Capital.com-Overview Guide of This Broker

Abstract:capital.com is a CFD (Contracts for Difference) broker registered in Cyprus and well regulated by a number of regulators. The broker offers access to various markets, including Forex, commodities, indices, shares, cryptocurrencies, and ESG on MT4 and other trading platforms. The platform offers a variety of trading tools and educational resources to help traders improve their skills and knowledge.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| capital.com Review Summary in 10 Points | |

| Founded | 2016 |

| Registered Country/Region | Cyprus |

| Regulation | ASIC, CYSEC, FCA, NBRB |

| Market Instruments | CFDs on Forex, Indices, Commodities, Shares, Cryptocurrencies and ESG |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | Mobile App, CFD Trading App, Desktop Trading, Capital.com API, MetaTrader 4, TradingView |

| Minimum deposit | N/A |

| Customer Support | 24/7 multilingual |

What is capital.com?

capital.com is a CFD (Contracts for Difference) broker registered in Cyprus and well regulated by a number of regulators. The broker offers access to various markets, including Forex, commodities, indices, shares, cryptocurrencies, and ESG on MT4 and other trading platforms. The platform offers a variety of trading tools and educational resources to help traders improve their skills and knowledge.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

capital.com offers a user-friendly and comprehensive trading experience with a wide range of markets and instruments, competitive spreads, and a variety of trading platforms. The platform also provides extensive educational resources and trading tools. Additionally, capital.com has no deposit or withdrawal fees, and there are multiple payment methods available. However, overnight funding and guaranteed stop premiums can add to the cost of trading, and some traders may prefer more trading platforms and account types.

| Pros | Cons |

| • Regulated by ASIC, CYSEC, FCA, NBRB | • Negative reviews and complaints |

| • Offers a wide range of trading instruments | • No MetaTrader 5 |

| • Demo accounts available | • Limited research tools |

| • User-friendly and intuitive trading platforms | • Overnight funding charges and guaranteed stop premiums |

| • Multiple account types and funding methods | • Limited info on accounts and deposits & withdrawals |

| • No deposit and withdrawal fees | |

| • Offers negative balance protection and guaranteed stop-loss | |

| • No funding fees, commission, or inactivity fees |

capital.com Alternative Brokers

Forex.com - a regulated and reputable broker with a comprehensive range of trading tools and educational resources;

IC Markets - offers low spreads and fast execution speeds with a variety of trading platforms;

TMGM - offers competitive spreads and fees with a user-friendly trading platform.

There are many alternative brokers to capital.com depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is capital.com Safe or Scam?

Capital.com is a legitimate and regulated online trading platform. It is authorized and regulated by the Australia Securities & Investment Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the National Bank of the Republic of Belarus (NBRB). It also follows strict regulatory requirements, including holding client funds in segregated accounts and providing negative balance protection. However, there are also some negative reviews from their clients complaining that they are unable to withdraw.

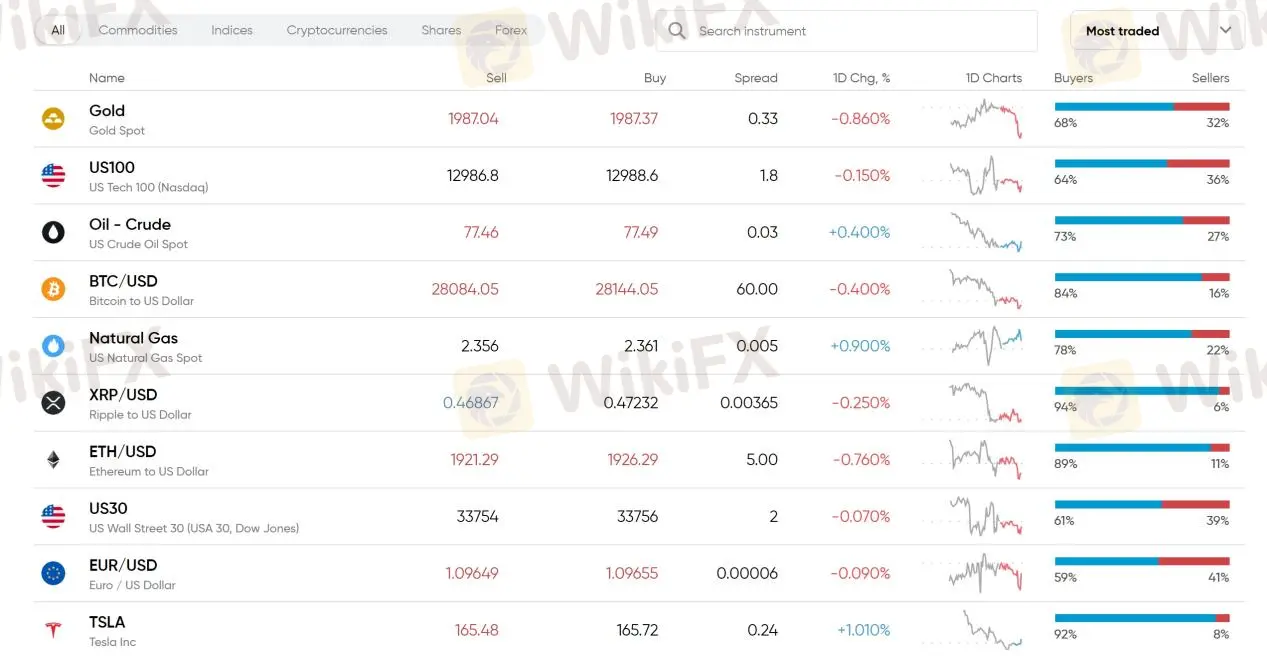

Market Instruments

Capital.com offers a wide range of market instruments for CFD trading, including Forex, Indices, Commodities, Shares, Cryptocurrencies and ESG. The Forex category includes major, minor and exotic currency pairs. The Indices category covers global indices such as the US 500, UK 100, and Germany 30. In the Commodities category, traders can trade on precious metals such as gold and silver, energy products such as oil and gas, and agricultural products such as wheat and corn. The Shares category offers CFD trading on popular global companies such as Apple, Amazon, and Google. Capital.com also offers CFD trading on a variety of cryptocurrencies such as Bitcoin, Ethereum, and Ripple, as well as ESG (Environmental, Social and Governance) trading, which focuses on socially responsible investments.

Accounts

Demo Account: Up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish.

Live Account: capital.com does not provide much real account information. Generally, Forex brokers offer several different levels of real accounts with different trading conditions (leverage, spreads, commissions, etc.) depending on the minimum deposit amount. Due to the law prohibiting interest in the Islamic region, some brokers also offer Islamic accounts without overnight interest charges.

Leverage

The maximum leverage offered by capital.com is only 1:30, which may seem too low to you. In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

Spreads & Commissions

Capital.com offers variable spreads on its various trading instruments, which means the spreads can widen or narrow based on market conditions. The spreads for each instrument are transparently displayed on the website and can be easily monitored in real-time using the platform's trading tools. As for commissions, capital.com does not charge any commissions for its CFD trading services. Instead, it makes money by incorporating a small markup on the spread, which is known as the “buy-sell spread.” This allows traders to have greater visibility and transparency into their trading costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| capital.com | 0.6 pips | No |

| Forex.com | 1.2 pips | No |

| IC Markets | 0.1 pips | $7 round turn |

| TMGM | 0.0 pips | $7 round turn |

Note: Spreads can vary depending on market conditions and volatility.

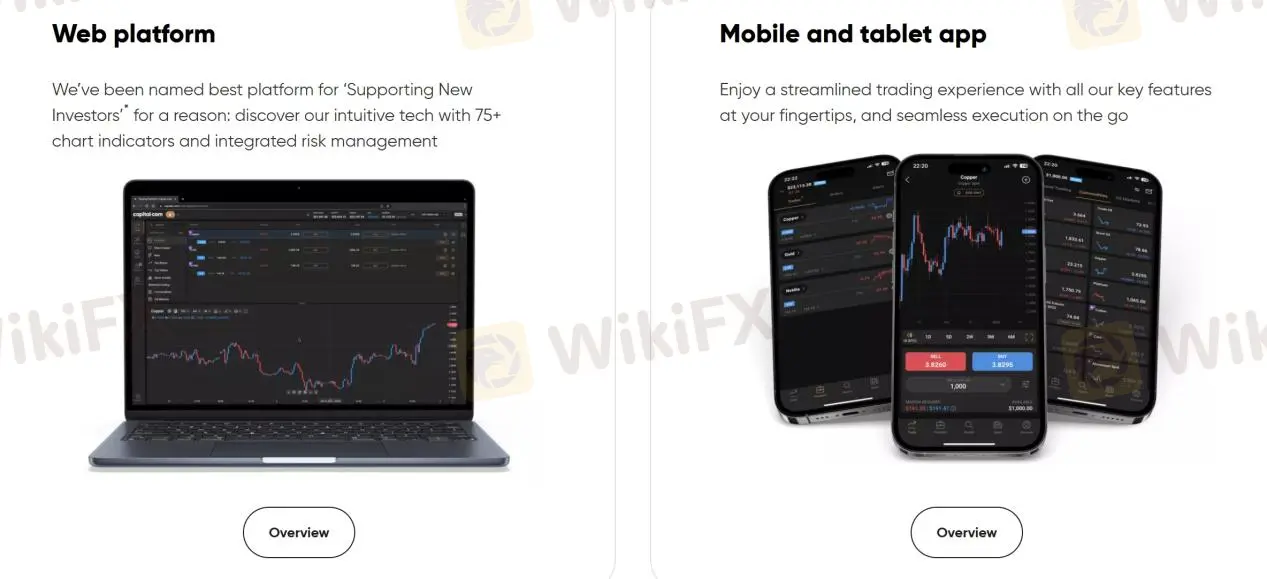

Trading Platforms

Capital.com offers a variety of trading platforms to cater to the needs of different traders. The platforms include mobile apps, CFD trading app, desktop trading, Capital.com API, MetaTrader 4, and TradingView. The mobile apps are available on both iOS and Android devices, providing access to real-time market data, charts, and trading opportunities. The CFD trading app offers an intuitive interface for fast and easy trading. The desktop trading platform provides advanced features for experienced traders. The Capital.com API enables third-party developers to access Capital.com's trading infrastructure, while MetaTrader 4 and TradingView are popular platforms that offer a range of technical analysis tools and customization options.

| Broker | Trading Platforms |

| capital.com | Mobile App, CFD Trading App, Desktop Trading, Capital.com API, MetaTrader 4, TradingView |

| Forex.com | MetaTrader 4, FOREX.com Web Trading Platform |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

| TMGM | MetaTrader 4, TMGM WebTrader |

Trading Tools

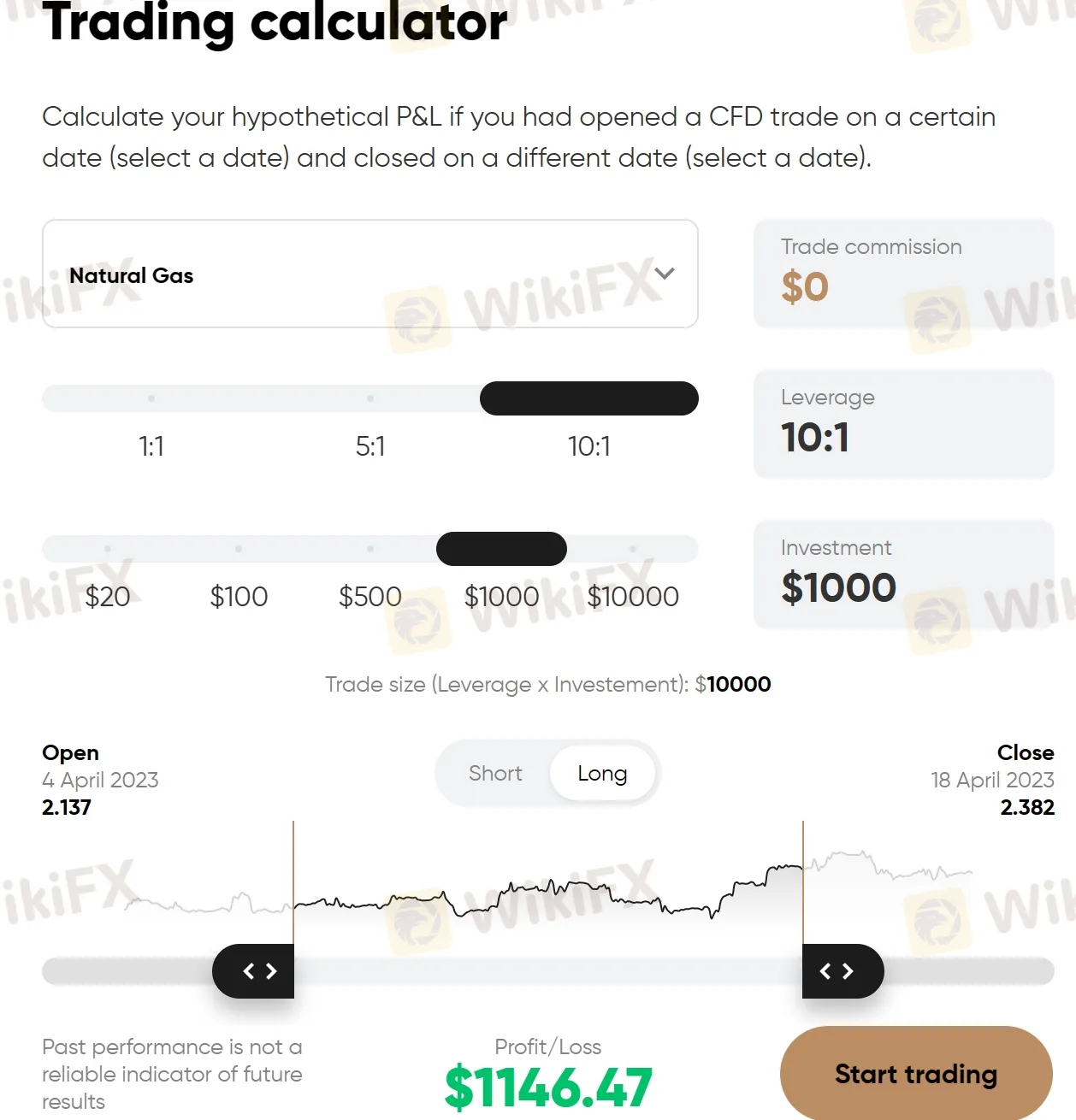

Capital.com offers a range of trading tools to help its clients make informed trading decisions. The trading calculator is one such tool that allows traders to calculate the potential profits and losses of a trade before placing it. Other tools include an economic calendar, market news, and an education section with a range of guides and tutorials for traders of all levels.

Deposits & Withdrawals

Capital.com offers a variety of payment methods for both deposits and withdrawals, including apple pay, VISA, MasterCard, wire transfer, PCI, worldpay, RBS, and trustly. One of the main advantages of Capital.com's deposit and withdrawal system is that there are no fees associated with either process. This means that traders can deposit and withdraw funds as frequently as needed without incurring any additional costs.

capital.com minimum deposit vs other brokers

| capital.com | Most other | |

| Minimum Deposit | N/A | $100 |

capital.com Money Withdrawal

To withdraw funds from your capital.com account, follow these steps:

Step 1: Log in to your account on capital.com

Step 2: Click on the “Withdraw” button, located in the “Funds” section

Step 3: Choose the payment method you prefer and enter the amount you want to withdraw

Step 4: Submit your withdrawal request

Please note that capital.com may require additional verification steps before processing your withdrawal request. The processing time for withdrawals can vary depending on the payment method you choose, but typically range from a few hours to a few business days.

Fees

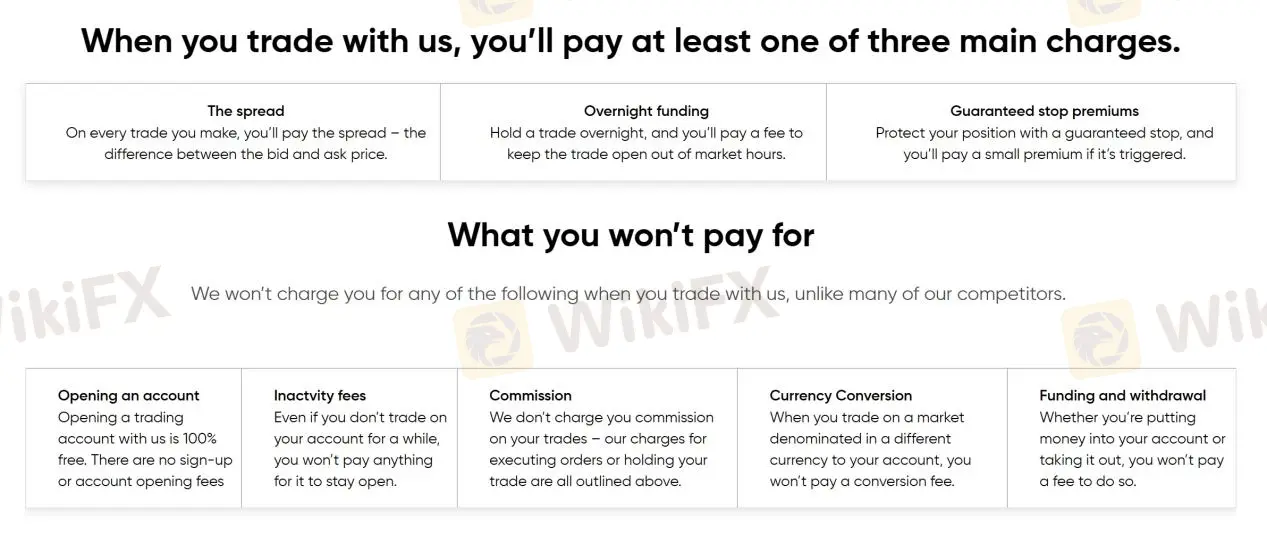

Capital.com's fee structure is designed to be transparent and competitive. The broker charges spreads on its trading instruments, which vary depending on market conditions and liquidity. It also charges Overnight Funding, which is a small fee for holding positions open overnight, and Guaranteed Stop Premiums, which is an optional feature that allows traders to set a limit on their potential losses. However, there are no funding fees for opening an account, inactivity fees, commission fees, currency conversion fees, or fees for deposits and withdrawals. This means that traders can focus on their trading strategies without worrying about unexpected fees eating into their profits.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| capital.com | Free | Free | None |

| Forex.com | Free | Free | $15/month after 12 months |

| IC Markets | Free | $7 per withdrawal | $20/month after 2 years |

| TMGM | Free | Free | $10/month after 6 months |

Customer Service

Languages: English, German, Italian, Portuguese, Arabic, Romanian, Vietnamese, Russian, Thai, Chinese, Spanish, Malay, French, Czech, Polish, Danish, etcetera.

Service Hour: 24/7

Live chat

Email: support@capital.com

Phone: +44 20 8089 7893

Social media: Facebook, Instagram, LinkedIn, YouTube, Twitter

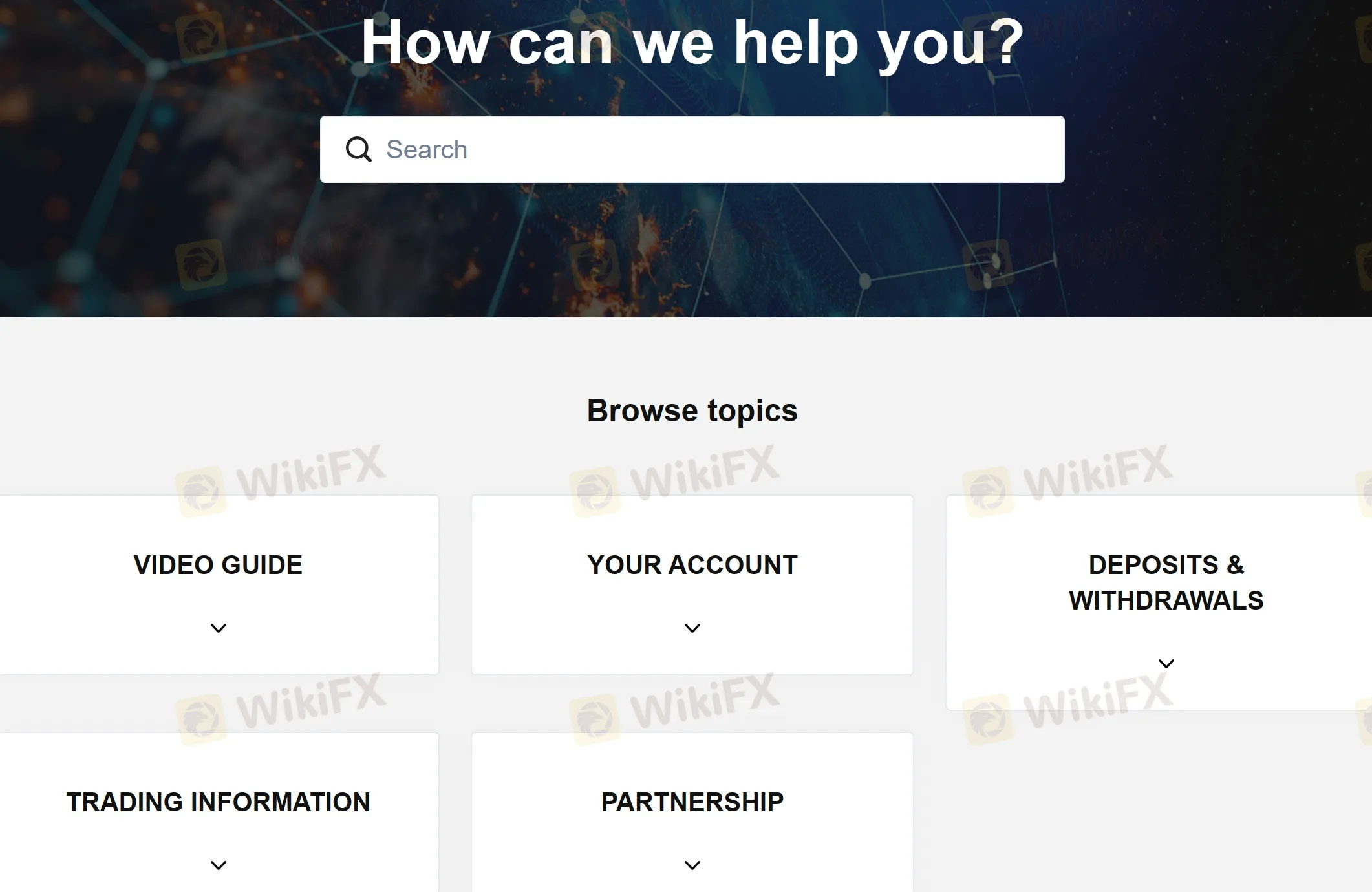

Help Center

Below are the details about the customer service.

Overall, capital.com's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 live chat | • No dedicated account manager for all users |

| • Multilingual customer support | • No community forums for users to engage with each other |

| • Helpful and knowledgeable representatives | |

| • Comprehensive online help center with frequently asked questions |

Note: These pros and cons are subjective and may vary depending on the individual's experience with capital.com's customer service.

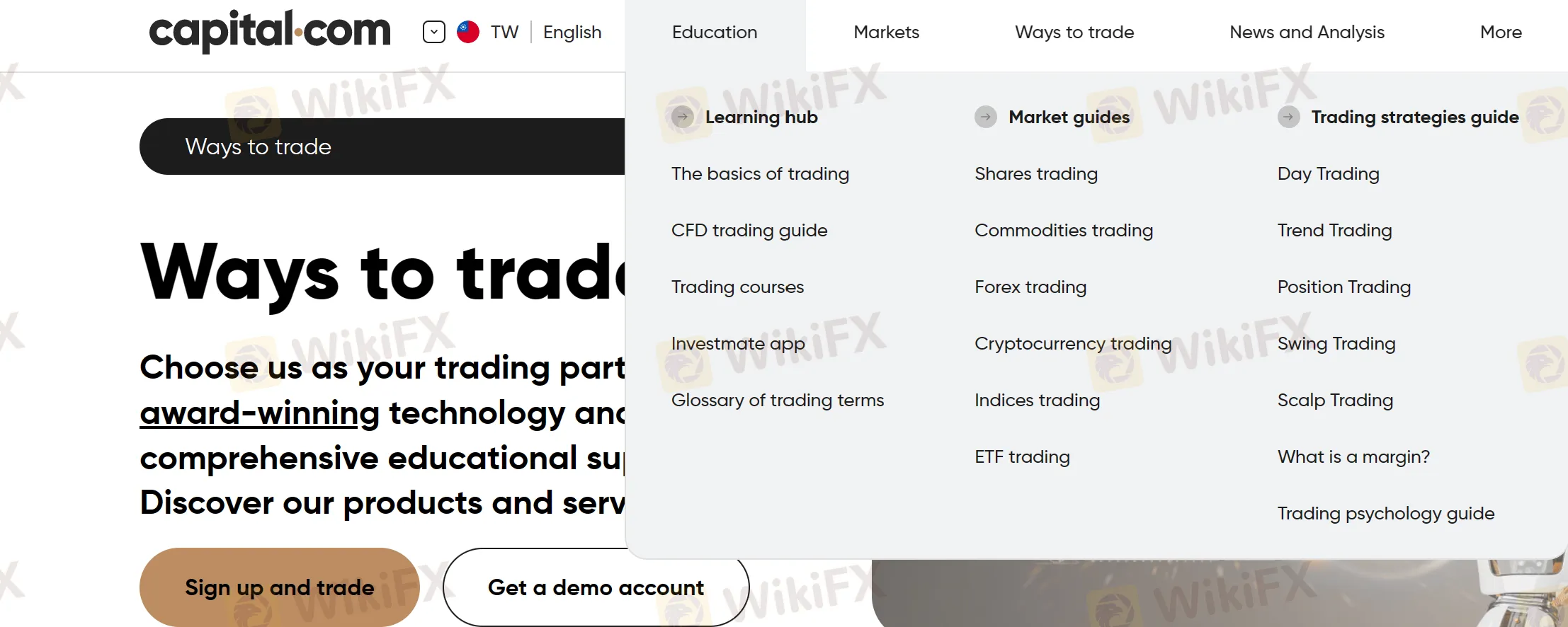

Education

Capital.com provides a comprehensive educational section on their website, called the “Learning Hub”, where traders can find various materials to improve their trading skills and knowledge. They offer a wide range of educational resources, including articles, videos, webinars, and courses on various trading topics, such as technical analysis, risk management, and market psychology. Additionally, they have a section dedicated to market guides, where traders can learn more about specific markets, and a section for trading strategies guides, where traders can find useful tips and strategies to enhance their trading performance. Overall, Capital.com's educational resources are quite extensive and can be helpful for traders of all levels.

User Exposure on WikiFX

On our website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, capital.com is a reputable online broker with a wide range of market instruments, low fees, and a variety of user-friendly trading platforms. The company offers free deposits and withdrawals with multiple payment methods, as well as educational resources to help traders of all levels. However, there are some negative reviews and complaints from their users. Overall, capital.com is a good choice for traders seeking a comprehensive and user-friendly trading experience.

Frequently Asked Questions (FAQs)

| Q 1: | Is capital.com regulated? |

| A 1: | Yes. It is regulated by SIC, CYSEC, FCA, and NBRB. |

| Q 2: | Does capital.com offer demo accounts? |

| A 2: | Yes. Demo accounts has up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish. |

| Q 3: | Does capital.com offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports Mobile App, CFD Trading App, Desktop Trading, Capital.com API, MetaTrader 4, and TradingView. |

| Q 4: | Is capital.com a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | Is Thaurus Okay to Invest in?

This article is about a broker called Thaurus. Is this platform trustworthy? WikiFX made a comprehensive review of this broker, hoping you have a clue to make a wise decision.

PSEi Rallies Amid Rate Cut Hopes; Peso Dips Slightly

PSEi climbs back over 6,500, boosted by rate cut expectations and the IMF's optimistic growth forecast, while the peso sees a minor decline.

Binance Elevates Dubai's Crypto Status with Full VASP License

Binance acquires a full VASP license in Dubai, enhancing its commitment to regulated growth and innovation in the crypto market.

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

With the changing expectations of the Federal Reserve’s monetary policy and the escalation of geopolitical tensions, global gold prices have continued to rise recently, reaching all-time highs. The gold price has risen by over 9%, demonstrating the most robust monthly growth since July 2020.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator