UK government borrowing falls in June

Abstract:UK government borrowing falls in June

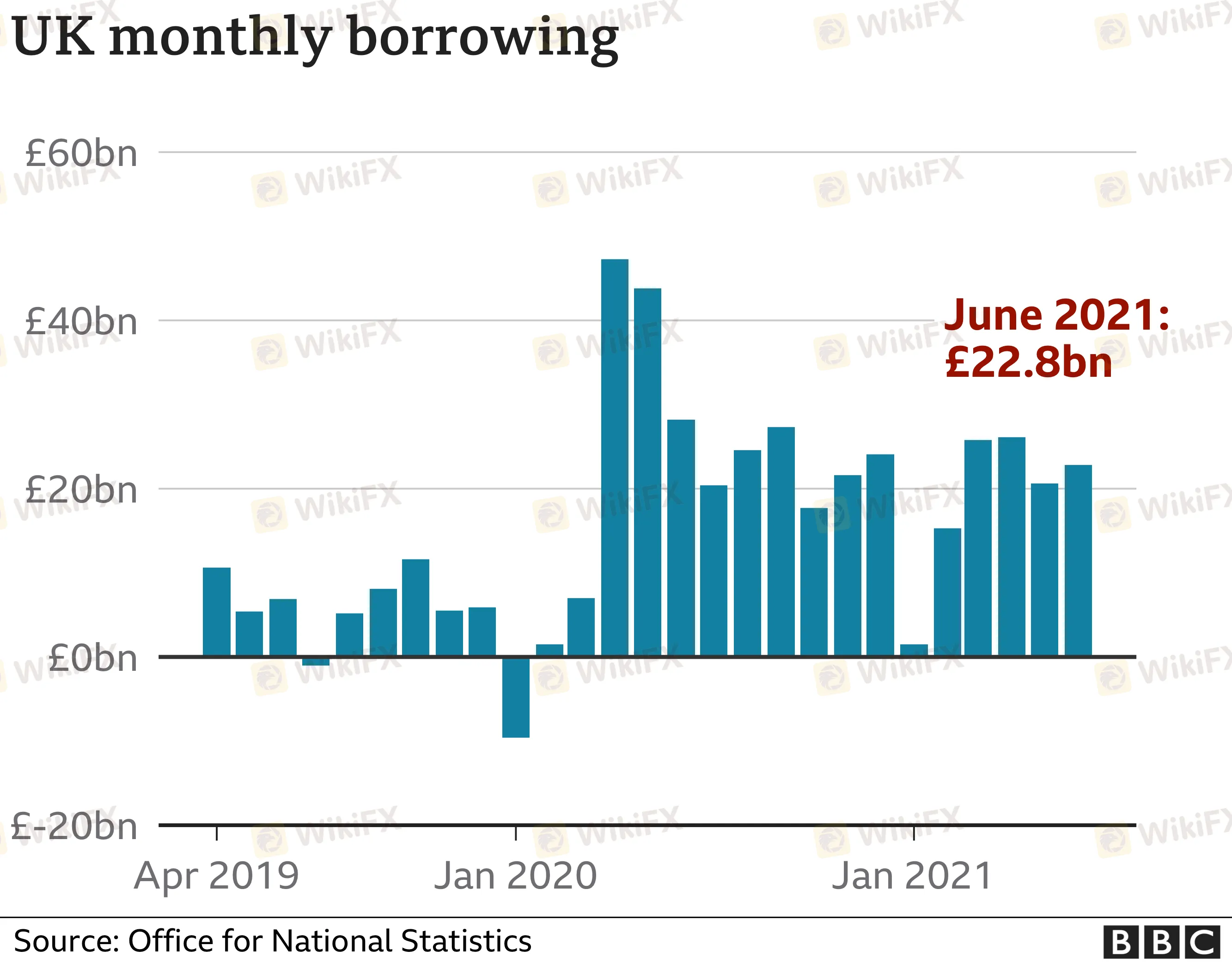

Government borrowing fell in June compared with the same month last year, with the economy in recovery mode after lockdown measures eased.

Borrowing - the difference between spending and tax income - was £22.8bn, official figures show, which was £5.5bn lower than June last year.

However, the figure was the second-highest for June since records began.

Borrowing has been hitting record levels, with billions being spent on measures such as furlough payments.

The huge amount of borrowing over the past year has now pushed government debt up to more than £2.2 trillion, or about 99.7% of GDP - a rate not seen since the early 1960s.

Where does the government borrow billions from?

The Office for National Statistics (ONS) now estimates that the government borrowed a total of £297.7bn in the financial year to March.

That was 14.2% of the UK's GDP and the highest level since the end of World War Two.

The ONS said the cost of measures to support individuals and businesses during the pandemic meant that day-to-day spending by the government rose by £204.3bn to £942.7bn last year.

In response to the latest figures, Chancellor Rishi Sunak said he was “proud of the unprecedented package of support we put in place to protect jobs and help thousands of businesses survive the pandemic”.

He added: “However, it's also right that we ensure debt remains under control in the medium term, and that's why I made some tough choices at the last Budget to put the public finances on a sustainable path.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

WikiFX Broker

Latest News

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

End of USD Dominance Amid Escalating Geopolitical Risks

Caution in Online Trading: Intersphere Enterprises Alleged Scam

WikiFX Forex Rights Protection Day has received extensive attention!

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator