OANDA

Abstract:OANDA is a well-known online forex broker that has been operating for over two decades. With a reputation for transparency and reliability, OANDA offers a wide range of trading products and services, including forex, CFDs, commodities, and indices. Founded in 1996, OANDA is headquartered in New York City and is regulated in multiple jurisdictions, including the US, UK, Canada, Australia, and Japan. This ensures that OANDA operates within strict regulatory frameworks and offers a high level of security and protection to its clients. OANDA offers a range of trading platforms, including its proprietary platform, as well as the popular MT4 platform. The broker also provides a range of educational resources and tools to help traders improve their trading skills and stay up-to-date with market developments. In terms of customer support, OANDA has a 24/7 customer service team that can be reached via phone, email, or live chat.

| OANDA | Basic Information |

| Registered Country/Region | Australia |

| Founded in | 1996 |

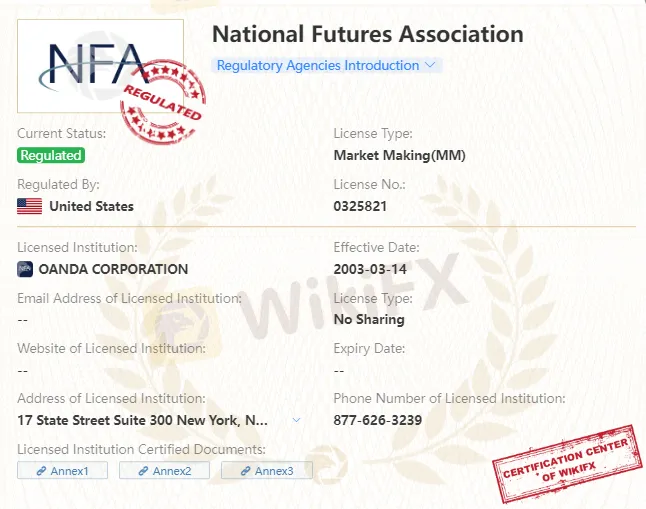

| Regulation | CFTC, FCA, ASIC, IIROC, MAS, NFA, FSA |

| Min. Deposit | No minimum deposit |

| Max. Leverage | 1:50 (US), 1:30 (EU), 1:200 (other regions) |

| Min. Spreads | From 0.6 pips (EUR/USD pair) |

| Trading Instruments | Forex, CFDs, indices, commodities, bonds |

| Trading Platforms | OANDA Trade, MetaTrader 4, API Trading |

| Payment Methods | Bank transfer, credit/debit cards, PayPal |

| Customer Support | 7/24 phone, email, live chat |

Overview of OANDA

OANDA is a well-known online forex broker that has been operating for over two decades. With a reputation for transparency and reliability, OANDA offers a wide range of trading products and services, including forex, CFDs, commodities, and indices.

Founded in 1996, OANDA is headquartered in New York City and is regulated in multiple jurisdictions, including the US, UK, Canada, Australia, and Japan. This ensures that OANDA operates within strict regulatory frameworks and offers a high level of security and protection to its clients.

OANDA offers a range of trading platforms, including its proprietary platform, as well as the popular MT4 platform. The broker also provides a range of educational resources and tools to help traders improve their trading skills and stay up-to-date with market developments. In terms of customer support, OANDA has a 24/7 customer service team that can be reached via phone, email, or live chat.

Pros & Cons

OANDA is a well-established forex and CFD broker with a range of features and services that may appeal to traders of all levels. As with any broker, there are both pros and cons to consider before deciding whether to open an account. Some of the key advantages of OANDA include its regulatory status, extensive range of instruments, competitive spreads, and variety of trading platforms. However, it is important to note that OANDA also has some potential drawbacks, such as limited deposit and withdrawal options, high non-trading fees, and a lack of negative balance protection. Understanding both the positives and negatives of trading with OANDA can help traders make informed decisions about whether this broker is the right fit for their needs.

| Pros | Cons |

| Regulated by top-tier authorities | Limited product portfolio |

| Competitive spreads and low trading fees | High inactivity fees |

| No minimum deposit requirement | Limited research tools |

| Variety of trading platforms | Negative reviews and complaints on customer support |

| Educational resources and tools | Limited payment options |

| Strong financial background | No professional account offered |

Is OANDA legit or a scam?

OANDA is a legitimate forex broker that has been in operation for more than 20 years and is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC). OANDA has also won numerous awards for its trading services and technology, including being named the “Best Forex Broker” by the Financial Times and Investors Chronicle for three consecutive years. However, as with any financial service, it is important for traders to conduct their own research and due diligence before deciding to trade with OANDA or any other broker.

Market Instruments

OANDA offers a wide range of trading instruments to its clients, allowing them to diversify their investment portfolio and take advantage of various market opportunities. The market instruments offered by OANDA include:

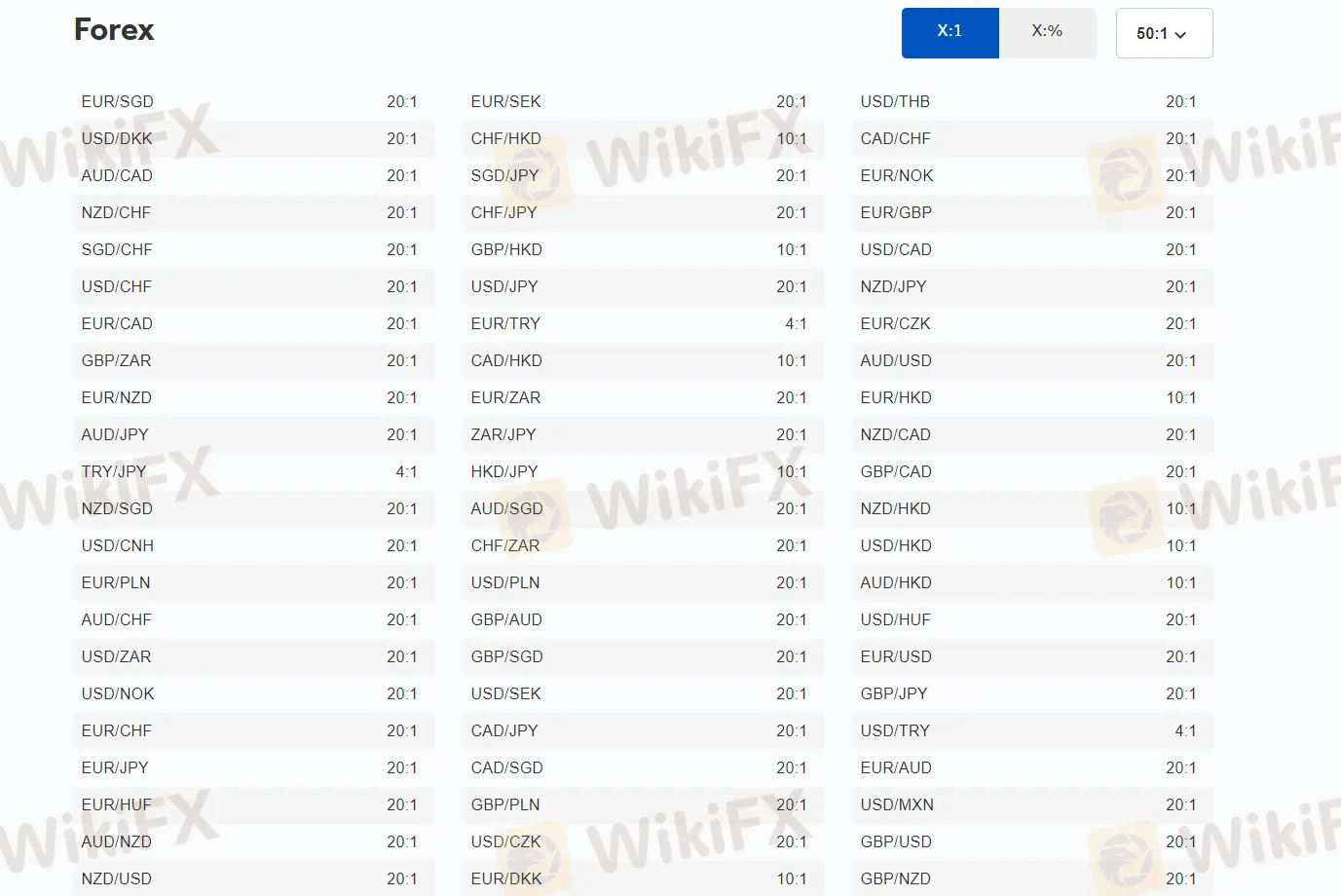

Forex: OANDA provides access to a wide range of currency pairs, including major, minor, and exotic pairs. The forex market is the largest and most liquid market in the world, offering traders the potential for high returns.

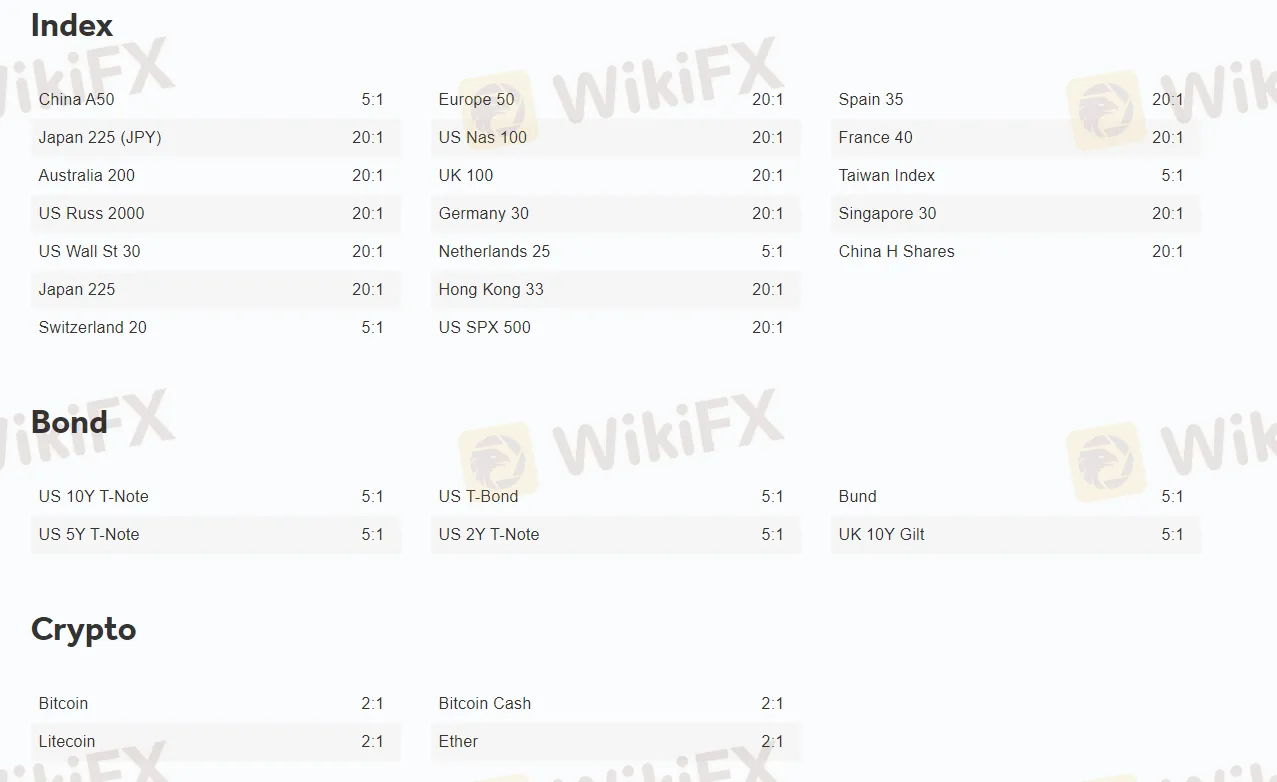

Indices: OANDA offers trading in a variety of global indices, such as the US 500, UK 100, and Germany 30. These indices represent the performance of a basket of stocks and provide traders with exposure to a broader market.

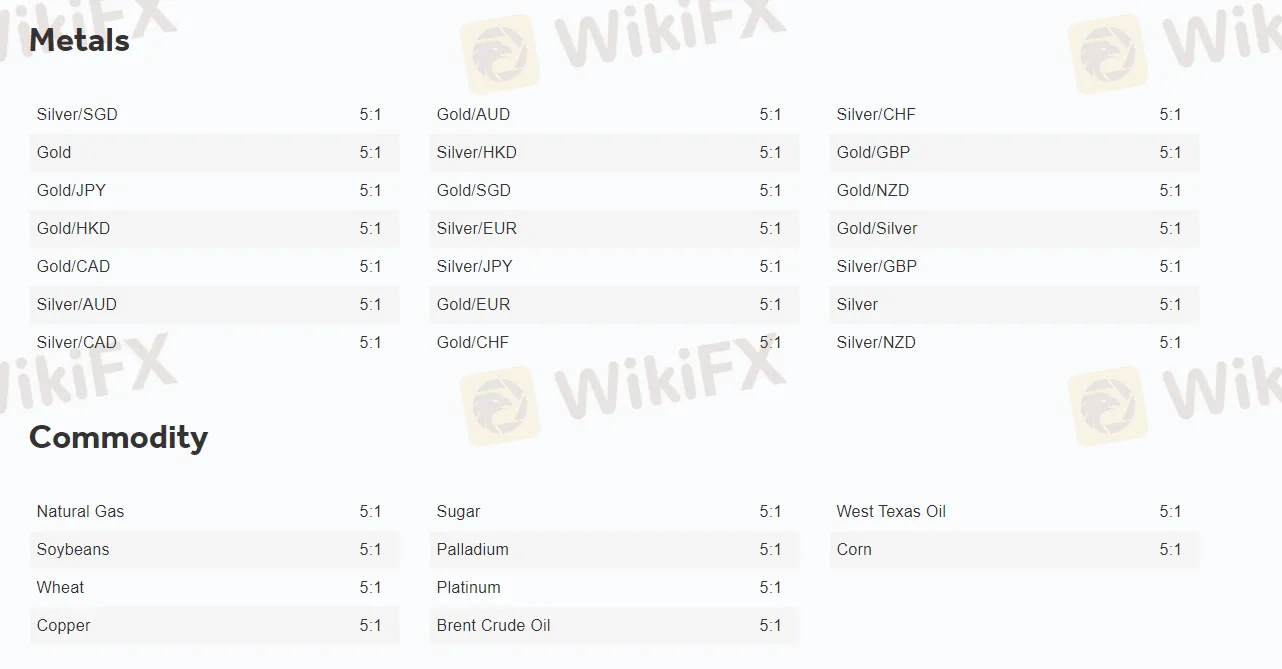

Commodities: OANDA offers trading in commodities such as precious metals, energy, and agricultural products. These markets can be highly volatile, but they offer the potential for significant returns.

Bonds: OANDA offers trading in government bonds from a variety of countries, providing traders with exposure to the fixed-income market.

Cryptocurrencies: OANDA offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The cryptocurrency market is highly volatile and can offer traders significant opportunities.

Bonds: OANDA also offers a range of bond CFDs to trade, including US Treasury Bonds, UK Gilts, and Euro Bunds. With bond trading, traders can access a wide range of bond markets and potentially benefit from price movements in global interest rates.

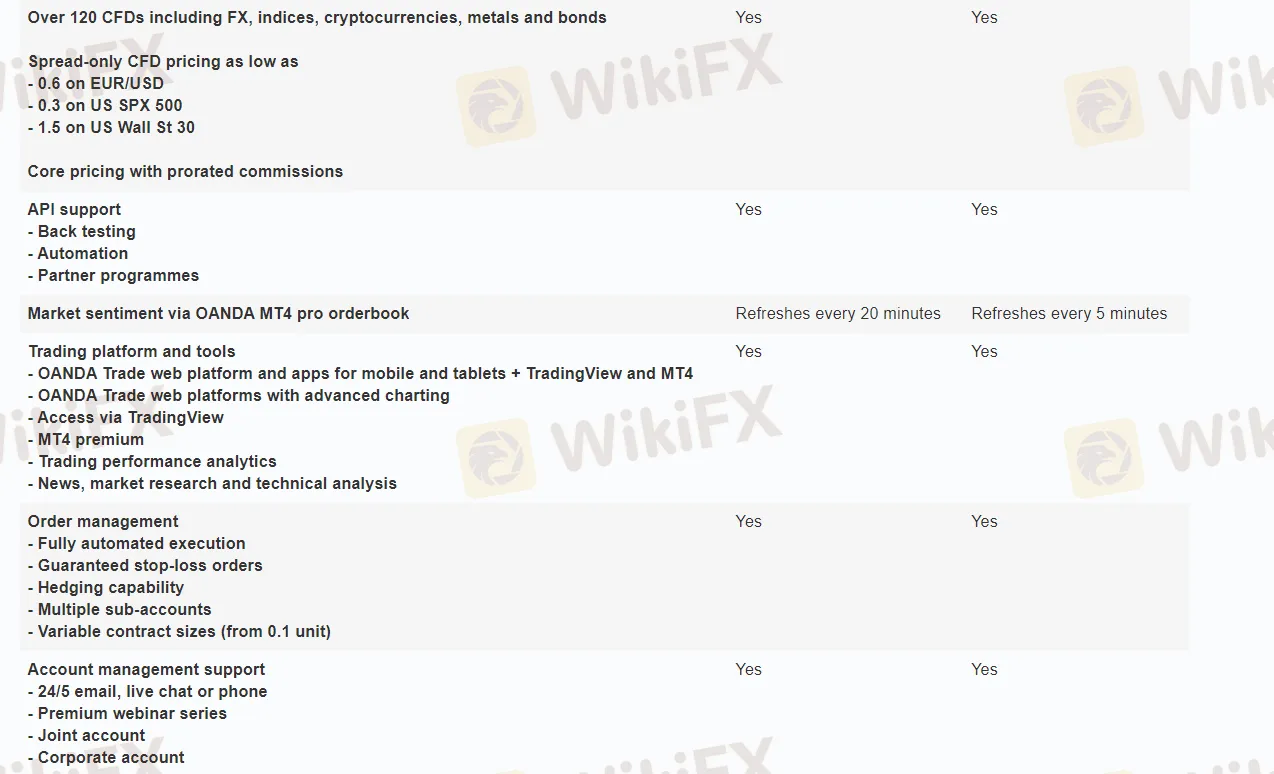

Account Types

OANDA offers two live account types to cater to different trading needs and experience levels of traders. Here are the account types offered by OANDA:

Standard Account: This account type is suitable for new traders who are just starting in the forex market. The minimum deposit requirement for this account is $0, and it offers access to the core features of OANDA's trading platform, including over 70 currency pairs, commodities, and indices.

Premium Account: This account is designed for more experienced traders who require additional features and services. The minimum deposit requirement for this account is $20,000, and it offers tighter spreads, lower trading costs, and a dedicated relationship manager.

Apart from two live trading accounts, OANDA also offers a free demo account, which allows traders to practice trading with virtual funds in a risk-free environment. The demo account provides access to all the features and tools of the OANDA platform, allowing traders to test their strategies and trading skills without risking real money.

| Pros | Cons |

| No minimum deposit requirement | Limited leverage offered |

| Multiple account types to choose | No professional accounts available |

| Wide range of trading instruments | Inactivity fee charged after 12 months of inactivity |

| Commission-free trading | |

| Negative balance protection | |

| Free demo account available |

How to open an account?

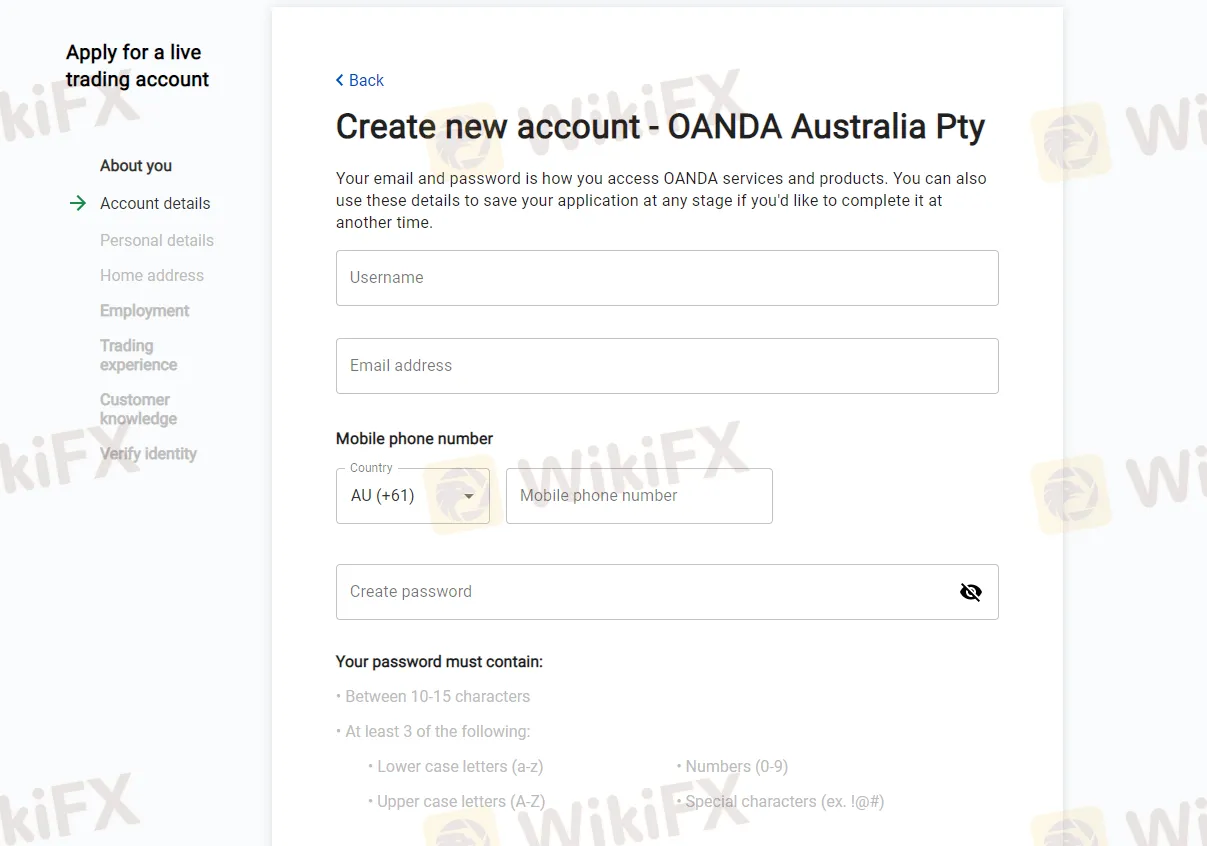

Visit the official OANDA website and click on the “Open an Account” button.

Choose the type of account you want to open.

Fill in your personal information, including your name, address, date of birth, and employment status.

Provide some additional information, such as your trading experience, investment goals, and financial status.

Agree to the terms and conditions of the account and submit your application.

Once your application is approved, you will receive an email with instructions on how to fund your account.

Follow the instructions to deposit funds into your account and start trading.

Leverage

OANDA offers leverage up to 50:1 for major currency pairs and up to 20:1 for minor currency pairs, commodities, and indices. However, leverage may vary based on the regulatory requirements of the country where the trader is located. It is important to note that high leverage can increase both profits and losses, and traders should carefully consider their risk tolerance before using leverage.

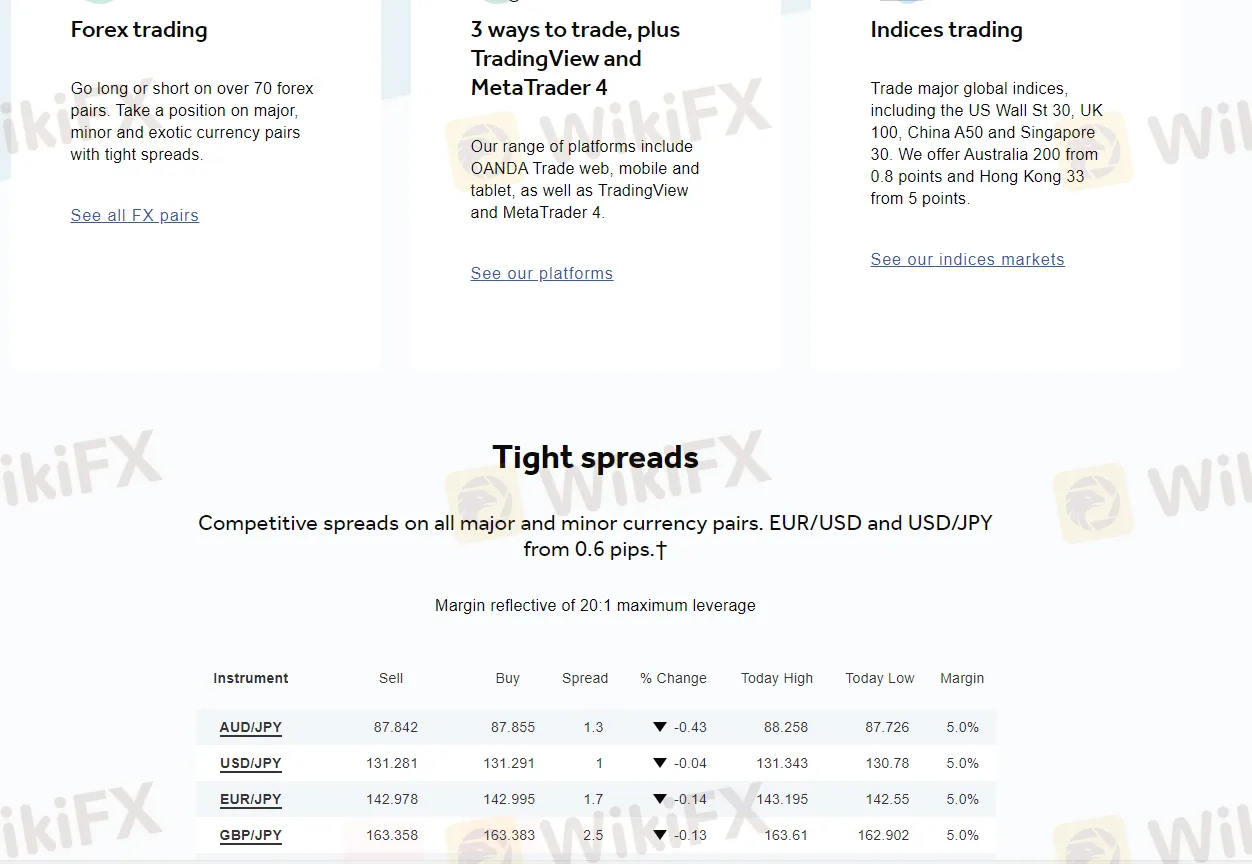

Spreads & Commissions (Trading Fees)

OANDA charges variable spreads that start from as low as 0.1 pips on major currency pairs. OANDA's spreads can vary depending on market volatility and liquidity, but they tend to be lower than the industry average.

In terms of commissions, OANDA does not charge any commissions on trades. Instead, the broker earns revenue from the spreads on trades. This can be a plus for traders who prefer to avoid paying commissions.

It's worth noting that OANDA also offers a range of order types, including limit, stop-loss, and take-profit orders, which can help traders manage their risk and maximize their profits.

Here is the combined data for EUR/USD, gold, and UK100 spreads from three brokers:

| Broker | EUR/USD | Gold | UK100 |

| OANDA | 0.9 pips | 25 cents | 1.4 pips |

| FP Markets | 0.0 pips | 35 cents | 1.0 pips |

| Exness | 0.3 pips | 35 cents | 0.5 pips |

Non-Trading Fees

OANDA also charges certain non-trading fees, which include:

Inactivity fee: OANDA charges an inactivity fee of 10 units of the account's base currency per month if there has been no trading activity for a period of 12 months or more. This fee can be avoided by simply placing a trade during this period.

Financing/rollover fees: If a position is held overnight, OANDA charges a financing/rollover fee. This fee is based on the interest rate differential between the two currencies involved in the trade and is calculated using the following formula: (trade size x interest rate differential x 1/365).

Deposit/withdrawal fees: OANDA does not charge deposit fees, but some withdrawal methods may incur a fee. For example, bank wire withdrawals within the US incur a $20 fee, while international wire withdrawals incur a $35 fee.

Conversion fees: If you are depositing or withdrawing funds in a currency other than your account's base currency, OANDA charges a conversion fee. This fee varies depending on the currency and the amount being converted.

Trading Platform

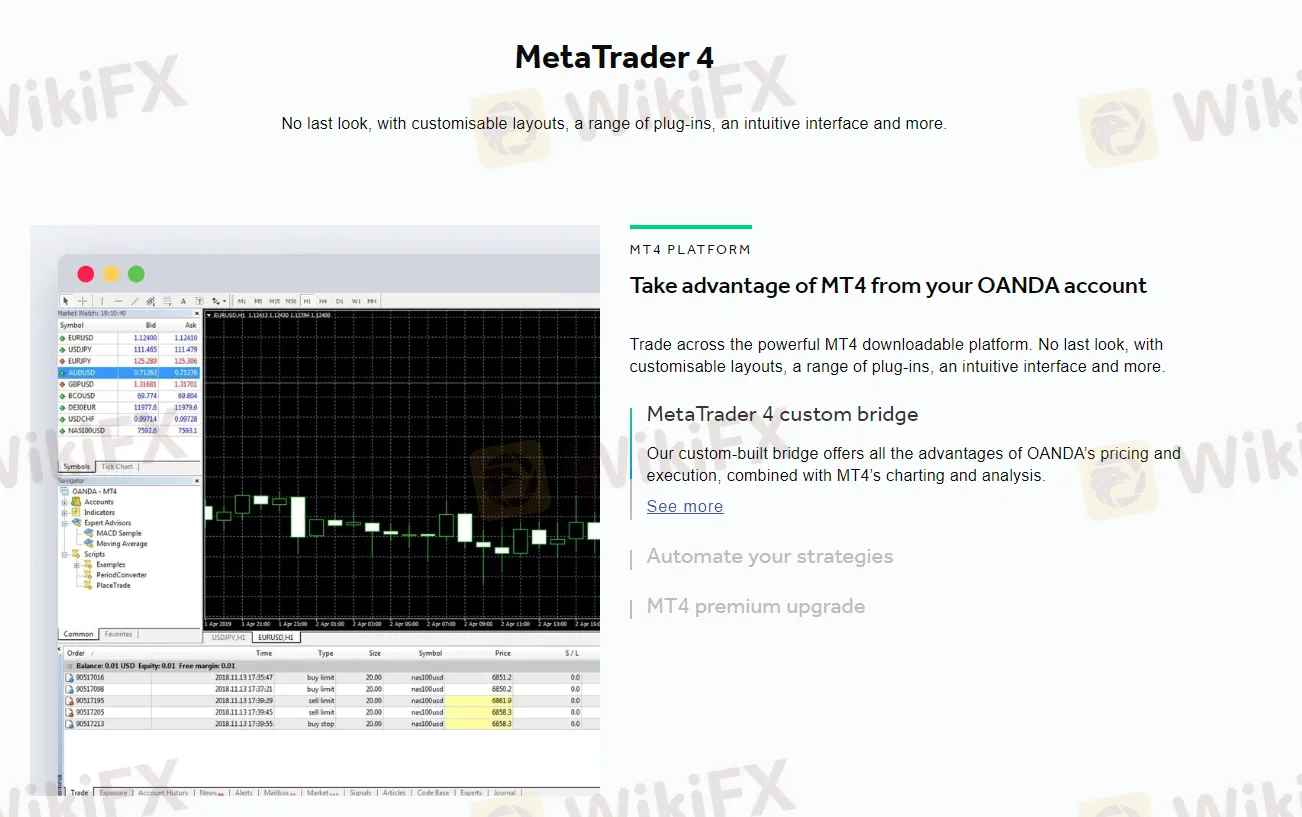

OANDA offers multiple choices of trading platforms, namely MetaTrader 4 (MT4), OANDA Web Trading Platform, and OANDA Trade.

MetaTrader 4 (MT4): This is a widely used trading platform in the forex industry, popular for its advanced charting tools and automated trading capabilities. OANDA offers MT4 to its clients as a downloadable desktop application and mobile app.

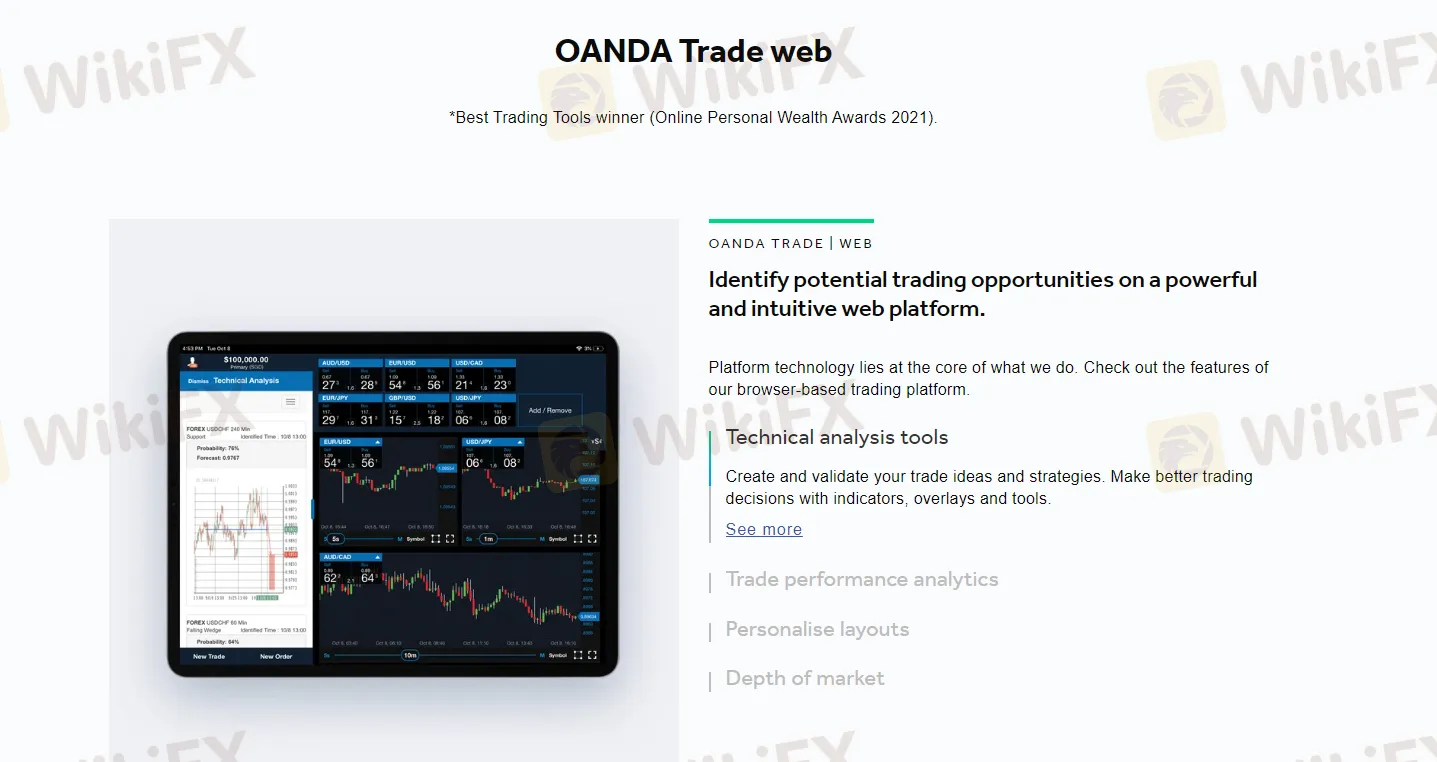

OANDA offers a proprietary trading platform called OANDA Trade, which is available in both web-based and mobile versions. The platform is highly customizable and offers a wide range of charting tools, technical indicators, and order types.

OANDA Web Trading Platform: This is a web-based platform accessible from any device with internet connectivity. It offers a user-friendly interface and customizable features for traders to analyze the market and execute trades.

Here is a comparison table of the trading platforms offered by OANDA, Avatrade, and IC Markets:

| Broker | Trading Platform | Desktop | Web | Mobile |

| OANDA | OANDA Platform | ✔ | ✔ | ✔ |

| MetaTrader 4 | ✔ | ✔ | ✔ | |

| MetaTrader 5 | ✔ | ✔ | ✔ | |

| Avatrade | AvatradeGO | ✖ | ✔ | ✔ |

| MT4 | ✔ | ✔ | ✔ | |

| MT5 | ✔ | ✔ | ✔ | |

| IC Markets | cTrader | ✔ | ✔ | ✔ |

| MetaTrader 4 | ✔ | ✔ | ✔ | |

| MetaTrader 5 | ✔ | ✔ | ✔ | |

| WebTrader | ✖ | ✔ | ✔ |

Trading Tools

OANDA provides several trading tools to its clients, including:

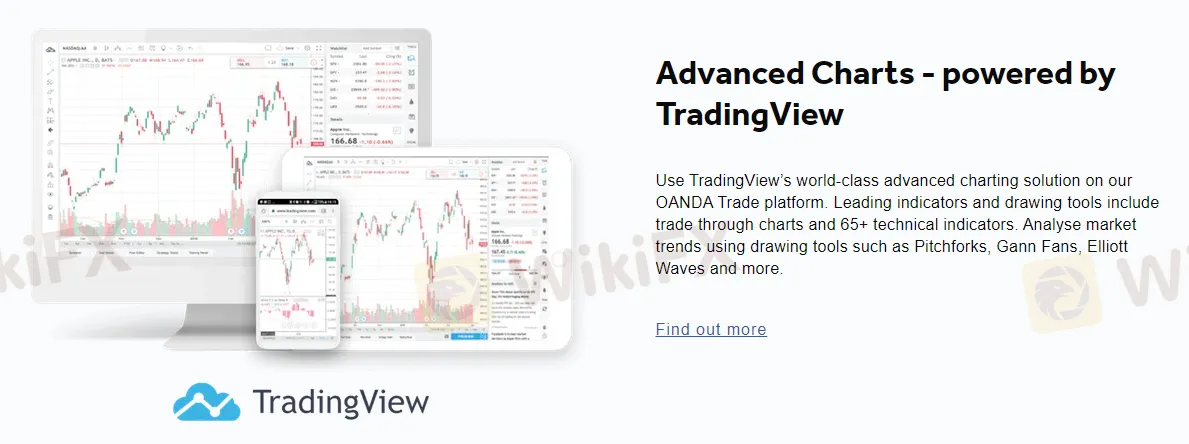

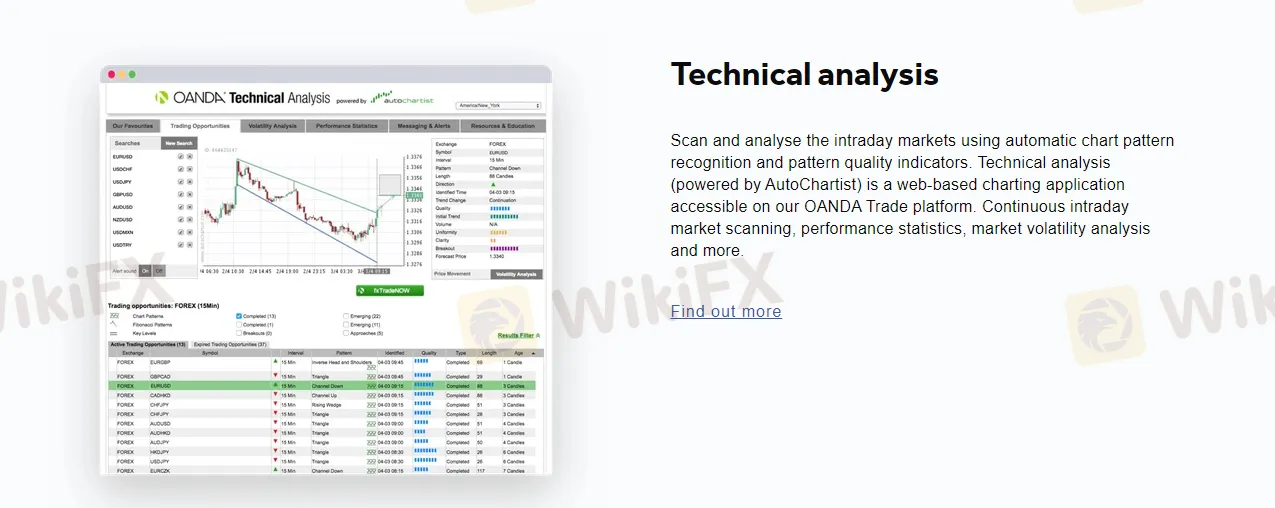

Advanced Charting: OANDA's advanced charting tools offer technical analysis and indicators to help traders make informed decisions.

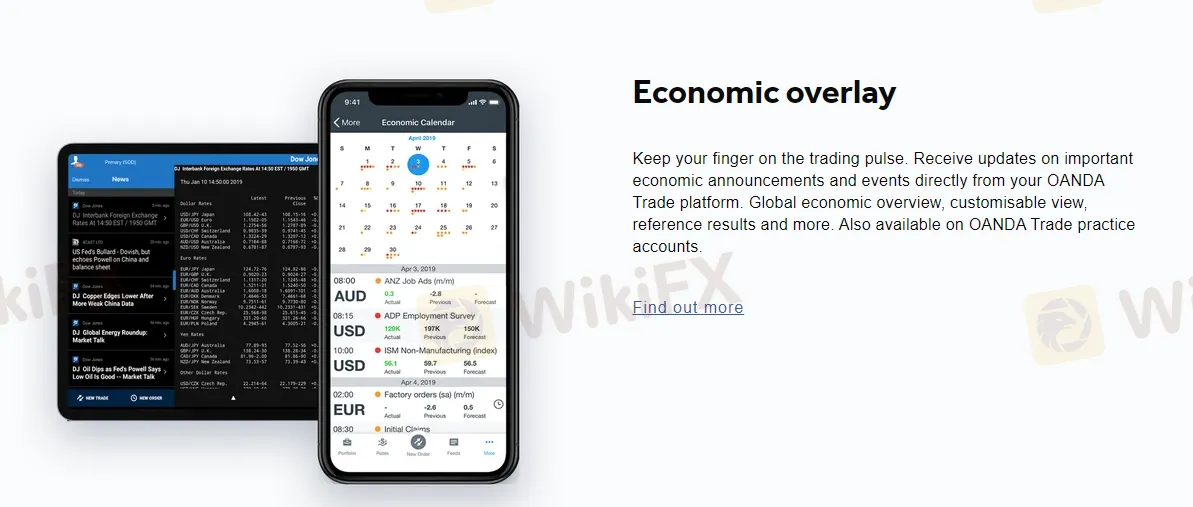

Economic Calendar: OANDA's economic calendar provides real-time updates on important economic events and news releases that can affect the markets.

Partners & VPS: OANDA partners with TradingView, a leading charting platform, to provide its clients with advanced charting and analysis tools. OANDA also partners with MotiveWave, a professional trading platform, to offer advanced technical analysis tools and trading strategies. In addition, OANDA offers a virtual private server (VPS) service to traders who require uninterrupted trading connectivity.

Deposit & Withdrawal

Deposit

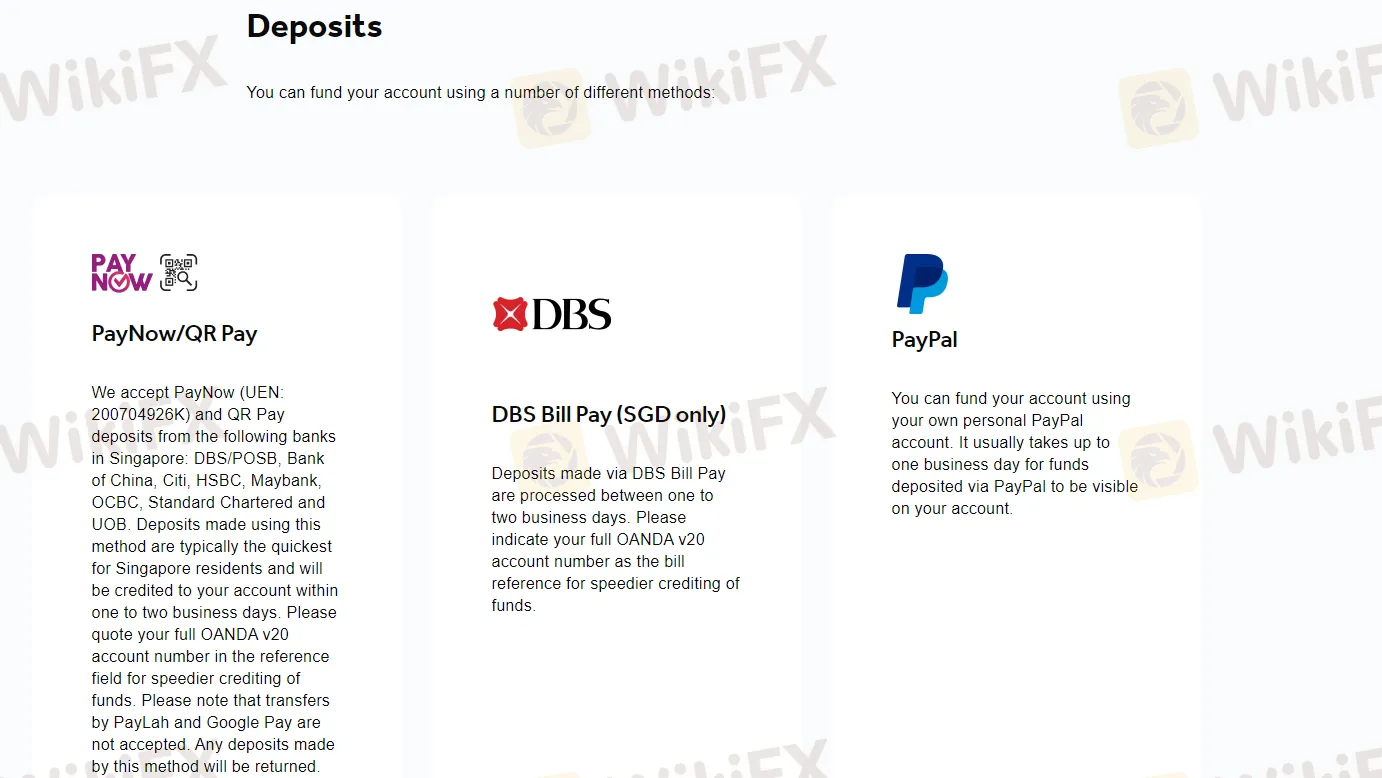

OANDA offers several deposit methods, including:

PayNow/QR Pay: This payment method is available for Singapore residents only. It allows for instant deposits into your trading account. Deposits from the following banks in Singapore: DBS/POSB, Bank of China, Citi, HSBC, Maybank, OCBC, Standard Chartered and UOB, are accepted.

DBS Bill Pay (SGD only): Another payment method available only for Singapore residents, DBS Bill Pay allows you to make SGD-denominated deposits into your trading account.

PayPal: PayPal is a popular online payment system that is accepted by OANDA. It allows you to make instant deposits and withdrawals from your trading account.

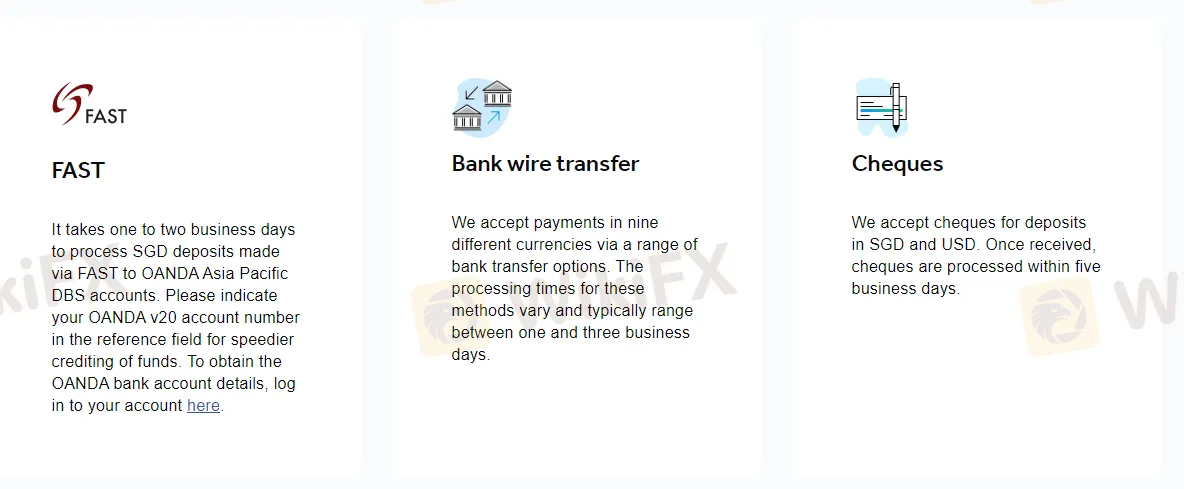

FAST: FAST (Fast and Secure Transfers) is a real-time interbank payment and settlement system in Singapore. It allows for instant SGD-denominated deposits into your trading account.

Bank wire transfer: You can also fund your trading account via bank wire transfer. This method typically takes 1-2 business days to process.

Cheques: Cheques are accepted for deposits only, and they must be in SGD currency.

Withdrawal

While withdrawals that can be done are limited to three channels: PayPal, Bank Wire Transfer, and Cheque.

Paypal: This is an online payment system that allows you to send and receive money electronically. To use this method for withdrawal, you will need to have a verified Paypal account that is linked to your OANDA trading account. Withdrawals are typically processed within 1-2 business days.

Bank Transfer: This method involves transferring funds from your OANDA trading account directly to your bank account. The time it takes to receive your funds will depend on your bank's processing time. OANDA does not charge any fees for bank transfers, but your bank may have its own fees.

Cheque: You can request to receive your funds via cheque, which will be sent to your registered address. It typically takes around 7-10 business days to receive your cheque. However, there may be additional fees for this method, depending on your location.

| Pros | Cons |

| Multiple deposit methods offered | Limited withdrawal methods |

| No fees charged on deposits | Withdrawals may take longer to process |

| Fast processing time for most deposit methods | Minimum withdrawal amount may vary by method |

| Deposit amounts in multiple currencies | No option to withdraw to credit/debit cards |

Customer Support

OANDA offers customer support services through various channels, including email, live chat, phone, and social media. The support team is available 24/7 to assist traders with any issues they may encounter during their trading journey.

One notable feature of OANDA's customer support is its multilingual support, which is available in several languages, including English, Chinese, French, German, Italian, Japanese, Korean, Portuguese, Russian, Spanish, and Turkish.

In addition to its customer support services, OANDA provides a comprehensive FAQ section on its website, which covers various topics, including account management, trading platforms, technical analysis, and more. The FAQ section is a valuable resource for traders who may have common questions and want quick answers without contacting customer support.

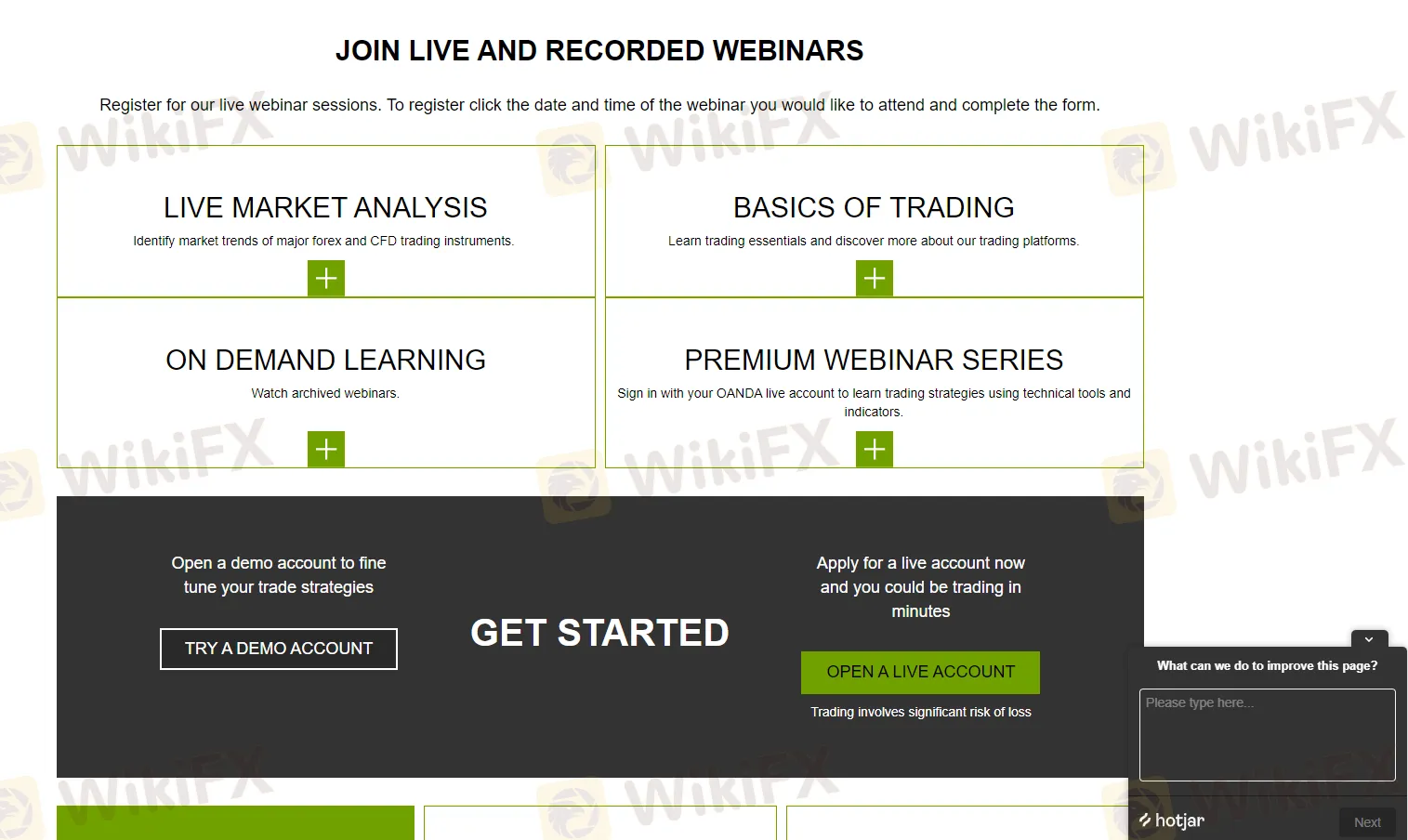

Educational Resources

OANDA offers a wealth of educational resources to its clients, enabling them to develop their trading skills and stay up-to-date with the latest market trends. Whether you are a beginner or an experienced trader, OANDA's educational resources cater to your needs.

One of OANDA's important educational resources is the OANDA Academy, which offers a range of educational materials, including videos, tutorials, webinars, and articles, covering a wide range of trading topics, from the basics of forex trading to advanced trading strategies.

Additionally, OANDA provides clients with a variety of market analysis tools and resources, including market news, economic indicators, and trading signals, enabling traders to stay informed about the latest market trends and make informed trading decisions.

Conclusion

OANDA is a well-established online broker that offers a variety of trading instruments, account types, and platforms to its clients. The broker is regulated by multiple reputable authorities and has been operating for more than two decades, which gives it credibility and reliability. Additionally, OANDA provides several trading tools, educational resources.

However, it is important to note that OANDA has received a significant number of complaints regarding its customer support, trading platforms, and pricing policies. While the broker has taken steps to address these issues, they still raise concerns about the overall quality of its services.

Overall, OANDA is a legitimate and reputable broker that offers a range of benefits to its clients. However, potential traders should be aware of the complaints and consider them before making a decision to open an account with OANDA. As with any investment, it is important to conduct thorough research and due diligence to ensure that the broker aligns with your trading needs and preferences.

Frequently Asked Questions (FAQs)

Q: Is OANDA regulated?

A: Yes, OANDA is regulated by multiple financial regulatory authorities around the world, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

Q: What is the minimum deposit required to open an account with OANDA?

A: The minimum deposit required to open an account with OANDA varies depending on the account type and the regulatory jurisdiction. In general, it ranges from $0 to $20,000.

Q: What trading instruments are available on OANDA's platform?

A: OANDA offers a wide range of trading instruments, including forex, CFDs, commodities, bonds, and stock indices.

Q: Does OANDA charge commissions on trades?

A: OANDA does not charge commissions on trades. Instead, they make money from the spread, which is the difference between the bid and ask price.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

eToro Introduces Onfido Selfie Motion Biometric Authentication Feature

eToro, the online brokerage platform, has unveiled its latest innovation: the Onfido Selfie Motion biometric authentication feature.

Midas Raises $45M for Türkiye Financial Services Expansion

Fintech start-up Midas has achieved a significant milestone by raising $45 million in equity funding, marking the largest Series A fundraising by a Turkish fintech firm, and the second largest across sectors.

eToro and 21Shares Launch Innovative Crypto Portfolio

eToro collaborates with 21Shares to introduce a dynamic, data-driven crypto investment portfolio for retail investors.

NAGA Shareholders Overwhelmingly Approved Merger with CAPEX.com

The Extraordinary General Meeting of NAGA shareholders has voted overwhelmingly in favour of the merger with CAPEX.com, reaching an impressive 99.81% approval rate.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator