How To Trade Chart Patterns

Abstract:How To Trade Chart Patterns

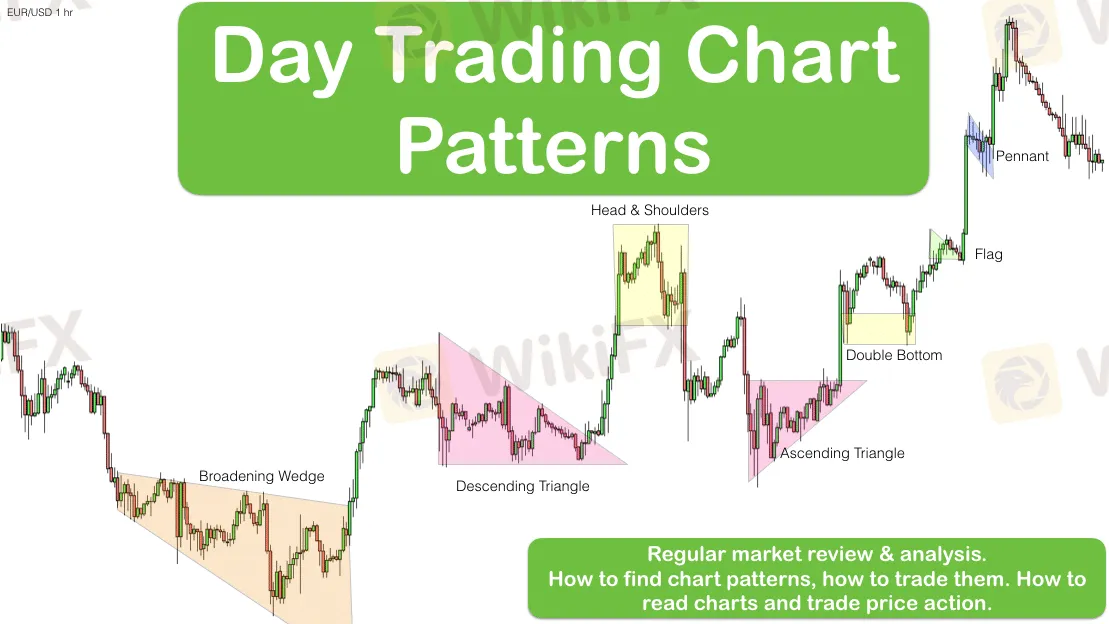

Chart patterns are distinctive price formations on price action charts, which are used in technical analysis to understand price information and forecast trends. Some chart patterns will occur more often than others, and by studying the historical precedents, and learning to recognize their shapes, we can trade them for profit. In technical analysis, it is assumed that history repeats itself, prices move in trends and the market factors in all information.

History will continue to repeat because human/market psychology will remain the same throughout, and by analyzing past price action, we can determine how likely these patterns are to lead to profitable trades. This way we can set realistic expectations for our trading activities and is the main reason why the signals given by these chart patterns can accurately predict future price movements. The chart patterns are a great tool to use to time the market and get confirmation on our trade ideas.

Two Types of Chart PatternsIn the study of technical analysis, we can distinguish between two types of chart patterns:

Reversal Patterns

Continuation Patterns

Depending on where these patterns develop relative to the trend, some patterns can be both reversal and continuation patterns. For example, a symmetrical triangle in the middle of the trend can act as a continuation pattern if the resistance line sloping downwards is broken. At the same time, the symmetrical triangle at the end of the trend can act as a reversal pattern if the support line sloping upwards is broken. Here is a quick review of the most popular chart patterns and give you a brief introduction to each.

Head and Shoulder Reversal PatternThe Head and Shoulder is a bearish reversal pattern that signals the possibility of the prevailing trend may end, and a new trend in the opposite direction might start. The standard Head and Shoulder pattern consists of four major components: the left shoulder, the head, the right shoulder and the neckline. Below is a real trading example from the BTCUSD pair.

Usually, the symmetrical triangle acts as a continuation pattern that will allow you to enter into a trending market if youve missed the starting point of a new trend. However, there are also other instances when the support line sloping upwards is broken. This signals the possibility of a trend reversal. The symmetrical triangle is characterized by a ranging market that produces a series of lower highs that can be connected using a resistance line sloping downwards and a series of higher lows that can be connected using a support line sloping upwards. Here is a real trading example of the pattern in play.

The double top pattern is another reversal trading pattern that signals the end of a bullish trend and the start of a new bearish trend. The standard double top pattern consists of three major elements. First, for the double top, we need a prevailing uptrend followed by two consecutive highs and a neckline, which is the support level where the first pullback that emerges from the first peak stops. Below is an example of how this could look in your trading environment, including where I would enter the trade and set my take profit.

The bullish flag pattern is formed by two distinctive elements. The first element of the flag pattern is a pre-existing trend. In the case of the bullish flag, were talking about an uptrend. The second element is the flag attached to the pole which looks like a horizontal pause in the trend where the market moves in a very narrow trading range between a support and resistance level. Below is an example of what a Bullish flag pattern looks like in trading.

The inverse of the Bullish flag is the Bearish flag, and while everything is the same in trading, all is just inverted.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator