Gold Prices at 3-Month High amid USD Weakness after Big NFP Miss

Abstract:Gold Prices at 3-Month High amid USD Weakness after Big NFP Miss

GOLD PRICE OUTLOOK:

Gold prices extended higher after rising sharply following a weak nonfarm payrolls report

The DXY US Dollar declined to a 10-week low, buoying precious metal prices

The worlds largest gold ETF saw net inflows for the first time in months as bullion prices rebound

Gold prices registered a two-day gain of 2.5% and soared to above $ 1,830 mark on Monday as fears surrounding tapering Fed stimulus cooled. A much lower-than-expected US nonfarm payrolls print sent the DXY US Dollar index to a ten-week low, buoying precious metal prices.

Friday‘s report showed that nonfarm jobs increased 266k in April, a far cry from market expectations of a 978k rise. March’s figures was revised down to 770k from 916k, underscoring a shortage in labor supply. This suggests that the job market may take longer to fully recover from the pandemic, and thus more time is needed for the Fed to consider tapering stimulus measures.

Meanwhile, a weaker jobs report also strengthened the prospect of fiscal spending. President Joe Biden said on Friday that his massive infrastructure and family support bills are “needed now more than ever” as job growth slowed in April. Earlier this year, Mr. Biden proposed a US$ 2.3 trillion infrastructure bill to revamp the nations transportation infrastructure and create millions of jobs.

The 10-year US treasury yield stabilized at around 1.59% after registering a “V-shaped” rebound on Friday. Gold prices are sensitive to yield changes. Therefore, reflation hopes may drive yields higher if Biden‘s fiscal stimulus plan is approved, potentially derailing gold’s upward trajectory.

Looking ahead, traders will eye Wednesdays US inflation data, which is forecasted to hit 3.6% YoY. Rising price levels may boost the appeal of gold, which is widely perceived as an inflation hedge. A slew of speeches by Fed officials this week will also be closely watched for clues about future monetary policy guidance.

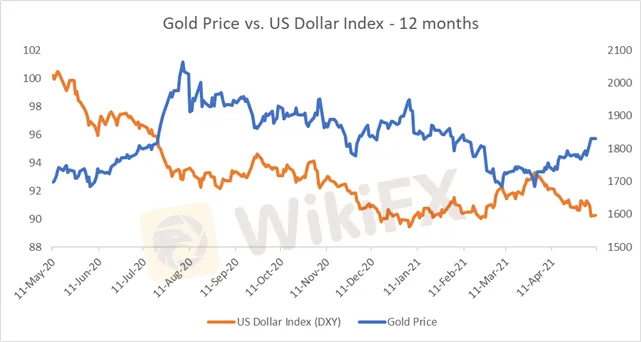

Gold Prices vs. DXY US Dollar Index

The worlds largest gold ETF - SPDR Gold Trust (GLD) – saw a small net inflow last week. This suggests that more buyers are returning to the bullion market after months of selling. The number of GLD shares outstanding increasing 2.9 million last week, compared to a net outflow of 1.6 million the prior week. Gold prices and the number of outstanding GLD shares have exhibited a strong positive correlation in the past (chart below). Therefore, a reversal of net redemption may be viewed as a bullish signal.

Gold Price vs. GLD ETF Shares Outstanding – 12 Months

Technically, gold prices extended higher within an “Ascending Channel” after completing a “Double Bottom” chart pattern. This suggests that gold prices may have found a mid-term bottom at around $ 1,677 and since resumed its upward trajectory. An immediate support level can be found at $ 1,810 (the 50% Fibonacci retracement), whereas an immediate resistance level can be found at $ 1,851 (the 61.8% Fibonacci retracement).

The MACD indicator is trending higher above the neutral midpoint, underscoring upward momentum.

Gold Price – Daily Chart

Gold

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Market Technically Analysis

The trend of gold on the daily chart is in line with technical requirements.

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

WikiFX Broker

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator