Confused about various types of forex brokers? Helps you understand brokers in 3 mins! Part 2

Abstract:No Dealing Desk(NDD) - the trading scale of individual traders is small, and it is impossible to conduct forex transactions in the interbank market. NDD will connect both in order to provide trading opportunity to individual. Generally, NDD always charge commission fee or increase spread for keeping profit.

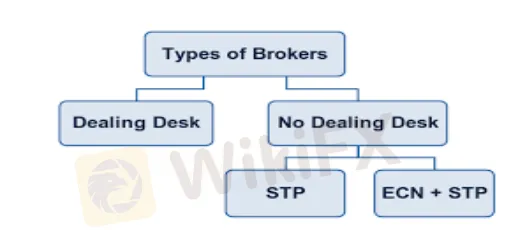

Different from DD, NDD can be divided into two categories: STP and ECN+STP.

STP: Straight though processing, the traders orders will be directly send to liquidity provider(also known as bank). Different STP forex broker has different quantity of liquidity providers. The buy/sell price quoted by each liquidity provider is different.

There are three key points of STP :

1: Providing liquidity: the better the liquidity is, the more favorable the buy/sell price is. If there are only one liquidity provider, then there is no price competition.

2: The types of spread. (fixed or floating ).

l The fixed spread : The spread is always fixed without adjustment based on the lowest buying price among multiple liquidity providers.

l The floating spread : the liquidity provider provides best buy/sell price, the STP broker will choose the best buy price from liquidity provider and the best sell price from broker. In this way, they can provide the lowest spread to customers.

3: Operation mode: ( instant execution or market execution)

l The instant execution will not be sent to market directly, it will be handled by brokers first.

l The market execution means order information will be sent to market directly and the price depends on liquidity provider

ECN:

Electronic Communications Network(ECN) allows customers to trade with other people. In other words, the customers order can interact with the order of other participants in the market. ECN forex traders provide participants with a market in which participants(banks, retail forex traders, hedge funds, brokers, etc.) trade with each other by sending competitive buy or sell quotations to the ECN system. Orders for all transactions will be matched in real time by a party in the opposite direction of operation. The ECN trading platform displays market depth in a data window. DOM (Depth Of Market) allows customers to see where other participants buy or sell orders, where there is liquidity, and the size of their own orders.

Conclusion:

ECN is the easiest way of forex trading. Broker benefits from charging commission not from spread.

Market makers make a profit through spread. The market makers classify customers into two types, loss-making customers and profitable customers. For loss-making transactions, instead of trading in the opposite direction, they become profits, and profitable transactions are sent to the interbank market for processing.

For NDD, with its transparent, anonymous and quick processing of orders, there is no operational platform to handle and observe brokers trading.

Generally speaking, the short-term traders who like daytime trading or scalping should choose low spread, because such traders trade frequently. For medium-and long-term traders, the spread is not as important as short-term or ultra-short-term.

Declaration:

The evidences in WikiFXs exposure articles are verified via the following processes:

1: Evidence Collection: (Chatting history records, Trading history records, Banking Transaction records and video recordings from victim).

2: These evidences will be evaluated and verified by experts who have been work in forex industry for many years.

3: The editor will review it again before the article is published.

WikiFX

App is a third-party inquiry platform for company profiles.WikiFX has

collected 17001 forex brokers and 30 regulators and recovered over

300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong

Kong Special Administrative Region of China, mainly provides basic

information inquiry, regulatory license inquiry, credit evaluation for

the listed brokers, platform identification and other services. At the

same time, Wiki has set up affiliated branches or offices in Hong Kong,

Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted

WikiFX to global users in more than 14 different languages, offering

them an opportunity to fully appreciate and enjoy the convenience

Chinese Internet technology brings. WikiFXs social media account as

below:

Facebook:

Singapore Area:https://www.facebook.com/wikifxsingapore/

USA Area:https://www.facebook.com/WikiFX.US

Nigeria Area:https://www.facebook.com/WikiFX.ng

LinkedIn:

Nigeria Area:https://www.linkedin.com/company/31506916

Twitter:

Nigeria Area:https://twitter.com/WikiFX_NG

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the WikiFX

Forum forum, which aims to provide urgently needed and professional

services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an

executive team will contact the broker to discuss the complaint or

expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With

24-hour real-time update of forex market data by minute, you can seize

the opportunity of every bullish market! Bookmark the link below and

follow the market trends immediately!

Singapore Area:https://live.wikifx.com/sg_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Webull Canada Unveils Desktop Trading Platform

Exploring the Top Three Artificial Intelligence Cryptocurrencies

Forex Fraud Exposed | California Man Hit with $9M Penalty by CFTC

Exposing Thunder Markets: A Trap of Deception and Exploitation

WikiFX Broker Assessment Series | Is Tradon Reliable?

Currency Calculator