BOJ to Stand Pat, Extend Covid Program in Coming Months: Survey

Abstract:The Bank of Japan will keep policy steady at its meeting next week and extend the duration of its Covid response measures by January at the latest, according to surveyed economists.

The Bank of Japan will keep policy steady at its meeting next week and extend the duration of its Covid response measures by January at the latest, according to surveyed economists.

All but one of 43 analysts polled by Bloomberg expect the central bank to stand pat at the two-day gathering ending on Oct. 29. The economists see the BOJ largely sticking to its existing economic forecasts in its quarterly outlook report.

While little more than a tenth of respondents see the bank extending the deadline for two virus-linked funding programs and enlarged asset purchases at the meeting, 95% of them expect the decision by January.

Click here to see full survey results.

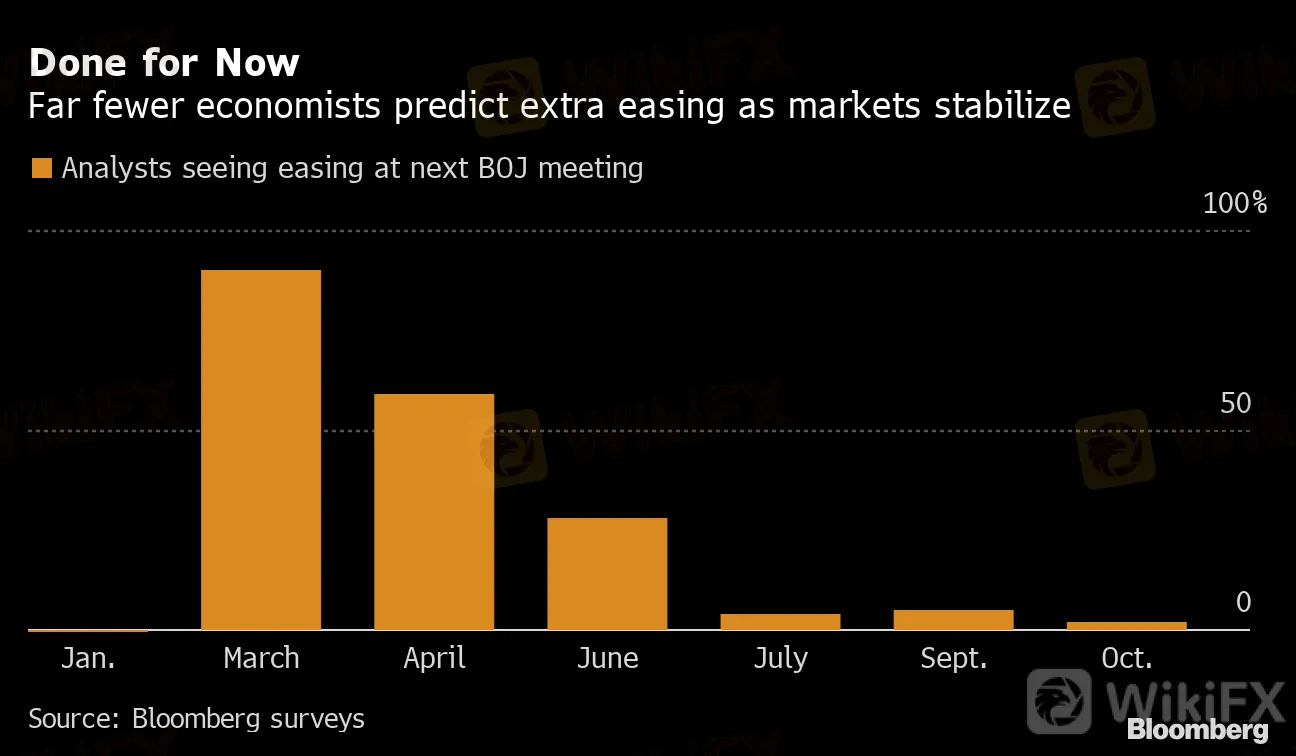

Done for Now

Far fewer economists predict extra easing as markets stabilize

{13}

Source: Bloomberg surveys

{13}

The results follow remarks by Governor Haruhiko Kuroda last month that there is a good chance the BOJ will lengthen the time frame of the program beyond March 31. At the height of the pandemic the bank created two funding programs worth a total of about $1 trillion and raised its buying limit on corporate bonds and commercial paper.

“The extension could even come as early as this meeting” said Ryutaro Kono, chief Japan economist at BNP Paribas SA. Still, “fiscal policy must play the leading role in supporting the economy with the BOJ helping back that up through yield curve control,” he added.

To that end, Prime Minister Yoshihide Suga will compile another extra budget by the end of this year, according to 85% of the economists. Kuroda said earlier this month that the government can keep the cost of issuing bonds low as the central bank anchors interest rates at ultra low levels to stimulate prices.

| GDP Outlook | BOJ Projection in July | Economists‘ Forecast for BOJ’s New Outlook |

|---|---|---|

| Fiscal 2020 | -4.7% | -4.9% |

| Fiscal 2021 | 3.3% | 3.4% |

| Fiscal 2022 | 1.5% | 1.5% |

The economists see only slight tweaks to the BOJs growth outlook and no change to its price forecasts, including its -0.5% projection for the year ending in March, according the median estimate in the survey.

{21}

— With assistance by Sumio Ito

{21}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

FOREX.com

IPCAPITAL

GRIC FX

TVR

SMART BALANCE

FXOpulence

FOREX.com

IPCAPITAL

GRIC FX

TVR

SMART BALANCE

FXOpulence

WikiFX Broker

FOREX.com

IPCAPITAL

GRIC FX

TVR

SMART BALANCE

FXOpulence

FOREX.com

IPCAPITAL

GRIC FX

TVR

SMART BALANCE

FXOpulence

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator