Indonesias Direct Financing Is Test Case for Emerging Markets

Abstract:Bank Indonesias unprecedented move to buy about $27 billion in bonds directly from the government may prove to be an exception rather than the norm in emerging markets.

Bank Indonesias unprecedented move to buy about $27 billion in bonds directly from the government may prove to be an exception rather than the norm in emerging markets.

With the world economy in crisis and Modern Monetary Theory gaining attention, governments are being pressured to spend more and turn to their central banks to print money to foot the bill. But when it comes to scooping up that debt, most central banks are doing it in the secondary market.

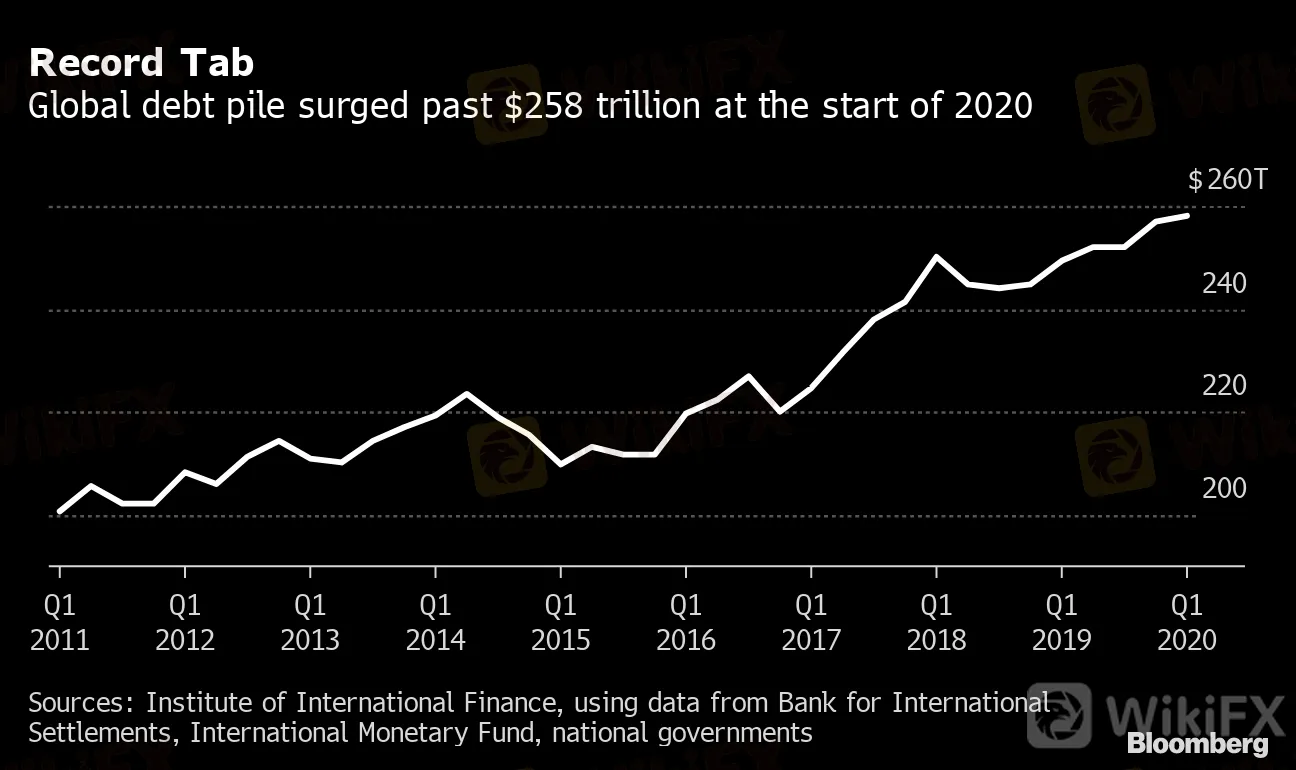

Record Tab

Global debt pile surged past $258 trillion at the start of 2020

Sources: Institute of International Finance, using data from Bank for International Settlements, International Monetary Fund, national governments

Three weeks on, currency and bond markets appear to have given Indonesia a pass on its direct financing foray. Analysts say thats because the central bank gave a clear signal that it was a one-time program and officials spearheading the plan, like Finance Minister Sri Mulyani Indrawati, are credible.

“The Indonesia burden-sharing program is a success given it has a clear timeline and framework,” said Jean-Charles Sambor, London-based head of emerging markets fixed income at BNP Paribas Asset Management. “If, however, we start to see a material increase in the size of such programs in emerging markets, it could result in considerable weakness in the currency.”

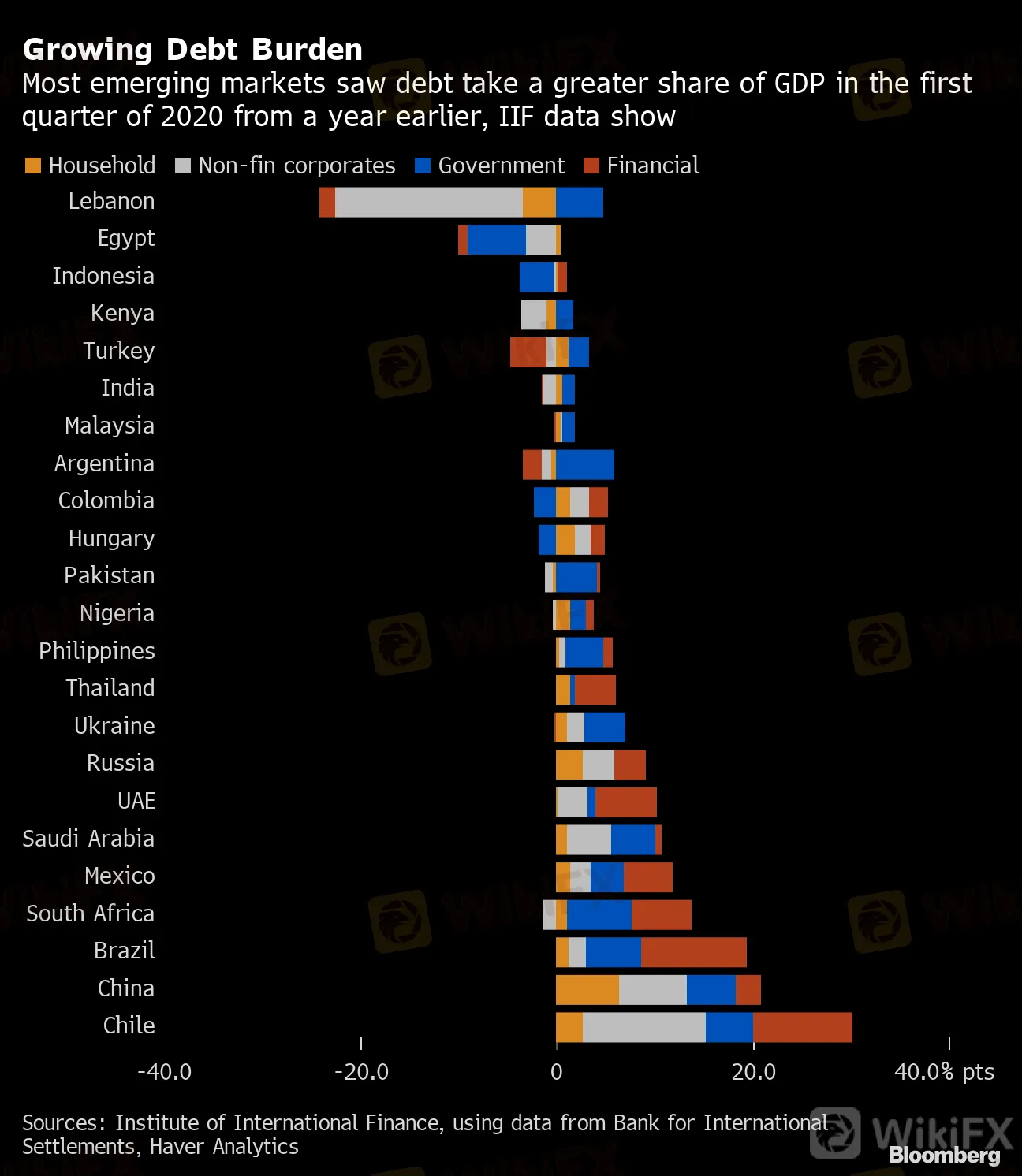

Growing Debt Burden

Most emerging markets saw debt take a greater share of GDP in the first quarter of 2020 from a year earlier, IIF data show

Sources: Institute of International Finance, using data from Bank for International Settlements, Haver Analytics

In many emerging nations, laws forbid the central bank from purchasing debt straight from the government, with several now buying domestic paper in the secondary market instead. Fitch Ratings Ltd. cites the following countries as having taken the latter approach: Indonesia, the Philippines, Thailand, Poland, South Africa, Croatia, Romania, Hungary, Chile, Costa Rica and Colombia.

Read more: Emerging Economies Face Real Risk of ‘Submerging,’ Tharman Says

In Argentina, which defaulted on its debt earlier this year, the central bank has transferred 1.3 trillion pesos ($18 billion) to the Treasury since the lockdown was announced on March 19. Cash in circulation has surged, dollar demand is high, and with a massive economic contraction underway, consumer prices are set to rise a staggering 53% over the next 12 months.

The Bank of Russia came under pressure to help fund a growing budget deficit after the energy exporter was hit by a double blow from the pandemic and slump in global oil demand. However, real interest rates remain positive there, so theres still room to use conventional measures.

The South African Reserve Bank is resisting calls for deficit financing, arguing it would bankrupt the central bank. And while the Reserve Bank of India hasn‘t bought bonds directly from the government, it’s expanded its balance sheet amid the pandemic by allowing Indian banks to borrow at cheap rates and lend money back to the federal government.

“There has been a lot of talk of monetary financing, but much less action,” said Elina Ribakova, deputy chief economist at the Washington-based Institute of International Finance.

— With assistance by Lilian Karunungan, Juan Pablo Spinetto, Patrick Gillespie, Gregory White, Rene Vollgraaff, Robert Brand, and Natasha Doff

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator