US Dollar Outlook: USD/JPY on Fire as Yields Soar Post-Powell

Abstract:US Dollar Outlook: USD/JPY on Fire as Yields Soar Post-Powell

USD/JPY price action trading at its strongest level in nine months at the 108.00-handle

US Dollar bulls propelled the DXY Index sharply higher as the bond selloff accelerated

Fed Chair Powell downplays the impact of surging yields on broader financial conditions

The US Dollar is flying high today with signs of strength across the board of FX peers. US Dollar gains were most notable against the Euro and Yen. USD/JPY soared over 90-pips on the session while EUR/USD plunged as Fed Chair Jerome Powell unleashed a surge in Treasury yields. The latest extension of the bond selloff sent the 10-year Treasury yield exploding past the 1.55% level, which further improved US interest rate differentials and energized US Dollar bulls.

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (05 OCT 2020 TO 04 MAR 2021)

Chart by @RichDvorakFX created using TradingView

On balance, the broader DXY Index spiked 0.75% to eclipse its 100-day simple moving average and upper Bollinger Band. Unsurprisingly, the recent acceleration in US Dollar buying pressure has corresponded with an upswing in both the MACD indicator and relative strength index. Nearside technical resistance for the DXY Index stands out around its 04 February swing high. Surmounting this obstacle could bring the 61.8% and 78.6% Fibonacci retracement levels of the November 2020 to January 2021 bearish leg into focus. Rejecting its year-to-date high might motivate US Dollar bears to set their sights on the 20-day simple moving average.

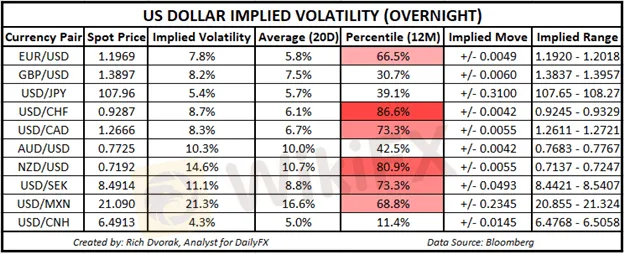

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

FX volatility has been heating up on the heels of recent bond market volatility. Interestingly, even despite today‘s move, USD/JPY overnight implied volatility of 5.4% is below its 20-day average reading of 5.7%. This suggests an implied range of a mere 62-pips. AUD/USD and NZD/USD are expected to be among the most active major currency pairs during Friday’s trading session judging by their respective overnight implied volatility readings of 10.3% and 14.6%. The upcoming release of monthly nonfarm payrolls data, due 05 March at 13:30 GMT, stands out as high-impact event risk facing the US Dollar. Learn more about how to trade the NFP report here.

-----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience! https://bit.ly/2XhbYt5

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator