Gold Weekly Forecast: Gold Prices Preparing for a Break Out?

Abstract:Gold Weekly Forecast: Gold Prices Preparing for a Break Out?

GOLD PRICE ANALYSIS AND NEWS

Gold Awaits US CPI

US Real Yields Are Still the Best Guide for Gold Direction

Gold Levels to Watch

GOLD AWAITS US CPI DATA

Despite edging lower towards the backend of the week, price action in gold had been somewhat encouraging with the precious metal attempting to form a double bottom. A culmination of a softer USD and US yields had in large part underpinned gold prices, however, the key area at $1760-65 has continued to cap rallies and thus keeps risks tilting lower.

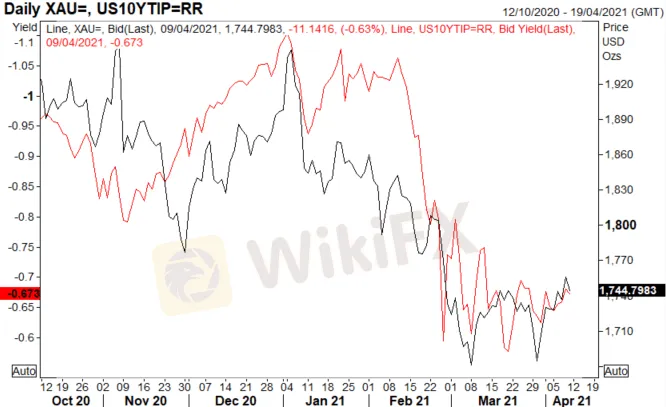

As we look towards next week, the main focus will be on the US CPI reading, which will be a key factor as to whether gold prices managed to break resistance or head back towards $1700. Taking a look at last months reading, which saw the headline CPI rate in line with expectations, the core reading had been slightly softer however. In turn, the initial reaction in gold was higher, on the basis that US yields edged lower. Alongside this, given that the market remain fixated that a spike in inflation is coming, should we see a slight disappointment in the figure, this is likely to give good grounds for a breach of $1760-65, my thought behind this is that yields have been the largest determinant for the precious metal. The chart below highlights the relationship between gold and real yields (inverted).

US REAL YIELDS ARE STILL THE BEST GUIDE FOR GOLD DIRECTION

Source: Refinitiv

GOLD LEVELS TO WATCH

The main area to focus on is $1760-65, in which a move lower in US yields would be needed to help gold break this resistance. Should this area be broken, this paves the way for a move to 1790-1800. While on the flip side, a close below $1670 would likely invalidate the potential recovery and open the doors to $1600.

GOLD CHART: DAILY TIME FRAME

Source: Refinitiv

=================

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔═══════════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚═══════════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

Easy Trading Online in Trader Fair Thailand Expo 2024

The Traders Fair Thailand 2024 was successfully held at Bangkok Shangri-La Hotel on February 3rd. As an exhibitor and sponsor, Easy Trading online attended the Expo with professional service team and extraodinary online trading experience on FX & CFDs.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator