JPY Q2 2021 Fundamental Forecast

Abstract:JPY Q2 2021 Fundamental Forecast

JAPANESE YEN FUNDAMENTAL OUTLOOK: IS IT REALLY ALL GLOOM AND DOOM?

JAPANESE YEN FIRST QUARTER RECAP – DOMINANT DOWNTREND ACCELERATED

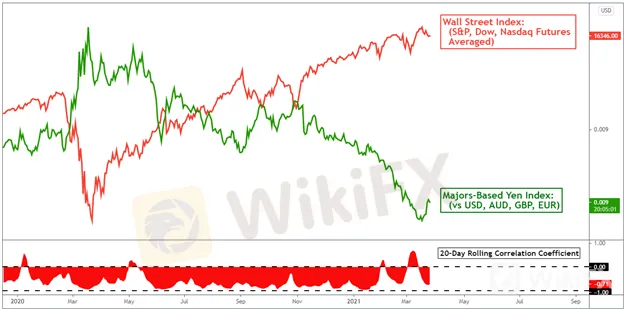

As anticipated, the Japanese Yen started off the new year on a sour note. Taking a look at a majors-based index on the chart below, JPY weakened as much as 6 percent before cautiously stabilizing towards the tail end of March. The anti-risk currency remained fairly depressed despite some emergence of global stock market volatility, especially from the technology sector. This could spell some trouble for the Yen as traders further settle into 2021.

MAJORS-BASED JAPANESE YEN INDEX VERSUS WALL STREET INDEX

*Correlation does not imply causation,Source: TradingView

THE YENS RELATIVELY DISMAL YIELD AND WHY IT MATTERS

A growing theme from the first quarter has been rising global growth and inflation expectations. Fairly swift vaccination rollouts in the United States, as well as President Joe Bidens US$1.9 trillion Covid relief package, have been driving up longer-term Treasury yields. The markets are slowly pricing in that the Federal Reserve could begin hiking rates sooner than expected. Fed Funds Futures indicate that there is about a 60% chance of a hike by the end of 2022.

Meanwhile, the Bank of Japan seems more likely to keep its loose monetary policy taps open for longer. Benchmark lending rates in Japan have been negative for some time due to a persistent struggle of trying to bring up stubbornly low inflation. The central bank did announce in March that it would implement a yield range target of about 25 basis points on either side of the 10-year yield mark of 0.0%. As such, JPY will likely be vulnerable to rising external bond yields, remaining a key funding currency for the carry trade.

SECOND QUARTER RISKS – TREASURY YIELDS, VACCINE HICCUPS, ROTATION TRADE, WEAK CORE CPI

While central banks such as the RBA and ECB have taken a more prominent stance against rising longer-term bond yields, the Fed appears to be relatively more sanguine. Chair Jerome Powell expressed little concern about them in March, perhaps leaving the door open for yields to continue climbing alongside growth expectations. That may leave the Japanese Yen vulnerable as traders chase returns outside of the island-nation economy. However, that doesnt mean that it is all clear for the Yen to resume its downward trajectory.

For one thing, the relatively slow rollout of Covid vaccines in Europe is working to cool GDP estimates. Hiccups can emerge, such as with what happened when Hong Kong suspended Pfizer-BioNTech vaccinations amid packaging defects. There is also the outcome of where core inflation, particularly out of the US, disappoints relative to headline figures. The former matter more to the Fed, especially as it views near-term inflationary pressures as transitory.

Still, President Biden is anticipated to deliver more fiscal support, via infrastructure spending. This could further boost economic growth, opening the door for Treasury yields to resume last years bottom. Consequentially, this may add life to the rotation trade out of growth and into value stocks. Further market volatility may thus offset some weakness in the anti-risk Japanese Yen depending on price action in global government bond yields.

JAPANESE YEN VERSUS 10-YEAR GOVERNMENT BOND YIELD SPREADS

Source: TradingView

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator