Ant Will Remain an Important Firm in Hong Kong, HKMA Says

Abstract:Ant Group Co. will continue to play an important role on Hong Kong‘s financial scene even as mainland regulators deepen their scrutiny of the financial technology giant’s business, according to a city official.

Ant Group Co. will continue to play an important role on Hong Kong‘s financial scene even as mainland regulators deepen their scrutiny of the financial technology giant’s business, according to a city official.

Nelson Chow, chief financial technology officer at Hong Kong Monetary Authority, said the city has no reason to question the presence of Ant, which has a license to run a virtual bank in the city as well as a so-called stored value facility, or SVF, license.

“This is one player, but many players are in town as well, so they are competing against each other to offer better services,” Chow said in an interview with Bloomberg Television on Thursday.

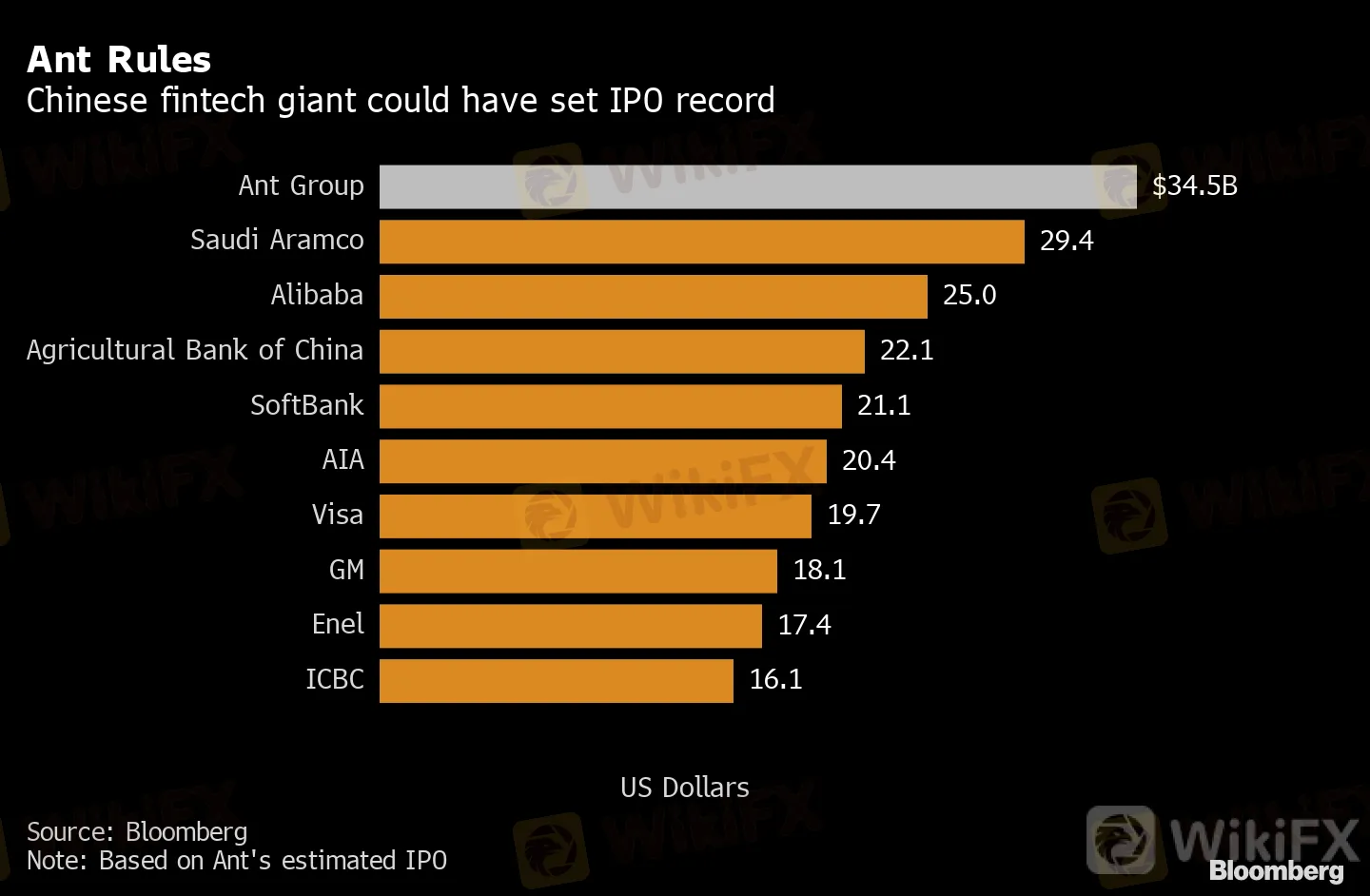

Ant was supposed to list in the city and in Shanghai on Thursday, in a $35 billion initial public offering that was abruptly called off by Chinese regulators on Tuesday. The move sent shock-waves through the financial hub, where as many as a fifth of the population, by one estimate, had signed up to buy Ant shares.

Ant Rules

Chinese fintech giant could have set IPO record

Source: Bloomberg

Note: Based on Ant's estimated IPO

The pulled deal forced the HKMA to reassure markets that theres ample liquidity in the system. “We have the confidence and ability to maintain the currency and financial stability,” the de facto central bank said in a statement.

{18}

Chow said the event won‘t damp the city’s fintech push or appetite among investors. “The tone is very upbeat,” he said. “Investors see Asia and particularly Hong Kong as one of the major places where well see a lot of fintech development.”

{18}

The city this year saw the launch of several virtual banks, including one operated by Ant. The progression of the lenders so far has been “good,” Chow said. They have “very good business models” and can help steer more funding to small and medium sized enterprises through the use of alternative data, he said.

{21}

As for granting more licenses, the HKMA will need “some time to observe the existing players,” he said.

{21}

{777}

Chow said that the HKMA would welcome any decision by China to also roll out its new digital currency in the city and “stand ready to cooperate.”

{777}

— With assistance by Adrian Wong

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator