Indonesia Set for First Recession Since Asian Financial Crisis

Abstract:Indonesia is set to record its first recession since the Asian financial crisis more than two decades ago as the economy buckles under the weight of Southeast Asias worst coronavirus outbreak.

Indonesia is set to record its first recession since the Asian financial crisis more than two decades ago as the economy buckles under the weight of Southeast Asias worst coronavirus outbreak.

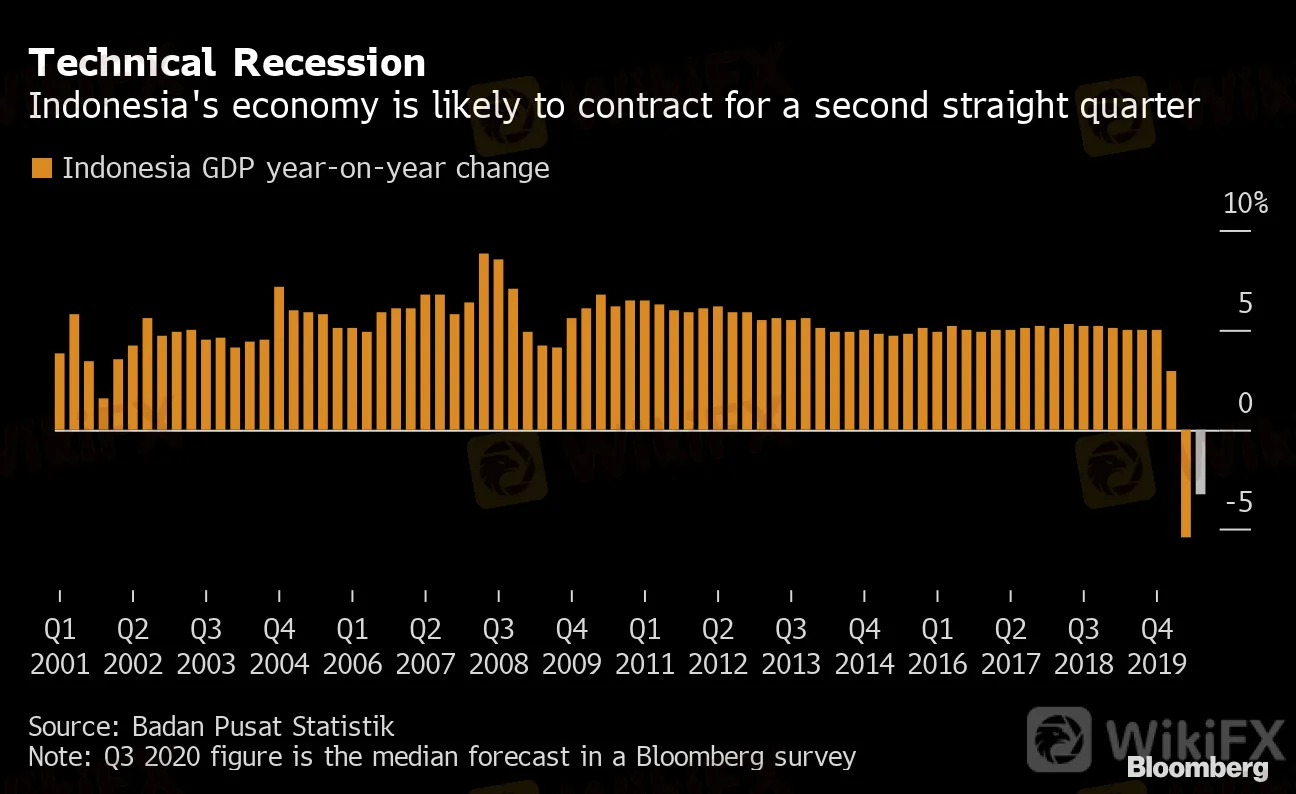

Data due Thursday will likely show that gross domestic product fell 3.2% in the third quarter from a year earlier, according to the median forecast of 27 economists surveyed by Bloomberg. A second straight quarter of contraction would signify a technical recession.

Technical Recession

Indonesia's economy is likely to contract for a second straight quarter

Source: Badan Pusat Statistik

Note: Q3 2020 figure is the median forecast in a Bloomberg survey

The worst may well be past for Southeast Asias largest economy: It likely bottomed out in the second quarter, when stringent curbs on movement dragged GDP to a 5.32% decline, the sharpest since 1999. “The rebound is expected to be shallow and uneven, with Indonesia still struggling to contain the spread of the pandemic,” said Mohamed Faiz Nagutha, an economist at BofA Securities Inc. in Singapore.

Here are some key issues economists are watching for Indonesias recovery:

Virus Strategy

The Covid-19 outbreak continues to impede efforts to spur consumption and investment as Indonesia exceeds 420,000 total infections. The government sees an eventual vaccine as key to fully reopening the economy; in the meantime, its investing in vaccine-storage facilities and holding simulations to prepare for a massive inoculation campaign among the 270 million-strong population.

Until then, the economys performance hinges on the success of Covid-19 containment, with the threat of lockdowns looming over Jakarta and other virus hotspots, PT Bank Permata economist Josua Pardede said.

Indonesia Tips Toward Recession as Consumer Spending Dwindles

{21}

The government must accelerate relief programs, with about half of its 695.2 trillion rupiah ($48 billion) pandemic recovery budget still unspent, Pardede said. The economy could contract again in the fourth quarter if consumption, which accounts for about 60% of GDP, remains sluggish, he added.

{21}

Investment Revival

{777}

A new law aimed at creating jobs and luring investment has improved sentiment, rekindling foreign inflows into Indonesian stocks and bonds. The rupiah was Asias second best-performing currency in October, gaining 1.7% to pare its year-to-date loss to 4.8%.

{777}

Analysts are waiting to see government guidelines for implementing the law so they can gauge how effective it will be at attracting foreign direct investment. The reform could be stalled by workers protests and a planned legal challenge.

FDI began to rebound in the third quarter, rising 1.6% from a year ago, as outlying islands in the sprawling archipelago benefit from smelter projects.

Policy Intervention

Low inflation could give policy makers room to cut interest rates and boost lending to consumers and businesses hit hard by the pandemic. Bank Indonesia Governor Perry Warjiyo has pledged to keep monetary policy accommodative through 2021, when the central bank expects the economy to grow 4.8% to 5.8%.

The central bank could cut its benchmark interest rate by another 50 basis points this year, according to Barclays Bank Plc economist Brian Tan, who expects 2020 GDP to undershoot the governments forecast of a 0.6% to 1.7% contraction.

“Our broad view remains that the central bank will eventually press on with rate cuts as GDP falls short of projections,” Tan said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Webull Canada Unveils Desktop Trading Platform

Alert: Beware Unlicensed Trading Broker ProMarkets

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator