Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is NordFX?

NordFX is a forex broker that offers over 30 currency pairs, bitcoin, other cryptocurrencies, gold and silver for your personal investment and trading options. It was established in 2008 and is registered in Vanuatu. NordFX provides online trading platforms and free training. The MetaTrader platforms also provide automated trading and market signals. However, it currently does not have any valid regulation.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

NordFX offers a wide range of financial instruments, providing traders with diverse trading opportunities. The availability of MetaTrader 4 across multiple devices enhances the convenience and accessibility of trading.

However, it is important to note that NordFX is an unregulated broker, which introduces higher risks to traders, especially regarding fund management and security. There have been reports of withdrawal issues, indicating potential challenges in this area.

NordFX Alternative Brokers

There are many alternative brokers to NordFX depending on the specific needs and preferences of the trader. Some popular options include:

IC Markets - Best broker on the market with fast support and flawless spreads and order execution.

Roboforex - Fast money deposit and withdrawal with similar spreads and commission for Forex and gold as other brokers but on stocks roboforex is King.

AvaTrade - Good trading conditions overall with multiple CFD trading instruments and high number of forex pairs.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is NordFX Safe or Scam?

NordFX does not hold any valid regulatory licenses at this stage and its Vanuatu Financial Services Commission (VFSA) license is revoked and Cyprus Securities and Exchange Commission (CYSEC, License No. 209/13) license is a suspicious clone.

It is important to note that trading with an unregulated broker can be risky as there is no guarantee that the broker will act in the best interest of the trader. Regulated brokers are required to follow strict rules and regulations which are designed to protect traders from fraudulent activities.

Market Instruments

NordFX provides a diverse range of market instruments for traders to choose from. They offer a selection of FX pairs, allowing traders to participate in the foreign exchange market and take advantage of currency fluctuations.

Additionally, NordFX provides access to trading metals, such as gold and silver, offering opportunities for investors interested in the precious metals market. Cryptocurrencies are also available for trading, allowing traders to speculate on the price movements of popular digital assets like Bitcoin, Ethereum, and more.

Furthermore, NordFX offers CFDs on indices and stocks, enabling traders to trade popular global indices and individual stocks. Lastly, oil trading is available, allowing traders to participate in the energy markets by speculating on the price of crude oil.

Accounts

NordFX provides traders with a variety of account options to suit their individual needs. They offer demo accounts, allowing traders to practice their strategies and familiarize themselves with the trading platform without risking real money.

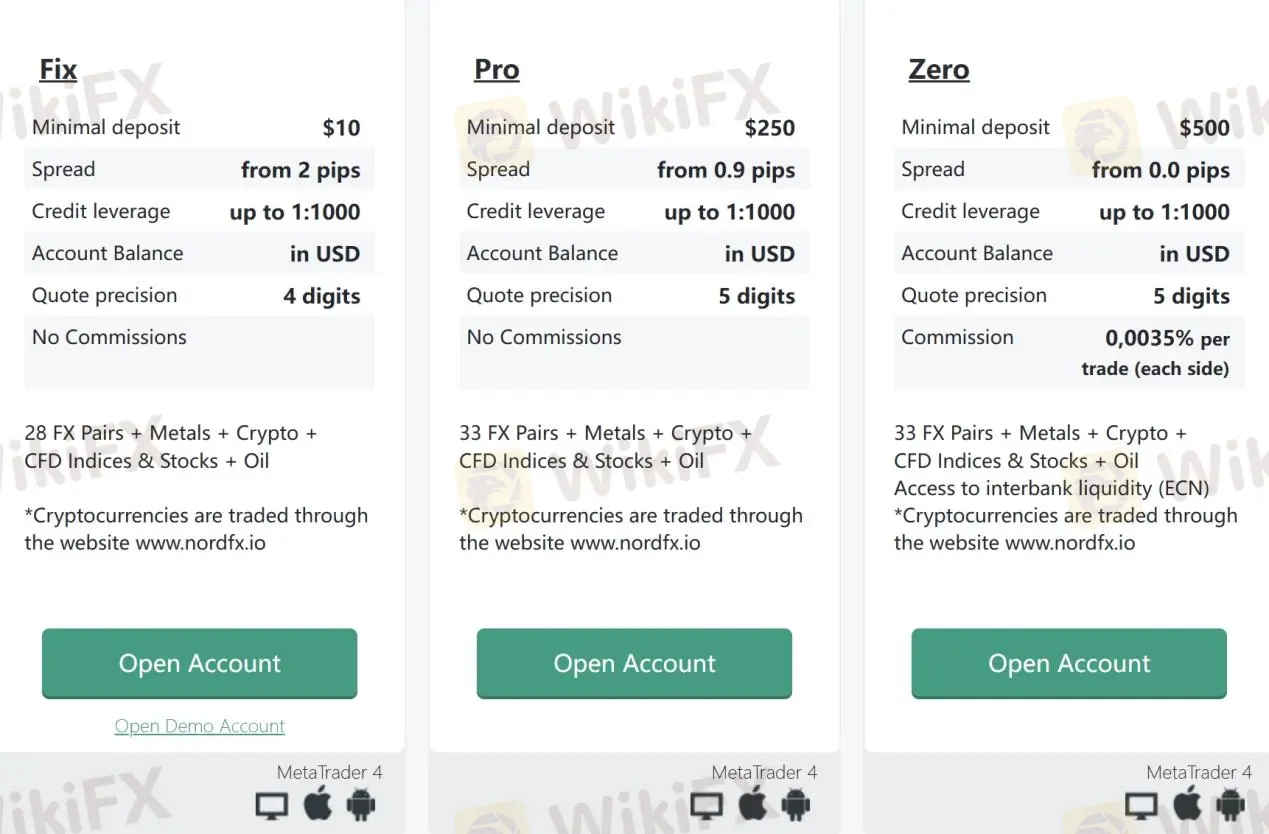

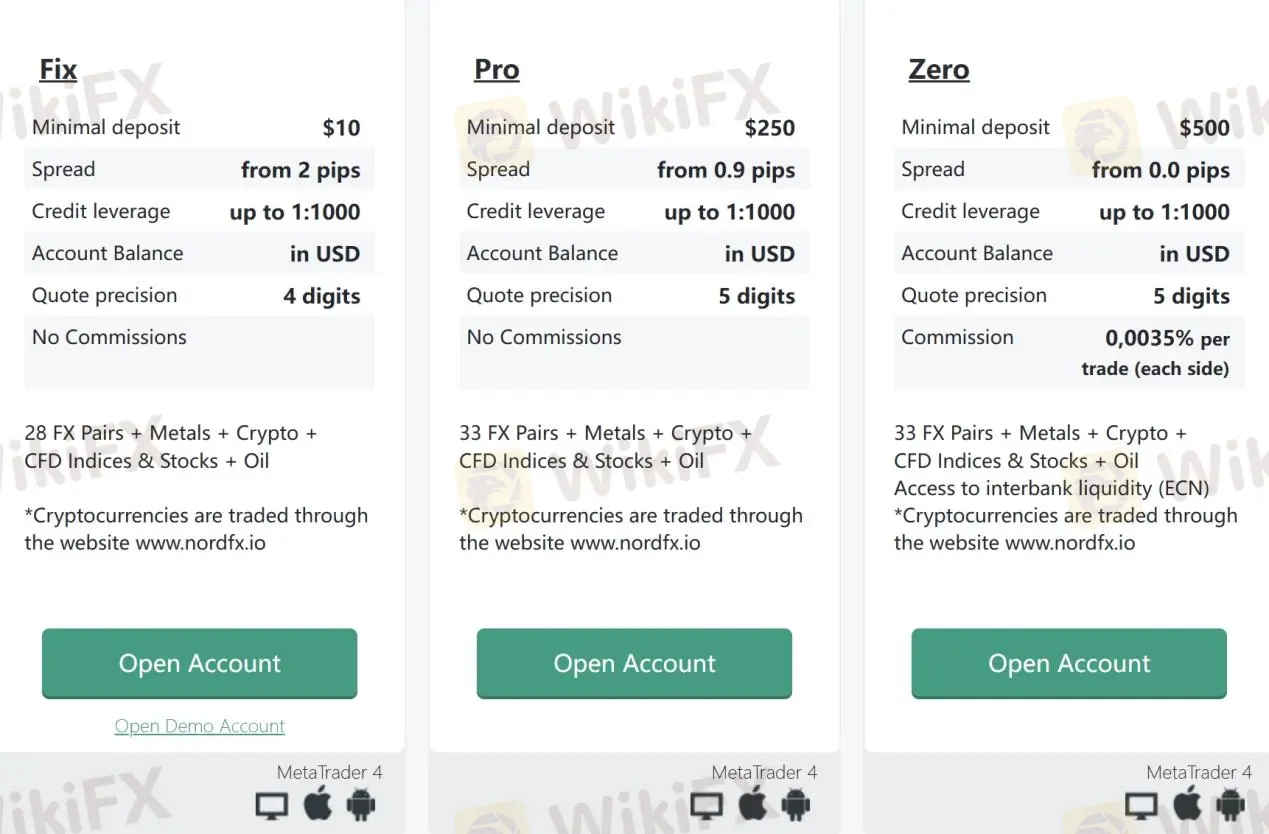

For live trading, NordFX offers three main account types: Fix, Pro, and Zero. The Fix account has a low minimum deposit requirement of $10, making it accessible to traders with smaller capital. The Pro account requires a minimum deposit of $250 and provides additional features and benefits, such as lower spreads and access to a broader range of trading instruments. The Zero account, with a minimum deposit of $500, is designed for more advanced traders who require tight spreads and direct market access.

Leverage

NordFX offers traders competitive leverage options, allowing them to amplify their trading positions. With leverage of up to 1:1000, traders can control larger positions in the market with a smaller amount of capital. This high leverage enables traders to potentially generate higher profits from successful trades.

However, it is important to note that while leverage can magnify profits, it also increases the risk of losses. Traders should exercise caution and carefully manage their risk when utilizing high leverage.

Spreads & Commissions

NordFX offers competitive spreads and commissions across its different account types. The Fix account has a spread starting from 2 pips, making it suitable for traders who prefer fixed spreads. The Pro account offers a tighter spread starting from 0.9 pips, appealing to traders who seek lower transaction costs. However, it's important to note that the Zero account stands out with a spread starting from 0.0 pips, providing traders with the potential for better pricing and reduced trading costs.

While the Fix and Pro accounts do not charge any commissions, the Zero account requires a commission of 0.0035% per trade on each side. Traders should consider their trading preferences and strategies to choose the account type that best aligns with their needs.

Below is a comparison table about spreads and commissions charged by different brokers:

Please note that the spreads and commissions may vary depending on the specific account types and trading conditions offered by each broker. It's advisable to refer to the official websites or contact the brokers directly for the most up-to-date and accurate information.

Trading Platforms

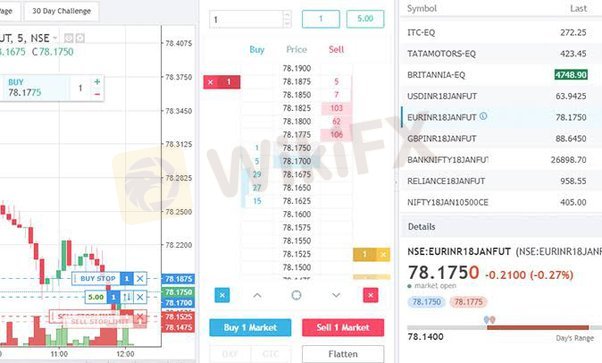

NordFX provides traders with the popular and widely recognized MetaTrader4 (MT4) platform, available for Windows, Mac, iPhone, and Android devices. MT4 is known for its user-friendly interface, advanced charting tools, and a wide range of technical indicators and analysis tools. With MT4, traders can access real-time market data, place trades, set stop-loss and take-profit levels, and manage their positions efficiently.

The platform also supports automated trading through expert advisors (EAs), allowing traders to implement and test their own trading strategies. Additionally, NordFX offers mobile versions of MT4, enabling traders to stay connected and manage their trades on the go.

Overall, NordFX's provision of MT4 across multiple devices ensures convenience, flexibility, and a seamless trading experience for its clients.

See the trading platform comparison table below:

Trading Tools

NordFX offers a range of useful trading tools designed to enhance the trading experience and provide valuable market insights. Traders can access various analysis tools, including technical analysis reports and market news updates, which can help them make informed trading decisions. The Economic Calendar feature keeps traders updated on important economic events and their potential impact on the markets. NordFX also offers Trading Signals, which provide valuable trading ideas and recommendations generated by experienced analysts.

For traders who require uninterrupted trading, NordFX offers Virtual Private Server (VPS) hosting, ensuring reliable and high-speed trading execution. Additionally, the Trader's Calculator helps traders calculate position sizes, profit/loss, and other important trading parameters. Lastly, the Currency Converter tool allows for quick and easy conversion of currencies. These trading tools provided by NordFX aim to empower traders with valuable information, analysis, and resources to support their trading strategies and decision-making processes.

Deposits & Withdrawals

NordFX offers a variety of convenient deposit and withdrawal options to cater to the diverse needs of its clients. Traders can fund their accounts using Bank Transfer, Bank Cards, Online Payment Systems, Online Exchange Services, and Internal Transfer.

Base Currencies:

USD, EUR, CNY, IDR, GBP, VND, THB, PHP

NordFX minimum deposit vs other brokers

The minimum deposit requirement is set at a low amount of $10, making it accessible for traders of different levels.

Most deposits are free of charge and processed instantly, allowing traders to quickly start trading. Withdrawals are typically processed within 1 business day, ensuring efficient access to funds. However, it's important to note that withdrawal fees may vary depending on the chosen withdrawal method.

Customer Service

NordFX places a strong emphasis on customer support and offers multiple channels for traders to get in touch with their team. Clients can utilize the online chat feature on their website for immediate assistance, or they can opt to contact NordFX through phone or email. Additionally, traders have the option to send messages online for any inquiries or concerns they may have. NordFX also maintains an active presence on various social media platforms, including Telegram, Twitter, Facebook, Instagram, YouTube, LinkedIn, and Pinterest.

Overall, NordFX's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Note: These pros and cons are subjective and may vary depending on the individual's experience with NordFX's customer service.

User Exposure on WikiFX

On our website, you can see that some reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Education

NordFX provides a range of educational resources to support traders in their journey. They offer comprehensive information and resources on various topics, including Forex trading, through their dedicated Forex section. Traders can access a glossary that helps them understand key trading terms and concepts. Additionally, NordFX has a learning center that offers educational materials, tutorials, and guides to enhance traders' knowledge and skills. They also provide useful articles that cover market analysis, trading strategies, and other relevant topics.

Conclusion

In conclusion, NordFX offers a wide range of financial instruments, competitive trading conditions, and multiple trading platforms, making it an attractive choice for traders. However, it is important to note that NordFX is an unregulated broker, which may raise concerns regarding the safety of funds and overall credibility. Traders should exercise caution and carefully evaluate the associated risks before deciding to trade with NordFX. It is recommended to conduct thorough research, seek additional information, and consider alternative regulated brokers that provide stronger regulatory oversight and investor protection.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX