The gold market approached 20-year highs in 2019 relative to other precious metals - Business Insider

Abstract:Gold broke through the $1,400/troy oz. barrier in June, a level which had not been breached since the gold market correction in 2013.

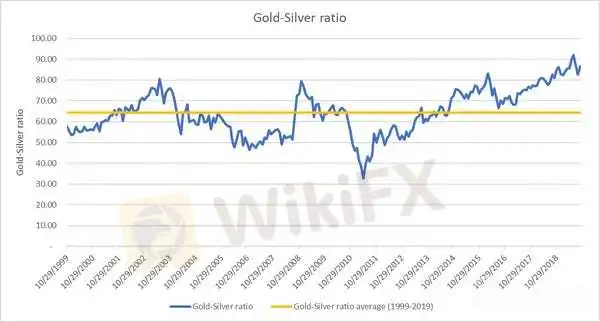

By Gregor Spilker for CME GroupAfter a few years away from the spotlight, the gold market has returned. Its performance year-to-date is up nearly 20% as investors flocked to safe haven assets in the light of trade wars and geopolitical uncertainty.With the Federal Reserve turning dovish and yields falling across the board, the opportunity cost of investing and holding gold was also reduced. The metal broke through the $1,400/troy oz. barrier in June, a level which had not been breached since the gold market correction in 2013.The performance of gold in 2019 looks even more impressive relative to other precious metals such as silver and platinum. Only one metal managed to outshine gold: palladium has advanced nearly 40% over the course of the year.The gold/silver barometerThe gold-silver ratio shows how many ounces of silver it takes to purchase one ounce of gold. It is a widely followed barometer of the relative price of gold and silver. Looking back over the past 20 years, the average gold-silver ratio was approximately 64x (one unit of gold would buy 64 units of silver). At the end of September 2019, the ratio stood at 87x, just shy of an all-time high of 92x recorded in June 2019. Currently, the ratio is about 33% above its long-term average and within the 95th percentile — meaning that the ratio was at this level only 5% or less of the time in this period.

CME Group, Bloomberg

Investors who believe that the market will move back toward its long-term average are implicitly backing silver to outperform gold in the future. Historically, a high gold/silver ratio was associated with a subsequent outperformance of silver versus gold. When the ratio was in its lowest quintile (meaning silver was the most expensive relative to gold), subsequent 12-month returns for a long silver/short gold trade were -14%. Conversely, the same trade would have returned 7% when the ratio was in its highest quintile (as is the case now).

Source: CME Group, Bloomberg, based on 228 monthly readings from Oct 1999 to Sep 2019)

Gold's precious metal cousinsIf silver is gold's little brother, palladium and platinum more resemble distant cousins. Prior to 2010, platinum traded at a healthy premium to gold. The situation is opposite now, with gold quoting higher than platinum. The difference between the two is at historically unprecedented levels at a premium of more than $600/troy oz. for gold over platinum.Demand from the automotive sector for platinum is subdued; the metal is mostly used in catalytic converters for vehicles with diesel engines and diesel demand is suffering as the industry is moving toward gasoline engines and, to a much smaller extent, electric and hybrid vehicles. Despite weaker industrial demand, the cheapness of platinum relative to gold may generate more interest — either from financial investors or from the jewelry sector.

CME Group, Bloomberg

Palladium managed to outshine gold this year, increasing near 40% and doubling since 2018's July lows. For the first time ever, the metal settled above $1,600/troy oz. in September 2019. The metal is much more dependent on automotive demand than platinum.According to Metal Focus, catalytic converters account for 40% of platinum demand, but 80% of palladium demand. Despite a slowdown in global vehicle sales, tightening emission standards in China and a move away from diesel engines elsewhere means that demand for palladium remains robust. Supply is relatively concentrated in Russia and South Africa, and lead time for any greenfield mining projects is long.

CME Group, Bloomberg

For anyone following the precious metals markets, 2019 has certainly been an exciting year, with gold breaking through long-defended resistance levels. The relative value between gold on one side and platinum or silver on the other side are at historically significant levels, indicating possible trading opportunities in the precious metals complex. Read more about the stories and trends that impact markets today. This post was created by CME Group with Insider Studios.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex | Gold

Gold trading inside the previous day’s range - investors wait for US PMI

GemForex - Gold

Gold on the front foot this week- consolidates ahead of ECB meeting, US inflation data

GemForex汇评 - Gold

Trade Gold with GemForex

Gold vs Forex Trading: Which Should you Trade?

Gold has been a classic investment option for centuries and is commonly used as a hedge against inflation and a reliable wealth storage medium. Gold offers a good investment opportunity that is often less focused on short-term profits, making it one of the top long-term investment options. On the other hand, forex trading is the speculation on currency prices for potential profits. A forex trader can profit from up and down price movements in both short and long term.

WikiFX Broker

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator