GBP/USD May See Deepened Loss

Abstract:GBP/USD created the deepest loss since March after experiencing a surge early this year and a slump in September.

WikiFX News (2 Oct.) - GBP/USD created the deepest loss since March after experiencing a surge early this year and a slump in September. The main theme for the pair this year lies in the Brexit and the outbreaks of COVID-19. In the last quarter of 2020, where will the British pound move to?

Technically speaking, GBP/USD dwindled straightly towards the 200-SMA (Simple Moving Average), a watershed between the upbeat and downbeat sentiment, after breaching the Rising Wedge support. The path of least resistance for the pair is expected to be lower as the RSI (Relative Strength Index) is approaching the oversold territory and the MACD indicator has fallen below the zero line.

Moreover, the negative slope of both the 21- and 50-DMA indicates a swelling bearish momentum, which could ultimately drive the price down to the confluent support crossed at the April high of 1.2648 and the uptrend extending from the May low of 1.2183 if the 200-DMA is unable to stifle selling pressure. On the contrary, a short-term recovery could be on the cards if price can climb back above the June high of 1.2813. Once there is a close above the August low of 1.2981 and the 50-DMA of 1.2960, the March high of 1.3200 may carve a path for a retest.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

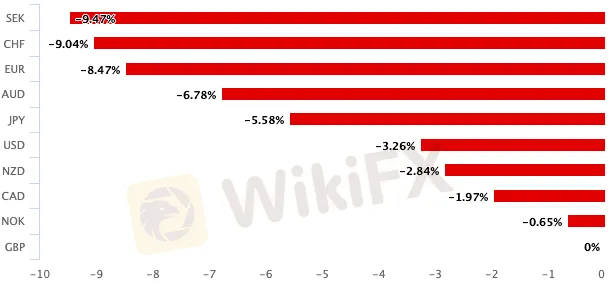

Chart: Comparison of Currencies; GBP is 2020's worst performing currency.

Chart: Trend of GBP/USD

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

New Products Launch in April

We are pleased to announce that STARTRADER will launch new products on April 22nd, 2024 to provide clients with a broader portfolio of products.

Market Closure in April

Please be advised that the following instruments' trading hours and market session times will be affected by the upcoming April holidays.

Rollover Notification in April

Please be advised that the following CFD instruments will be automatically rolled over as per the dates in the table below. As there can be a pricing difference between old and new futures contracts, we recommend clients to monitor their positions closely and manage positions accordingly.

Market Closure in April

Please be advised that the following instruments' trading hours and market session times will be affected by the upcoming April holidays.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator