Gold Prices Hint at Topping Before Jackson Hole Symposium

摘要:Gold prices may form a top if bearish technical cues find follow-through as all eyes turn to a speech by Fed Chair Powell at the Jackson Hole symposium.

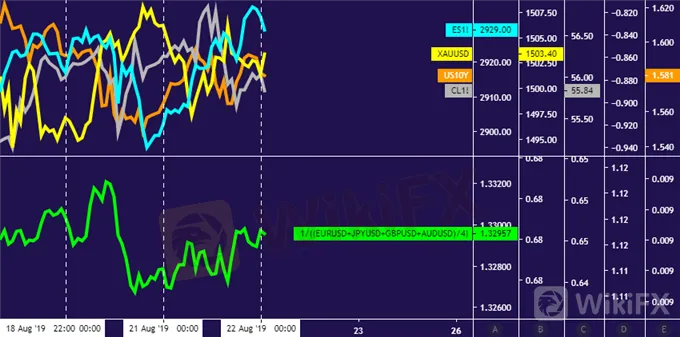

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

Gold prices mark time as all eyes turn to Jackson Hole symposium

Downturn may be in the cards as Powell cools rate cut speculation

ECB minutes, Eurozone PMI data may struggle for follow-through

The release of minutes from July‘s FOMC meeting did not inspire a strong response from financial markets. While the document reiterated that the central bank sees last month’s rate cut as a “mid-cycle adjustment” – downplaying scope for follow-on easing – stimulus-hungry financial markets refused to relent.

Indeed, Fed Funds futures still imply 50-75bps in further easing before year-end. Investors‘ defiant stance probably reflects lingering hope that the dated Minutes document will be superseded by promises of lavish accommodation to be unveiled at the US central bank’s symposium in Jackson Hole, Wyoming.

The gathering gets underway today, but the main event comes on Friday when Fed Chair Powell steps up to the microphone. The bar to exceed the markets ultra-dovish baseline outlook seems exceedingly high while the risk of disappointment appears outsized against the backdrop of still-solid economic data.

That probably bodes ill for gold. The appeal of the non-yielding metal is likely to be diminished if Mr Powell and company appear unwilling to commit to big-splash rate reduction. Cycle-geared crude oil prices look likewise vulnerable as fading faith in policy support sours market-wide risk appetite.

Directional conviction may be absent in the meanwhile. July ECB meeting minutes could cheer investors a bit if the central bank telegraphs fireworks with its own stimulus boost – a move whose likelihood might be reinforced by soft Eurozone PMI data – but Jackson Hole anticipation may contain follow-through.

GOLD TECHNICAL ANALYSIS

Gold prices are still treading water below Augusts high at 1535.03 but negative RSI divergence warns a turn lower may be ahead. A daily close below initial support at 1480.00 opens the door for a test of the 1437.70-52.95 area. Alternatively, a break of resistance targets a weekly chart inflection level at 1563.00.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are still grinding against resistance set from late April, now at 58.18. A daily close above that targets the 60.04-84 zone next. Alternatively, a reversal back below the 53.95-54.84 congestion area sets the stage to challenge the $50/bbl figure once more.

Crude oil price chart created using TradingView

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

每周收益率60%? FCA警告:远离非法平台CAPE FX LIMITED

中东危机形势不断加剧,但WTI油价仍震荡于 85.00 美元附近的区间

新西兰3月BNZ服务业表现指数再次陷入收缩,纽元/美元交投于 0.5950 附近

FCA揭露13家未授权公司在英国违规招揽客户

最新消息:加拿大 3 月份通胀率走高

由于美元走强,金价仍在2370美元附近低迷,缺乏后续抛售

干预担忧和地缘政治冲突之际,日元空头变谨慎

今日银价FXStreet数据显示白银下跌

中国将在2024年下半年进一步放宽政策以刺激经济增长 - 渣打银行

美国 3 月份工业生产如期增长 0.4%

汇率计算