Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

VT Markets was founded in 2016 and headquartered in Sydney, Australia, a subsidiary of Vantage International Group Limited, has over ten years' experience and expertise in global financial markets. As a regulated broker, VT Markets operates under the oversight of the Financial Sector Conduct Authority (FSCA). VT Markets offers a suite of trading instruments, including major, minor, and exotic currency pairs, allowing traders to capitalize on various market opportunities. In addition to forex, the broker also provides access to other financial instruments, including Soft Commodities, Indices, Cryptocurrencies, Energy, Share CFDs, Bonds CFDs, ETFs trading, Precious Metals .

Traders can benefit from competitive trading conditions at VT Markets, including low minimum deposit of $100, fast execution speeds, and flexible leverage options up to 1:500. The broker employs advanced technology infrastructure to ensure reliable and efficient trading, catering to the needs of both novice and experienced traders.

VT Markets supports the industry-standard MetaTrader 4 (MT4) trading platform and MetaTrader 5 (MT5) trading platform, as well as webtrader, known for its robust functionality, advanced charting tools, and customizable features, offering a seamless trading experience, with access to a wide range of technical indicators, expert advisors (EAs), and automated trading capabilities.

VT Markets provides a responsive and professional customer support team to assist traders with their inquiries and concerns. Support is available through various channels, including phone, email and live chat, ensuring timely and efficient assistance. The broker's website also features a comprehensive FAQ section, providing answers to commonly asked questions.

Is VT Markets legit or a scam?

VT Markets operates under the regulation of multiple regulatory authorities, including the Australian Securities and Investments Commission (ASIC) in Australia and the Financial Sector Conduct Authority (FSCA) in South Africa.

With its entity in South Africa regulated by the FSCA, VT Markets complies with the regulatory requirements set by this reputable financial authority. The FSCA is known for its stringent oversight and supervision of financial services providers.

Additionally, VT Markets also holds an Investment Advisory License. It is important for traders to evaluate the specific details and limitations of this license to determine its scope and relevance to their individual investment needs.

Pros and Cons

VT Markets offers several advantages, including a wide range of trading instruments, multiple account types and flexible leverage options to cater to the diverse needs of traders. The user-friendly trading platforms, along with advanced trading tools and features, enhance the trading experience.

However, it's important to consider some drawbacks. VT Markets operates with limited regulatory oversight, which may raise concerns for some traders seeking a higher level of regulatory protection. They also have limited educational resources available, which may be a drawback for traders looking to enhance their knowledge and skills.

Market Instruments

VT Markets is a forex broker that offers a wide range of tradable assets to cater to the diverse needs of traders. With a comprehensive selection of instruments, including Forex, Soft Commodities, Indices, Cryptocurrencies, Energy, Share CFDs, Bonds CFDs, ETFs trading, and Precious Metals, VT Markets provides ample opportunities for traders to participate in various global markets.

Forex Pairs-Forex trading is one of the primary offerings of VT Markets, allowing traders to engage in currency pairs from major, minor, and exotic currencies. This enables them to take advantage of fluctuations in the forex market and capitalize on potential profit opportunities.

Soft Commodities-VT Markets also provides access to Soft Commoditiessuch as agricultural products, including wheat, corn, soybeans, and more. Traders interested in diversifying their portfolios can take advantage of price movements in these markets.

Indices-Indices trading is another prominent asset class offered by VT Markets. Traders can trade popular stock market indices like the S&P 500, NASDAQ, FTSE 100, and more, allowing them to speculate on the performance of the broader market.

Cryptocurrencies-Cryptocurrencies have gained significant popularity in recent years, and VT Markets acknowledges this trend by offering a range of digital currencies for trading. Traders can participate in the crypto market and potentially benefit from the volatility and potential growth of cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others.

Energy-Energy products, such as crude oil and natural gas, are also available for trading on VT Markets. Traders can speculate on the price movements of these essential energy commodities, influenced by various geopolitical and economic factors.

Share CFDs-Share CFDs provide an opportunity for traders to engage in equity trading without actually owning the underlying shares. VT Markets offers a selection of share CFDs from leading global companies, allowing traders to speculate on their price movements.

Bonds CFDs-Bonds CFDs and ETFs trading are additional asset classes offered by VT Markets, providing traders with exposure to fixed-income securities and diversified investment portfolios, respectively.

Precious Metals-Precious Metals like gold, silver, platinum, and palladium are also available for trading. These metals are often seen as safe-haven assets and can be an attractive option for traders looking for alternative investments.

Account Types

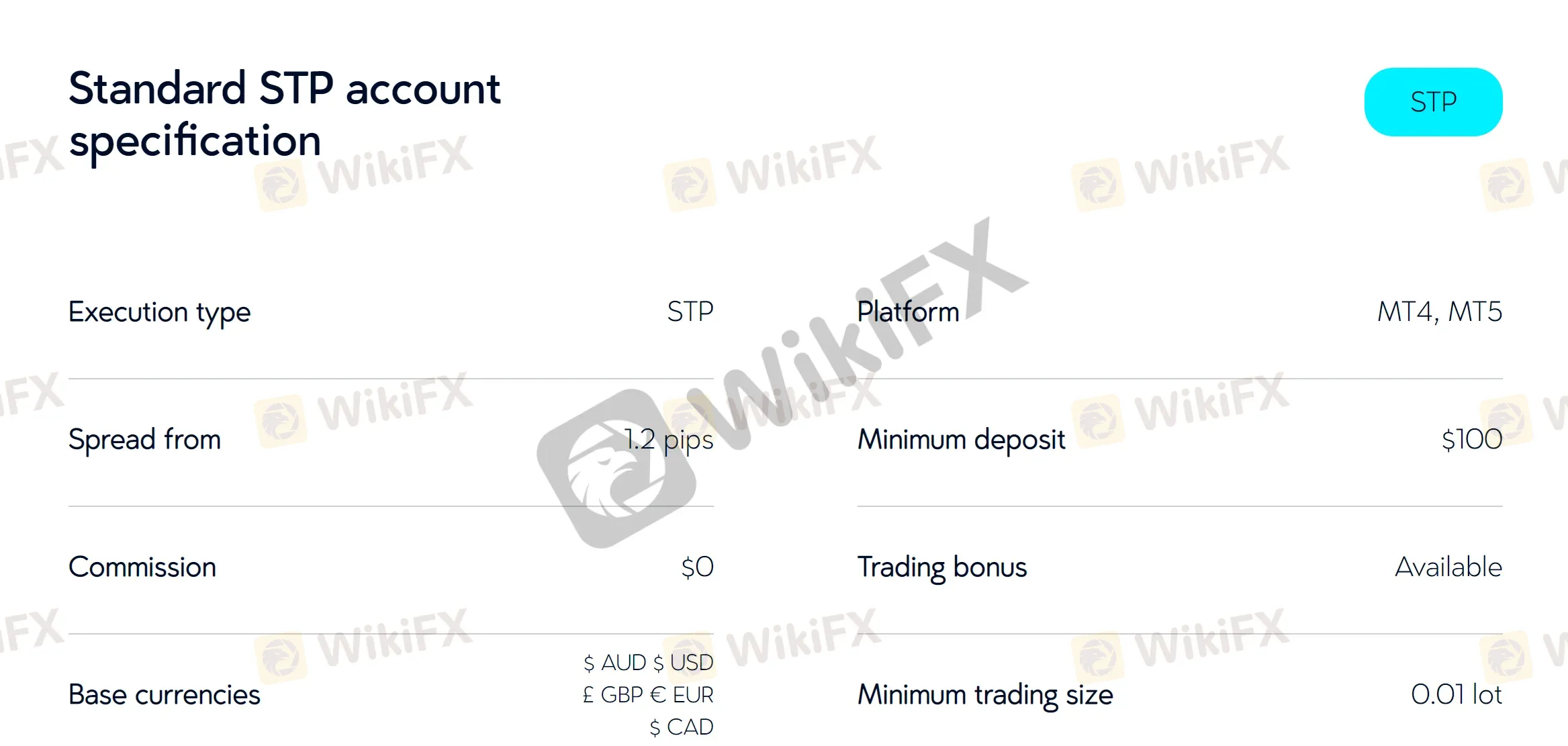

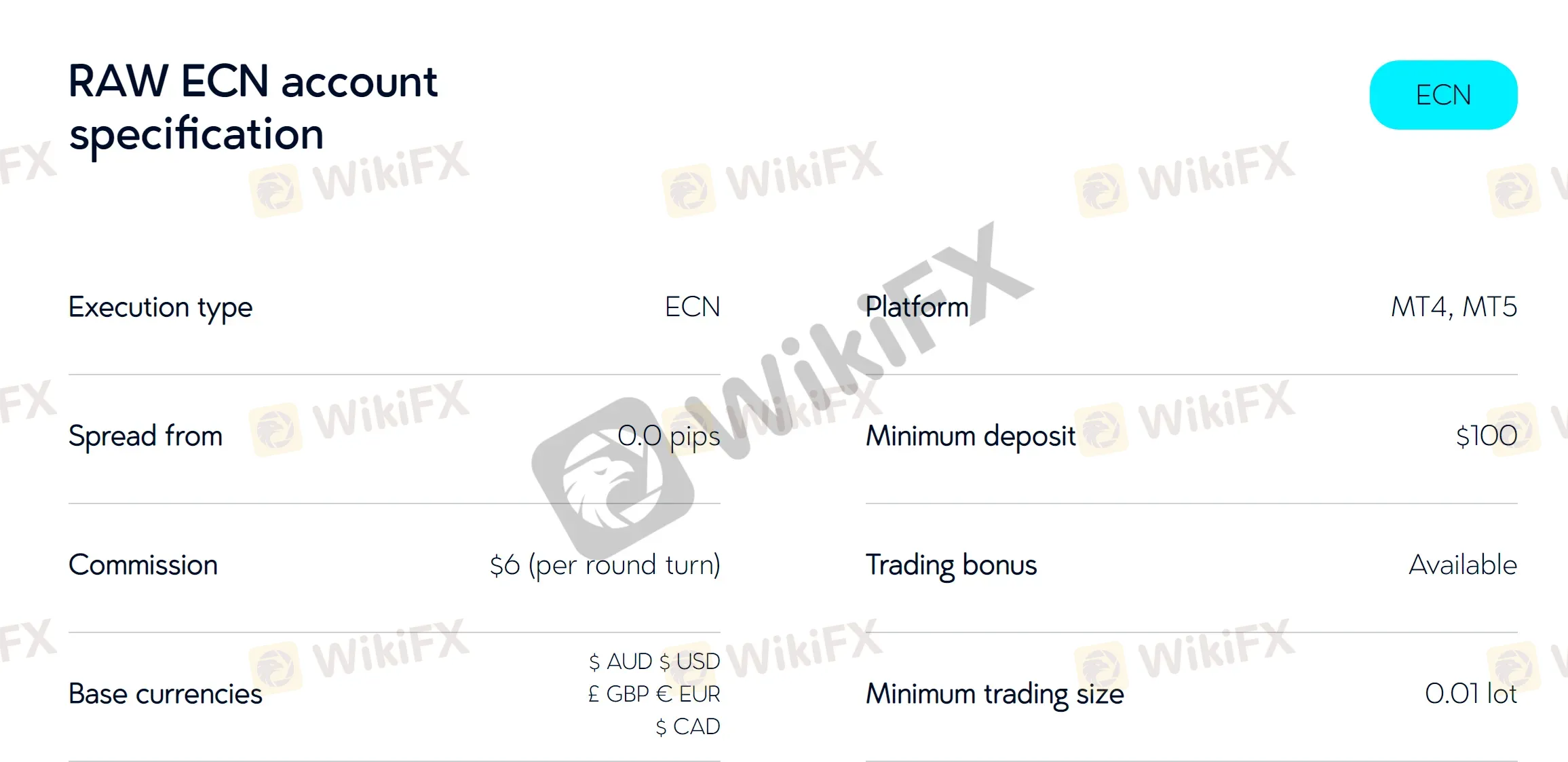

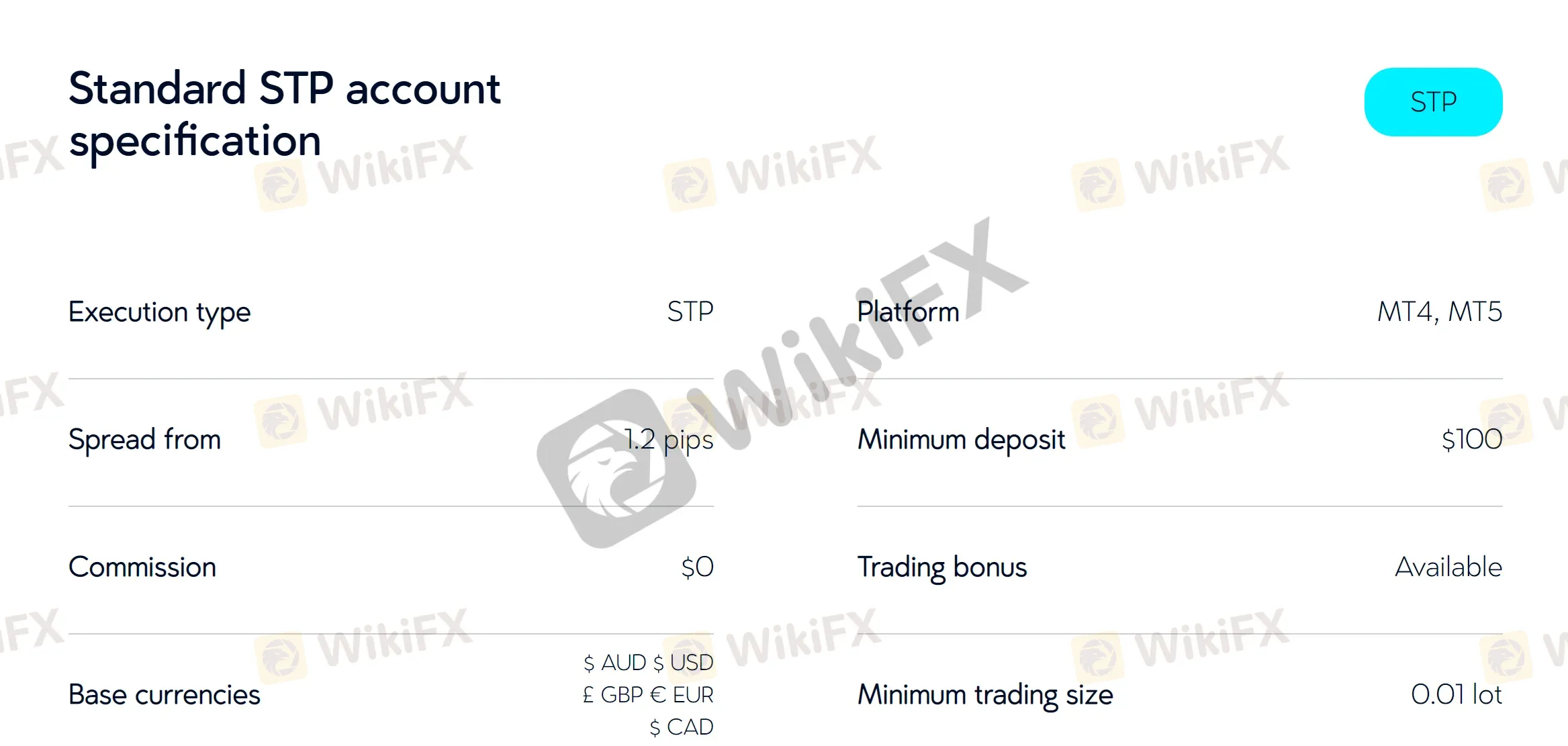

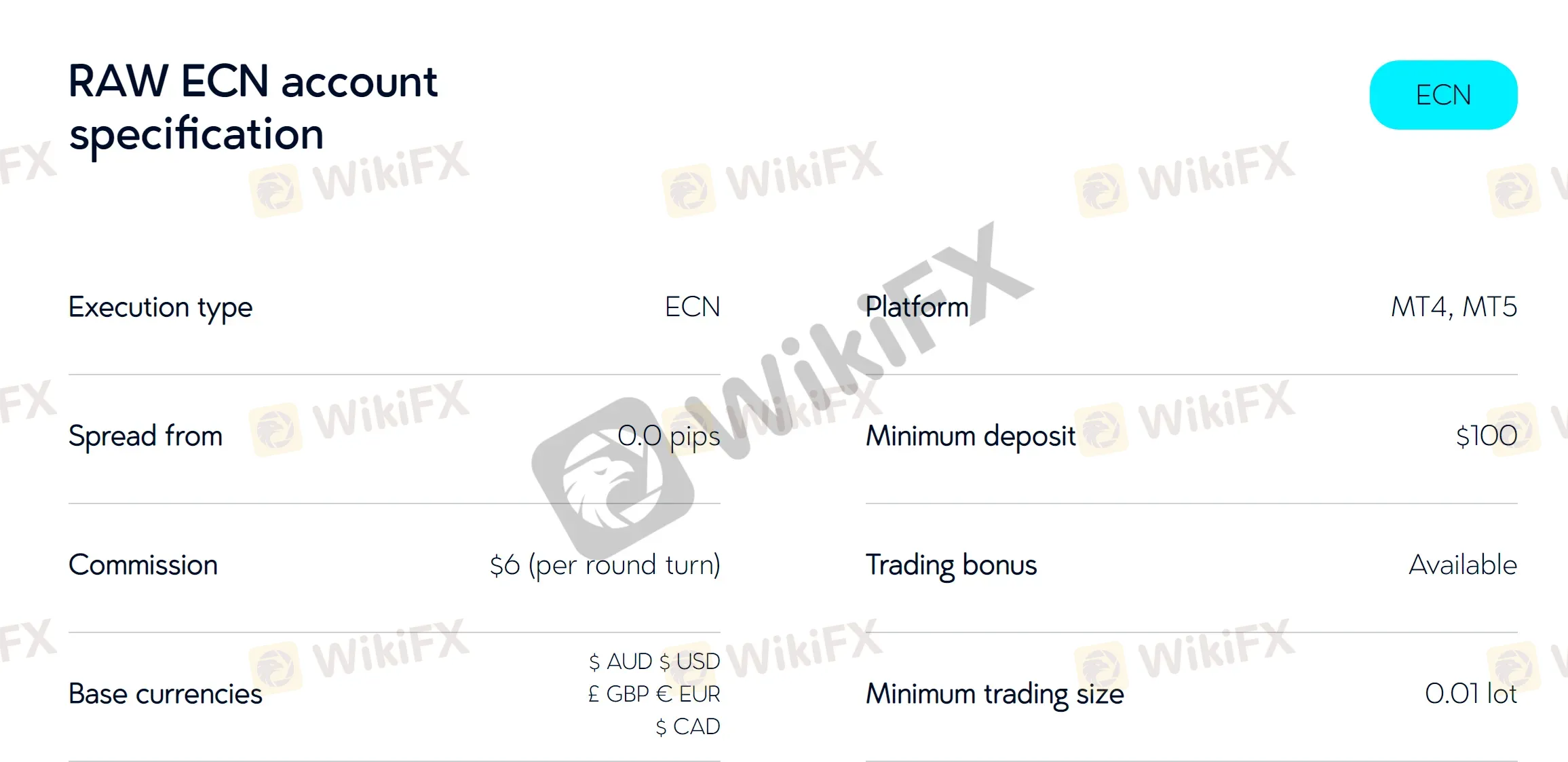

VT Markets offers two distinct types of trading accounts designed to cater to the diverse needs of traders. The first account type is the Standard STP account, which operates on the execution model of Straight Through Processing (STP). The second account option is the Raw ECN account, which utilizes an Electronic Communication Network (ECN) execution model. This account type is particularly suitable for traders seeking direct market access, tighter spreads, and increased liquidity.

Both the Standard STP and Raw ECN accounts require a minimum deposit of $100, making them accessible to traders with varying levels of capital. Additionally, VT Markets offers a range of base currencies for account holders to choose from, including USD, AUD, GBP, EUR, and CAD. This allows traders to select their preferred currency for more convenient account management.

Furthermore, VT Markets provides swap-free options for both account types, also known as Islamic or Sharia-compliant accounts. These accounts are designed for traders who adhere to Islamic principles, as they eliminate any interest charges on positions held overnight.

Aside from live trading accounts, VT Markets also provides demo accounts for traders to test the trading environment and practice their trading skills.

How to open an account?

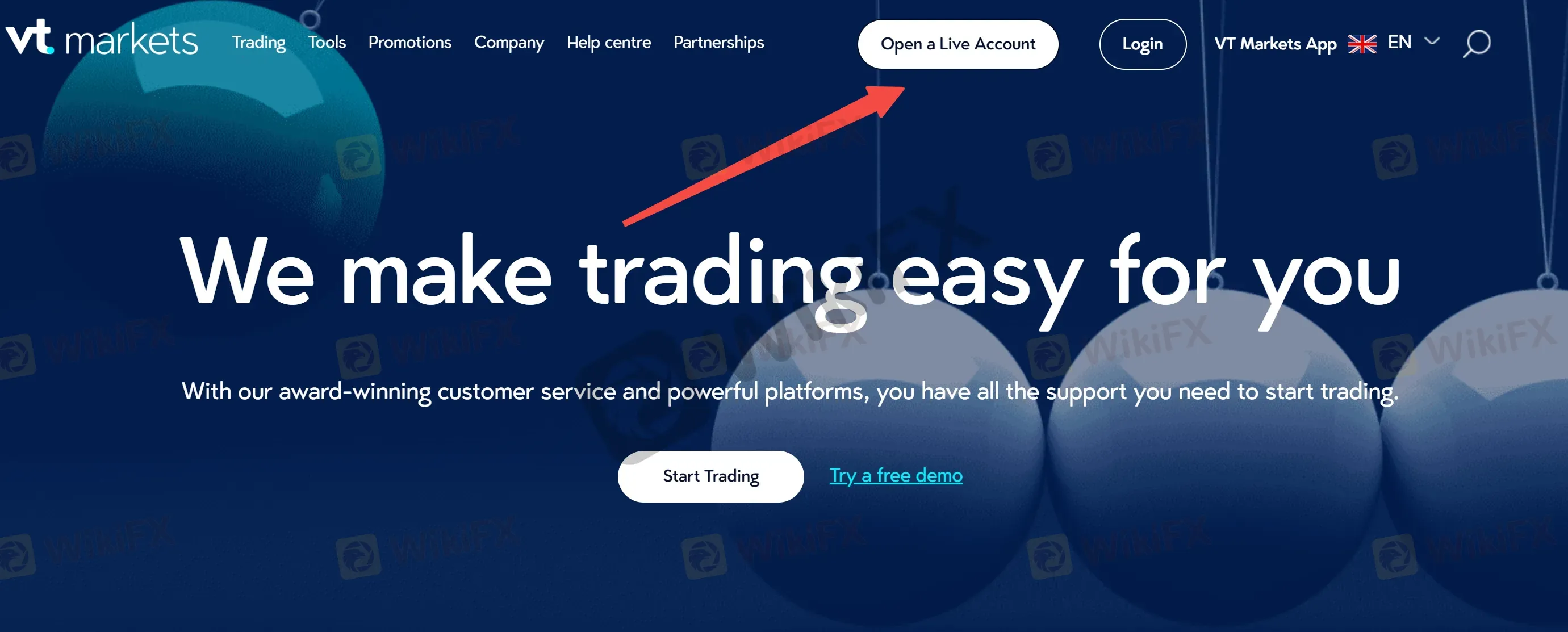

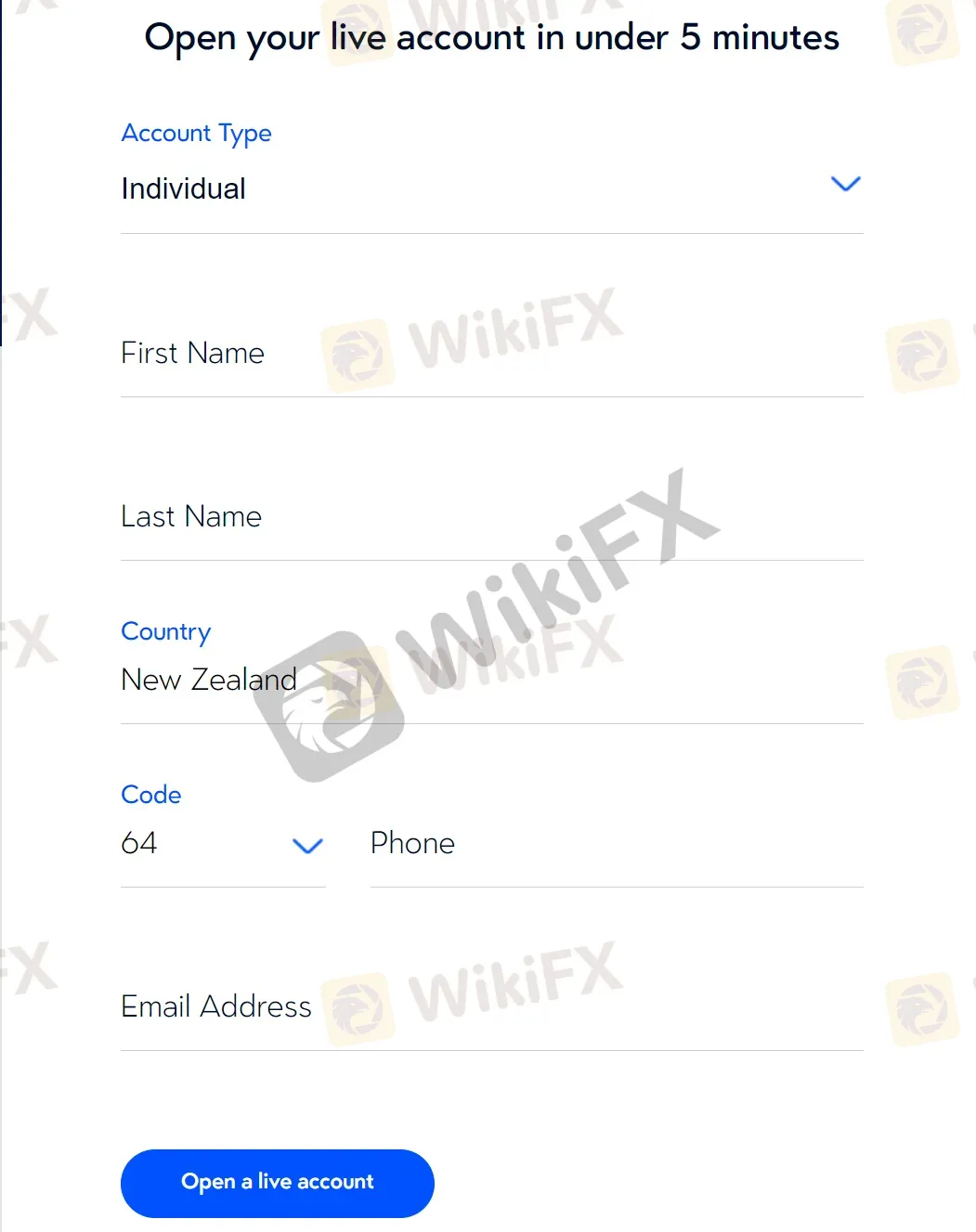

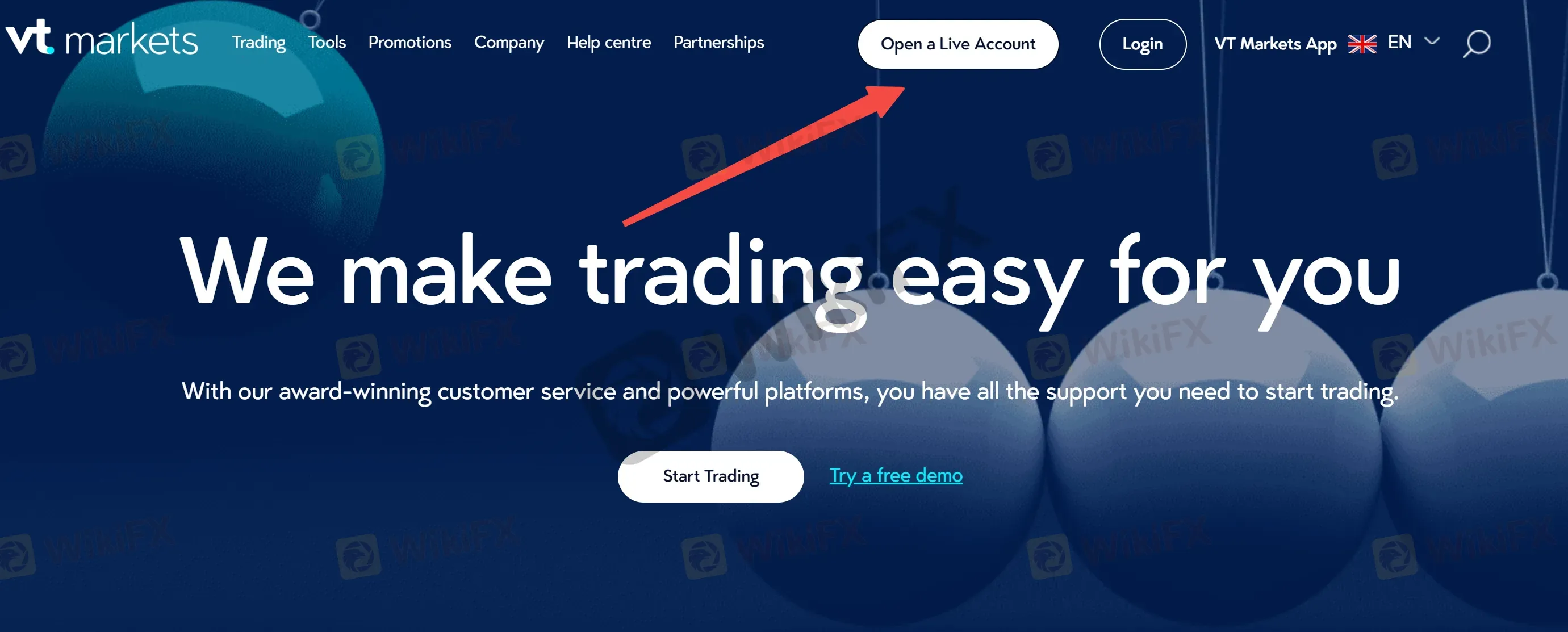

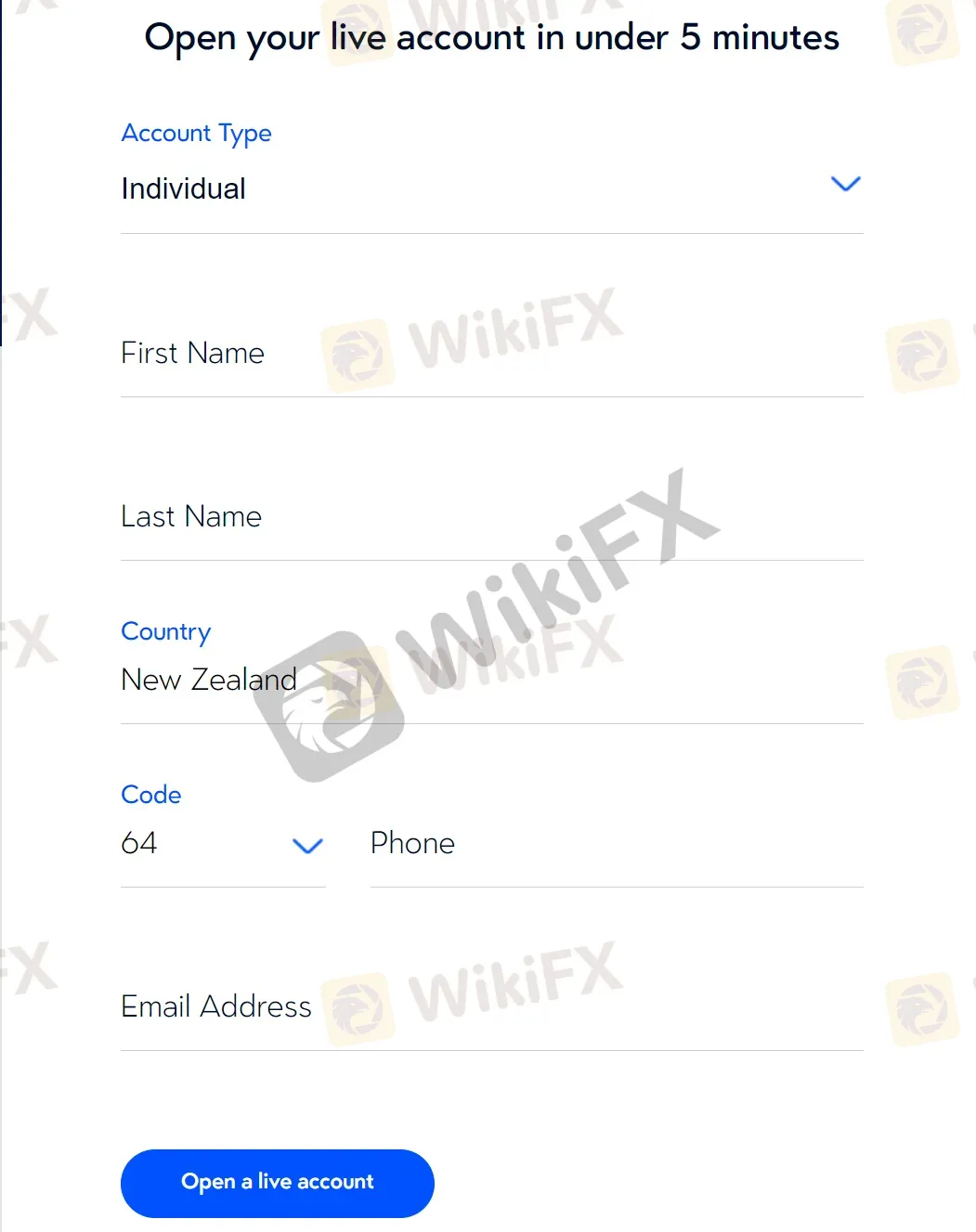

Opening an account is the first step towards accessing the financial markets and participating in forex trading. VT Markets has simplified the account opening process to ensure a seamless experience for traders. Here is a step-by-step guide on how to open an account with VT Markets:

1. Visit the VT Markets official website,and click on the “Open Live Account” button: On the VT Markets website, locate the “Open Account” button or a similar option that signifies the account opening process. This will redirect you to the account registration page.

2. Fill out the account registration form: Complete the account registration form with accurate personal information, including your full name, email address, phone number, and country of residence. Ensure that you provide all the required details correctly to avoid any issues during the verification process.

3. Select the desired account type: VT Markets offers different account types to cater to the diverse needs of traders. Choose the account type that aligns with your trading preferences and objectives.

4. Submit the necessary documents: As part of the account opening process, VT Markets may require you to submit certain identification documents for verification purposes. These documents typically include a valid ID proof (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Follow the instructions provided by VT Markets to upload the required documents securely.

5. Fund your trading account: Once your account is successfully opened and verified, you can proceed to fund your trading account. VT Markets supports various deposit methods, including Visa, MasterCard, bank wire transfer and more.

Leverage

With a leverage of up to 1:500, its customers can trade 40 different currency pairings and spot gold contracts. One can use a leverage of up to 1:333 on energy commodities, 1:100 on Silver Spot, and 1:20 on soft commodities such as cocoa, coffee, cotton, orange juice, and raw sugar (Crude Oil, Natural gas, Gasoline, and Gasoil). Stocks of the 50 largest U.S. and Hong Kong firms are available for trading via Contracts for Difference (CFDs), with leverage of 1:20. You can trade 15 stock indexes, including the SP 500, DJ30, and US 2000, with high leverage (up to 1:333).

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

VT Markets offers different trading accounts with varying spreads and commission structures to cater to the diverse needs of traders.

The standard account at VT Markets provides a zero-commission trading environment, which means that you won't be charged any commissions on your trades. However, it offers average spreads on currency pairs. For example, the spreads on major pairs like EUR/USD start from 1.3 pips, GBP/USD from 1.8 pips, AUD/USD from 1.6 pips, and USD/JPY from 1.5 pips. While these spreads are competitive, they are slightly wider compared to ECN account spreads.

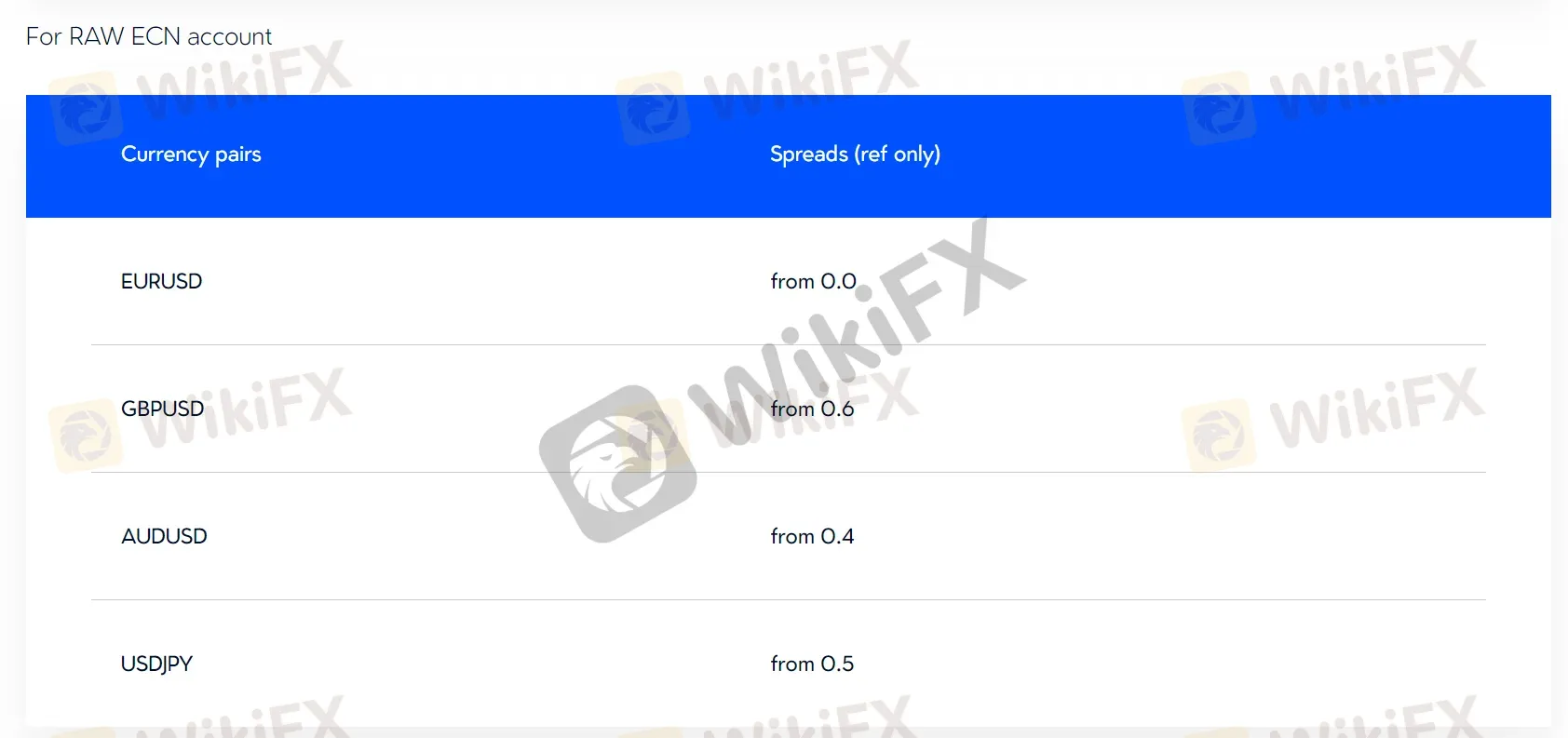

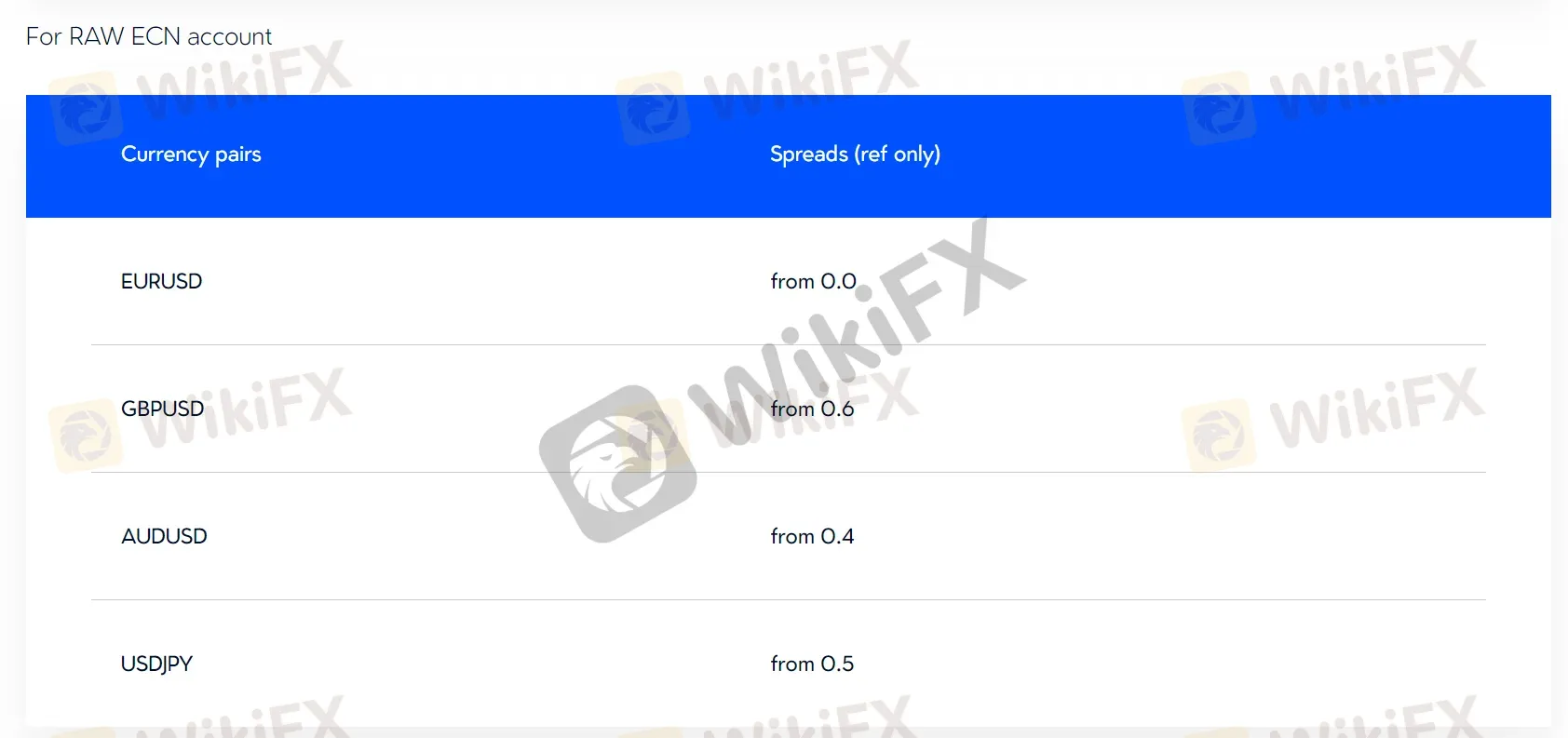

On the other hand, VT Markets' ECN accounts offer relatively low spreads. For instance, the spreads on EUR/USD can start from as low as 0.0 pips, GBP/USD from 0.6 pips, AUD/USD from 0.4 pips, and USD/JPY from 0.5 pips. These tight spreads are particularly attractive for traders who prioritize lower transaction costs.

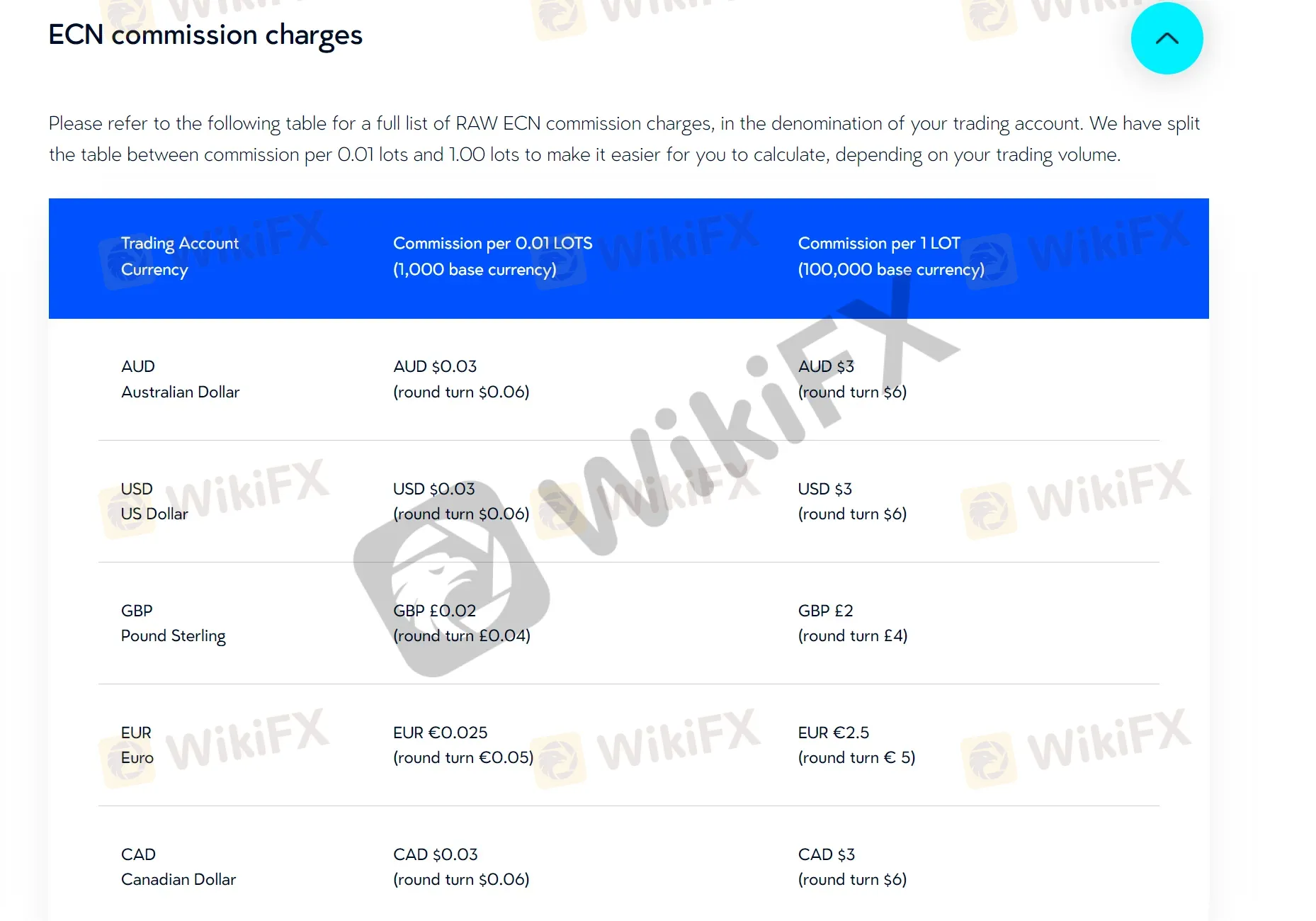

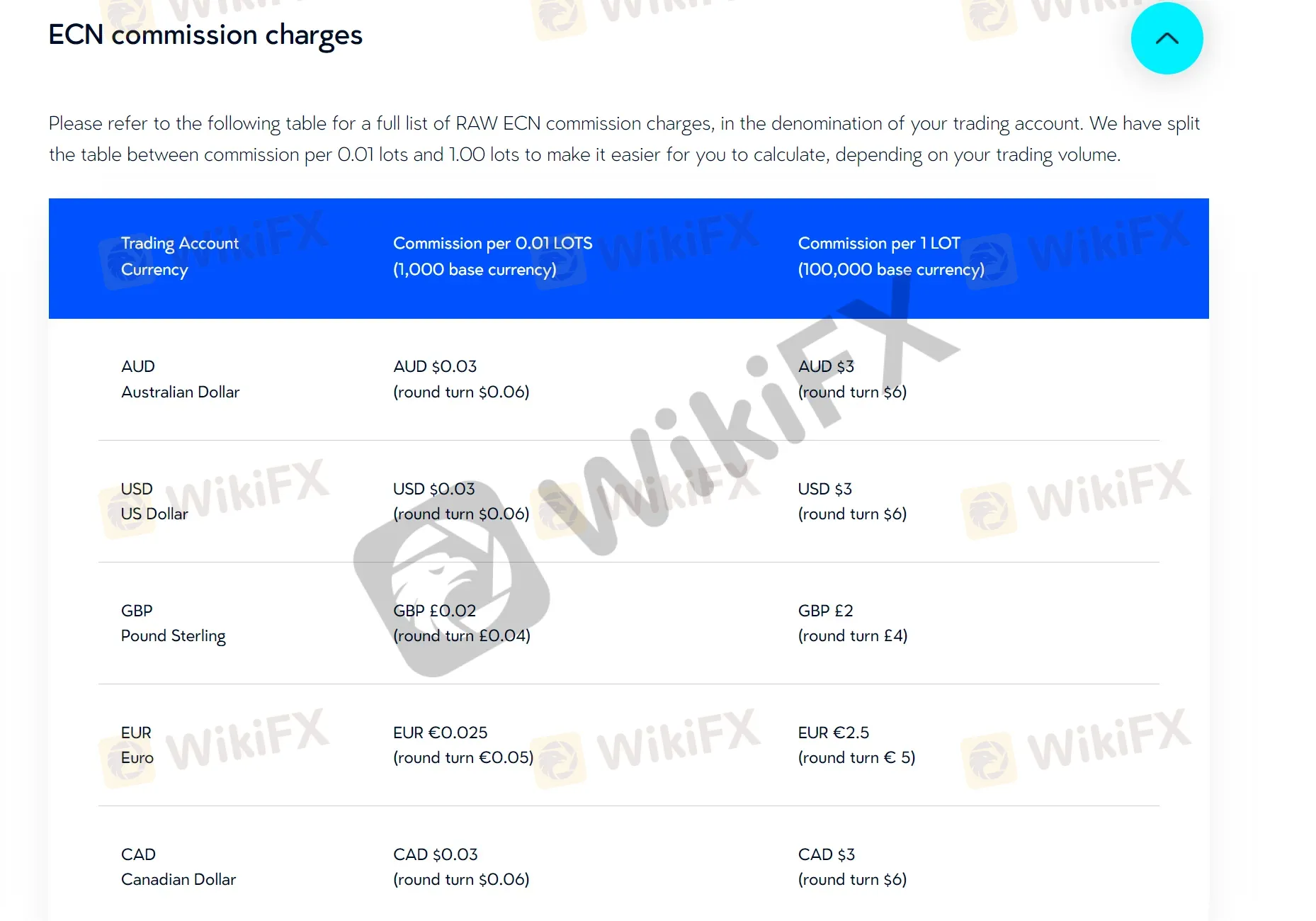

However, it's important to note that ECN accounts incur a commission fee. VT Markets charges a commission of $3 per lot traded on ECN accounts. This commission is added on top of the spreads and is a transparent fee for accessing the interbank market liquidity and tighter spreads.

Overall, VT Markets provides a range of account options with competitive spreads and commission structures. Traders can choose between the standard account with zero commissions but slightly wider spreads, or the ECN account with lower spreads and a commission fee per lot.

Non-Trading Fees

VT Markets prides itself on its transparent fee structure, and while the focus is primarily on competitive trading conditions, there are a few non-trading fees to be aware of. Let's explore these fees in more detail to gain a comprehensive understanding of the costs involved.

One of the notable non-trading fees charged by VT Markets is the inactivity fee. This fee is applied when an account remains inactive for a specified period of time, typically several months. It is important to review the specific terms and conditions of the inactivity fee, including the duration of account inactivity and the associated charges.

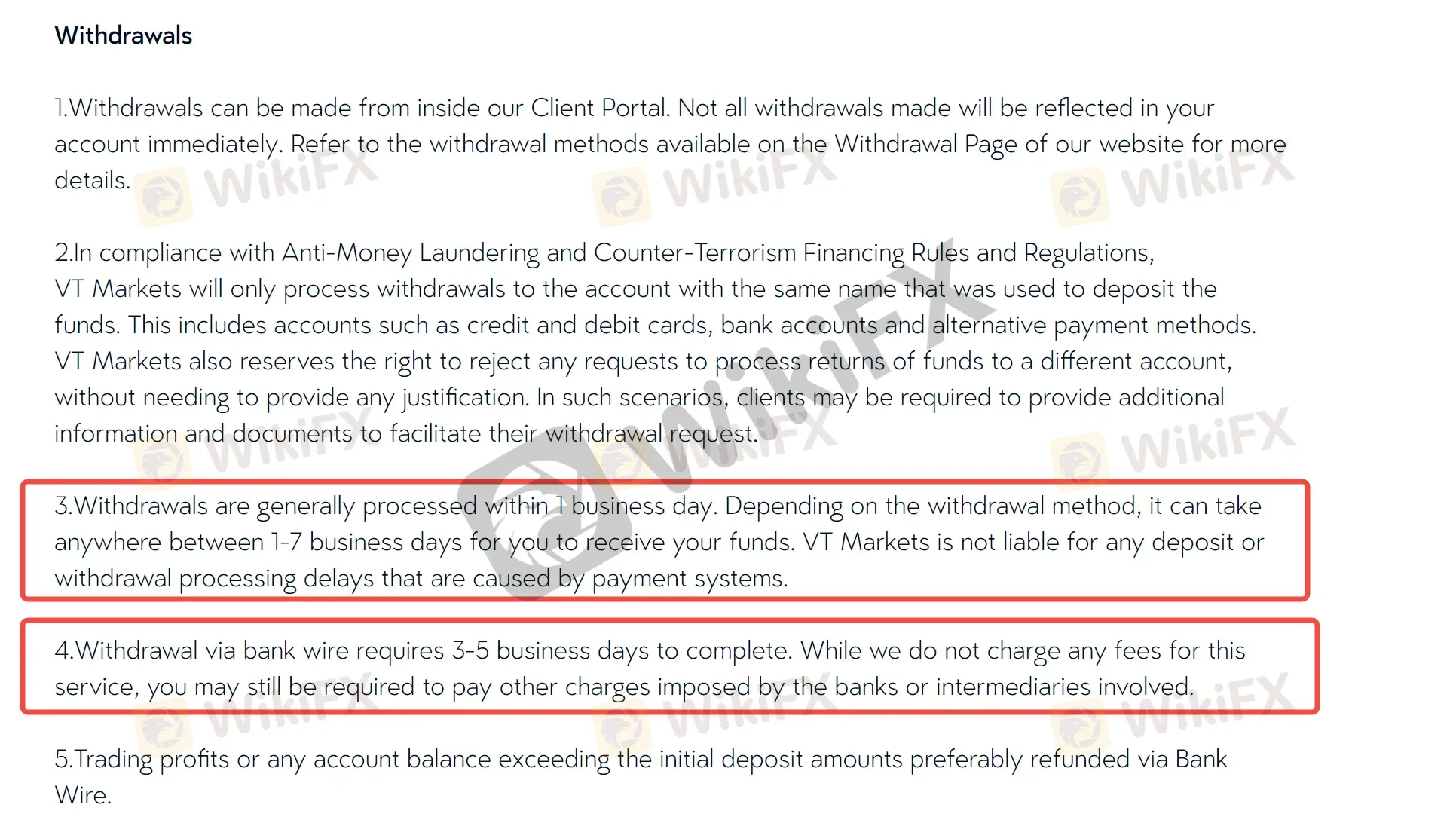

Another non-trading fee to consider is the withdrawal fee. While VT Markets offers various convenient withdrawal methods, it's important to be aware that certain fees may apply when transferring funds from your trading account to your personal bank account or e-wallet. These fees can vary depending on the chosen withdrawal method, so it's advisable to review the broker's official website or contact their customer support for detailed information on withdrawal fees.

Additionally, VT Markets may impose fees for specific services or requests, such as account statement requests or document processing. These fees are typically disclosed in the broker's fee schedule or terms and conditions, so it's recommended to familiarize yourself with these details to avoid any unexpected charges.

Trading Platform Available

VT Markets offers a range of advanced trading platforms to cater to the diverse needs of traders. With their selection of robust platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, WebTrader+, and the VT Market App, traders can access the financial markets with ease and precision. Each platform provides unique features and capabilities to enhance trading experiences and execute trades efficiently.

MetaTrader 4 (MT4):MT4 is a globally recognized and widely used trading platform, renowned for its user-friendly interface and extensive range of trading tools. It offers real-time market data, advanced charting options, and customizable indicators to help traders analyze the markets and make informed trading decisions. MT4 also supports automated trading through expert advisors (EAs), allowing traders to automate their strategies.

MetaTrader 5 (MT5):MT5 is the successor to MT4 and comes with additional features and enhanced capabilities. It offers an improved interface, advanced charting tools, and an expanded range of technical indicators. MT5 also allows traders to access different asset classes, including stocks and futures, in addition to forex trading. With its powerful analytical tools and multi-asset support, MT5 caters to traders seeking advanced trading functionalities.

VT Market App:The VT Market App is a mobile trading platform designed for traders who prefer to trade on the go. Available for both iOS and Android devices, the app allows traders to access their accounts, monitor market conditions, and execute trades from anywhere, anytime. The VT Market App provides a seamless trading experience, ensuring traders never miss out on potential trading opportunities.

WebTrader:The WebTrader platform is a web-based trading solution that provides traders with the flexibility to access their accounts from any web browser without the need for software installation. It offers a user-friendly interface, real-time market data, and essential trading features. Traders can analyze charts, place trades, and manage their positions conveniently through WebTrader.

WebTrader+:WebTrader+ is an enhanced version of the WebTrader platform, offering additional features and functionalities. It provides advanced charting tools, technical indicators, and customizable trading settings. With WebTrader+, traders can monitor market movements in real-time, execute trades swiftly, and manage their positions effectively, all within a browser-based interface.

Deposit & Withdrawal

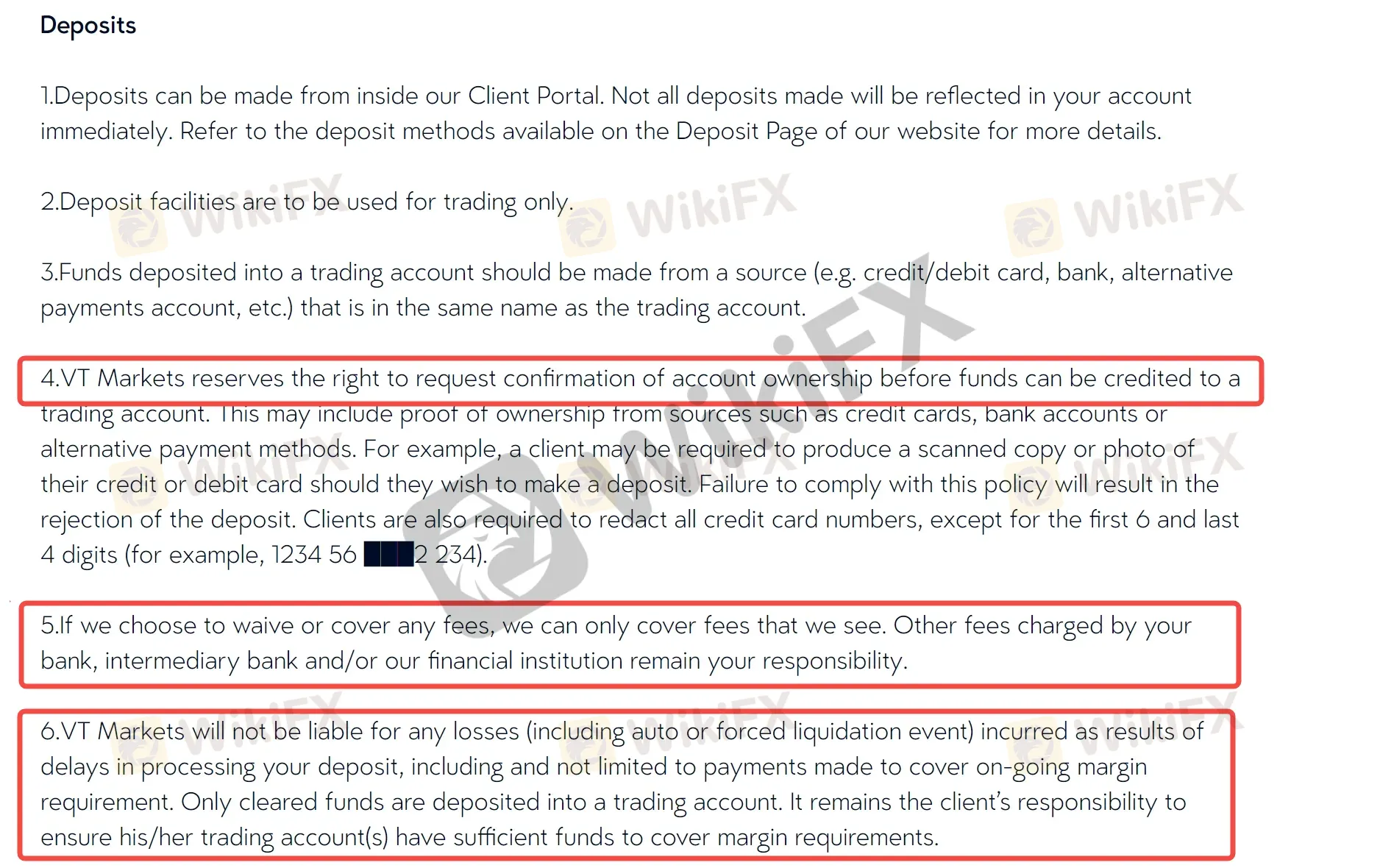

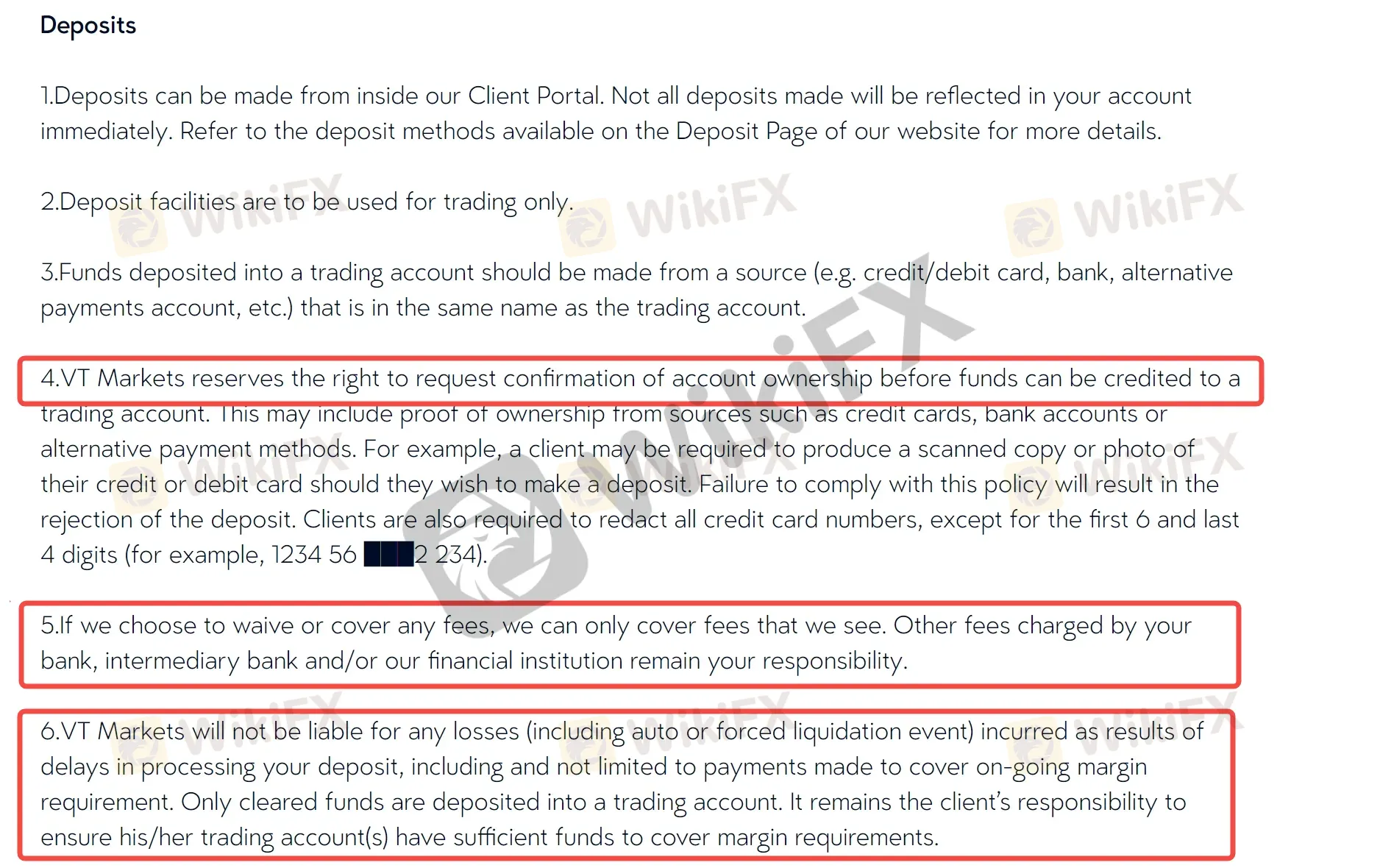

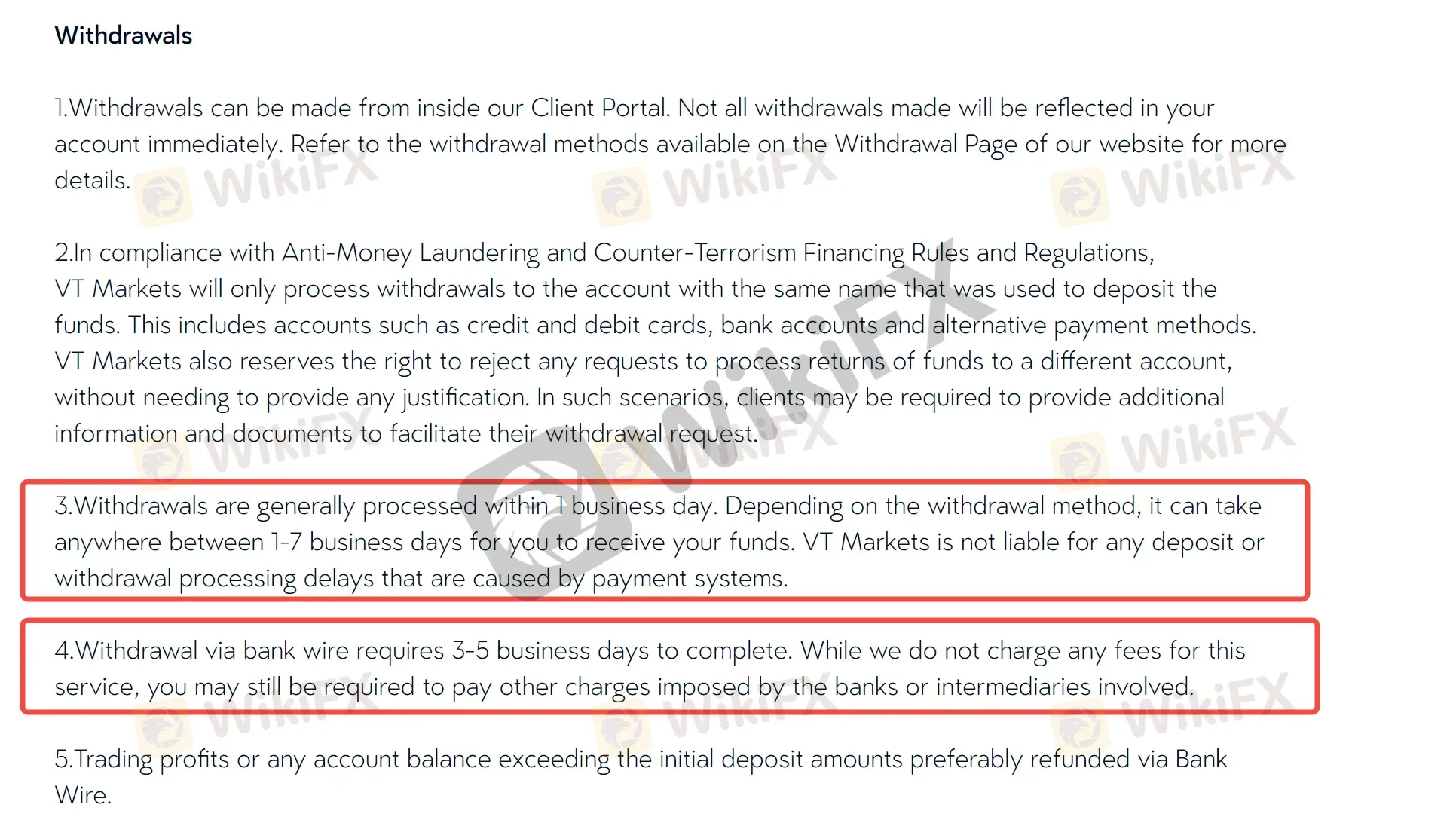

VT Markets offers clients access to a diverse range of supported payment methods, including VISA, Mastercard, Bank Transfer, Neteller, Skrill, UnionPay, Alipay, FasaPay, Tether, and Bitcoin. The minimum deposit requirement of $100 makes VT Markets accessible to a wide range of traders, whether they are beginners starting with a smaller capital or experienced traders looking to add funds to their trading accounts.

It is important to note that specific terms, conditions, and fees may apply to each payment method, and it is advisable to review the broker's official website or contact their customer support for detailed information regarding the deposit and withdrawal process.

Bonuses

VT Markets claims to offer various trading incentives at the time, including a 50% Welcome Bonus, 20% Deposit Bonus and referral bonuses. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

It's important to note that bonuses come with specific terms and conditions that traders should be aware of. These terms may include minimum deposit requirements, trading volume requirements, and certain restrictions on bonus withdrawals. Traders are encouraged to carefully review the bonus terms and conditions on VT Markets' official website or consult with their customer support for detailed information.

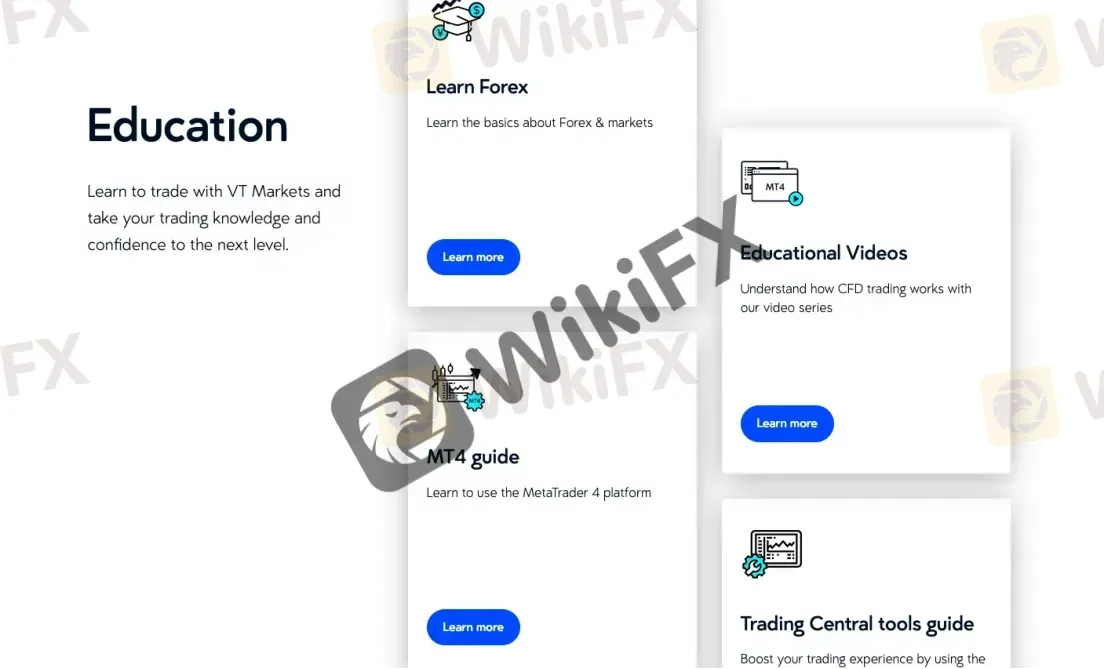

Educational Resources

VT Markets offers a comprehensive range of educational resources designed to empower traders with the knowledge and tools necessary for their trading.

One of the standout features of VT Markets' educational resources is the availability of various trading tools. Traders can leverage expert advisors, forex signals, and an economic calendar to make informed trading decisions. These tools provide valuable insights, automate trading strategies, and help traders stay updated with key economic events that can impact the markets.

Additionally, VT Markets offers the MAM/PAMM (Multi-Account Manager/Percentage Allocation Management Module) system, allowing experienced traders to manage multiple accounts simultaneously. This feature is especially beneficial for fund managers and traders looking to diversify their trading strategies.

For technical analysis enthusiasts, VT Markets integrates Trading Central MT4 tools into its platform. These tools provide in-depth market analysis, including price forecasts, trend analysis, and key levels to watch. Traders can utilize this information to identify potential trading opportunities and make well-informed trading decisions.

VT Markets also provides daily market analysis to keep traders informed about the latest market trends, news, and insights. This analysis covers various financial instruments, including forex, commodities, indices, and more. It helps traders stay ahead of market developments and adapt their trading strategies accordingly.

To assist traders in navigating the MT4 trading platform effectively, VT Markets offers an MT4 guide. This comprehensive guide covers the platform's features, functionalities, and how to optimize its use for trading purposes. It is particularly useful for beginner traders who are new to the MT4 platform.

Moreover, VT Markets supports social trading through its innovative program called VTrade. This program allows traders to connect, interact, and share trading ideas with other traders within the VT Markets community. Traders can learn from experienced traders, gain insights, and even replicate successful trading strategies.

Customer Support

VT markets customer support can be reached by email: info@vtmarkets.com. You can also follow this broker on social networks such as Twitter, Facebook, Instagram, YouTube and LinkedIn. Company address: Level 35, 31 Market St, Sydney NSW 2000, Australia; 4th Floor, the Harbour Centre, 42 N Church St, George Town, Cayman Islands.

VT Markets offers various channels for customer assistance. Traders can reach out to the dedicated support team through email, and online chat, allowing for convenient communication and prompt resolution of queries or concerns.

Additionally, VT Markets recognizes the importance of staying connected with clients through social media platforms. They actively engage with traders on platforms like Facebook, Twitter, and Linkedin and Youtube, providing updates, market insights, and addressing customer inquiries in a timely manner.

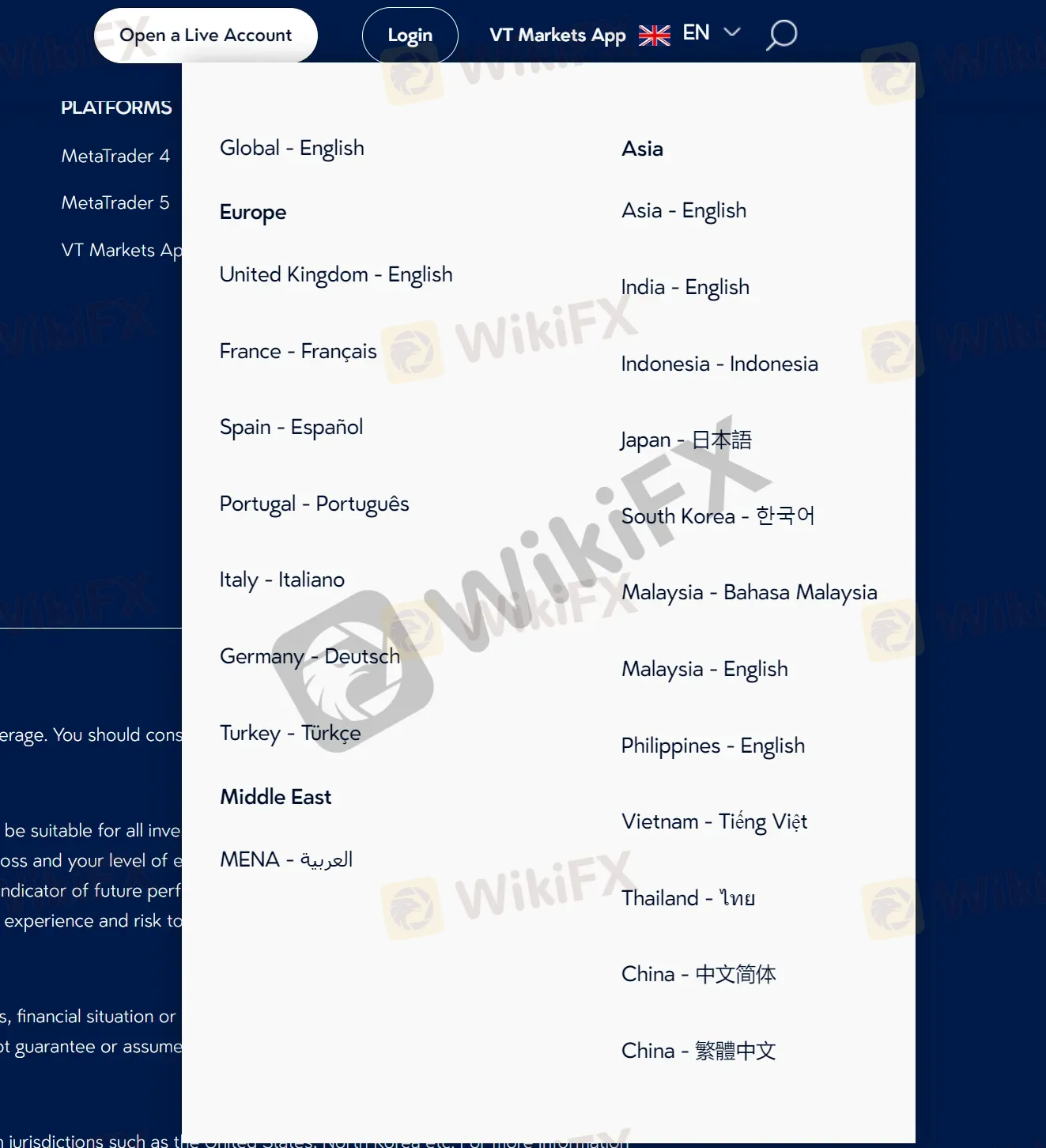

One of the key advantages of VT Markets' customer support is its multilingual capability. The support team is proficient in multiple languages, enabling them to effectively assist clients from diverse backgrounds and ensure clear communication.

Conclusion

VT Markets is a forex broker that offers a range of trading services and features. As with any broker, there are both positive and negative aspects to consider when evaluating their offerings.On the positive side, VT Markets provides a user-friendly trading platform that is equipped with advanced charting tools and a wide range of technical indicators. Moreover, VT Markets offers a diverse selection of trading instruments, including major and minor forex currency pairs, commodities, indices, and cryptocurrencies.

However, it's important to consider the potential drawbacks. VT Markets has limited customer support options, as they primarily rely on email communication. This may result in slower response times and limited real-time assistance for urgent queries.

Additionally, while VT Markets provides educational resources such as webinars and tutorials, the availability and depth of these materials could be further expanded to better support traders in their learning journey.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX