Moving Average Trading Strategies

Abstract:Moving Average Trading Strategies

One of the most common ways to trade the Forex market, or any financial market for that matter, is to use a moving average trading strategy. There is an untold amount of trading strategies available using moving averages, and quite frankly it is a topic that can be endless. However, in this article I will look at some of the most common ways to use moving averages as a trading strategy, and both the advantages and disadvantages of doing so.

Moving average crossover system

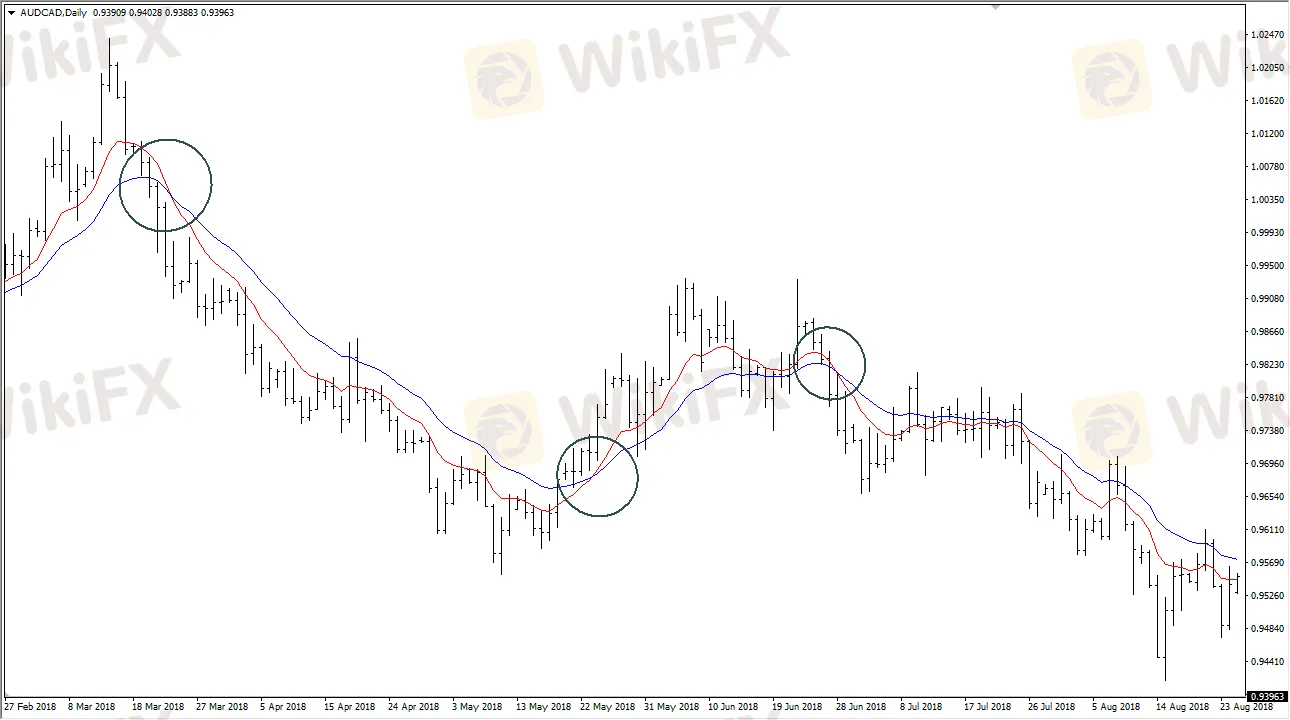

The moving average crossover system is by far the most common way that you will see moving average is used. It‘s a simple blend of at least two moving averages at different intervals. There is the faster moving average, which is used to determine the short-term trend, and a slower moving average to determine the longer-term trend. The idea is that when the short-term interval moving average crosses above the slower longer-term interval moving average, momentum is building to the upside and buyers will jump in and continue to push higher. Of course, the exact opposite is true as well. If the short-term interval moving average crosses below the longer-term moving average, it’s a signal to start selling.

As you can see on the chart above, the moving average is crisscrossing three different times. Traders will simply buy and sell every time they get a crossover. Because of this, the trader is always in the market. As a side note, I would point out that you need both moving averages either turning up or down to give a better signal, as this is a trend following system, meaning that you get chopped up in a sideways market as the moving averages can cross back and forth randomly.

Dynamic support or resistance

Moving averages can also be used to enhance systems to promote better trading. For example, the 200 day moving average is often used as a trend finding tool, and also recognized as significant support or resistance, especially on the daily chart. This is because it represents the 200 working days over the course of a year. If the 200 moving average is turned up, you are looking to buy the asset, and of course the opposite is true. There are also moving average is that people will use quite significantly, including the 50 and the 100 moving average.

As you can see on the chart above, there has been a reaction to the 200 moving average on the daily chart more than once. However, I would point out that the moving average by itself is typically not a reason to get involved. Most of the time you are looking for a price action along with that moving average to back up your trading decision.

The benefits of using a moving average trading strategy

Some of the most common trading strategies are profitable because so many other people use them. After all, if it‘s a simple strategy that pays profits over time, it’s attractive to most people. Beyond that, most moving average trading systems are extraordinarily simple, which is very attractive as they allow even newer traders to be involved. Beyond that, moving average systems are very attractive for algorithmic traders, which will automatically buy or sell at basic averages. This is because of her time its been shown to be a profitable strategy.

Moving averages and the appropriate strategy can keep you in sync with the overall trend of the markets. This is of course crucial to being a profitable trader over the longer-term. Moving average strategies tend to be somewhat mechanical, so it makes trading much simpler for those who tend to suffer from “paralysis by analysis.”

Some of the cons of using a moving average trading strategy

As with all things, there are both pros and cons. Moving average strategies tend to get chopped up and sideways markets as I had mentioned previously, and that is by far one of its greatest weaknesses. Because of this, quite often people will add other indicators such as an oscillator to determine whether or not the crossover is viable. After that, people tend to add far too much to moving average strategies as they don‘t necessarily have a high profitable rate, but the gains far surpass the losses. That’s one of the biggest issues with trading these strategies: the trader needs to be able to trade the system without getting shaken out after a couple of losses. They simply must trust the longer-term viability of the system, and that is typically difficult for most traders. It takes a lot of psychological wherewithal to hang onto these systems over the longer-term.

One of the other major cons of these systems is also they are typically discovered early in your trading career. Those new traders tend to jump from one system to the other, so they wont stay in the same system long enough to realize the gains. This will typically sour them to moving average strategies for the longer-term.

My take on moving average trading strategies

I believe that moving average trading strategies do work and they are very good over the longer-term. However, whether the trader can hang onto those trades or not is a completely different story. You must look within yourself to see whether you can handle a lower percentage win rate. Most traders can‘t, and that’s why these systems get a bit of a bad rap. If you have a lot of patience, the profitability is there and has been for decades. This is why these systems have been a staple for traders over time. The question is whether or not you can handle it.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator