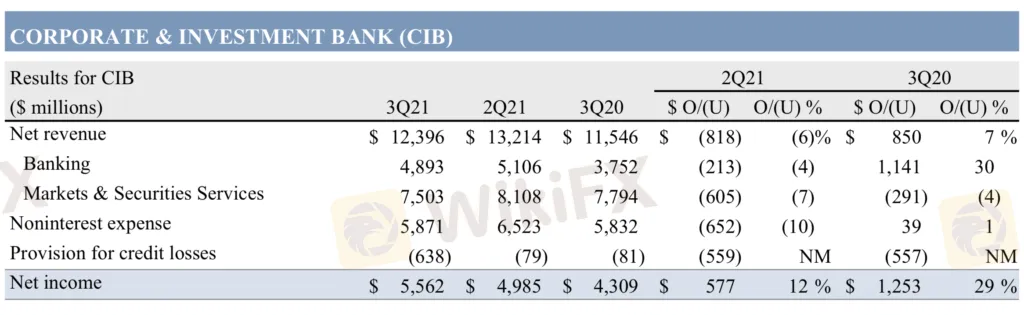

Markets & Securities Services revenue was $7.5 billion, down 4% from the equivalent period a year earlier. The result for the third quarter of 2021 was also lower than the $8.1 billion registered in the preceding quarter.

In the third quarter of 2021, Markets revenue was $6.3 billion, down 5% from the year-ago period. Fixed Income Markets revenue was $3.7 billion, down 20%, predominantly driven by lower revenue in Commodities, Rates and Spread products as compared with a favorable performance in the prior year. The current quarter also included an adjustment to liquidity assumptions in the derivatives portfolio.

Equity Markets revenue was $2.6 billion, up 30%, driven by strong performance across products.

Securities Services revenue was $1.1 billion, up 9%, largely driven by fee growth.

Across all segments, net income for the third quarter of 2021 was $11.7 billion, up $2.2 billion from a year earlier, largely driven by credit reserve releases of $2.1 billion compared to credit reserve releases of $569 million in the prior year. The current quarter included an income tax benefit of $566 million related to finalizing the Firms 2020 U.S. federal tax return.

Net revenue was $30.4 billion, up 2% from the year-ago period. Noninterest revenue was $17.3 billion, up 3%, predominantly driven by higher Investment Banking fees in CIB and management fees in AWM, predominantly offset by net investment securities losses in Corporate compared to net gains in the prior year and lower revenue in Home Lending.

Net interest income was $13.2 billion, up 1%, driven by balance sheet growth and higher rates, primarily offset by change in balance sheet mix and lower net interest income in CIB Markets.

Noninterest expense was $17.1 billion, up 1%, driven by continued investments in the business including marketing and technology, and higher volume- and revenue-related expense, predominantly offset by lower legal expense and structural expense. The prior year included an impairment on a legacy investment.

For more news please stay tuned on WikiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Next market crash: JPMorgan's top defensive sector, stock picks to buy - Business Insider

This underperforming sector of the stock market is reasonably priced and will bolster your portfolio's growth, JPMorgan says.

CECL regulation explained: How it will impact banks, lending - Business Insider

Starting January 2020, big banks will have to record all expected future losses on their loans once they're issued, thanks to a new accounting rule.

Best earnings season options trades from JPMorgan quant guru Kolanovic - Business Insider

JPMorgan's Marko Kolanovic moves markets with his research. These are his "favorite" trades to profit from earnings-season volatility.

JPMorgan third-quarter earnings preview in light of failed WeWork IPO - Business Insider

Here's what analysts say they'll be looking for when JPMorgan reports earnings next week. They aren't sounding serious alarms, but WeWork questions are likely.

WikiFX Broker

Latest News

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

End of USD Dominance Amid Escalating Geopolitical Risks

Caution in Online Trading: Intersphere Enterprises Alleged Scam

WikiFX Forex Rights Protection Day has received extensive attention!

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CLONE FIRM ALERT

Morgan Stanley Fined $90,000 for Supervisory Failures

Currency Calculator