Budget Depicts Havoc Virus Wreaked on South Africas Economy

Abstract:South African Finance Minister Tito Mboweni delivered a grim assessment of the nations finances in a special adjustment budget that forecast a deep recession and plunging tax revenue.

South African Finance Minister Tito Mboweni delivered a grim assessment of the nations finances in a special adjustment budget that forecast a deep recession and plunging tax revenue.

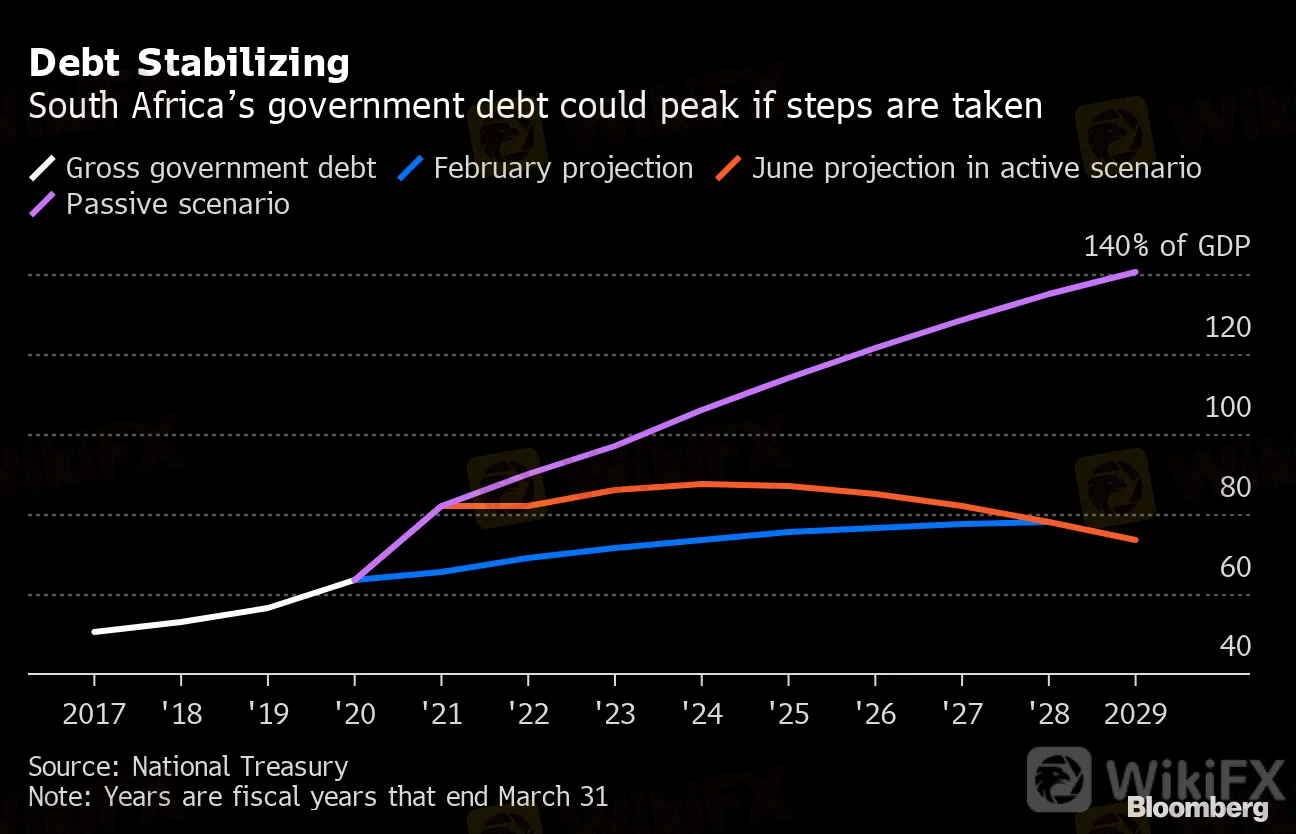

Gross domestic product is forecast to shrink 7.2% this year, the most in almost nine decades, and the consolidated budget deficit is expected to surge to 15.7%. While gross debt-to-GDP is to peak at 87.4% in four years, investors were cheered by a pledge to cut spending and bring borrowing under control.

“We have accumulated far too much debt; this downturn will add more,” Mboweni said Wednesday in a speech to lawmakers in Cape Town. “Our Herculean task is to stabilize debt.”

Yields on benchmark 10-year government bonds fell as much as 16 basis points to a two-week low. The rand weakened as Mboweni spoke, before erasing most of the decline.

Debt Stabilizing

South Africas government debt could peak if steps are taken

Source: National Treasury

Note: Years are fiscal years that end March 31

South Africa was already mired in recession and contending with power shortages when the coronavirus pandemic struck. Turnaround efforts were upended when the government imposed a stringent lockdown in late March to try slow the diseases spread. While some restrictions have since been eased, many businesses have gone bust and widespread job losses are set to worsen a 30.1% unemployment rate.

“The debt level for our sized economy are now at an unsustainable level,” said Isaac Matshego, an economist at Nedbank Group Ltd. “Weve been there for a couple of years, but now we have really entered red territory. Once we have passed this shock of Covid-19 pandemic, government will really have to show even greater commitment to revising economic growth and reducing its very high level of debt.”

| Read more: |

|---|

|

The government cut its revenue projection for the current fiscal year to 1.12 trillion rand ($64.6 billion), from 1.43 trillion rand it estimated in February. An additional 40 billion rand in tax will be raised over the next four years, while spending will be cut by 230 billion rand over the next two years to contain debt. Details will be announced in the 2021 budget speech.

The government intends borrowing $7 billion from international financial institutions, including $4.2 billion from the International Monetary Fund. The lender and the Treasury are in protracted negotiations and “its critical that nothing is done to undermine the national sovereignty” in these talks, Mboweni told reporters after the budget speech.

Some members of the ruling party and labor groups initially opposed plans to approach multi-lateral lenders for help, saying the conditions attached to that could threaten the country‘s sovereignty. ANC leadership supports these requests for support and IMF staff will make a submission about South Africa’s funding early in July, Mboweni said.

The government has already secured a $1 billion loan from the New Development Bank and Mboweni said the World Bank support is likely to follow approval of the IMF funding.

Ballooning Deficit

South Africas budget gap will be more than 15% of GDP this fiscal year

Source: National Treasury

Note: Chart shows data for fiscal year that ends March 31; the deficit for 2019-20 is the estimate that was given in February

Peter Attard Montalto, head of capital markets research at advisory service Intellidex, doesn‘t see the Treasury’s goal of stabilizing debt by the 2024 fiscal year as credible.

“You cant just decide to do these things, you have to take the decisions to achieve that, and this will not be possible,” he said.

The supplementary budget redirected money to programs aimed at containing the fallout from the pandemic, with the health department given an extra 21.5 billion rand to build field hospitals and hire more staff, and 12.6 billion rand to other entities involved in tackling the disease. It also provides 40.9 billion rand to support vulnerable households for six months, 20 billion rand to shore up municipal finances and 12.5 billion rand to education.

The Congress of South African Trade Unions, the countrys largest labor group and a member of the ruling coalition, said it was “extremely disheartened and disillusioned” by the budget, which was unfit for a country with mass unemployment.

“We are now in danger of entering an economic depression and the scariest thing is that government does not have a plan,” it said in a statement. “This budget only served to remind us that as workers we are on our own and the policy makers have no idea what they are doing.”

— With assistance by Gordon Bell, Paul Vecchiatto, and Monique Vanek

(Updates market reaction in fourth paragraph, adds analyst comment after chart)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator