Daily Market Recap - USOil Rises After Suez Traffic Jam

摘要:Oil prices rebounded on Wednesday, despite the announcement of a new increase in weekly U.S. oil inventories.

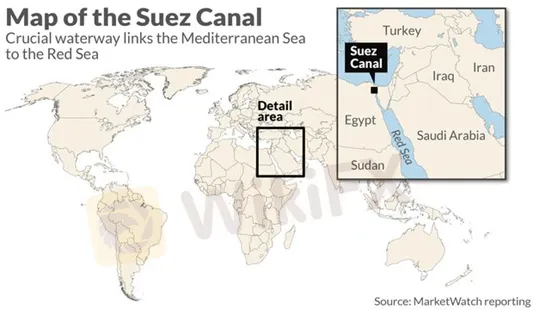

Oil prices rebounded on Wednesday, despite the announcement of a new increase in weekly U.S. oil inventories. For the week ended March 19, these inventories rose by 1.9 million barrels. Prices recovered after news that a container ship ran aground in the Suez Canal, blocking traffic on one of the world's busiest maritime trade routes, especially for oil tankers.

Around 16H10 GMT the U.S. barrel of WTI for the month of May gained 5.12% from the previous day's close to 60.72 dollars. The barrel of Brent North Sea for delivery in the same month was at the same time 63.89 dollars in London, up 5.10%.

Oil prices had lost 6% on Tuesday, after falling more than 6% last week, their biggest weekly decline since October 2020. After surging more than 30% since the beginning of the year, crude prices have begun a correction in recent weeks amid concerns about the third wave of coronavirus in Europe.

The intensification of restrictive measures against the pandemic, particularly in Germany and France, has raised fears of a slowdown in economic recovery, which is weighing on oil demand. In Germany, the Ifo institute has revised its growth forecast downwards on Wednesday to 3,7% in 2021 against +4,2% previously.

Investors today “are trying to gauge how long the massive container ship will block one of the world's busiest waterways,” said Edward Moya, an analyst at Oanda; to gauge the extent of the disruption to black gold supply as a result.

It was the Ever Given, a 400-meter-long ship flying the Panamanian flag and heading from Yantian (China) to Rotterdam, which ran aground on Tuesday across the canal.

(Chart Source: Tradingview 24.03.2021)

With traffic expected to resume “later today or Thursday,” crude prices are “settling in at their highs” in late European trading, Moya noted.

Disclaimer: This material has been created for information purposes only. All views expressed in this document are my own and do not necessarily represent the opinions of any entity.

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

澳洲ASIC 宣布高階主管領導層退出

黑平台Hengtuo Finance詐騙手法揭密:誆稱跟單操作黃金輕鬆賺,指控洗錢凍結帳戶拒出金

投資人請小心仿冒中信證券!誆稱充值贈高額禮金,藉故凍結帳戶騙繳費

最近很多人詢問T4Trade的評價,這家經紀商是詐騙嗎?監管情況與平台環境一次看

加密貨幣和外匯市場有什麼區別?

Bell Potter天眼評分滿高的,這家外匯券商好用嗎?

塞浦路斯CYSEC 對 16 家未經授權的投資公司發出警告

香港券商Global Immense高寶來傳交易糾紛,投資人申請出金1個月仍未到帳

匯率計算