Some Detailed Information about MEX Exchange

Abstract:Established in 2012 in Sydney, Australia, MEX Exchange offers Forex, metals, equities, and CFD products in online finance to individual investors, introducing brokers and institutions.MEX Exchange currently holds a full license from the Australian Securities and Investments Commission (Regulatory Number: 416279).

General Information & Regulation of MEX Exchange

Established in 2012 in Sydney, Australia, MEX Exchange offers Forex, metals, equities, and CFD products in online finance to individual investors, introducing brokers and institutions.MEX Exchange currently holds a full license from the Australian Securities and Investments Commission (Regulatory Number: 416279).

Market Instruments

MEX Exchange offers investors access to financial trading assets primarily in foreign exchange currency pairs, metals (including but not limited to gold, silver, platinum, copper, and aluminum), and CFDs.

Minimum Deposit of MEX Exchange

MEX Exchange offers two different types of trading accounts, the Classic account, and the ECN account. Both accounts requires no minimum deposit limitation, which sounds great for new traders to strat out.

Leverage of MEX Exchange

In terms of trading leverage, MEX Exchange permits the leverage up to 1:500 for forex products, 1:250 for precious metals, 1:100 for spot commodities. Obtained leverage also depending on the instrument you trade, as well as defined by the level of trader, thus professionals access higher levels once confirming its status.

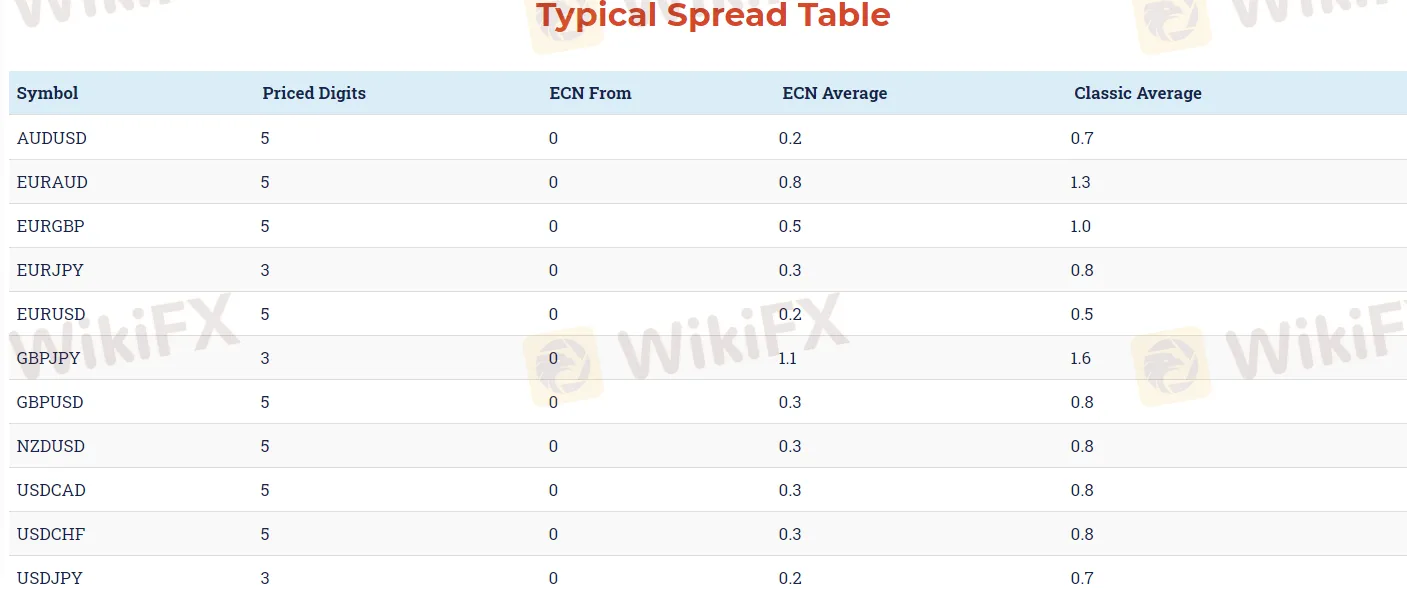

Spreads & Commissions

The average spreads offered on MEX Exchange Classic accounts are 0.5 pips for EURUSD, 1.0 pips for EURGBP, 0.8 pips for EURJPY, 0.8 pips for GBPUSD, and 1.5 pips for XAUUSD, with no trading fees. USD is 0.4 pips, and the account charges a commission of $7 per lot.

Trading Platform of MEX Exchange

MEX Exchange offers traders the MT4 trading platform, as well as the MT4 Web Edition, MT4 Mac Edition, MT4 Mobile Edition, MAM Multi-Terminal Software, and FIX API software. The MEX Exchange MT4 platform offers trading in foreign exchange (FX), metals, and CFDs using MEX's latest ECN technology and MT4 trading system with excellent reliability and strict five-digit two-way pricing execution.

Deposit & Withdrawal of MEX Exchange

MEX Exchange accepts traders via VISA, MasterCard credit cards (generally processed instantly), bank wire transfers (subject to funds processing within 24 hours), Skrill (processed within 1-4 hours), Neteller (processed within 1-4 hours). The currencies supported by credit cards and wire transfers for deposits are AUD, EUR, GBP, and USD. Skrill and Neteller do not support deposits in AUD. MEX Exchange does not charge any internal deposit or withdrawal fees.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator