Economic Outlook of the Eurozone in 2020 Is Expected to Be Steady

Abstract:In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

European Central Bank(ECB) Executive Board member Isabel Schnabel said the Eurozone‘s inflation is estimated to be slowly inching towards the central bank’s target range. Monetary policy and increasing loans may prop up prices in the medium term, and Eurozones economy, supported by easing monetary measures, is estimated to see a 1.1% growth this year.

Germany‘s economy resumed marginal growth after declining for 3 months, while Spain and France both experienced considerable expansion. New jobs have been growing for the first time in 4 months, while business confidence also improved. Britain also had some good news, as the service sector’s index last December has been revised upwards, while new orders have seen the largest increase in 5 months. Inflation is expected reach 1.6% in 2022 as economic expansion accelerates.

In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

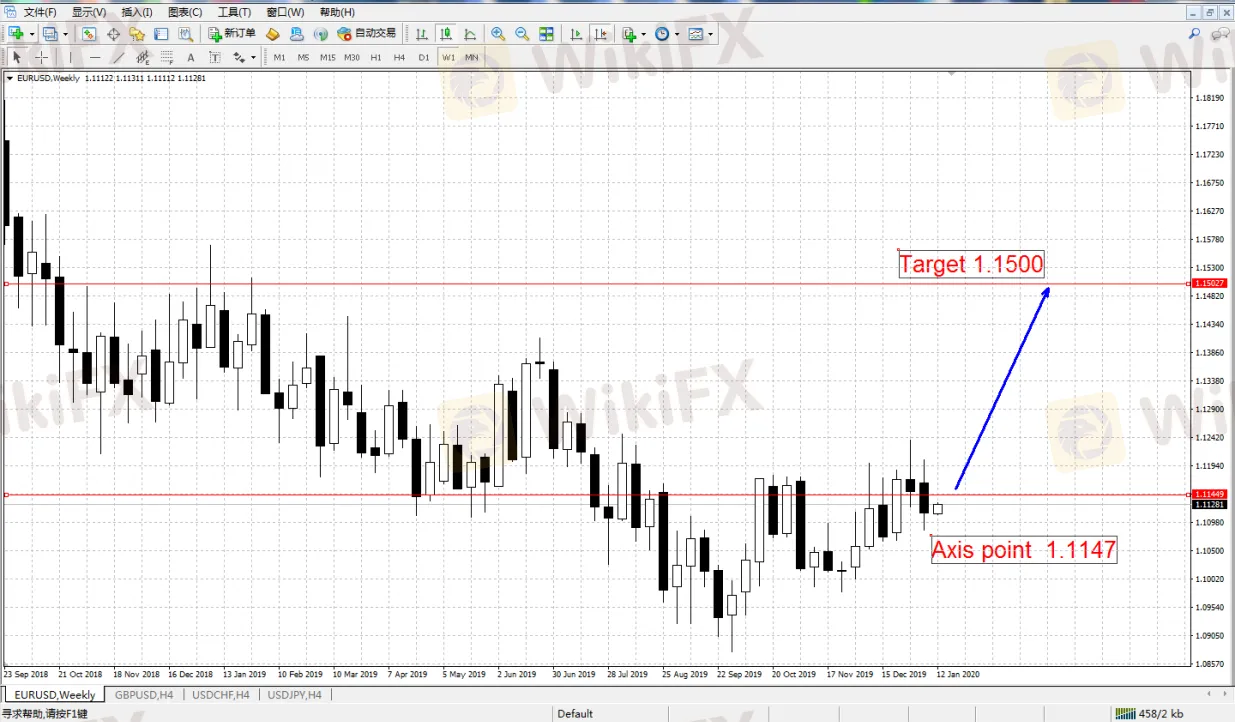

Technically, 1.1147 will be the axis point for EUR/USD in the first half of the year. Based on stabilized Eurozone economic data, weakened US dollar and reduced systematical risks, it‘s likely that the euro will slightly rise to above 1.15. On the other hand, US President Donald Trump’s policies have boosted USD above fair level for at least the past 2 years, but as the influence of these policies eventually declines, USD is also expected to return to a fair level. After the initial impacts of fiscal stimulus eventually faded, US economy growth may not reach its full potential.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

Consolidation for the week ahead: US inflation report to cast light on the Fed’s trajectory

Oil and euro slip, markets on edge over COVID-19 curbs in Europe

Asian stocks made a soft start to the week on Monday while oil and the euro were under pressure, as the return of COVID-19 restrictions in Europe and talk about hastened tapering from the U.S. Federal Reserve put investors on guard.

Markets Q4 Outlook: Dow Jones, US Dollar, Gold, Fed, Euro, ECB, Oil, Volatility Returns?

As investors head into the fourth quarter, the VIX Volatility Index - often referred to as the market‘s ’fear gauge - is in an uptrend. In September, US benchmark stock indices saw some of the worst monthly performance since March 2020. In fact, the S&P 500 and Nasdaq 100 finished the third quarter little changed. More importantly, they trimmed most of their gains. The Dow Jones declined.

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator