Further Economic Shock Looms Large amid Grim Global Outlook Improved situations of the coronavirus

Abstract:Improved situations of the coronavirus outbreak have seen China’s imports and exports slowly picking up as the country resumes production and business. Yet as the virus quickly evolve into a global pandemic, posting significant threats on the global economy, investors need to beware of the risks of a one-two punch.

Improved situations of the coronavirus outbreak have seen Chinas imports and exports slowly picking up as the country resumes production and business. Yet as the virus quickly evolve into a global pandemic, posting significant threats on the global economy, investors need to beware of the risks of a one-two punch.

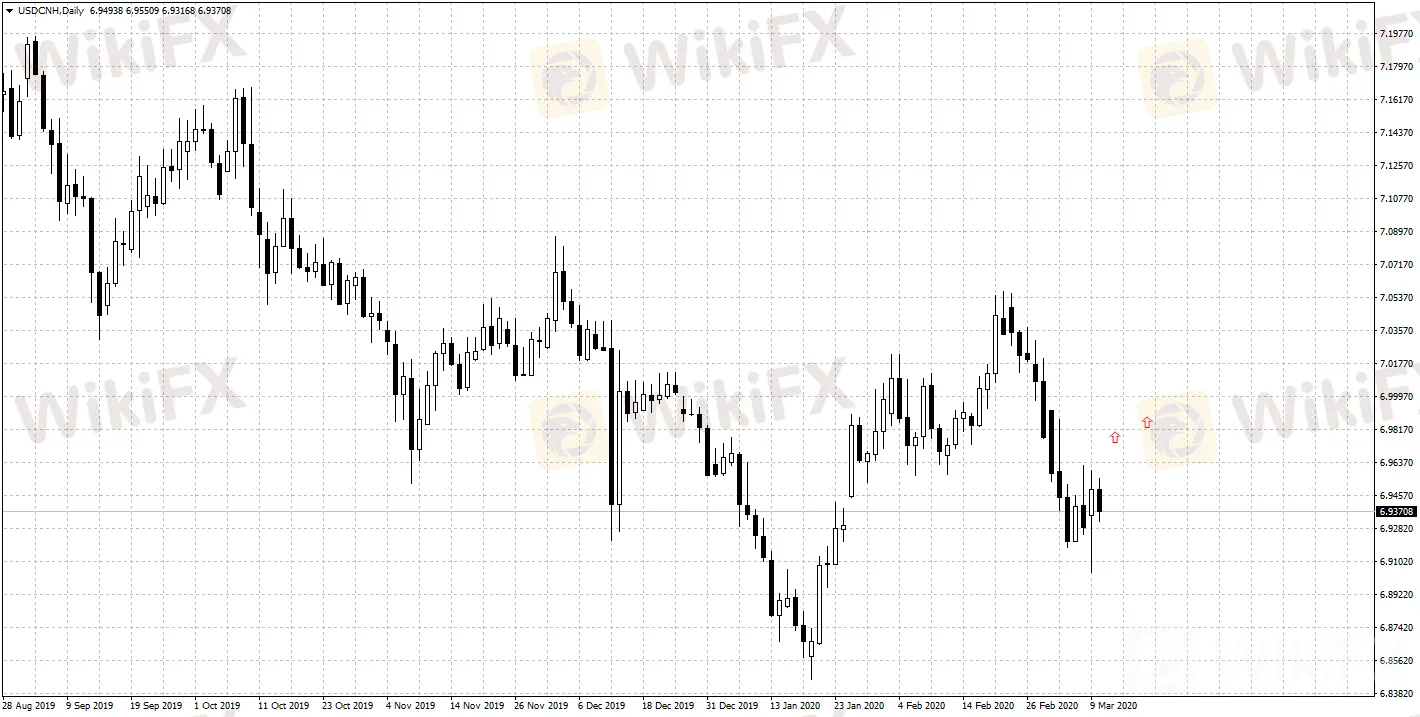

China‘s import and export growth rates have both declined year-on-year during January to February, with exports falling beyond estimation to the lowest since last February. Statistics released by China General Administration of Customs suggest that exports in dollar terms fell by 17.2% year-on-year during January and February, while imports dropped 4%, higher than the estimated median of a 15% decline. January-to-February trade deficit reached US$7.09 billion, reversing Reuters’ previous estimation of a US$2.46 billion surplus.

The evolving pandemic has led to great fluctuations in the price of major assets. Yielding rate of 10-year US Treasury Bond plunged below 1% for the first time in history; later the Federal Reserve announced the first emergency rate cut after the financial crisis, lowering rate by half a percentage point to cushion the rising economic threats brought by the coronavirus outbreak. Meanwhile, the Reserve Bank of Australia had also slashed rate by 25bp to a record-low of 0.50%

Report from Goldman Sachs points out that G10 members and emerging market economies will likely follow suit and cut rates. The Fed‘s 50bp emergency rate cut reflects a gloomy estimation on the impact of the coronavirus outbreak, and further evolution of the pandemic will further impose uncertainties on both the global supply chain and economic recovery of many countries. It’s estimated that POBC will have sufficient policy room to cut interest rate in March.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Election Countdown: Indian Market Will Emerge As a Winner

With less than a week to go, the political drama - US presidential election - is approaching the climax after witnessing campaign ads blanketing the world, campaign rallies reaching fever pitch, and debates turning increasingly fierce.

Three Challenges Ahead of Investors with Markets Awaiting Next Trigger

Most commodity prices have greeted a growth amid economic recovery and stimulus measures, but the next trigger is still pending.

Fragmented U.K. Induces Long-run GBP Pessimism

The U.K. is currently encountering several political and economic troubles besides the pandemic. In terms of politics, Brexit and Scottish independence are waiting for its solution; while in terms of economics, the largest recession in 300 years is raging on it.

Collapsed U.S. GDP Was Followed by a Slump in Gold Prices, Stock Indexes & Oil Prices

On July 30 (local time), the U.S. Commerce Department reported that U.S. GDP shrank by 32.9% in the second quarter, according to the advance estimates.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator