Gold Price Forecast: XAU/USD up for the second consecutive week above $1,790 after Powell comments

Abstract:XAU/USD ended the day in a high tone, clung above $1,790.00. Fed’s Chairman Powell: High inflation will likely last well into next year. XAU/USD: Has an upward bias, but higher US bond yields and market sentiment could impact the non-yielding metal.

Gold (XAU/USD) finished the day at $1,792.59 for a 0.54% gain at the time of writing. The yellow metal had a roller-coaster session, reaching a daily high at $1,813.82, then retreating the move down to $1,782.76, on Federal Reserve Chairman Jerome Powell comments at a virtual appearance at the Bank for International Settlements event.

Powell speech: High inflation will likely last well into next year

On Friday, Fed Chairman Jerome Powell commented that the US central bank is on track to begin the bond taper. Furthermore, he added that if the economy evolves as the Fed expected, the QE reduction program will finish by half of 2022. Nevertheless, he reinforced that once the bond taper ends, that would not mean hiking rates afterward.

Regarding inflation, Powell said that inflation would remain higher well into the following year. However, they [Fed] still expect it would move down towards the Fed 2% target. Moreover, he added that “If we [Fed] see persistent inflation, we will use our tools.”

Markets reaction

The US Dollar Index recovered some of its losses but ended the day in the red, lost 0.16%, closed at 93.60. The 10-year benchmark note rate dropped 3.7 basis points (bps) down to 1.638%.

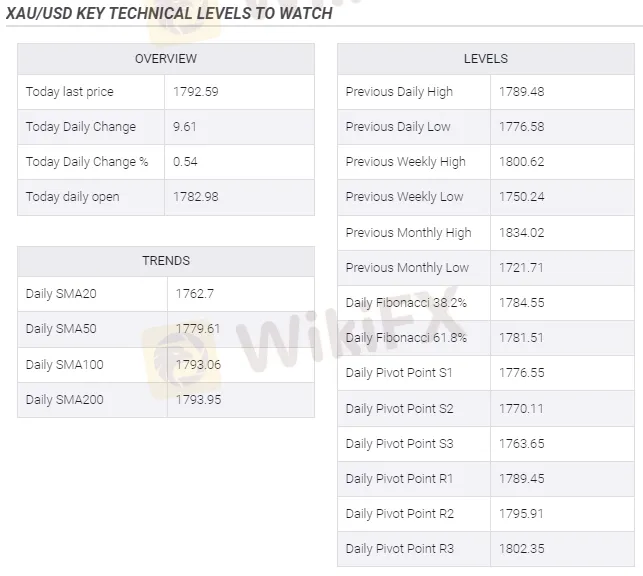

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart depicts that the yellow metal is under heavy selling pressure. The 100 and the 200-day moving averages (DMAs) finished the session on top of the spot price, indicating that gold is under some selling pressure. Momentum indicator like the Relative Strength Index (RSI) at 58 shows the yellow metal is tilted to the upside, but to exacerbate an upward move, it will need a daily close above $1,800.00.

In that outcome, the first resistance level would be the confluence of a downward slope trendline with the September 3 high at $1,833.83. A sustained break above the latter could accelerate the XAU/USD rally towards $1,900.00.

On the flip side, another failure at $1,800.00 will keep gold prices trapped within the weekly range of $1,760.00-$1,800.00 range.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

Easy Trading Online in Trader Fair Thailand Expo 2024

The Traders Fair Thailand 2024 was successfully held at Bangkok Shangri-La Hotel on February 3rd. As an exhibitor and sponsor, Easy Trading online attended the Expo with professional service team and extraodinary online trading experience on FX & CFDs.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator