Reshaping Pips Reshoring of Global Supply Chains, HSBC Says

Abstract:LISTEN TO ARTICLE 2:05 SHARE THIS ARTICLE ShareTweetPostEmailSupply Lines is a daily newsletter th

Supply Lines is a daily newsletter that tracks Covid-19s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.

Globalization wobbled in the pandemic, even failed on some counts as the coronavirus spread around the world, but the changes companies are planning to strengthen their sprawling supply chains dont suggest a big retrenchment from their overall strategy of international commerce.

Thats one way to read the results of an HSBC Holdings Plc survey of 2,604 companies in 14 nations and territories. The questions reached companies during some of the darkest days of lockdowns and soaring death tolls, from April 28 to May 12.

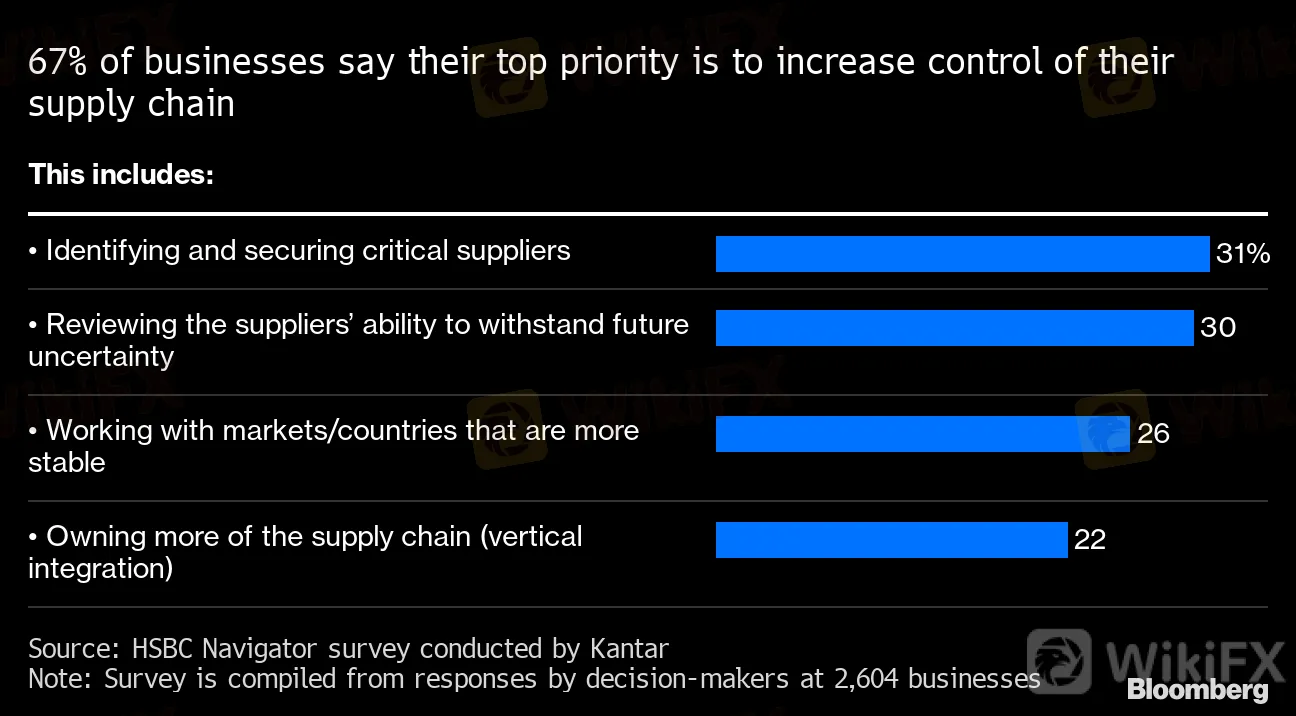

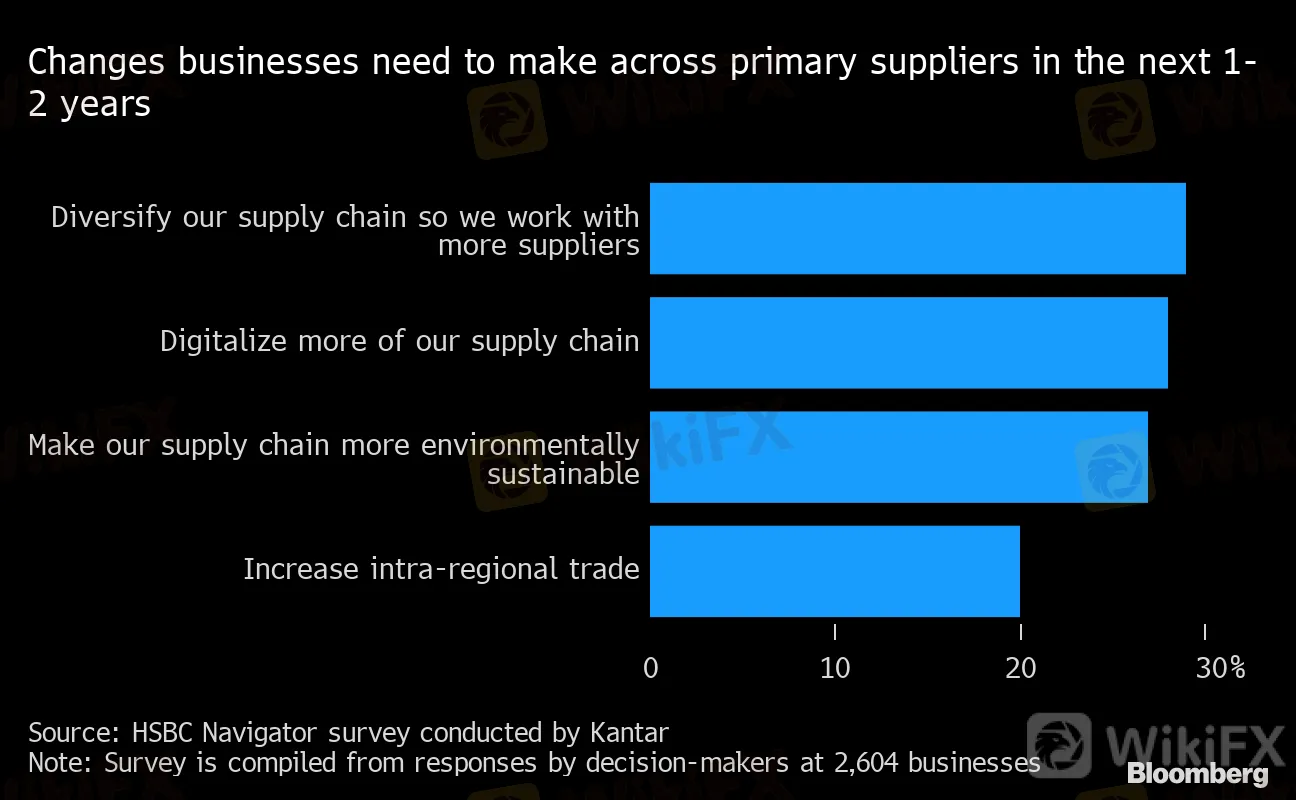

Two-thirds of respondents said their biggest priority was increasing control of their supply chain, the survey showed. But only 17% said shrinking their geographic footprint was the way to do it, and just as many are looking to expand their supplier base for more diversity regionally. Digitization, automation, better data and timelier technology were ways cited to prevent the supply failures in the future.

67% of businesses say their top priority is to increase control of their supply chain

Source: HSBC Navigator survey conducted by Kantar

Note: Survey is compiled from responses by decision-makers at 2,604 businesses

“What we‘re seeing in reality is actually there isn’t that much reshoring going on -- there is reshaping and restructuring,” said Natalie Blyth, HSBC‘s global head of trade finance. “You can see some of the old national champion approach coming back in, but it’s not viable globally to produce everything that our nation needs onshore.”

In the middle of the crisis, governments that raised export controls and other trade barriers on medical equipment quickly found that to be a losing strategy. Countries will probably move to stockpile medical equipment and raw materials, like the ingredients needed for 3D printing of protective gloves.

Changes businesses need to make across primary suppliers in the next 1-2 years

Source: HSBC Navigator survey conducted by Kantar

Note: Survey is compiled from responses by decision-makers at 2,604 businesses

For all its disruptions, the successes of the past six months have been a prelude to a more formidable challenge in the months ahead, Blyth said. The pandemic‘s supply shock, the knee-jerk protectionism and the collapse in demand that followed -- they were all just the warm-up for the big test of globalization’s resilience: delivering the vaccine.

“What we have seen through Covid is extraordinary collaboration between competitors, between supply chains -- people really caring about the whole end-to-end of the supply chain,” she said. “And that is what youre going to see being absolutely necessary from a vaccine perspective.”

(Adds charts. An earlier version of this story corrected the number of companies surveyed in second paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator