Gold Prices May Fall as US CPI Data Cools Fed Rate Cut Bets

Abstract:Gold prices may turn lower as US inflation data prints near the Feds target, cooling increasingly dramatic speculation about an incoming interest rate cut cycle.

GOLD & CRUDE OIL TALKING POINTS:

Gold prices probe higher, but chart setup warns of exhaustion

US CPI data may cool Fed rate cut bets, boost the US Dollar

Crude oil prices up on Aramco earnings, API inventories due

Gold prices rose as market-wide risk appetite unraveled once again, pushing bond yields lower alongside stocks and boosting the appeal of non-interest-bearing alternatives. The usually sentiment-geared crude oil prices managed to sidestep the selloff as Saudi state-owned oil giant Aramco revealed it slashed capital spending by a hefty 12 percent in the past year, stoking bets on reduced supply.

GOLD, CRUDE OIL PRICES MAY FALL AS US CPI DATA COOLS FED RATE CUT BETS

Looking ahead, Julys US CPI data dominates the spotlight. The core inflation rate is expected to print at 2.1 percent while the headline number ticks up from a four-month low to 1.7 percent on-year. While the Fed targets the perennially lower PCE measure of price growth (1.6 percent on-year as of June), outcomes in line with expectations may nevertheless cool Fed rate cut speculation.

As it stands, the markets are certain that more easing is due at next month‘s FOMC meeting, with a 67.7 percent chance of a 25bps cut and a nontrivial 32.4 percent probability of a 50bps one. For its part, the central bank has been far less exuberantly dovish in its guidance than investors’ bets imply. Firm CPI data might pointedly suggest that markets have over-extrapolated.

Gold prices seem likely to suffer if the baseline outlook for Fed monetary policy is adjusted to a relatively less-dovish setting. The shift would probably boost the US Dollar and undermine the appeal of a non-yielding anti-fiat alternative. The Greenbacks gains may be amplified as diminished scope for accommodation in the current jittery environment makes for a risk-off tilt to overall sentiment trends.

Crude oil may revert to its place on the pro-risk side of the global asset spectrum, which would make it vulnerable in this scenario. API inventory flow data might muddy the waters somewhat however. It will be judged against expectations of a 1.57-million-barrel drawdown expected to emerge out of official EIA numbers due Wednesday.

Get our free guide to help build confidence in your gold and crude oil trading strategy!

GOLD TECHNICAL ANALYSIS

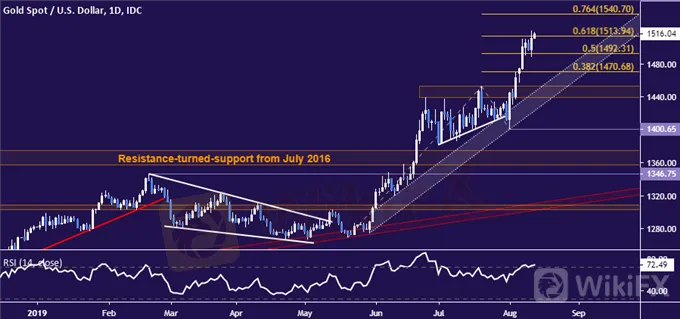

Gold prices are probing above the 61.8% Fibonacci expansion at 1513.94, with a break higher confirmed on a daily closing basis exposing the 76.4% level at 1540.70 next. Negative RSI divergence warns of ebbing upside momentum however, hinting that a turn might be brewing ahead. A turn back below the 50% Fib at 1492.31 initially targets the 38.2% expansion at 1470.68.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are retesting the 54.72-56.09 inflection area, with a daily close above its upper layer exposing falling trend line resistance defining a broadly bearish bias since late May (now at 58.86). Immediate support is in the 49.41-50.60 zone. Slipping below that would put the spotlight on the 49.41-50.60 region next.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

See our guide to learn about the long-term forces driving crude oil prices

Having trouble with your strategy? Heres the #1 mistake that traders make

Join a free webinar and have your commodity market questions answered

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Stocks Dip, Bitcoin Surges, Euro Weakens | Daily Market Update

Tech Stocks Under Pressure, Inflation Data Looms

Beginner Tips for Gold Technical Analysis - Forex4you

Are you interested in trading gold? Forex4you will provide you 6 tips for gold technical analysis, which each beginner or novice should know.

5 Qualities of the Best Forex Brokers - Forex4you

Discover the top qualities of the best forex brokers with Forex4you. Explore key factors that set reliable brokers apart in the world of trading

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

WikiFX Broker

Latest News

India's Forex Rules Shake-Up Stuns Traders and Markets

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Maunto Review: Imp. Things to Know!!

Webull Canada Unveils Desktop Trading Platform

Currency Calculator