Blueberry Markets-Some Important Points about This Broker

Abstract:Blueberry Markets, a trading name of BLUEBERRY MARKETS PTY LTD, is an Australian broker established in 2016 that is committed to offering not only low spreads but also a range of currency pairs and CFDs online trading services to its clients.

Note: Blueberry Markets official site - https://www.blueberrymarkets.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Australia |

| Found | 2016 |

| Regulation | Regulated by ASIC |

| Market Instrument | forex currency pairs, and CFDs on commodities, shares, cryptocurrencies, and indices |

| Account Type | Standard & Direct |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread (EUR/USD) | from 0.8 pips |

| Commission | Standard: $0, Direct: $7 |

| Trading Platform | MT4 & MT5 |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | credit/debit cards, bank transfers, crypto wallets, PayPal, Skrill, Neteller, POLi, fasapay, dragon pay, and BPay |

General Information

Blueberry Markets, a trading name of BLUEBERRY MARKETS PTY LTD, is an Australian broker established in 2016 that is committed to offering not only low spreads but also a range of currency pairs and CFDs online trading services to its clients.

Despite the risks associated with Blueberry Markets, they offer a wide range of market instruments for trading. Clients can access over 300 instruments, including forex, share CFDs, crypto CFDs, commodities, metals, and indices. The broker operates in multiple regulated markets and keeps client funds segregated in a trust account, providing some level of security. Blueberry Markets offers two types of trading accounts: the Blueberry Standard Account and the Blueberry Direct Account. The Blueberry Standard Account has spreads starting from 1.0 pips and no commission charges, while the Blueberry Direct Account offers raw spreads starting from 0.0 pips with a commission fee of $7 per trade. The broker provides access to popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer a range of features, customization options, and tools for analysis and automation. Blueberry Markets also offers a web trader platform for access through web browsers.

Pros and Cons

Blueberry Markets provides a wide range of investment assets and the opportunity to implement trading strategies. It grants access to popular cryptocurrencies and offers low spreads on cash indices. The availability of segregated accounts and an easy-to-use web platform are notable features. The platform also supports automated trading capabilities and provides a full suite of alerts and risk management tools. However, the unregulated status of Blueberry Markets raises concerns, as does the lack of specific details about spreads and leverage. The absence of regulatory oversight and limited information about trading conditions may deter some potential users. Additionally, there have been complaints and potential issues related to order execution and withdrawal processing time. It is important to consider these pros and cons, along with other factors, when assessing the suitability of Blueberry Markets as a trading platform.

| Pros | Cons |

| Wide range of investment assets | Unregulated status of Blueberry Markets |

| No fees for most deposit methods | Complaints received |

| Access to popular cryptocurrencies | Potential risk associated with unregulated brokers |

| Low spreads on cash indices | Limited information about the trading conditions |

| Free demo account with virtual funds | Lack of transparency regarding potential fees |

| Accessible on various devices | Withdrawal processing time may vary |

| Customizable charts and indicators |

Is Blueberry Markets Legit?

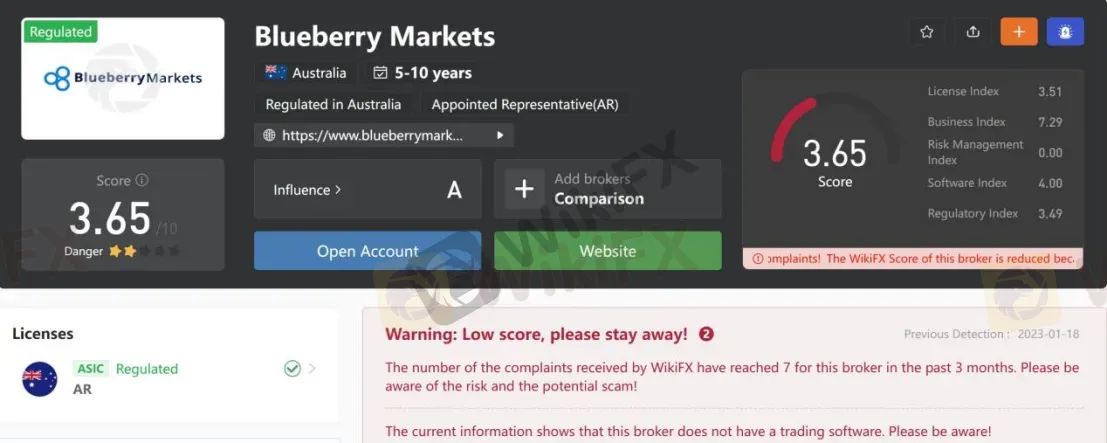

As for regulation, it has been verified that Blueberry Markets is regulated by Australia Securities & Investment Commission - ASIC. That is why its regulatory status on WikiFX is listed as “Regulated”.

Note: The screenshot date is January 18, 2023. WikiFX gives dynamic scores, which will update in real time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

Blueberry Markets offers investors a wide range of investment assets, including forex currency pairs, and CFDs on commodities, shares, cryptocurrencies, and indices.

Forex: Blueberry Markets offers trading in more than 60 currency pairs, providing the opportunity to implement trading strategies with minimal slippage.

Share CFDs: Clients can go long or short on Australian or US companies of their choice. Trading CFD contracts in shares comes with a fixed leverage of 5:1.

Crypto CFDs: Blueberry Markets enables users to buy and sell leading cryptocurrencies, such as Bitcoin, through the popular MT5 platform.

Commodities & Metals: Trading spot gold and spot silver contracts against the US dollar is available with spreads, starting from 0.0 pips on the pro account.

Indices: Blueberry Markets allows trading in popular indices, offering low spreads on cash indices like the UK 100, S&P 500, and Wall Street.

| Pros | Cons |

| Wide range of investment assets | Unregulated status of Blueberry Markets |

| Opportunity to implement trading strategies | Lack of specific details about spreads and leverage |

| Access to popular cryptocurrencies | Potential risk associated with unregulated brokers |

| Low spreads on cash indices | Limited information about the trading conditions |

| Segregated accounts available |

Account Types

BLUEBERRY STANDARD ACCOUNT

The Blueberry Standard Account requires a minimum deposit of $100. With this account, the costs are already included in the spread, meaning that all the profit made by the trader belongs to them. Spreads start from 1.0 pips, and there is no commission charged for trades. Traders who prefer traditional spread pricing may find this account type suitable. It supports a maximum leverage of 1:500 and a minimum trade size of 0.01. The Blueberry Standard Account allows trading on over 300 instruments and is compatible with popular trading platforms such as MT4, MT5, and Web Trader.

BLUEBERRY DIRECT ACCOUNT

On the other hand, the Blueberry Direct Account also requires a minimum deposit of $100. This account type offers raw spreads with a commission fee charged over every trade. Spreads start from 0.0 pips, but there is a commission of $7 per trade. It is designed for traders who prefer raw spreads and fixed commissions. Like the Blueberry Standard Account, the Blueberry Direct Account supports a maximum leverage of 1:500, a minimum trade size of 0.01, and provides access to over 300 tradable instruments. It can be accessed through platforms such as MT4, MT5, and Web Trader.

| Pros | Cons |

| Access to over 300 instruments | Commission fee on every trade (Blueberry Direct Account) |

| Minimum deposit of $100 | Potential higher costs with commission fees (Blueberry Direct Account) |

| Costs included in the spread, allowing all profits to belong to the trader | Potential for higher spreads starting from 1.0 pips (Blueberry Standard Account) |

| No commission charged for trades (Blueberry Standard Account) | Limited options for traders who prefer raw spreads (Blueberry Standard Account) |

| Maximum leverage of 1:500 | Potential higher spreads starting from 0.0 pips (Blueberry Direct Account) |

| Minimum trade size of 0.01 | Limited availability of trading platforms (MT4, MT5, and Web Trader) |

How to Open an Account

To open an account with Blueberry Markets, follow these steps:

Visit the Blueberry Markets website and click on the “Create live account” button or the “Open demo account” button if you prefer to start with a demo account.

2. On the registration page, enter your email address and choose a password for your account. By proceeding, you agree to the Privacy Policy.

3. Click on the “Register” button to create your login credentials.

4. Complete the application form provided by Blueberry Markets. This form is designed to gather necessary information about you as a trader and is fast and secure.

5. Once you have submitted your application, you may be required to verify your identity online or upload identification documents if requested by Blueberry Markets.

6. After your application is approved, you can proceed to fund your account. Blueberry Markets offers multiple funding methods. Choose the most suitable option for you and deposit funds into your account.

Leverage

As regularly leverage ratios fall under regulatory restrictions, Blueberry Markets being an Australian brokerage still allows high leverage ratios up to the maximum leverage of 1:500 for Forex instruments, and default at 1:30 for AU resident clients.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

The spreads on Blueberry Markets Standard accounts start at 1.0 pips, and there are no trading commissions. For Direct accounts, spreads start at 0.0 pips, and commissions are $7 per lot (clients with over 50k trading volume negotiable).

Trading Platform

Blueberry Markets offers two main trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly rated and trusted by both beginner and experienced traders. The platforms provide a range of features and tools for accurate trading analysis, as well as the ability to automate trading through custom algorithms or Expert Advisors.

MetaTrader 4 (MT4) is an advanced trading platform that offers customization options with thousands of online tools to plug in. It supports one-click trading, quick order execution, VPS hosting, and various pending order types and trailing stops. The charts are fully customizable and provide in-depth trading history. MT4 also allows traders to build their own algorithms or import Expert Advisors.

MetaTrader 5 (MT5) is a multi-asset trading platform that allows trading in forex, indices, commodities, cryptocurrencies, and stocks from a single account. It offers six types of pending orders, a wide range of technical indicators and analytical objects, quick order execution, and customizable platform options. MT5 also provides features such as an economic calendar, copy trading, and virtual hosting.

In addition to MT4 and MT5, Blueberry Markets offers a web trader platform. This web-based platform allows traders to access their accounts and trade directly from their web browsers without the need for software installation. It supports one-click trading, real-time trade monitoring, and compatibility with all leading browsers.

Overall, the trading platforms provided by Blueberry Markets offer a feature-rich environment with tools for analysis, customization, and automation. Here is a table summarizing the pros and cons of the platforms:

| Pros | Cons |

| Easy-to-use web platform | Not regulated |

| Customizable charts and indicators | Lack of regulatory oversight |

| Automated trading capabilities | Complaints received |

| Full suite of alerts and risk management tools | Lack of trading software |

| Free demo account with virtual funds | Potential issues with order execution |

| Accessible on various devices | |

| Multi-asset trading capabilities | |

| Wide range of technical indicators | |

| Copy trading feature and Virtual hosting (MT5) |

Deposit & Withdrawal

Blueberry Markets offers a range of deposit and withdrawal methods for clients. For deposits, clients can choose from options such as bank wire, China Union Pay, credit card, cryptocurrency, Dragonpay, FASA, Neteller, Paytrust, Perfect Money, Skrill, STICPAY, and THB QR Payment. These methods have varying availability based on location and support different currencies. The minimum deposit amounts range from $100 to $300, and there are no fees associated with deposits. Processing times for deposits are generally within 24 hours, although bank wire transfers may take 3 to 7 business days.

When it comes to withdrawals, clients have similar options available, including bank wire, China Union Pay, credit card, cryptocurrency, Dragonpay, FASA, Neteller, Paytrust, Perfect Money, Skrill, STICPAY, and THB QR Payment. Withdrawals can be made globally, with the exception of China Mainland for some methods. The minimum withdrawal amount is $50, and the maximum withdrawal limits vary depending on the method. Processing times for withdrawals range from 1 to 7 business days. It's important to note that additional fees may apply for certain withdrawals, such as intermediary fees for bank wire transfers and potential fees imposed by Skrill and STICPAY.

In summary, Blueberry Markets provides clients with a range of deposit and withdrawal options, supporting various currencies and accommodating different client preferences. While the minimum deposit and withdrawal amounts are reasonable, it's important to consider factors such as processing times and potential fees associated with certain withdrawal methods.

| Pros | Cons |

| Wide range of payment options | Lack of transparency regarding potential fees |

| Quick processing times for deposits | Withdrawal processing time may vary |

| No fees for most deposit methods | Potential intermediary fees for certain withdrawal methods |

| Availability in multiple countries | Limited availability for specific payment methods |

| Supports various currencies | Lack of regulation and oversight |

Trading Tools

Blueberry Markets offers various trading tools to assist traders in their decision-making and market analysis. Here are the types of trading tools available:

1. Market News & Analysis: Blueberry Markets provides up-to-date market news and analysis to help traders stay informed about market trends and make well-informed trading decisions. This includes trading plans, methods, bullish and bearish divergence analysis, and live foreign exchange charts with indicators for major and minor currency pairs.

2. Week Ahead for Trading: Traders can access in-depth weekly analysis of the forex market from trading experts at Blueberry Markets. This analysis helps traders understand the upcoming market trends and potential trading opportunities.

3. Economic Calendar: Blueberry Markets offers an economic calendar that highlights important economic events and indicators. Traders can stay updated on key economic releases and plan their trading strategies accordingly.

4. Trading Hours: Blueberry Markets provides information on market hours and trading sessions. This helps traders know the active trading hours for different markets and adjust their trading activities accordingly.

5. Weekly Newsletter: Traders can subscribe to Blueberry Markets' weekly newsletter, which delivers market insights and comprehensive how-to guides straight to their inbox. This newsletter provides additional valuable information and trading tips.

By utilizing these trading tools, traders can enhance their market analysis, stay updated on important events, and make more informed trading decisions.

| Pros | Cons |

| Comprehensive market news and analysis | Lack of specific details about the newsletter |

| Weekly analysis for upcoming market trends | Limited customization options for tools |

| Economic calendar for key events | No mention of real-time market data or signals |

| Trading hours information | Lack of specific details about the newsletter |

| Weekly newsletter with market insights | Potential reliance on external sources for news |

Educational Resources

Blueberry Markets offers a range of educational resources to enhance your trading skills. They provide a structured Trading Program divided into Beginner, Intermediate, and Advanced levels. These courses cover everything from basic concepts to advanced trading indicators in the financial markets.

For beginners, there are courses that introduce the fundamental concepts of buying and selling in Forex. Intermediate traders can access materials that help them level up their knowledge and skills. Advanced traders can benefit from courses that focus on identifying hidden opportunities and mastering risk management.

Blueberry Markets also provides video tutorials on their YouTube channel. These tutorials cover various topics suitable for traders at all levels. From platform tutorials to understanding Forex trading sessions, leverage, spreads, and choosing a Forex broker, these videos offer valuable insights and tips to trade smarter.

By offering a combination of structured Trading Program courses and informative video tutorials, Blueberry Markets aims to empower traders with the knowledge and skills necessary to succeed in the Forex market.

Pros and Cons

| Pros | Cons |

| Structured Trading Program for all skill levels | Limited information about the depth of course content |

| Beginner, Intermediate, and Advanced courses | Lack of interactive or live educational sessions |

| Comprehensive coverage of trading concepts | No mention of additional resources or materials |

| Video tutorials covering various topics | No feedback or assessment mechanism for learning progress |

| Insights and tips for trading smarter | Limited information on the expertise of instructors |

| Accessible on YouTube for easy viewing | No information on any community or peer support |

| Aims to empower traders with necessary knowledge | No mention of ongoing updates or additions to content |

Customer Support

Blueberry Markets provides customer support through various channels. You can contact them via telephone at +61 2 8039 7480 or reach out to them via email at support@blueberrymarkets.com. They are also present on social media platforms including Twitter, Facebook, Instagram, YouTube, and LinkedIn. For direct communication, you can visit their office located at Level 4/15 Blue Street North Sydney NSW 2060, Australia.

Conclusion

In conclusion, Blueberry Markets is an unregulated brokerage firm with potential risks and scams. The lack of valid regulation raises concerns about the safety and security of investments. The broker has received multiple complaints in recent months, further emphasizing the potential dangers involved. While Blueberry Markets offers access to a wide range of market instruments and provides trading platforms like MT4 and MT5, the absence of specific details about spreads and leverage, as well as limited information about trading conditions, poses a disadvantage. Traders should exercise caution and consider regulated alternatives for their investments to ensure a higher level of protection.

Frequently Asked Questions (FAQs)

| Q 1: | Is Blueberry Markets regulated? |

| A 1: | Yes. Blueberry Markets is regulated by ASIC. |

| Q 2: | Does Blueberry Markets offer the industry-standard MT4 & MT5? |

| A 2: | Yes. Both MT4 and MT5 are available at Blueberry Markets. |

| Q 3: | What is the minimum deposit for Blueberry Markets? |

| A 3: | The minimum initial deposit at Blueberry Markets to open an account is $100, |

| Q 4: | Is Blueberry Markets a good broker for beginners? |

| A 4: | No. Blueberry Markets is not a good choice for beginners. The official site is unavailable currently and it seems that it is offshore. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

High-score brokers: Easter Event Season S2: Get easter eggs and enjoy multiple rewards

We are glad to announce that the high-score brokers: Easter event season S2 has started. The season will last from April 2024 to May 2024. During this event, participants can get easter eggs and enjoy multiple rewards. WikiFX has listed some brokers that offer luxury gifts or cashback bonuses for you.

WikiFX Broker Assessment Series | Is Voyage Markets Reliable?

In this article, we'll look in-depth at Vogage Markets, examining its key features. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

B2Broker Bolsters Leverage for FOREX, BTC, and ETH Trading

B2Broker increases leverage for major FOREX pairs to 1:200 and for BTC and ETH to 1:50, enhancing trading flexibility.

Leverate Losses ICF Membership & CIF Authorization

CySEC recently addressed the termination of Leverate Financial Services Ltd.'s membership in the Investors Compensation Fund (ICF), clarifying that clients remain eligible for compensation despite the loss of membership, while highlighting broader regulatory actions and enforcement measures undertaken by the commission.

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

CLONE FIRM ALERT

Morgan Stanley Fined $90,000 for Supervisory Failures

FOREX TODAY: AHEAD OF MID-TIER DATA, THE US DOLLAR RETREATS FROM MULTI-MONTH HIGHS.

Currency Calculator