Rug Of All Time? Iron Finance Titan Token Falls 98.1%, What Happened?

Abstract:Rug Of All Time? Iron Finance Titan Token Falls 98.1%, What Happened?

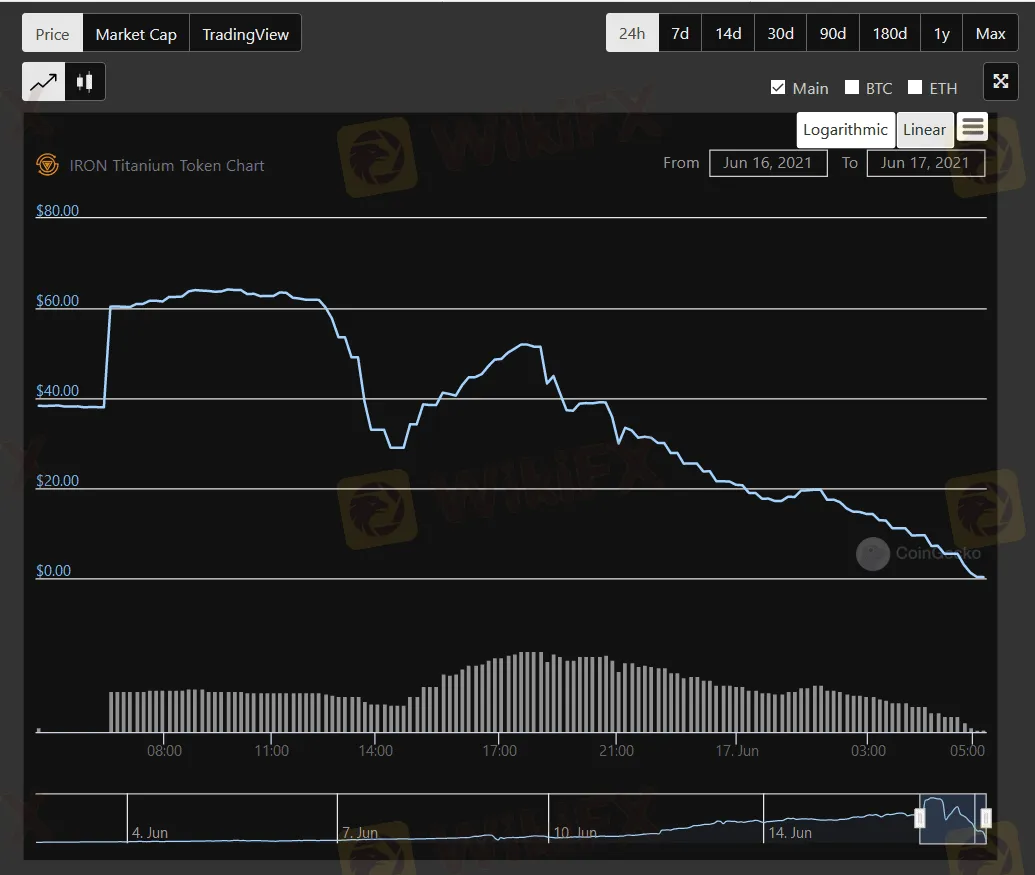

It‘s just another day and another DeFi protocol, which has taken a hit. This time it’s Iron Finance – an algorithmic stable coin, whose token TITAN‘s value plummeted 98.1% in less than 24%. According to the official documentation, Iron was “a partially collateralized token, soft pegged to the U.S. Dollar, available both on the Polygon network and on the Binance Smart Chain”. It’s principle was the same as all other algorithmic stablecoins – store collateral enough to back the token to 1 USD. So, what happened?

At the time of this writing, the Iron Finance Titan token is trading at $1.23, it‘s showing a very slight recovery after the token went down upto $0.0016. It’s astonishing since the token was trading at $64, around 19 hours ago. A fork of the FRAX stable coin, Iron Finance was popularized by Twitter influencers especially billionaire Mark Cuban, whose recommendation saw the price skyrocket to several order of magnitudes. Hes now believed to have lost $8M, though there has been no confirmation on his part.

Iron Finance TITAN Token – CoinGecko

Iron Finance – Anatomy Of The DownfallThere was no exploit or malicious activity, from the reports received until now. Simply, a bank run, where people kept cashing out and the token price kept falling. The way it works with Iron Finance is that there are two tokens – IRON and TITAN. The USDC is deposited into the protocol upon users minting IRON token, while the TITAN token used for minting is burned. When the user redeems, the USDC is paid back and TITAN are minted back.

However, it turned out to be the race to the exits as people kept dumping their fractional reserve type TITAN tokens, after redeeming their initial collateral. This caused a domino effect as more and more players chose to exit the game and the price plummet severely in a matter of hours. The reason? TITAN marketcap wasnt large enough to support such a market, also the token was overpriced had relatively constrained liquidity and there was no locking period like FRAX, to prevent a bull run.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Analysts pinpoint bull and bear scenarios as Bitcoin price dips below $56K

BTC price dropped below $56,000 again, leading analysts to discuss various bull and bear scenarios for Bitcoin’s short term price action.

Nigeria to launch digital currency on Monday to enhance payments Read more at: https://economictime

Nigerian President Muhammadu Buhari will launch a digital currency on Monday aimed at improving the payments system in the West African nation, according to the central bank.

G7 financial leaders reach agreement on digital currencies

G7 financial leaders reach agreement on digital currencies

Bitcoin Smashes Through All-Time High Surpassing $66,000 per Unit

The spot price of bitcoin smashed through the leading crypto asset’s all-time high (ATH) surpassing $66,000 per unit after the first bitcoin exchange-traded fund (ETF) was launched in the United States. The last time bitcoin touched an ATH six months ago on April 14, 2021, the price tapped $64,804 per unit.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator