User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

6

CommentsWrite a review

2024-04-25 17:50

2024-04-25 17:50

2024-03-22 15:06

2024-03-22 15:06

2024-03-20 18:45

2024-03-20 18:45

2023-12-01 18:18

2023-12-01 18:18 2023-11-30 18:14

2023-11-30 18:14

2023-03-29 11:58

2023-03-29 11:58 Australia|10-15 years|

Australia|10-15 years| https://royal-fi.com/en/

Website

MT4/5 Identification

Full License

Cyprus

CyprusSingle Core

1G

40G

+61 2 8284 5100

+357 25 080 880

+961 1 975 275

+1 888 705 9006

More

Royal Financial Trading (Cy) Ltd

OneRoyal

Australia

Pyramid scheme complaint

Expose

Visiting Australian forex broker Royal

A field survey confirmed that Royal Financial Trading’s actual address is consistent with that shown in its regulation details. The company holds a full license from the Australia ASIC (420268) and a straight-through license from the Cyprus CySEC (312/16).

A Site Visit to Royal Financial in Cyprus

The inspection team confirmed the authenticity of Royal Financial in Cyprus after the site visit. The office is small with about 20 working desks.

Visiting Australian forex broker Royal

A field survey confirmed that Royal Financial Trading’s actual address is consistent with that shown in its regulation details. The company holds a full license from the Australia ASIC (420268) and a straight-through license from the Cyprus CySEC (312/16).

A Site Visit to Royal Financial in Cyprus

The inspection team confirmed the authenticity of Royal Financial in Cyprus after the site visit. The office is small with about 20 working desks.

| Company Name | OneRoyal |

| Years of Establishment | 10-15 years |

| Headquarters | Australia |

| Office Locations | Florida, U.S.A., Sydney, Australia, Kingstown, St. Vincent & the Grenadines |

| Regulation | ASIC, CYSEC, VFSC |

| Tradable Assets | FX Majors, FX Minors, Metals, Indices, Oil, Cryptocurrencies, Shares, ETF |

| Account Types | Demo Account, Classic Zero, Classic ECN, VIP Zero, VIP ECN |

| Minimum Deposit | $50, $50, $10,000, $10,000 |

| Leverage | Up to 1:1000 |

| Spread | 1.4 pips, 0.0 pips, 0.4 pips, 0.0 pips |

| Deposit/Withdrawal Methods | Bank Transfer, Debit/Credit Card, E-wallets |

| Trading Platforms | MT4, MT5, Webtrader, Multi Terminal |

| Customer Support Options | WhatsApp, Facebook Messenger, Live Chat, Phone |

| Educational Content | YouTube, Roy and AL Show, Knowledge Hub, Webinars |

OneRoyal is an Australian-based company with a history spanning 10-15 years, offering trading services in the financial sector. They operate in multiple locations, including offices in Florida, U.S.A., Sydney, Australia, and Kingstown, St. Vincent & the Grenadines. The company is regulated by ASIC, CYSEC, and VFSC, instilling confidence in its compliance with industry standards. OneRoyal provides a range of tradable assets, encompassing FX Majors, FX Minors, Metals, Indices, Oil, Cryptocurrencies, Shares, and ETFs.

They offer various account types, with differing minimum deposit requirements and associated commission and spread rates. Traders can access their services through popular trading platforms such as MT4, MT5, Webtrader, and Multi Terminal, supported by a selection of customer support channels, including WhatsApp, Facebook Messenger, Live Chat, and phone. Additionally, OneRoyal offers educational resources through YouTube, the Roy and AL Show, the Knowledge Hub, and webinars to assist traders in their endeavors.

OneRoyal is subject to regulation by three reputable financial regulatory authorities: ASIC, CYSEC, and VFSC. These regulatory bodies oversee and monitor the company's operations to ensure compliance with established industry standards and guidelines.

OneRoyal holds an Institution Forex License issued by the Australia Securities & Investment Commission (ASIC). This license, bearing the number 420268, authorizes OneRoyal to operate within the financial sector. The Institution Forex License allows the company to conduct its financial activities within the defined scope of regulatory compliance.

OneRoyal holds a Straight Through Processing (STP) license issued by the Cyprus Securities and Exchange Commission (CYSEC). The specific license number is 312/16. This authorization enables OneRoyal to engage in financial activities under the regulatory framework established by CYSEC, allowing the company to operate within the financial sector while adhering to the stipulations of the STP license.

OneRoyal operates under a Retail Forex License granted by the Vanuatu Financial Services Commission (VFSC) as an Offshore Regulatory. It is essential to note that offshore licenses like the VFSC Retail Forex License may not carry the same level of oversight and protection as licenses from more established regulatory bodies. Traders and investors should be aware of the associated risks, which may include limited recourse in case of disputes, potential exposure to unscrupulous entities, and varying degrees of regulatory scrutiny.

The specific license number is 700284. This regulatory authorization allows OneRoyal to engage in retail forex trading and related financial activities within the jurisdiction of Vanuatu, as stipulated by the terms and conditions outlined in the Retail Forex License.

| Pros | Cons |

| Regulated Oversight | Limited Cryptocurrency Information |

| Educational Resources | Lack of Fixed Leverage Information |

| Diverse Trading Platforms | Variability in Spreads |

Pros:

Regulated Oversight: One of the significant advantages of OneRoyal is its regulatory status under ASIC, CySEC, and VFSC. This ensures that the brokerage operates with adherence to established financial standards and legal requirements, providing a level of security and transparency to traders.

Educational Resources: OneRoyal stands out in its commitment to trader education, offering a range of informative content, including a talk show, webinars, and a Knowledge Hub. This dedication to enhancing traders' knowledge and skills is a valuable resource for clients looking to improve their trading strategies.

Diverse Trading Platforms: OneRoyal offers a selection of trading platforms, including MT4, MT5, Webtrader, and Multi Terminal, allowing traders to choose the platform that best suits their preferences and strategies.

Cons:

Limited Cryptocurrency Information: OneRoyal's provided information lacks specific details about cryptocurrency trading, making it challenging for traders interested in this asset class to assess the offerings effectively.

Lack of Fixed Leverage Information: While OneRoyal specifies dynamic leverage ratios for various instruments, the information regarding fixed leverage, especially for Cryptocurrencies, Shares, and ETFs, is missing. This absence may leave traders uncertain about leverage options for these assets.

Variability in Spreads: While OneRoyal offers competitive spreads, the variability in spread values across account types can be a drawback for traders seeking consistency in trading costs. This variation may necessitate careful consideration when selecting an account type.

OneRoyal provides access to a variety of market instruments, each falling into distinct categories:

Forex: This category allows traders to engage in the trading of major currency pairs, encompassing some of the most actively traded currencies in the foreign exchange market. OneRoyal also offers a selection of minor currency pairs, providing trading opportunities with lesser-known currencies, thus expanding the range of forex options available to traders.

Metals: Traders interested in precious metals can access this category, which includes the trading of commodities such as gold and silver.

Indices: OneRoyal extends its offerings to stock market indices, enabling traders to explore and invest in a diverse range of global indices.

Oil: In this category, traders can participate in the energy commodities market, including trading opportunities related to oil.

Cryptocurrencies: OneRoyal provides access to the world of digital assets, allowing clients to trade various cryptocurrencies.

Shares: For traders seeking to diversify their portfolios, OneRoyal offers the opportunity to trade individual company shares.

ETFs: OneRoyal also includes Exchange-Traded Funds (ETFs) in its offerings, allowing traders to invest in diversified portfolios of assets.

The following table compares OneRoyal's market instruments with those of competing brokerages:

| Broker | Market Instruments |

| OneRoyal | FX Majors, FX Minors, Metals, Indices, Oil, Cryptocurrencies, Shares, ETFs |

| OctaFX | FX Majors, FX Minors, Metals, Indices, Cryptocurrencies |

| FXCC | FX Majors, FX Minors, Metals, Indices, Cryptocurrencies |

| Tickmill | FX Majors, FX Minors, Metals, Indices, Oil, Cryptocurrencies |

| FxPro | FX Majors, FX Minors, Metals, Indices, Oil, Cryptocurrencies, Shares |

OneRoyal offers four account types: Classic Zero, ECN Zero, VIP Zero, and ECN Zero. The CLASSIC account has a minimum deposit of $50 and follows a VIP pricing method, while the ZERO ECN account requires a $10,000 minimum deposit and charges no commission. The ZERO COMMISSION account has a $50 minimum deposit and charges a $7 commission per 100k round turn (RT). The ECN Zero account, with a $10,000 minimum deposit, offers the most competitive pricing at $3.50 commission per 100k RT or zero commission with tighter spreads as low as 0.4 pips. All account types support leverage up to 1:1000, provide access to MT4/MT5/Webtrader/Multi Terminal platforms, and trade in major currencies like USD, EUR, GBP, and PLN.

Demo Account: The Demo Account allows traders to practice and familiarize themselves with the platform without risking real capital. It serves as an educational tool, enabling users to simulate trading scenarios.

Classic Zero: The Classic Zero account is designed for traders with a minimum deposit requirement of $50. It features no commission fees and a spread of 1.4 pips, making it suitable for those seeking cost-effective trading.

Classic ECN: With a minimum deposit of $50, the Classic ECN account offers trading with a commission fee of $7 and a competitive spread of 0.0 pips, making it suitable for traders who prioritize tight spreads.

VIP Zero: Tailored for high-net-worth individuals, the VIP Zero account requires a minimum deposit of $10,000 and offers a spread of 0.4 pips with no commission fees, catering to experienced traders.

VIP ECN: The VIP ECN account, also requiring a minimum deposit of $10,000, features a lower commission fee of $3.50 and a tight spread of 0.0 pips, providing advanced traders with a competitive trading environment.

The specifics of the account types are as follows:

| Account Type | Minimum Deposit | Commission | Spread |

| Classic Zero | $50 | $0 | 1.4 pips |

| Classic ECN | $50 | $7 | 0.0 pips |

| VIP Zero | $10,000 | $0 | 0.4 pips |

| VIP ECN | $10,000 | $3.50 | 0.0 pips |

OneRoyal provides traders with the valuable option of a Demo Account, a tool designed to offer a risk-free environment for individuals to familiarize themselves with the trading platform and hone their trading skills. A Demo Account operates with virtual funds, allowing users to engage in simulated trades without risking their actual capital. Traders can experience real-time market conditions and practice various trading strategies within this virtual setting. It serves as an invaluable resource for both novice and experienced traders. Two notable benefits of utilizing a Demo Account are risk mitigation and skill development.

To start the process, navigate to the “Sign Up” button at the top right of the OneRoyal official page.

From that point, the user will be forwarded to the initial account information page, where the user will be prompted to fill out personal information including full name, E-mail and phone number.

After agreeing to the Privacy Policy, press the Open Account button to finish the account creation process.

From this point, the user has the option to customize the account and use educational content that is provided by OneRoyal.

OneRoyal offers a range of minimum deposit rates based on the type of trading account selected. These deposit requirements cater to a diverse clientele, starting at a minimum deposit of $50 for the Classic Zero and Classic ECN accounts.

For those seeking more exclusive accounts, the VIP Zero and VIP ECN accounts require a higher minimum deposit of $10,000. These deposit rates provide flexibility for traders with varying capital sizes and trading preferences, allowing them to choose an account that aligns with their financial capabilities and objectives.

OneRoyal charges commission fees on certain account types. For the Classic ECN account, traders are subject to a commission fee of $7 per 100,000 RT. The VIP ECN account features a lower commission fee of $3.50 per 100,000 RT. These commission rates are specific to the respective account types and are applied in addition to the spread costs associated with each trade.

OneRoyal offers leverage in form of dynamic and static Leverage. It's important to note the distinction between dynamic and static leverages. Dynamic leverages, as offered for FX Majors, FX Minors, Metals, Indices, and Oil, can vary depending on market conditions and volatility. Traders may experience fluctuations in leverage as market dynamics change. On the other hand, static leverages, applicable to Cryptocurrencies, Shares, and ETFs, typically feature fixed leverage ratios. These ratios remain constant, regardless of market conditions.

OneRoyal offers a range of leverage options, depending on the category of market instruments being traded. For Dynamic Leverages, traders can access leverage ratios of up to 1:1000 when trading FX Majors and 1:500 when trading FX Minors and Metals. In the case of Indices, the maximum leverage offered is 1:200, while for Oil, it is set at 1:50.

| Market Instrument | Maximum Leverage |

| FX Majors | Up to 1:1000 |

| FX Minors | Up to 1:500 |

| Metals | Up to 1:500 |

| Indices | Up to 1:200 |

| Oil | Up to 1:50 |

OneRoyal provides traders with competitive spreads across its various account types. The spread, which represents the difference between the buying and selling prices of an asset, is an essential consideration for traders.

For the Classic Zero account, OneRoyal offers a spread of 1.4 pips, while the Classic ECN account boasts a notably tight spread of 0.0 pips. The VIP Zero account offers a spread of 0.4 pips, providing traders with an attractive option for lower-cost trading. Finally, the VIP ECN account maintains a tight spread of 0.0 pips. These spreads cater to traders with different preferences, allowing them to select an account that aligns with their trading strategies and cost considerations.

OneRoyal offers a range of deposit and withdrawal methods to facilitate financial transactions for its clients.

Bank Transfer: OneRoyal facilitates secure financial transactions through traditional bank transfers. This method offers a reliable way to transfer funds to and from the trading account, ensuring the safe movement of capital.

Debit/Credit Card: OneRoyal supports Debit/Credit Card transactions, including VISA and Mastercard. These card options provide traders with convenient and widely recognized methods for depositing and withdrawing funds.

E-wallets: OneRoyal offers a variety of e-wallet options, including Whish money, Fasapay, Neteller, Paytrust, Skrill, NganLuong, PM, and Poli. E-wallets provide traders with flexible electronic transfer capabilities, catering to a range of preferences and geographic locations.

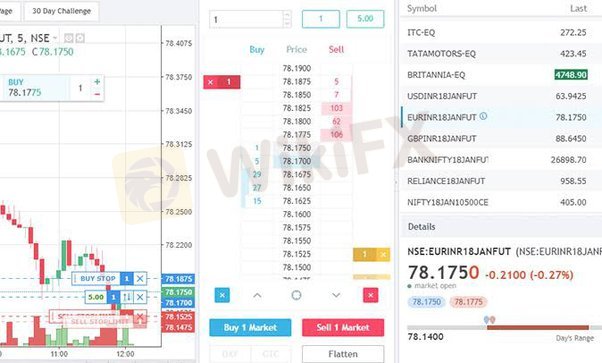

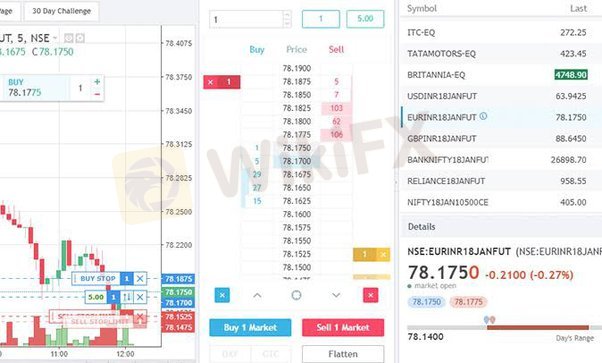

OneRoyal provides its traders with a variety of trading platforms to cater to different trading preferences.

MT4 (MetaTrader 4): OneRoyal provides access to the widely acclaimed MT4 platform. It offers a user-friendly interface, a plethora of technical analysis tools, customizable charts, and automated trading capabilities through expert advisors (EAs).

MT5 (MetaTrader 5): OneRoyal also offers the advanced MT5 platform, which builds upon MT4's features by offering additional timeframes, technical indicators, and an economic calendar. It provides traders with expanded capabilities for analysis and execution.

Webtrader: For those seeking web-based trading convenience, OneRoyal offers the Webtrader platform. Traders can access their accounts and execute trades directly from their web browsers, without the need to download or install software.

Multi Terminal: OneRoyal caters to traders managing multiple accounts with the Multi Terminal platform. This platform provides efficient management tools for traders handling multiple trading accounts simultaneously.

The following table summarizes the trading platforms offered by OneRoyal and compares them with competing brokerages:

| Broker | Trading Platforms |

| OneRoyal | MT4, MT5, Webtrader, Multi Terminal |

| OctaFX | MT4, MT5, cTrader, OctaFX Trading App |

| FXCC | MT4, Sirix Web Trader, Mobile App |

| Tickmill | MT4, MT5, Web Trader, Mobile Trading App |

| FxPro | cTrader, MT4, MT5, FxPro Edge, Webtrader |

OneRoyal offers a diverse range of customer support options, including WhatsApp, Facebook Messenger, live chat, multiple phone numbers, and email communication to ensure clients have various channels for assistance and inquiries.

WhatsApp: Clients can reach out to OneRoyal's customer support team via WhatsApp using the number 19545526898.

Facebook Messenger: For inquiries and assistance, clients can connect with OneRoyal through Facebook Messenger using the official page: OneRoyalOfficial.

Live Chat: OneRoyal offers a live chat feature on its website, providing real-time assistance to clients navigating trading-related queries directly on the platform.

Phone: OneRoyal offers several English-speaking phone numbers for clients to contact the customer support team:

+61 2 8284 5100 (Australia)

+357 25 080 880 (Cyprus)

+961 1 975 275 (Lebanon)

+1 888 705 9006 (USA/Vanuatu)

+1 844 885 3159 (St. Vincent & Grenadine)

+234 09035755510 (Nigeria)

Email: For formal communication, clients can send inquiries and requests to the company's designated email address: support@oneroyal.com.

OneRoyal offers a variety of educational content types, including YouTube videos available at the provided link, an informative talk show, a Knowledge Hub, webinars, and a Demo Account, to support traders in gaining knowledge and experience in the financial markets.

Youtube: OneRoyal provides educational content through its YouTube channel, offering informative videos available at the provided link, covering various aspects of trading and market analysis.

Link: https://www.youtube.com/channel/UCGzU-VLC7ml-528leQVqMEA?cbrd=1

Roy and AL Show (Informative talk show): The “Roy and AL Show” is a talk show format that delivers informative discussions on trading-related topics, providing traders with valuable insights and perspectives.

Knowledge Hub: OneRoyal offers a Knowledge Hub where traders can access information on demand, likely including articles, guides, or resources aimed at enhancing their trading knowledge.

Webinars (Internet Lessons to Ask Questions): Traders can participate in webinars, which serve as internet lessons where they can acquire knowledge and have the opportunity to ask questions and engage in discussions.

Demo Account (No Cost Virtual Environment Trading): OneRoyal offers a Demo Account, providing traders with a risk-free virtual environment for practicing and refining their trading skills without incurring real financial losses.

OneRoyal provides community support through active engagement on Twitter, Facebook, Instagram, and LinkedIn, allowing traders and clients to connect, access information, and participate in discussions within the trading community using the full hyperlinks provided.

Twitter: OneRoyal maintains an active presence on Twitter, providing clients with updates, news, and the latest developments. Traders can access the company's Twitter account at https://twitter.com/OneRoyalEN.

Facebook: The company also engages with its community on Facebook, offering a platform for discussions and updates. Clients can follow OneRoyal on Facebook at https://www.facebook.com/OneRoyalOfficial.

Instagram: OneRoyal shares insights and visual content on Instagram, enhancing engagement with its community. Clients can connect with OneRoyal on Instagram at https://www.instagram.com/oneroyalofficial/.

LinkedIn: OneRoyal maintains a professional presence on LinkedIn, where traders can access informative updates and connect with the company. Clients can follow OneRoyal on LinkedIn at https://www.linkedin.com/company/oneroyalofficial/.

These community support options through various social media platforms ensure that clients have multiple channels for staying informed, engaging in discussions, and connecting with OneRoyal's trading community using the provided hyperlinks.

In conclusion, OneRoyal is an internationally regulated brokerage that presents itself as a trading platform committed to transparency and client support. With over a decade of experience in the financial markets, the brokerage offers a range of educational resources, market instruments, and account types to give customers a high level of customization. Furthermore, the availability of a Demo Account serves as a valuable tool for traders, allowing them to refine their skills and strategies in a risk-free virtual environment.

OneRoyal's support extends beyond traditional means, as it leverages social media platforms such as Twitter, Facebook, Instagram, and LinkedIn to foster a sense of community among traders. Clients have access to multiple trading platforms, including MT4 and MT5, to cater to their individual preferences. The company's competitive spreads, alongside varying account types and leverage options, grant traders flexibility in tailoring their trading experience to their specific needs.

Q: How does OneRoyal ensure regulatory compliance?

A: OneRoyal maintains oversight from regulatory authorities such as ASIC, CySEC, and VFSC.

Q: What distinguishes OneRoyal's educational content?

A: OneRoyal offers diverse educational resources, including a talk show, webinars, and a Knowledge Hub.

Q: How can traders practice without risking capital?

A: Traders can utilize OneRoyal's Demo Account, offering a risk-free virtual environment for practice.

Q: What distinguishes OneRoyal's support channels?

A: OneRoyal provides a range of support options, including WhatsApp, Facebook Messenger, and live chat.

Q: Which trading platforms are available on OneRoyal?

A: OneRoyal offers various trading platforms, including MT4, MT5, Webtrader, and Multi Terminal.

Q: What social media platforms does OneRoyal use for community engagement?

A: OneRoyal actively engages with its trading community through Twitter, Facebook, Instagram, and LinkedIn.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Sort by content

User comment

6

CommentsWrite a review

2024-04-25 17:50

2024-04-25 17:50

2024-03-22 15:06

2024-03-22 15:06

2024-03-20 18:45

2024-03-20 18:45

2023-12-01 18:18

2023-12-01 18:18 2023-11-30 18:14

2023-11-30 18:14

2023-03-29 11:58

2023-03-29 11:58