Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Abstract:Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

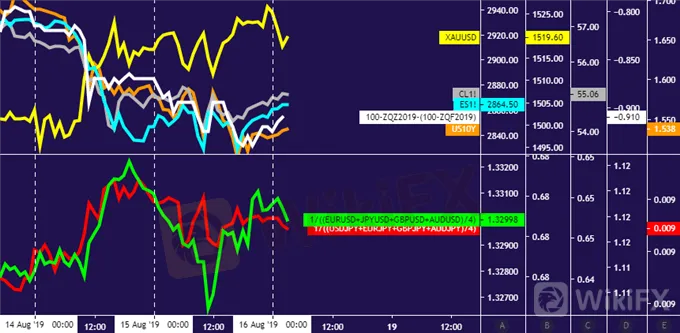

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

Gold prices may rise as markets tilt risk-off before the weekend

Crude oil prices vulnerable, might move to retest $50/bbl figure

Progress may be limited before FOMC minutes, Jackson Hole

Commodity prices idled Thursday as a lull in pace-setting news flow made room to digest recent volatility. From here, a relatively quiet offering on the economic data docket seems likely to keep broad-based market sentiment trends in control. The path of least resistance favors a risk-off scenario.

Sudden bursts of volatility have become increasingly common recently as prices react to eye-catching headlines from Washington and Beijing amid US-China trade war escalation. This probably has traders more leery than usual of holding pro-risk exposure over the weekend.

With that in mind, a round of defensive liquidation might pull down cycle-sensitive crude oil prices alongside stocks. A parallel dip in bond yields might have scope to push up gold, especially since the metal has managed gains even as the US Dollar trades higher recently.

Absent a burst of headline-driven volatility however, significant trend development seems unlikely. The week ahead brings critical inflection points in the Fed policy outlook – a defining macro input – by way of FOMC minutes and the Jackson Hole symposium. Commitment may be scarce in the interim.

GOLD TECHNICAL ANALYSIS

Gold prices are inching toward resistance at 1540.70, the 76.4% Fibonacci expansion. A daily close above that exposes a weekly chart inflection level at 1563.00 next. Negative RSI divergence hints upside momentum is ebbing however. A turn below the 61.8% Fib at 1513.94 targets the 50% level at 1492.31.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices slipped back below the lower bound of the 54.72-56.09 congestion area, breaking the weekly uptrend in the process. Sellers may now move test the 49.41-50.60 zone anew. A daily close above trend resistance set from late April – now at 58.53 – seems necessary to neutralize downward pressure.

Crude oil price chart created using TradingView

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

March 21, 2024 DAILY MARKET NEWSLETTER: Fed Hints at Rate Cuts, Stocks Surge

Consider including the date in your title for clarity.

Daily Market Newsletter - March 12, 2024: Market Recap: S&P 500 and Nasdaq Decline, Bitcoin Boosts Microstrategy to Record Highs

Insights from Trading Central's Global Research Desks

Stocks Dip, Bitcoin Surges, Euro Weakens | Daily Market Update

Tech Stocks Under Pressure, Inflation Data Looms

U.S. stock indexes retreated from their record-high levels. The Dow Jones Industrial Average dropped 274 points (-0.71%) to 38,380, the S&P 500 fell 15 points (-0.32%) to 4,942, the Nasdaq 100 was down 29 points (-0.17%) to 17,613.

Nvidia (NVDA) gained 4.79% to $693.32, marking a third consecutive record close. Goldman Sachs raised its price target on the stock to $800. Tesla (TSLA) fell 3.65% to $181.06, the lowest close since May 2023. ON Semiconductor (ON) jumped 9.54% as fourth-quarter results exceeded market expectations.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator