Indian Nifty BSE Sensex 30 Update

Abstract:Indian stock indices ended in the green, after witnessing a high swing during the trading session. Nifty closed at 11971 with a gain of 37 points and BSE Sensex 30 ended with a gain of 169 points at 40795.

Indian stock indices ended in the green, after witnessing a high swing during the trading session. Nifty closed at 11971 with a gain of 37 points and BSE Sensex 30 ended with a gain of 169 points at 40795.

Bank Nifty traded low of 23149 and took reversal and traded high for the day at 23963 before settling at 23875. Nifty hits low of 11822, high at 11997, and closed at 11971. Nifty climbed up maintained bullish stance at closing supported by a sharp recovery in Banking stocks, Financial Services sector, and realty sector. Basically, good support was seen from interest rate sensitives. Bank Nifty spiked on strong support from private banks. The IT and Pharma sectors witnessed pressure during the day. Result upbeat from the IT sector seems duly discounted, hence limited upside seems capped for the IT sector. The auto sector also remained subdued for the day.

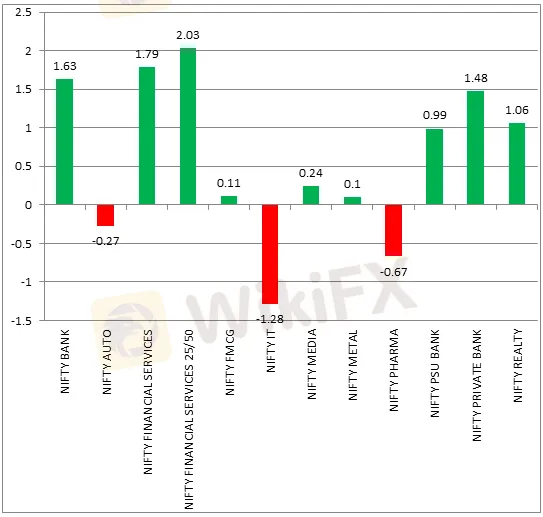

The changes in Broader and Sectoral Indices for the day are as under:

Bank Nifty likely to trade bullish for the rest of the week. Levels to be watched in Bank Nifty are 24192 and 24620 on the upside, whereas on the lower side, 23515 seems good to support followed by 23122. Bank Nifty already traded near 23149 today. The momentum indicator is buoyant for the week. Further, on the technical front, Nifty has formed a highly bullish structure. It is worth noting that Nifty has not closed in RED since 30th September 2020. Moreover, a higher high higher low pattern is made on the daily timeframe. Overall, Nifty is trading as buy on dip bet.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator