User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

2

CommentsWrite a review

2023-10-12 15:07

2023-10-12 15:07 2023-10-11 14:08

2023-10-11 14:08 China|5-10 years|

China|5-10 years| https://www.cifutures.com.cn/

Website

Influence

D

Influence index NO.1

China 2.84

China 2.84Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years |

| Company Name | 兴业期货有限公司 (INDUSTRIAL FUTURES) |

| Regulation | Regulated by the China Financial Futures Exchange (license number: 0306) |

| Fees | Fees vary depending on commodities and trading volumes |

| Service | Brokerage, investment consulting, asset management, risk management subsidiary business (specific details not provided) |

| Tradable Assets | Commodities (precious metals, base metals, energy resources, agricultural products, industrial materials), Financial indices, Bond futures |

| Account Types | Individual Clients, General Corporate Clients, Special Corporate Clients, Specific Product Authorization |

| Demo Account | Not specified |

| Customer Support | Phone: 400-888-5515, Fax: 021-80220211/0574-87717386 |

| Payment Methods | Bank transfers, online banking, telephone banking, futures trading platform |

| Educational Tools | Company news updates, research reports, announcements |

INDUSTRIAL FUTURES is a regulated futures company based in China, operating under the name 兴业期货有限公司. It holds a futures license and is regulated by the China Financial Futures Exchange. The company offers a range of services including brokerage, investment consulting, asset management, and risk management subsidiary business. However, specific details and features of these services are not provided.

INDUSTRIAL FUTURES provides various investment products, including collective asset management plans. However, detailed information about the specific features, strategies, or objectives of these products is not provided. The company offers a diverse range of market instruments for trading, including commodities like precious metals, base metals, energy resources, agricultural products, and industrial materials. It also offers futures contracts and options on financial indices and government bonds with different maturities.

Opening an account with INDUSTRIAL FUTURES requires individuals to register on the company's website and complete the online account opening process. Specific requirements vary based on client category, but generally, clients need to provide identification documents, demonstrate trading experience, and have a clean credibility record. However, detailed information about fees, deposit and withdrawal processes, trading platforms, educational resources, customer support, and reviews is not provided in the given information.

INDUSTRIAL FUTURES presents several pros and cons for potential investors. On the positive side, the company is regulated by the China Financial Futures Exchange, providing a level of oversight and credibility. They offer a diverse range of market instruments, including commodities, agricultural products, financial indices, and bond futures, allowing for a variety of trading options. INDUSTRIAL FUTURES also provides different account types to accommodate various client categories. They offer multiple trading platforms to cater to different needs and provide educational resources such as company news and reports. Customer support is available through phone and fax. However, there are some drawbacks, including insufficient information about their services and products, a lack of specific details on features and objectives of the products, and no information provided about their website, address, phone number, or expiration date. Additionally, there is a negative review claiming the platform is a scam, and details about response times and availability of customer support are not mentioned. Furthermore, fees vary based on commodities and trading volumes.

| Pros | Cons |

| Regulated by the China Financial Futures Exchange | Insufficient information provided about services and products |

| Offers a diverse range of market instruments | Lack of details on specific features and objectives of products |

| Provides different account types for various client categories | No information on website, address, phone number, or expiration date |

| Offers multiple trading platforms to cater to different needs | Negative review claiming the platform is a scam |

| Provides educational resources like company news and reports | Lack of specific details on frequency and content of resources |

| Customer support available through phone and fax | Lack of information on response times and availability |

| Wide range of commodities available for trading | Fees vary based on commodities and trading volumes |

INDUSTRIAL FUTURES is regulated by the China Financial Futures Exchange. It holds a futures license and is regulated by the regulatory agencies in China. The specific license number is 0306, and it is operated by 兴业期货有限公司. However, no further information regarding its website, address, phone number, or expiration date is provided.

Service:

INDUSTRIAL FUTURES offers a range of services that include brokerage, investment consulting, asset management, and risk management subsidiary business. The specific details and features of these services are not provided in the given information.

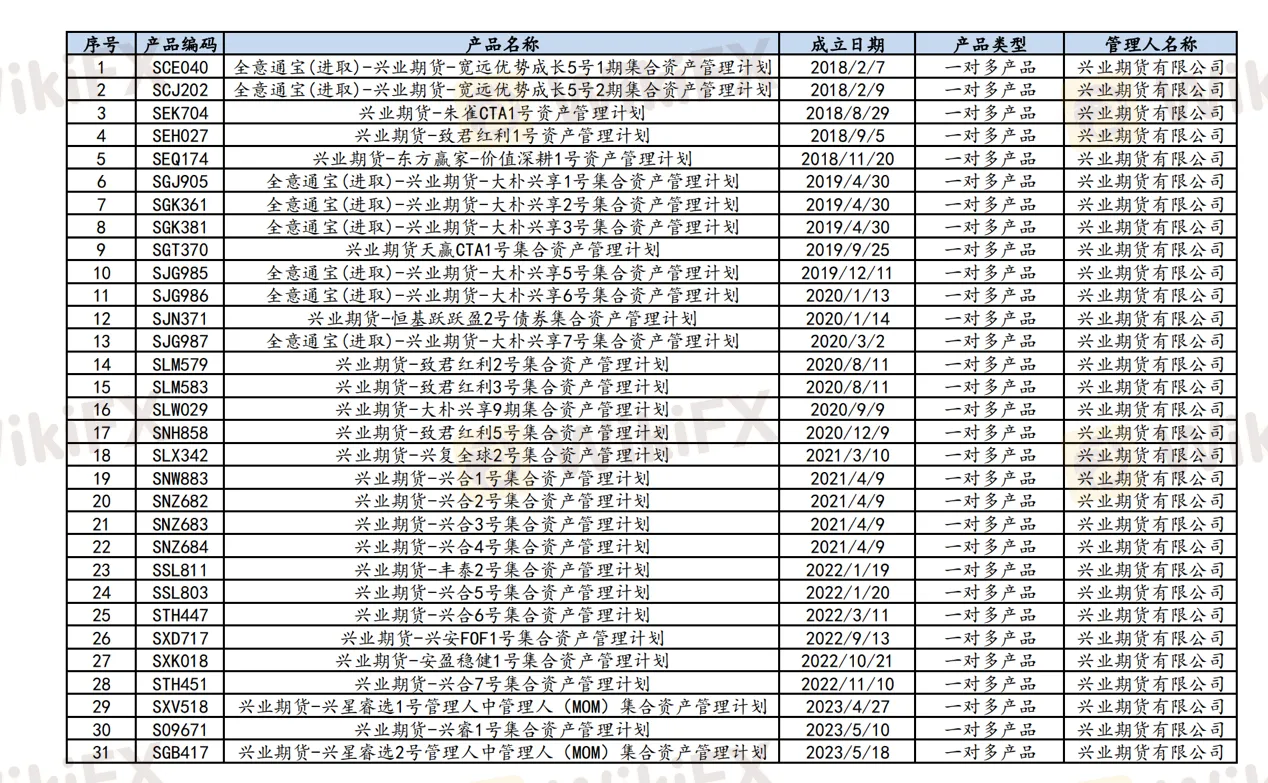

Products:

INDUSTRIAL FUTURES provides various investment products, each identified by a unique product code and name. These products include collective asset management plans, with examples such as “全意通宝(进取)-兴业期货-宽远优势成长5号1期集合资产管理计划,” “兴业期货-朱雀CTA1号资产管理计划,” and “兴业期货-致君红利1号资产管理计划.” However, detailed information about the specific features, strategies, or objectives of these products is not provided.

INDUSTRIAL FUTURES offers a diverse range of market instruments for trading. These instruments can be categorized into several types:

1. Commodities: INDUSTRIAL FUTURES provides futures contracts for various commodities, including precious metals like silver (AG) and gold (AU), base metals such as copper (CU) and aluminum (AL), energy resources like crude oil (BU) and fuel oil (FU), agricultural products like corn (C) and soybeans (A), and industrial materials like steel (RB) and rubber (RU).

2. Agricultural Products: Apart from the commodities mentioned above, INDUSTRIAL FUTURES also offers futures contracts for agricultural products like cotton (CF), palm oil (P), soybean oil (OI), and wheat (PM). These contracts allow participants to hedge against price fluctuations or speculate on the future value of these agricultural commodities.

3. Financial Indices: INDUSTRIAL FUTURES provides futures contracts and options on various financial indices, including the CSI 300 Index (IF), the SSE 50 Index (IH), the SZSE 1000 Index (IM), and the CSI 500 Index (IC). These instruments allow traders to gain exposure to the overall performance of the Chinese stock market or specific sectors represented by these indices.

4. Bond Futures: INDUSTRIAL FUTURES offers futures contracts for government bonds with different maturities. These include 2-year Treasury bonds (TS), 5-year Treasury bonds (TF), and 10-year Treasury bonds (T). Bond futures provide a means for investors to manage interest rate risks and speculate on future interest rate movements.

Pros and Cons

| Pros | Cons |

| Ability to manage interest rate risks through bond futures | Insufficient information on specific features and objectives of instruments |

| Opportunity to trade various commodities and agricultural products | Lack of details on services and products |

| Access to futures contracts on financial indices and bond futures | Limited information provided about the company |

| Potential for exposure to the overall performance of the Chinese stock market | Negative review claiming the platform is a scam |

INDUSTRIAL FUTURES offers different account types based on the client category and specific requirements.

For Individual Clients, valid personal identification documents are necessary, along with passing a suitability knowledge test. Trading experience can be demonstrated through a record of transactions in futures, options, or other derivative products, either through actual trading or simulated trading. Additionally, a minimum balance of 5 million RMB in the margin account for the five days prior to applying for a trading code is required. A clean credibility record is also essential.

General Corporate Clients are required to provide copies of the legal representative or authorized person's identification documents and the business license. They must have well-established internal controls and risk management systems related to futures trading. The designated order placer must pass a suitability knowledge test. The margin account should have a minimum balance of 5 million RMB for the five days preceding the application. Trading experience and a clean credibility record are prerequisites as well.

Special Corporate Clients must provide copies of the legal representative or authorized person's identification documents and the business license. They are also expected to have robust internal controls and risk management systems specifically designed for futures trading. A clean credibility record is required.

For specific product authorization, similar requirements apply to individual and general corporate clients. However, they must also demonstrate trading experience in the specified product category, either domestically or internationally, or through simulated trading. A clean credibility record is mandatory.

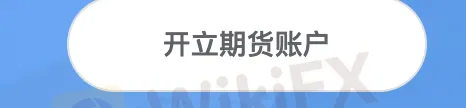

To open an account with INDUSTRIAL FUTURES, you can follow these steps:

Visit the INDUSTRIAL FUTURES website and click on the “在线开户” (Open Account Online) or “开立期货账户” (Open Futures Account) option.

2. Register your account by providing the necessary personal information as required.

3. Set up your settlement account details, which include linking your bank account for fund transfers.

4. Complete the appropriateness assessment, where you may be asked to answer questions to determine your suitability for futures trading.

5. Select the specific exchanges you wish to trade on.

6. Undergo a video verification process, where you may be required to provide identification and have a video call with a representative for verification purposes.

7. Sign the required agreements and documents electronically.

8. Complete any follow-up questionnaires or surveys as requested.

9. Submit your application for review.

INDUSTRIAL FUTURES imposes fees based on different commodities and trading volumes. For stock index futures on the China Financial Futures Exchange, the fee is 1 yuan per transaction. For other commodities traded on the Zhengzhou Commodity Exchange, the fees vary depending on the trading volume and contract type. For example, for methanol futures and short fiber futures, there are no fees for trading volumes up to 4,000 contracts, and fees of 0.1 yuan per contract for volumes between 4,000 and 8,000 contracts. The fees increase to 1 yuan per contract for volumes exceeding 8,000 contracts. Similar fee structures apply to other commodities such as sugar, rapeseed oil, cottonseed oil, palm oil, iron ore, soybean meal, and more, with varying fee rates based on trading volumes and contract types.

1. Deposit & Withdrawal Time: For regular trading hours, the deposit can be made from 8:30 to 15:30, and withdrawal can be done between 9:05 to 15:30. During the night trading period, deposits are accepted from 20:30 to 2:30, but withdrawals are not allowed.

2. Customer Delivery Fees: When engaging in delivery, customers may incur various fees, including storage fees, transfer fees, inspection fees, etc. These fees vary depending on the specific commodity and are available for inquiry on the exchange's website.

3. Margin System: INDUSTRIAL FUTURES implements a margin system for stock index futures trading to ensure contract fulfillment and protect the legitimate rights of both parties. All participants, whether buyers or sellers, are required to deposit margins as per the exchange's regulations.

4. Margin Categories: INDUSTRIAL FUTURES differentiates between “Settlement Reserve” and “Trading Margin.” Settlement Reserve refers to unallocated margin, and the minimum balance requirement for settlement members is 2 million RMB, to be deposited using their own funds. The trading margin is the portion of the margin used for contracts.

5. Transfer Methods: Customers can conduct transfers through bank counters, online banking, telephone banking, or via the futures trading platform.

Pros and Cons

| Pros | Cons |

| Defined Deposit & Withdrawal Time | Limited withdrawal hours during night trading |

| Margin System for Contract Fulfillment | Customer Delivery Fees may apply |

| Multiple Transfer Methods Available | Differentiated Margin Categories |

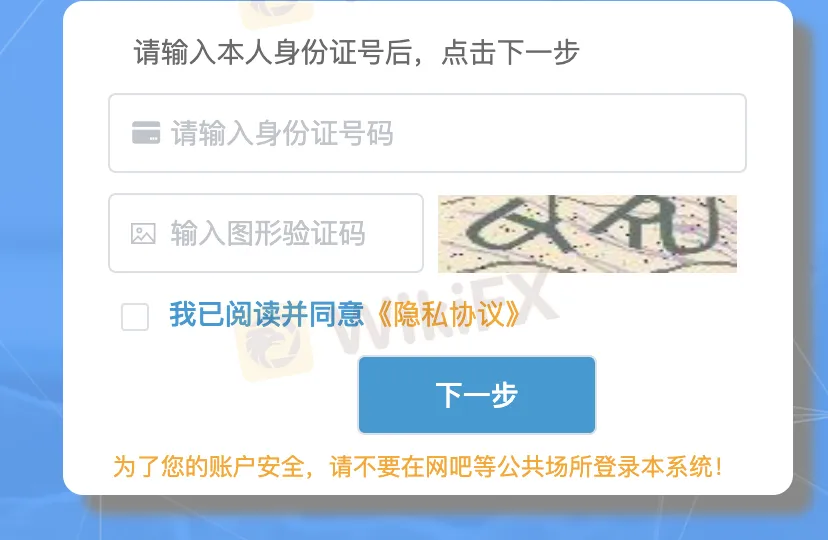

INDUSTRIAL FUTURES offers a variety of trading platforms to cater to different needs and preferences of traders. Here are a few examples:

1. 兴业期货CTP-博易云交易版(看穿式): This platform supports futures and options market data and trading. It features comprehensive market data and supports continuous trading throughout the day. It includes the Lightning Hand and Lightning King order placement tools.

2. 兴业期货-极星9.5客户端(看穿式): This platform is a powerful and user-friendly trading software designed for retail investors. It supports market data and trading for both domestic and international markets. It offers a range of features, including cross-account, cross-market, and cross-product arbitrage trading, as well as options strategy analysis.

3. 兴业期货-文华WH6(看穿式): This platform is a classic futures software with over 20 years of history. It supports futures and options market data and trading and is known for its simplicity. It also provides night trading functionality.

4. 兴业期货CTP-快期V2(看穿式): This professional order placement software aims to provide a simple, and fast trading experience for futures investors. It offers various interface styles, operation methods, and advanced technology architecture.

Pros and Cons

| Pros | Cons |

| Comprehensive market data | Limited market options |

| User-friendly and intuitive interface | Limited advanced features |

| Continuous trading throughout the day | Limited international market access |

1. COMPANY NEWS: The educational resources provided by INDUSTRIAL FUTURES include company news updates. These updates cover various topics related to the company's activities and development. However, specific details or numbers regarding the frequency or content of these news updates are not mentioned.

2. RESEARCH REPORTS: INDUSTRIAL FUTURES offers research reports under the category of “兴期研究” (Xingqi Research). These reports provide insights and analysis on specific commodities or market trends. The available reports include updates on cotton, PVC, urea, iron ore, and other relevant commodities. However, the specific number of reports or their frequency is not specified.

3. ANNOUNCEMENTS: INDUSTRIAL FUTURES also provides announcements through their “兴期公告” (Xingqi Announcements) section. These announcements may include information related to the use of their after-hours query system, updates regarding their mobile app, or notifications regarding adjustments in trading margin standards and price limits for certain futures contracts. No further details or specific numbers regarding the frequency or content of these announcements are provided.

INDUSTRIAL FUTURES provides customer support through various contact channels. The company can be reached via phone at 400-888-5515. Additionally, fax communication is available at 021-80220211/0574-87717386. The company has two office locations: one in Ningbo at No. 796 Zhongshan East Road, Donghang Building, 11th floor, and another in Shanghai at No. 167 Yincheng Road, Xingye Bank Building, 11th floor. Further details about the customer support services, response times, or availability were not provided.

According to a review on WikiFX, INDUSTRIAL FUTURES is described as a scam and fraudulent platform that does not allow users to withdraw funds. The reviewer claims that after contacting customer service, the platform was closed down. The review was posted on December 17, 2020, by the user with the ID FX3505414173.

In conclusion, INDUSTRIAL FUTURES is a regulated futures company in China, operating under the supervision of the China Financial Futures Exchange. It offers a range of services, including brokerage, investment consulting, asset management, and risk management subsidiary business. INDUSTRIAL FUTURES provides various investment products and market instruments, such as commodities, agricultural products, financial indices, and bond futures. The company offers different account types based on client categories and specific requirements. Opening an account involves a series of steps, including registration, appropriateness assessment, video verification, and document signing. INDUSTRIAL FUTURES imposes fees based on different commodities and trading volumes. The company provides deposit and withdrawal services with specific timeframes and margin requirements. It offers multiple trading platforms to cater to different needs. Educational resources include company news, research reports, and announcements, although the frequency and content are not specified. Customer support is available through phone and fax communication, with office locations in Ningbo and Shanghai. While one review on WikiFX claims INDUSTRIAL FUTURES to be a scam, no further details or additional reviews are provided.

Q: Is INDUSTRIAL FUTURES a legitimate company?

A: Yes, INDUSTRIAL FUTURES is a regulated company licensed by the China Financial Futures Exchange.

Q: What services and products does INDUSTRIAL FUTURES offer?

A: INDUSTRIAL FUTURES offers brokerage, investment consulting, asset management, and risk management subsidiary services. They provide various investment products, including collective asset management plans.

Q: What market instruments can I trade with INDUSTRIAL FUTURES?

A: INDUSTRIAL FUTURES offers a wide range of market instruments, including commodities (precious metals, base metals, energy resources, agricultural products, and industrial materials), agricultural products, financial indices, and bond futures.

Q: What are the account types available at INDUSTRIAL FUTURES?

A: INDUSTRIAL FUTURES offers account types for individual clients, general corporate clients, special corporate clients, and specific product authorization clients.

Q: What are the fees charged by INDUSTRIAL FUTURES?

A: The fees imposed by INDUSTRIAL FUTURES vary based on commodities and trading volumes. Different fee structures apply to stock index futures and other commodities traded on the Zhengzhou Commodity Exchange.

Q: How can I deposit and withdraw funds at INDUSTRIAL FUTURES?

A: Deposits and withdrawals can be made during regular trading hours. Deposit methods include bank counters, online banking, telephone banking, and the futures trading platform. Customer delivery fees may apply for certain transactions.

Q: What trading platforms does INDUSTRIAL FUTURES provide?

A: INDUSTRIAL FUTURES offers trading platforms such as 兴业期货CTP-博易云交易版, 兴业期货-极星9.5客户端, 兴业期货-文华WH6, and 兴业期货CTP-快期V2.

Q: What educational resources are available at INDUSTRIAL FUTURES?

A: INDUSTRIAL FUTURES provides company news updates, research reports, and announcements on specific commodities or market trends.

Q: How can I contact customer support at INDUSTRIAL FUTURES?

A: You can contact INDUSTRIAL FUTURES via phone or fax, and they have office locations in Ningbo and Shanghai.

Q: Are there any reviews about INDUSTRIAL FUTURES?

A: There is a negative review claiming that INDUSTRIAL FUTURES is a scam platform. However, further information or additional reviews were not provided.

兴业期货有限公司

INDUSTRIAL FUTURES

Regulated

Platform registered country and region

China

--

--

--

--

--

宁波市江东区中山东路796号东航大厦11楼

上海市浦东新区银城路167号兴业银行大厦11层

--

--

--

--

office@cifutures.com.cn

Company Summary

Sort by content

User comment

2

CommentsWrite a review

2023-10-12 15:07

2023-10-12 15:07 2023-10-11 14:08

2023-10-11 14:08