Half of Europes Smaller Businesses Risk Bankruptcy Within Year

Abstract:LISTEN TO ARTICLE 1:00 SHARE THIS ARTICLE ShareTweetPostEmail Photographer: Alessia Pierdomenico/B

Over half of Europe‘s small and medium-sized businesses say they face bankruptcy in the next year if revenues don’t pick up, underscoring the breadth of damage wrought by the Covid-19 crisis.

One in five companies in Italy and France anticipate filing for insolvency within six months, according to a McKinsey & Co. survey in August of more than 2,200 SMEs in Europes five largest economies. Such businesses are key to the region, accounting for more than two-thirds of the workforce and more than half of the economic value-added.

The pandemic has hit European firms hard, with 70% reporting lower revenues. That level was even higher in Italy and Spain, reflecting the severity of the virus and lockdown measures in those countries.

{8}

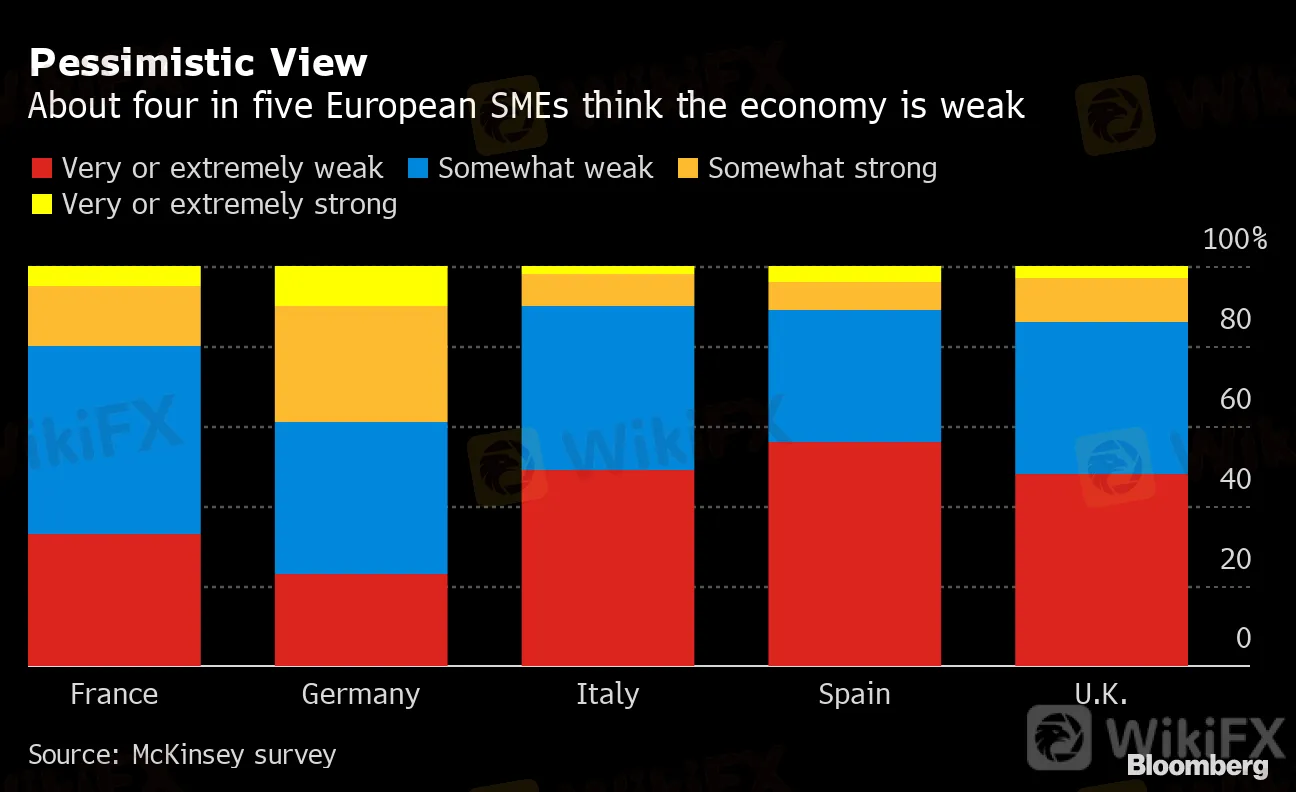

Pessimistic View

{8}

About four in five European SMEs think the economy is weak

{11}

Source: McKinsey survey

{11}

There‘s little optimism, with the vast majority describing the economy as weak. That’s leading to worries about loan defaults and the need for layoffs. The governments of all the surveyed nations have now announced further support for jobs in efforts to limit unemployment amid a resurgence of the virus.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator