GBP/JPY rallies at five-year highs, braces to 157.00

Abstract:The British pound continues its rally against the Japanese yen on the back of BoE’s hiking rates expectations. The market sentiment is upbeat, boosting risk-sensitive currencies like the Sterling. Japanese Finance Minister said that currency stability is “very important” and will keep an eye on the forex market moves.

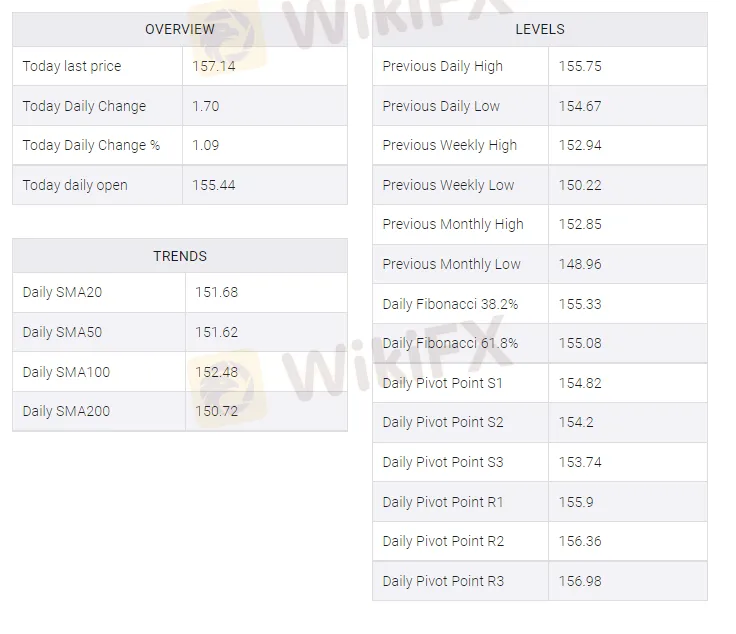

The GBP/JPY extends its seven-day rally during the New York session, advances 1.09%, is trading at 157.14 at the time of writing. As witnessed by the US equity stocks rising between 0.48% and 1.13%, risk-on market sentiment in the financial markets weighs on the safe-haven yen.

The British pound and the New Zealand dollar are the stronger currencies in the forex market, whereas the Japanese yen is the laggard. Factors like risk appetite and central bank divergence exert additional pressure on the yen.

Since Monday of this week, the British pound has been on the right foot against the yen. Over the last weekend, members of the Bank of England expressed concerns about higher energy prices, which in part spurred consumer prices that passed the levels tolerated by the central bank. That said, Michael Saunders, and Governor Andrew Bailey, talked openly about the need for higher rates to contain inflationary pressures.

In the meantime, Finance MinisterShunichi Suzuki said that currency stability is “very important” and that Japans government will scrutinize the economic impact of the forex market moves. Further added, that “we will continue to closely watch currency market moves and their impact on the economy.”

GBP/JPY Price Forecast: Technical outlook

The weekly chart depicts that the cross-currency is at five-year highs, approaching the June 2016 swing highs, around 160.10, which is the next resistance for the GBP/JPY pair.

The GBP/JPY is in an uptrend, confirmed by the Relative Strenght Index (RSI) at 66, aiming higher, accelerating toward oversold levels, but with room left, for another leg-up. However, to resume the upward trend, it will need a close above 157.00.

GBP/JPY Key additional levels to watch

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator